How to Start a Crypto Company and Succeed

The crypto landscape has climbed out of several market downturns in recent years, enduring even the hardest crises and roadblocks to developing a global industry. In 2024, the crypto market experienced the most sustainable bull run in recent history and expanded the horizons of blockchain utility across different sectors. Currently, over 318 million users own crypto, over 15,000 businesses support it, and the entire market cap has reached almost $2.5 trillion in valuation.

With promising market-wide metrics, numerous entrepreneurs and startup owners are interested in entering the crypto industry. But what is the best gateway to the crypto market? Which business idea is the most practical yet potentially lucrative, even in the short term? This piece will discuss the top cryptocurrency business ideas and how to start a crypto company of your own.

Key Takeaways

- Crypto businesses have become popular due to the recent and sustainable growth of the crypto market.

- Starting a crypto company has tremendous potential, allowing you to become an early bird in a developing market.

- Creating a crypto business is quite complex, including a mix of business planning, license approvals, funding, technology acquisition and marketing.

Let’s Define a Crypto Company

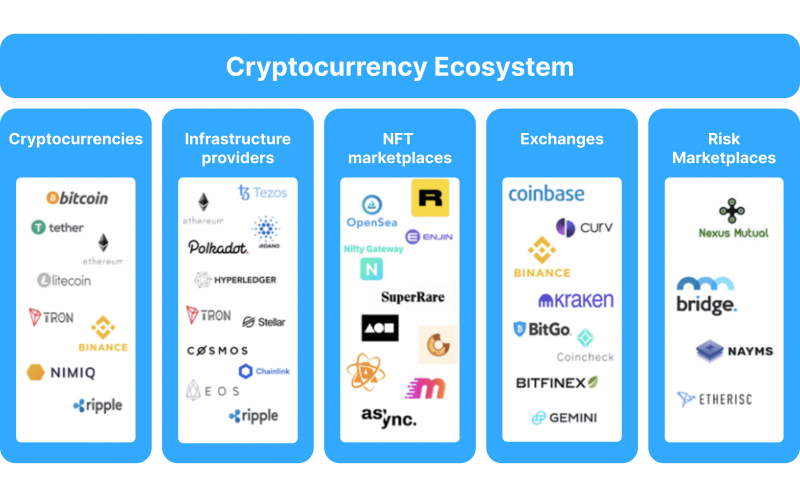

Crypto businesses come in forms, ranging from exchanges and fund management firms to crypto wallets and NFT marketplaces. As the crypto market expands, numerous innovative business models are entering the scene, including identity management solutions and data storage services. The crypto market is quite diverse in terms of business concepts, all sharing the concepts of decentralisation, direct fund exchange, speed, and efficiency.

Crypto companies can branch out in many directions, but the core idea remains the same – leverage the power of blockchain, harnessing the capabilities of decentralisation, anonymity and digital transfers.

Most businesses try to simplify the crypto trading practice or introduce new and exciting use cases for blockchain technology, allowing users to enjoy decentralisation and efficiency in other sectors like finance, data management, supply chains, healthcare, etc.

As a result, there have never been more options to start a fresh crypto company business that can generate healthy profit margins. But why is the crypto industry so attractive for entrepreneurs in the current climate? Let’s discuss.

Advantages of Entering a Crypto Business Sector

While the crypto market has been around for a while, it is still a fresh industry compared to other global juggernauts like finance, banking, and tech solutions. As a result, even the most popular crypto startup ideas are far from being classified as a red ocean, which signals oversaturation in the market. So, most crypto projects that you might consider share the following upsides.

Early Bird Opportunities

The extent of the crypto market growth should not be underestimated. The latest crypto comeback has presented a 100% growth for the entire market compared to 2023. While the 2022 market downturn causes these numbers, the current crypto market growth is much more sustainable and less driven by hype. As a result, even the most conservative projections from crypto experts showcase at least 20% annual growth going forward.

Since the crypto industry is far from standardisation, the growth record presents a lucrative early-bird opportunity for businesses that will enter today and stick with it in the following years. Established crypto companies like Binance and CoinMarketCap started very small and managed to accumulate a sizable audience due to the rapid growth of the blockchain industry. Today, numerous opportunities exist to follow this pathway and aggregate a considerable net worth in the following years.

It is important to note that most companies are still dubious of crypto, having suffered losses or analysing the numerous controversies that plague the blockchain sector. As a result, becoming an early bird and growing alongside the industry is possible even today!

An Untapped Customer Base

Currently, most crypto owners engage in the crypto market for trading purposes, buying, selling or exchanging cryptocurrencies. However, the potential for market expansion is still huge. As more and more individuals worldwide start to appreciate blockchain benefits like decentralisation and speed of transactions, the industry will likely branch out into numerous sectors in the coming years.

Even today, many crypto owners who value privacy have gone exclusively digital, only using crypto funds for any operation online. As a result, we are witnessing the foundation of a completely fresh user base that could reach a massive size in the upcoming years. So, entering the crypto market today could help you tap into a niche with tremendous upside in multiple directions.

