How to Find the Best Crypto Broker Software for Spot Trading

Articles

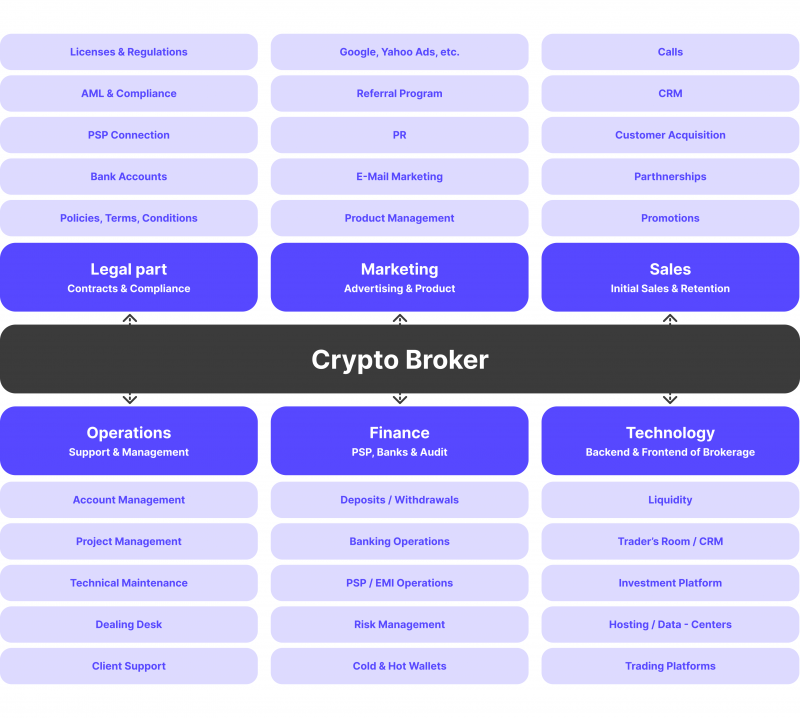

The crypto sphere is evolving and transforming rapidly, creating new trends at the intersection of finance, information technology, and blockchain innovation. One of the breakthrough concepts in this area is the crypto broker business model, a multifunctional system combining all the advantages of traditional brokerage houses with a bias towards the crypto segment.

Such a system includes a variety of finely tuned software and services, the coordinated joint work of which ensures smooth and high performance of liquidity aggregation, order matching and crypto processing processes.

This article aims to explain crypto broker software, its main components, functionality, and the benefits of using it. You will also learn to find the best crypto broker software by following simple principles.

Key Takeaways

- Crypto broker software is a system that includes highly specialised solutions and modules to enable crypto trading, particularly spot trading.

- The main components of such software are a trading platform, a liquidity aggregation system, a matching engine and a payment channel system.

- Crypto broker software is a solution that can be developed on a turnkey basis or used on a White Label model.

What Is a Crypto Broker Software?

Cryptocurrency brokerage software encompasses the technological framework and software tools created to streamline the process of cryptocurrency trading and brokerage activities. This sophisticated platform allows both individuals and businesses to function as cryptocurrency brokers, granting their customers the ability to engage in cryptocurrency markets and execute trades efficiently.

The primary function of crypto broker software is to offer a seamless and user-friendly interface for conducting cryptocurrency transactions. By leveraging advanced technology and innovative solutions, this platform empowers users to navigate the complexities of cryptocurrency trading with ease, ultimately enhancing their overall trading experience.

With the help of top crypto broker software, individuals and businesses can effectively manage their cryptocurrency portfolios, execute trades in real time, and access a wide range of trading tools and features. This software plays a crucial role in enabling users to capitalise on the opportunities presented by the dynamic and fast-paced cryptocurrency markets, ultimately helping them achieve their trading goals.

