How to Start a White-Label Broker in 2026

The financial markets are undergoing swift changes, presenting an excellent chance for entrepreneurs to venture into the brokerage sector without the need to develop a platform from zero. Setting up a white-label brokerage represents a practical approach to starting a trading enterprise, as it provides access to superior technology, regulatory assistance, and easy integration with the market.

Instead of spending years on infrastructure, brokers can focus on branding, client acquisition, and growth. With rising demand for Forex, stocks, and crypto trading, white-label solutions provide the flexibility to serve diverse markets.

This guide covers the key steps, benefits, and strategies for launching a successful brokerage in 2026 — making now the ideal time to enter this thriving industry.

Key Takeaways

- A broker white-label solution allows you to launch in weeks instead of years.

- Avoid the high costs of building a platform by using turnkey brokerage software.

- Expand your business with deep liquidity, multi-asset trading, and custom branding.

What is a White Label Brokerage Model?

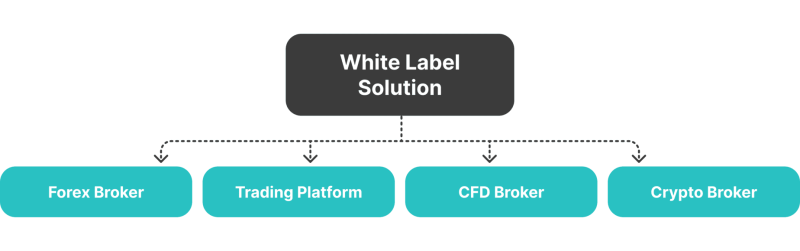

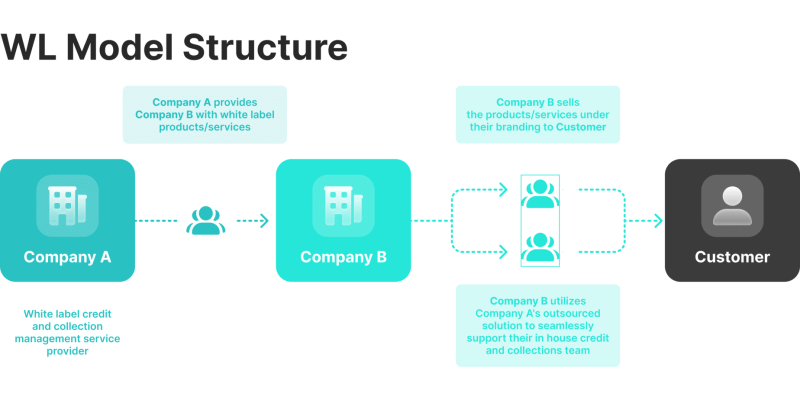

The WL brokerage model is a turnkey solution allowing businesses to launch their brokerage services without developing proprietary trading infrastructure. In this model, a financial institution or entrepreneur partners with a third-party technology provider that supplies a fully functional trading platform, liquidity aggregation, and back-office management tools.

The broker then brands the platform under its name, customises trading conditions, and focuses on acquiring and managing clients. This approach significantly reduces the time, cost, and technical complexity of building a brokerage from the ground up.

Success in the white-label brokerage space requires careful provider selection. A reliable partner must offer robust technology, competitive spreads, deep liquidity, and regulatory compliance support.

Additionally, brokers must differentiate themselves through branding, superior customer service, and targeted marketing strategies. The competitive landscape is fierce, and while the white-label model lowers the entry barriers, brokers must still invest in building trust, optimising user experience, and fostering long-term client relationships.

In 2026, with increasing demand for multi-asset trading and fintech innovation, the white-label brokerage model continues to evolve. Advanced AI-driven analytics, automated trading solutions, and enhanced regulatory frameworks are shaping the future of white-label brokerages.

Firms strategically leveraging these innovations while prioritising compliance and customer engagement will have the greatest potential for sustainable growth and profitability in the global trading industry.