The CeFi 2.0, a recent trend that aims to bridge the gap between crypto and fiat, involves crypto businesses providing crypto-backed loans and interest-bearing accounts, blurring the lines between the established financial system and the crypto solutions.

How to Start a Cryptocurrency Company

As discussed, starting your own crypto company might be one of the most conceptually sound and high-upside ideas in the current business landscape. However, executing this ambitious idea is quite difficult, requiring considerable resources, time, dedication, and critical decision-making. Regardless of your entry point into the crypto scene, here are essential steps you should take when trying to jumpstart a successful crypto company.

Identifying a Niche

First and foremost, you must decide which niche you wish to enter within the crypto market. The obvious and most popular choice is starting a crypto exchange business, with white-label solutions and other service providers drastically simplifying the development process. However, crypto exchanges are considerably more saturated than other business ideas, so it could be worthwhile to explore other options.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Aside from exchanges, you can create a DeFi lending platform, crypto processing service, crypto analytics platform, NFT marketplace, or crypto wallet for businesses. Each of these sectors has a promising upside but considerably different business models, so it is prudent to research them carefully and assess whether you can execute their startup process properly.

DeFi lending platforms are very technical and depend on optimal interest rates, whereas crypto processing services must be fast and reliable. Crypto analytics platforms must have real-time updates and complementary cryptocurrency trading tools. Finally, crypto wallets must be very secure and multi-functional, and NFT marketplaces require a completely different approach from everything else. As you can see, each business idea comes with unique challenges, and it is essential to assess these undertakings realistically to avoid future disappointments.

Finding a Target Audience

Once you decide which niche is perfect for your needs, it’s time to select a target audience for your prospective business. For example, suppose you decide to make your own cryptocurrency exchange. In that case, you must decide what customer demand you aim to satisfy, including users that value privacy, security, low prices, accessibility, advanced trading mechanisms, diverse instruments and many other factors. In most cases, select as many qualities as possible and create an exchange that excels in these aspects.

While you can try to achieve peak quality in all domains, striving for excellence in every aspect is costly and will likely drain your business capital too fast. So, focusing on a few highly demanded features like security, accessibility, or high-speed execution will help you stand out from other small or mid-sized startups.

The same is true for every other crypto business idea. It is critical to understand the demands of clients in every niche and try to do one thing great. The initial appeal generated by your one strong suit will be enough to develop a sizeable audience, and you can continue growing from there.

Market Research and Competitive Analysis

Research is one of the most underrated skills in the current crypto market. Many business owners need to conduct more research and due diligence before entering a specific niche, which often leads to failures in the crypto world. Here’s how a thorough and professional market analysis can help you in the initial stages of developing a crypto company:

First, researching your competitors helps you understand what works and doesn’t. There is no shortage of highly visible crypto businesses in the market that you can analyse and assess. As a result, you will have a good grasp on the best practices employed within a niche, allowing you to avoid newcomer mistakes.

Secondly, market research will help you gauge the costs of starting a specific crypto company. Some business models might be too expensive for your upstart budgets, allowing you to avoid stepping into an undertaking you can’t finalise due to financial limitations.

Finally, research helps you understand where the specific niche of blockchain technology is going and the current climate. For example, DeFi lending is becoming more popular than ever due to the increased demand for international borrowing practices without the red tape. As a result, it is safe to assume that the DeFi loans niche will thrive in the foreseeable future.

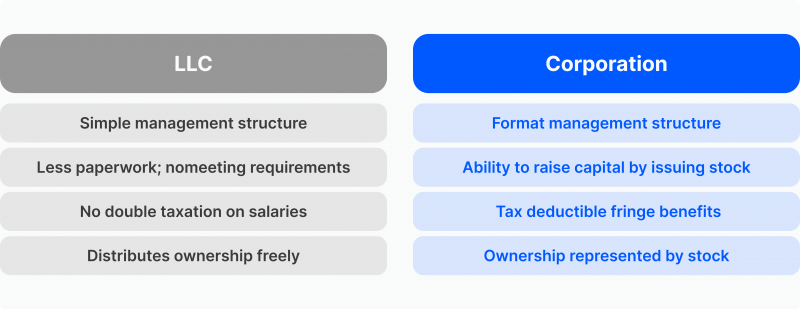

Choosing a Legal Structure

Selecting a legal structure for your crypto company requires balancing flexibility with compliance. Limited Liability Companies (LLCs) offer ease of formation and liability protection but may face limitations in attracting investors. Conversely, corporations provide a more straightforward path for fundraising but involve more complex filing requirements. Both alternatives have their merits and should be decided by considering your distinct circumstances, including your funding goals, risk tolerance, potential operating jurisdiction, and desired business structure.