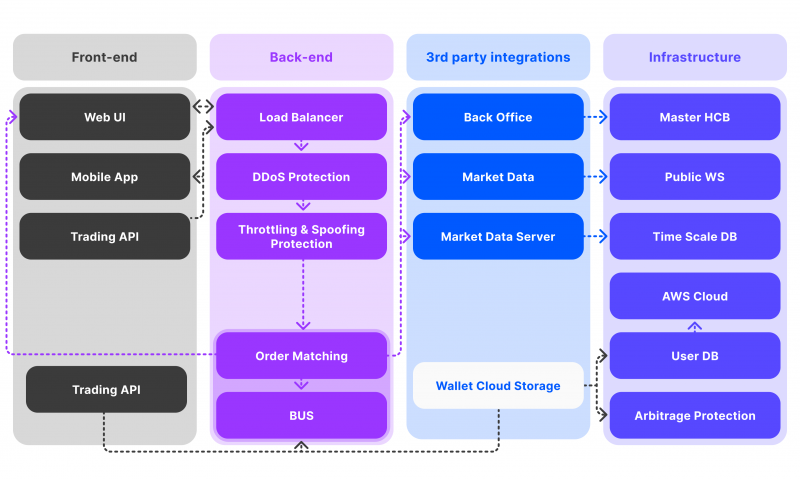

Crypto broker software has a multimodal architecture and includes a technology stack consisting of cloud solutions, messaging protocols, API interfaces, etc.

Key Components of Crypto Broker Software

Crypto broker software encompasses a range of technological tools and solutions aimed at streamlining the process of cryptocurrency trading and brokerage services. It’s a sophisticated infrastructure that empowers businesses to function as cryptocurrency brokers, granting customers seamless access to cryptocurrency markets and trading capabilities. Most crypto brokerage platforms combine the following software necessary for a full-fledged trading process.

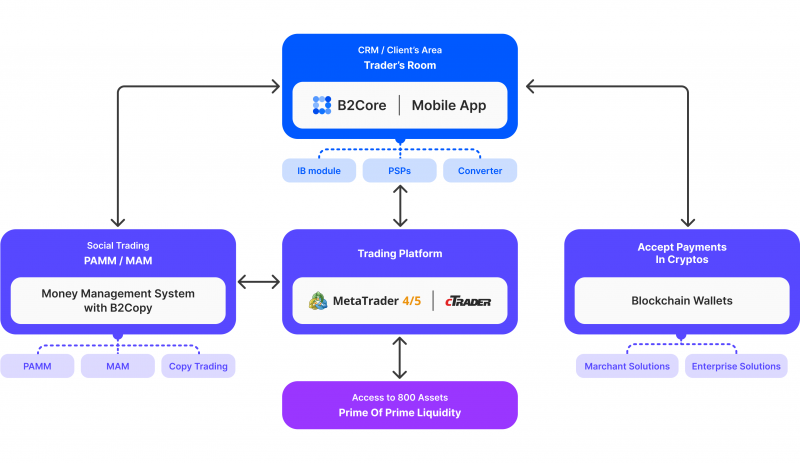

Trading Platform

Like a cryptocurrency exchange, a crypto broker provides a comprehensive trading platform that serves as the primary hub for trading activities. This platform is equipped with a wide range of essential tools to facilitate seamless trading experiences.

It encompasses a multifunctional space featuring intuitive trading interfaces in the form of charts, individual order books for each trading instrument, market depth charts, tables displaying quotes, and other valuable information crucial for formulating effective trading strategies and informed decision-making throughout the trading journey.