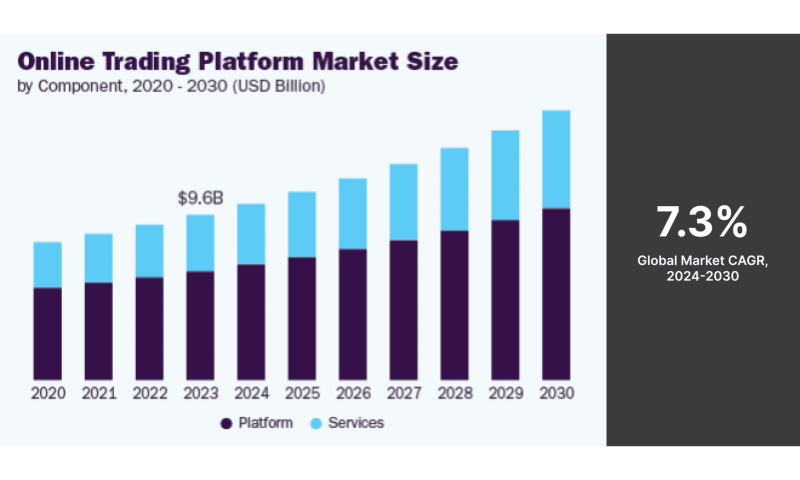

The global online trading market is projected to reach over $12 billion by 2028, making it a prime time to launch a brokerage.

Main Reasons to Launch a White-Label Broker

The white-label brokerage model has gained significant traction in the financial trading industry, offering entrepreneurs and financial institutions an efficient, cost-effective, and scalable way to enter the market.

Here are the key motivations for starting a white-label brokerage, making it a compelling business opportunity in 2026.

Lower Startup Costs Compared to a Proprietary Brokerage

Building a brokerage from scratch requires a substantial investment in technology development, liquidity sourcing, regulatory compliance, infrastructure setup, and ongoing operational costs. This can amount to millions of dollars and take years to complete.

A white-label brokerage eliminates these barriers by providing a ready-made, fully functional trading platform with a significantly lower upfront investment. Instead of spending vast sums on proprietary software and IT infrastructure, brokers pay a setup fee and ongoing licensing or service costs, making it a cost-efficient entry into the financial trading industry.

Faster Time-to-Market

Time is crucial in financial markets, and developing a brokerage from the ground up involves extensive planning, regulatory approval, software development, and testing. A white-label solution drastically reduces the go-to-market timeline, enabling brokers to launch their platform within weeks rather than months or years.

Since the backend infrastructure, liquidity, and trading technology are already in place, brokers can focus on branding, marketing, and client acquisition from day one. This speed-to-market advantage is particularly beneficial in an industry where trends and trading demand shift rapidly.

Built-in Liquidity and Risk Management

One of the biggest challenges for new brokers is securing liquidity from tier-1 banks and liquidity providers. White-label solutions often come with integrated liquidity aggregation, letting brokers comply with narrow spreads and deep market depth without establishing direct relationships with liquidity providers.

Along with that, these solutions include risk management tools to mitigate exposure, automate hedging, and ensure sustainable profitability. Access to such resources minimises operational risks and improves clients’ market execution quality.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Compliance and Regulatory Assistance

Regulatory compliance is a significant hurdle for new brokers. Obtaining the necessary licenses, ensuring AML and KYC compliance, and adhering to global financial regulations can be tricky and labor-intensive. Many white-label providers offer compliance assistance, helping brokers operate legally in various jurisdictions.

Some providers even have pre-established licenses, allowing brokers to operate under their regulatory umbrella, thus reducing legal hurdles and compliance costs.

Customisable Branding and Business Model

Despite using a third-party platform, white-label brokers have complete control over their branding, website design, trading conditions, and pricing structure.

They can customise the user experience, set commissions, spreads, leverage, and differentiate themselves from competitors through tailored services.

This flexibility allows brokers to position themselves in niche markets, target specific trader segments, and build a unique brand identity while leveraging world-class trading technology.

Multiple Revenue Streams

When structured correctly, a white-label brokerage offers diverse revenue opportunities, making it a highly profitable business model. The primary income source comes from spreads and commissions, where brokers earn a percentage of each trade their clients execute. Another significant revenue stream is swap fees generated from overnight positions held by traders.