Licensing and Regulatory Considerations

Acquiring a license is arguably the most time-consuming and potentially costly process for a crypto company. The modern regulatory landscape is quite chaotic for crypto, with different countries and jurisdictions proposing their unique ways of taxing and accounting for crypto transactions and digital currencies.

Numerous crypto regulations are being considered, approved or annulled almost every single month. So, navigating the legal environment might be best with professional assistance, helping you decide the most suitable license for your business model and guiding you during a lengthy license approval process.

The most likely regulatory guidelines you will face are SEC and MiCA for the USA and European markets, respectively. Both of these regulatory bodies demand a strict adherence to operational standards. The standards mainly include security guidelines, ensuring the safekeeping of user funds and risk management practices to avoid volatility in the market. You have to learn and actualise numerous other legal details, which legal advisors can simplify.

Funding and Permits

The next logical step is to acquire funding for your development process and initial capital considerations. Most licenses require some initial capital, so it might be impossible to acquire a desired license without funding. There are several channels that you can pursue.

Traditional routes like venture capital and angel investors offer familiar structures but may be limited by crypto’s evolving nature. Newer options like Initial Coin Offerings (ICOs) and Security Token Offerings (STOs) allow fundraising directly from the crypto community but come with complex regulations. Choosing the best option depends on factors like business stage, regulatory landscape, and risk tolerance.

In any case, you must ensure that your funding is above the critical threshold of required business capital, including development costs, licensing process fees and deposits, marketing expenses, salaries, and other expenses.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Selecting and Setting up Software

In the current landscape, operational software for crypto businesses can be acquired at affordable prices. For example, white-label crypto spot trading platforms have become much less expensive compared to previous years. The same is true for crypto processing solutions, CRM suites, social trading services, and various API tools for integration.

Selecting the right bundle of software solutions and platforms depends on your chosen crypto niche. However, regardless of your selected sector, you must prioritise the security of digital assets, high-speed execution of your crypto operations and general convenience for your end-users. These qualities must serve as core pillars for your business, setting your company up for long-term success.

The setup process can be simplified with the help of software providers. Modern software platforms, APIs, and other tools are much easier to integrate within your workflow and do not require any technical expertise or a dedicated engineering team.

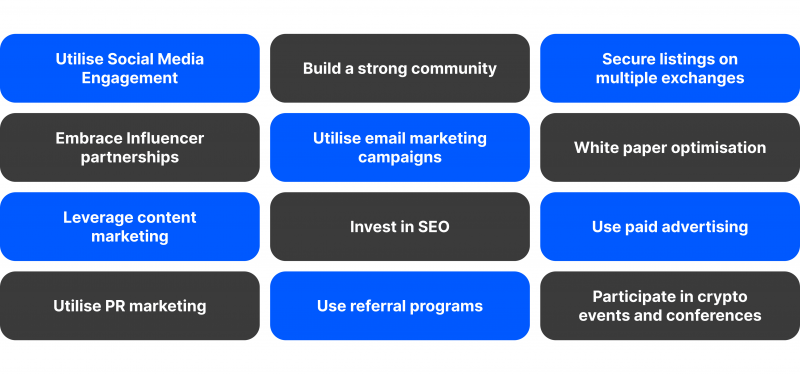

Developing a Marketing Strategy

The final step in your business process is finding the right brand voice for your business and marketing it across the correct channels. While crypto might not be saturated, the digital ad space is a fully-fledged red ocean. To make a dent in this environment, your marketing efforts should be strong, convincing and consistent across different points of customer interaction.

To achieve this goal, you must employ strong marketing specialists who are proficient in digital marketing, copywriting, CRM management and a variety of other promotional areas. As a result, your crypto business will launch on the right note and make a sufficient impact on the market during the critical launch period.

Final Thoughts – Is it a Good Idea to Start a Crypto Company?

There are many ways to enter the crypto market, even by purchasing a crypto business for sale. While the entry points are diverse, the core challenge remains the same – navigating a tricky and often chaotic crypto landscape.

Regardless of your final business model choice, you must prepare for a challenging journey that requires critical thinking and flexibility. Otherwise, the ever-changing crypto landscape will be too unwieldy to control and manage. So, it is advisable to equip yourself with legal assistance, hire experienced marketing professionals, understand the tech inside out, and be ready for frequent shifts in market sentiment.

FAQ

How Difficult is it to create a crypto exchange business plan?

Crypto exchange business plans are complex due to their workflows, liquidity demands, technological intricacy and other variables. However, their execution can be simplified by obtaining white-label platforms and avoiding the technical challenges.

How hard is it to obtain crypto licenses?

The difficulty of acquiring a crypto license depends on your business model and your desired license jurisdiction. European and US licenses are generally more challenging than Asian and offshore licenses. Moreover, exchange licenses are much harder to acquire compared to crypto wallets or other minor businesses.

What is white-label software?

White-label software is a pre-made template for your crypto company. White-label platforms can be crypto exchanges, management platforms for crypto assets and various other digital software. Adopting White-label can help you minimise costs and simplify technical challenges.