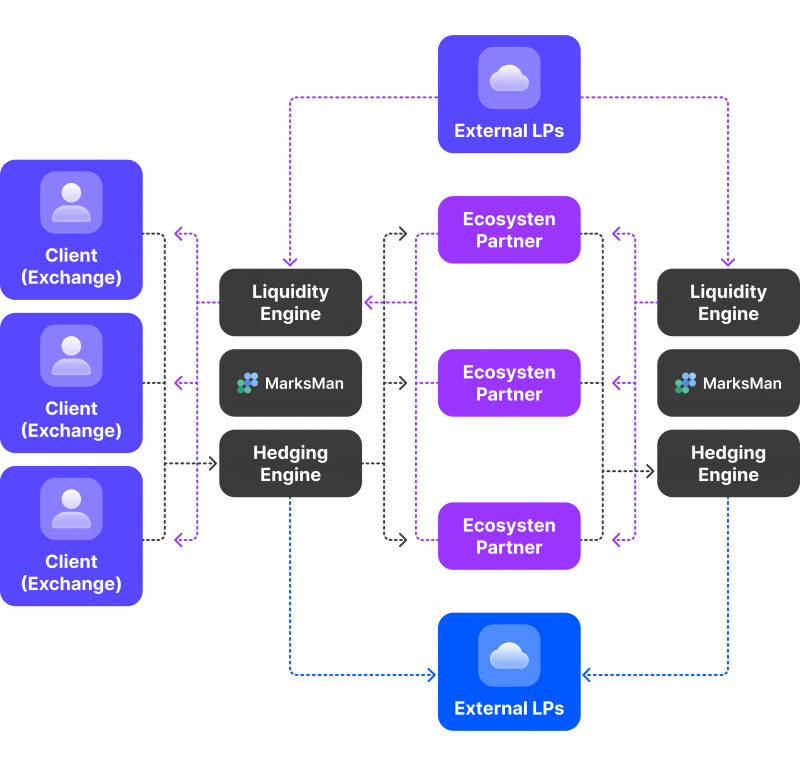

Liquidity Aggregation Module

Liquidity aggregation involves consolidating buy/sell offers for an asset from various sources and transmitting them to executors. This crucial process facilitates crypto trading operations at highly favourable prices (near market rates) and allows for large trading volumes.

By aggregating crypto spot liquidity from multiple sources into a single stream, it becomes feasible to maintain a relative equilibrium between supply and demand levels. Consequently, this helps prevent undesirable occurrences in the crypto market, such as slippage and spread, which can significantly hinder trading effectiveness.

The liquidity aggregation module allows you to access many sources and use each of them alternately, depending on market conditions and the specifics of trading in certain crypto assets.

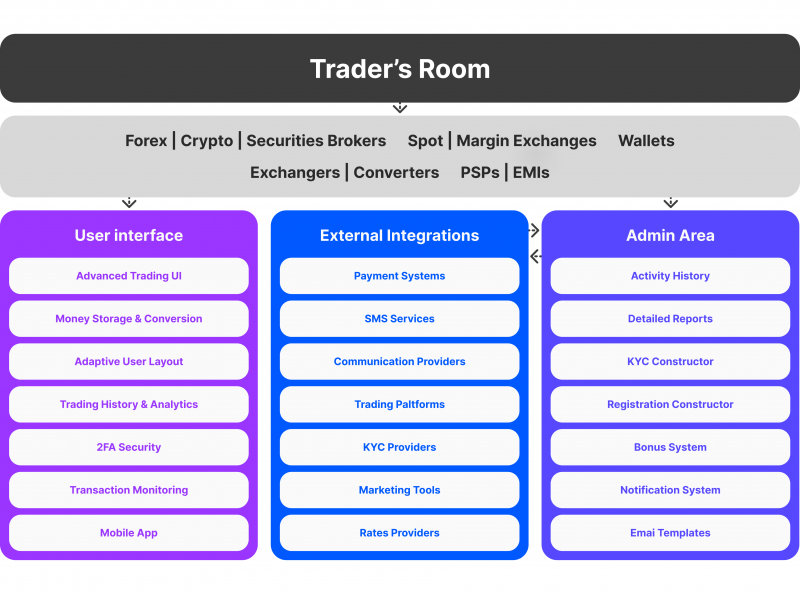

Trader’s Room

The trader’s room serves as a hub for traders, offering a comprehensive range of tools and features to enhance their trading activities. It provides a platform for managing accounts and analysing transaction history. It integrates seamlessly with CRM systems, enabling traders to streamline their trading process and access advanced analytics for refining their trading strategies.