Beyond trading fees, brokers can monetise their platform through deposit and withdrawal fees, ensuring a steady cash flow from client transactions. Offering premium account features, such as VIP trading conditions with lower spreads or exclusive market insights, provides an additional way to generate income.

Furthermore, advanced trading features like copy and social trading allow brokers to earn a share of profits from users who follow experienced traders.

To scale their business, brokers can establish partnership programs by collaborating with Introducing Brokers (IBs) and affiliate marketers who refer new clients in exchange for commissions.

By strategically combining these revenue streams, white-label brokers can build a sustainable, high-margin business model that maximises profitability.

Scalability and Market Expansion

A white-label brokerage is inherently scalable, meaning brokers can start small and expand their operations as their client base grows. They can add new asset classes, integrate additional trading tools, and expand into different markets and jurisdictions over time.

White-label solutions support multi-language interfaces and multi-currency accounts, enabling brokers to reach a global audience with minimal modifications.

Focus on Business Growth Instead of Technical Challenges

Running a brokerage involves numerous technical and operational complexities, such as maintaining servers, ensuring cybersecurity, handling trade execution speed, and updating software regularly.

White-label solutions offload these responsibilities to the technology provider, allowing brokers to focus entirely on client acquisition, retention, and marketing strategies. Brokers can prioritise business growth, customer experience, and revenue generation by eliminating technical headaches.

High Demand for Online Trading in 2026

The financial markets are experiencing an unprecedented surge in online trading, making it an ideal time to develop a white-label brokerage. Retail investors are participating in financial markets at a record pace, driven by increased financial literacy, accessibility to trading platforms, and the growing popularity of multi-asset trading, including Forex, stocks, commodities, and cryptos.

Fintech advancements have played a crucial role in this growth, making trading more accessible through mobile platforms, AI-driven analytics, and automated trading solutions.

Beyond that, the rise of algorithmic trading has attracted a new generation of traders looking for sophisticated tools to enhance their strategies.

How to Start a White-Label Brokerage in 2026?

Launching a white-label trading business in 2026 can be a lucrative business venture, enabling you to enter the financial markets without having to build a trading platform from scratch. This guide will walk you through the essential steps, from selecting a provider to acquiring clients.

Choosing the Right White-Label Provider

Selecting the right provider is crucial as it impacts technology, liquidity, compliance, and operational efficiency. Ensure the platform is stable, supports automation, and offers deep liquidity from Tier-1 banks. Check for regulatory support, strong customer service, and transparent pricing without hidden fees.

Leading providers in 2026 include B2BROKER, Spotware, Leverate, Gold-i, Match-Trade Technologies, and Brokeree Solutions.

Regulatory and Compliance Considerations

Regulations vary by region: CFTC/NFA (US), ESMA/MiFID II (EU), MAS/ASIC/SFC (Asia). Licensing options include offshore jurisdictions (Belize, Seychelles) or Tier-1 licenses (FCA, CySEC, ASIC) for credibility.

Brokers must comply with AML & KYC policies, verify identities, and monitor transactions. Hiring a compliance consultant simplifies regulatory challenges.

Setting Up Your Brokerage Infrastructure

A robust infrastructure includes a trading platform, a CRM system, back-office tools, and risk allocation solutions. Choose between A-Book (direct market access) or B-Book (market-making) models for trade execution. Strong infrastructure reduces technical failures and enhances customer experience.

Branding and Personalisation

Differentiate your brokerage through customised trading platforms, branded UI, and tailored trading conditions. A professional website and mobile app improve client engagement. Use high-quality marketing materials and social media content to establish credibility.

Funding and Payment Solutions

Seamless payments are key. Partner with trusted PSPs (PayPal, Stripe, Skrill, Neteller) and crypto payment processors. Offer credit/debit cards, bank transfers, and e-wallets for global accessibility. Optimise transaction fees and processing times for better client experience.

Marketing and Client Acquisition Strategies

Leverage SEO, content marketing, and influencer partnerships to attract traders. Use social media (Facebook, YouTube, TikTok) and paid advertising (Google Ads, PPC campaigns) to boost visibility. Implement affiliate and IB programs to scale client development.

Customer Support and Retention

Provide multilingual, 24/7 support for global clients. Enhance engagement with educational resources, webinars, and trading tutorials. Retain clients through loyalty programs, bonuses, and cashback offers, ensuring consistent trading volume.

Scaling and Growth Strategies

Expand into emerging markets (Africa, Latin America, Southeast Asia) and add new asset classes like crypto, stocks, and commodities. Develop proprietary tools with AI and algorithmic trading. Attract high-net-worth clients with VIP accounts and premium services.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Why Start a White-Label Broker with B2BROKER?

Starting a white label trading business is a great way to enter the financial markets without the complexities of developing a trading platform from scratch.

Today, one of the most efficient ways to launch a broker white label is by partnering with B2BROKER. Our solutions minimise the development resources, provide top-tier liquidity, and offer fully customisable trading environments.

B2TRADER White Label Platform

B2TRADER, a versatile trading platform crafted by B2BROKER, serves brokers and financial institutions in diverse markets. It is available as a white label trading platform, enabling firms to brand it as their own. It facilitates immediate trading access and allows users to manage multiple asset classes from a unified interface, including Forex, cryptocurrency CFDs, spot fiat and crypto transactions, precious metals, commodities, equity indices, non-deliverable forwards (NDFs) CFDs, equities, exchange-traded funds (ETFs), and fixed income.

Capable of handling up to 3,000 requests per second, the platform ensures swift order execution and dependable performance, even under significant operational demands. This reliability is crucial for brokerage firms of all sizes, from smaller entities seeking a robust and stable system to larger retail and prime brokers employing copy and algorithmic trading strategies, catering to vast numbers of clients.

Additionally, B2BROKER offers ready-made Forex and crypto broker turnkey packages based on B2TRADER, which include various other products from the B2BROKER ecosystem. These comprehensive solutions enable businesses to quickly set up and scale their operations with integrated support and advanced functionalities.

Power your Brokerage with Next-Gen Multi-Asset & Multi-Market Trading

Advanced Engine Processing 3,000 Requests Per Second

Supports FX, Crypto Spot, CFDs, Perpetual Futures, and More in One Platform

Scalable Architecture Built for High-Volume Trading

cTrader White Label

B2BROKER’s cTrader White Label is an advanced trading solution designed for brokers who want to offer a professional trading experience. The platform supports multi-asset trading, including FX, commodities, indices, and digital coins.

With a highly intuitive interface, cTrader enhances user experience through advanced trading tools such as depth of market (DOM), automated trading strategies, and powerful charting capabilities.

Brokers can fully customise the platform with their trademarks, including logos, domains, and colour schemes, allowing them to establish a unique identity in the competitive financial market.

Another major advantage is the cost-effectiveness of this white-label platform, as it eliminates the need for costly software development and licensing fees. Additionally, the solution ensures regulatory compliance, making it easier for brokers to operate within legal frameworks.

Final Remarks

The demand for online trading continues to rise, and forming a white-label brokerage in 2026 presents a lucrative opportunity for financial entrepreneurs. By leveraging turnkey brokerage software, brokers can reduce costs, speed up market entry, and focus on business growth rather than technical challenges.

With the right strategy, strong branding, and competitive offerings, a WL brokerage can quickly gain traction and build a loyal client base. Now is the perfect time to enter the market and establish a profitable trading business.

FAQ

What is a White Label brokerage?

A WL brokerage provides a pre-established trading platform that encourages companies to introduce their own branded trading services without the need to create the underlying infrastructure from zero.

How much does it cost to start a white-label broker?

Costs vary, but are significantly lower than building a platform from the beginning. Expenses typically include setup fees, licensing, and operational costs.

How long does it take to launch a white-label trading business?

With a WL platform, a brokerage can be launched in a few weeks, compared to months or years for proprietary platforms.

What trading assets can be offered on a white-label brokerage?

Most platforms support FX, stocks, commodities, indices, and virtual assets, offering brokers diverse trading opportunities.

How can a white-label broker make money?

White-label brokers earn revenue through spreads, commissions, swap fees, and additional services like premium accounts or educational content.