Within the trader’s room, traders can familiarise themselves with the exchange and its functionalities, gaining valuable insights into the tools available.

This dedicated space offers diverse functions and tools, including technical analysis tools, a comprehensive trading activity history, wallet management, analytics, a web trading terminal, and up-to-date market news. By leveraging these resources, traders can optimise their trading experience and make informed decisions to achieve their desired outcomes.

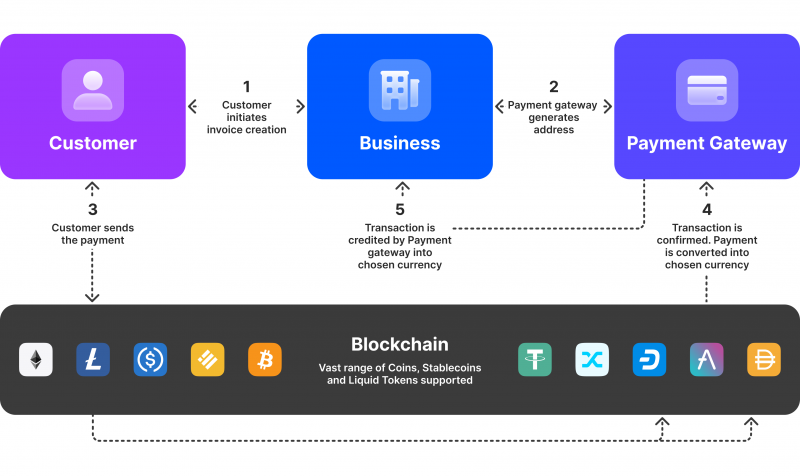

Payment Gateway

Given the intricacies involved in making regular or crypto payments, which entail various stages of verification, processing, and validation, the crypto payment gateway acts as a bridge connecting all the system elements involved in the transaction. This comprehensive system operates in a closed loop, ensuring that every transaction undergoes all the necessary stages to be validated and executed successfully.

By harnessing the power of blockchain technology, these online platforms or digital systems facilitate the seamless transfer of digital coins from one address to another. Moreover, these gateways also enable the conversion of crypto assets into fiat money, which serves as the electronic equivalent of physical currency in different countries across the globe.

Matching Engine

A matching system, also known as an order matching engine, is an electronic platform designed to match buy and sell orders within a stock exchange, commodities market, or any other financial exchange. It serves as the fundamental component of all electronic exchanges, facilitating the execution of orders placed by exchange users.

Acting as an order book for each specific trading pair, the matching mechanism brings buyers and sellers together to facilitate trade completion. By ensuring swift and efficient transactions, the matching engine strives to provide the most favourable price for both parties involved.

Major Functionalities of Crypto Broker Software

Within crypto broker software, you can find a multitude of essential functionalities that are commonly utilised in the industry. These features are specifically tailored to enhance the efficiency and effectiveness of cryptocurrency trading and brokerage services, ensuring a seamless experience for users.

Market Connectivity

The software integrates with cryptocurrency exchanges and liquidity providers to access real-time market data and execute trades. It establishes connections with multiple exchanges to offer a wide range of crypto instruments and ensure competitive pricing.

Account Management

Crypto broker software typically includes tools for managing client accounts. It enables brokers to create and manage user accounts, set account permissions, and handle deposits and withdrawals. It may also provide features for user verification, KYC (Know Your Customer), and AML (Anti-Money Laundering) compliance.

Risk Management

Effective risk management is crucial in crypto brokerage. The software may include risk management tools such as position monitoring, account margining, stop-loss orders, and risk assessment algorithms to help brokers mitigate potential risks associated with cryptocurrency volatility.

Reporting and Analytics

Crypto broker software often offers reporting and analytics features. It generates reports on trade history, account balances, performance metrics, and other relevant data. Brokers can use these insights to analyse their clients’ trading activities, monitor profitability, and make informed business decisions.

Security and Compliance

Given the sensitive nature of cryptocurrency trading, security is a paramount consideration. Crypto broker software implements robust security measures such as encryption, two-factor authentication (2FA), secure storage of private keys, and withdrawal controls. Compliance features help brokers adhere to regulatory requirements and industry standards, such as AML and KYC regulations.

Customisation and White-Labelling

Some crypto broker platform solutions offer customisation options, allowing brokers to tailor the platform’s branding, user interface, and functionalities to align with their business requirements. White-label solutions enable brokers to rebrand the software as their own, providing a seamless and consistent user experience.

Integrations

Crypto broker software integrates with various external services to enhance its functionality and provide a seamless user experience. Common types of integrations include cryptocurrency exchanges, liquidity providers, payment gateways, KYC/AML providers, market data providers, trading APIs, and wallet services.

These integrations offer real-time market data, competitive pricing, seamless deposit and withdrawal processes, compliance with regulations, access to essential market information, advanced trading functionalities, and secure storage of cryptocurrency holdings.

Selling Points Crypto Broker Software Offer

In the competitive landscape of cryptocurrency spot trading and brokerage, businesses are constantly seeking ways to gain a competitive edge. Crypto broker software stands out as a compelling solution, offering a range of advantages that make it an appealing choice for those who want to start a crypto broker. Here is the highlight of some key selling points that set this type of software offer:

User-Friendly Interface

The crypto broker software streamlines the trading process by providing a user-friendly interface, ensuring that experienced traders and newcomers can easily navigate the cryptocurrency market. Its intuitive design, clear visuals, and easy-to-use features enhance the overall trading experience, making it accessible and enjoyable for all users.

Wide Range of Cryptocurrencies

Crypto broker software often integrates with multiple cryptocurrency exchanges, enabling access to a wide range of cryptocurrencies. This variety allows brokers and traders to offer diverse trading options and cater to the preferences of different clients.

Efficient Order Execution

The software used by cryptocurrency brokers guarantees swift order processing by establishing connections with various liquidity providers and exchanges. This enhancement in trade execution speed minimises the chances of slippage, ultimately providing traders with a more advantageous trading environment.

Competitive Pricing and Liquidity

By connecting with various exchanges and liquidity providers, cryptocurrency brokerage software guarantees competitive pricing and access to abundant liquidity. This guarantees that traders are able to swiftly execute trades at equitable market prices, ultimately improving their overall trading experience.

Advanced Trading Tools

Traders can benefit from the advanced trading tools and features offered by crypto broker software, which are designed to support them in making well-informed decisions. These tools encompass real-time price charts, technical analysis indicators, market research resources, and risk management functionalities. By utilising these features, traders can optimise their trading strategies and unlock their full trading potential.

Security Measures

The security of crypto broker software is of utmost importance. It encompasses various strong security measures, including encryption, two-factor authentication (2FA), and the secure storage of private keys. These advanced security features play a crucial role in safeguarding user funds and personal information, ensuring protection against unauthorised access and potential cyber threats.

Crypto Broker Software — How to Find The Best Option for Spot Trading

The highly competitive environment in which most companies have to operate has created conditions under which choosing a genuinely high-quality product can be difficult.

In particular, the choice of the best crypto spot trading platform depends on many factors, which will determine the convenience and efficiency of the solution in the future. Among these factors, the following deserve attention:

1. Individual Requirements

Begin by outlining your exact needs and requirements for spot trading. Take into account factors like the cryptocurrencies you wish to trade, the expected trading volume, the desired user experience, and any specific features or functionalities you require.

2. Research and Analysis

Engage in comprehensive research to identify reliable crypto broker software providers. Seek out companies with a strong track record, positive feedback from users, and a reputable standing in the industry. Consider aspects such as their experience, software quality, and level of customer support.

One of the most sought-after professional crypto broker turnkey solutions for this purpose today is the B2TRADER brokerage platform — a universal infrastructure that combines innovative developments in crypto trading, including countless useful features, integration solutions and deep customisation. B2TRADER Brokerage Platform (BBP) creates a convenient mix of research and charting tools with trading mechanisms and instruments to present a full-stop trading environment.

3. Platform Features

Assess the features provided by various crypto broker software platforms. Look for fundamental features like an intuitive interface, real-time market data, various order types (market, limit, stop-loss, etc.), charting tools, and portfolio management options. Also, consider advanced trading tools, risk management features, and integration capabilities with other services or platforms.

4. Security and Compliance

Given the risks associated with cryptocurrency trading, prioritise security and compliance features. Ensure that the software includes robust security measures such as encryption, two-factor authentication (2FA), and secure storage of funds and personal data. Confirm that the platform adheres to industry standards for KYC (Know Your Customer) and AML (Anti-Money Laundering) compliance.

5. Integration Features

Check the cryptocurrency exchanges integrated with the crypto broker software. Confirm that the software supports reputable exchanges with ample liquidity and a diverse range of tradable cryptocurrencies. Multiple exchange integrations enhance trading opportunities and price competitiveness.

6. Reputation and Support

Evaluate the software provider’s reputation and level of customer support. Look for providers with a solid customer support system, quick responses to inquiries, and a dedication to resolving issues promptly. Consider contacting their support team or speaking with current customers to assess their responsiveness and the quality of support they offer.

7. Scalability and Customisation

Take into account the scalability of the cryptocurrency broker software. Ensure that it can handle growing trading volumes and adapt to your business expansion. Additionally, verify if the software allows for customisation, such as branding options, user interface adjustments, and the ability to add or remove specific features based on your preferences.

8. Pricing

Analyse the pricing model of the software. Compare the expenses related to using the software, including licensing fees, transaction costs, and any additional charges. Weigh the pricing against the features and advantages provided to ensure you are receiving value for your investment.

9. Demo and Trial Features

Whenever feasible, request a demo or trial of the cryptocurrency broker software. This will enable you to evaluate the platform’s features, user experience, and overall suitability for your crypto spot trade requirements. Pay attention to the platform’s performance, ease of use, and if it aligns with your needs.

10. User Feedback and Reviews

Lastly, seek out feedback and reviews from current users of the cryptocurrency broker software. User experiences can offer valuable insights into the strengths and weaknesses of various platforms, aiding you in making an informed decision.

Conclusion

Crypto broker software is a ready-made set of essential programmes and services that allow you to effectively conduct the trading process, whether using a crypto broker turnkey business model or white label software to operate.

As in the process of choosing any other solution, to find the best crypto broker platform for spot trading, you need to consider several factors, each of which is important to the long-term success of the broker.

FAQ

What is crypto broker software?

Crypto broker software is a platform or application that enables individuals and businesses to trade cryptocurrencies. It provides functionalities such as order placement, market data analysis, portfolio management, and integration with cryptocurrency exchanges.

What features should I look for in crypto broker software for spot trading?

When evaluating crypto broker software for the crypto spot market, consider features such as a user-friendly interface, real-time market data, a wide range of tradable cryptocurrencies, advanced trading tools (e.g., price charts, technical indicators), order types (market, limit, stop-loss), portfolio management options, security measures (encryption, 2FA), compliance features (KYC, AML), scalability, integration capabilities, and customer support.

Can I customise crypto broker software for my specific needs?

The best online crypto broker software providers offer customisation options. These may include branding options to align the platform with your business, UI customisation, and the ability to add or remove specific features based on your requirements. However, the level of customisation available may vary between providers.

How do I compare the pricing of different crypto broker software?

When comparing the pricing of different crypto broker software options, consider licensing fees, transaction fees (per trade or volume-based), subscription plans, and any additional charges for certain facilities or services.