How To Start White Label CFD Broker in 2023?

Articles

The world of trading has reached new heights of accessibility and freedom, providing lucrative opportunities to small and mid-sized investors across the globe. In 2023, the capital requirements for becoming a successful broker are lower than ever, thanks in small part to various trading instruments decreasing entry barriers.

Contracts for difference (CFDs) are a prime example of such trading instruments, decreasing the need for substantial trading capital for traders with limited budgets. Due to their increased popularity and benefits, the demand for CFD brokers has risen astronomically as of 2023.

This article will analyze the crucial nature of CFDs and provide a comprehensive guide to starting a white-label CFD brokerage from scratch.

Key Takeaways

- CFDs are trading instruments allowing traders to profit from asset price changes without purchasing them.

- Aspiring CFD brokers can purchase white-label software to avoid developing the entire broker platform from scratch.

- White-label CFD brokerage has become increasingly popular due to its convenience and accessibility for small to mid-sized firms.

- Building a white-label CFD broker firm requires thorough research, diligent business planning, an understanding of CFD regulations and much more.

CFDs Explained

In its most basic form, the trading landscape is quite restrictive for traders with average or small capital. Generally, tradable assets like bonds, stocks, fiat and various commodities do not fluctuate enough to produce significant profits in small volumes. Therefore, only the investors with substantial capital could earn massive profits from trading, as high volumes are required to accumulate sizable returns.

Thus, without advanced trading mechanisms, average traders would be effectively shut out from the market, unable to yield material rewards with limited capital resources. CFDs were invented to reverse these circumstances and provide traders with opportunities for profit without requiring massive capital to invest.

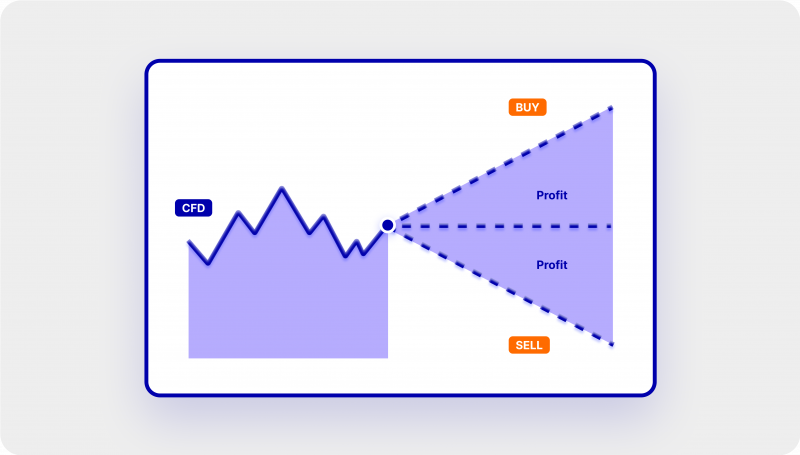

CFDs function as financial derivatives, enabling traders to profit from asset price changes without purchasing them. This happens via CFD brokers, who effectively provide short-term loans to their customers through CFDs. In this process, a trader must specify their position related to the price change of a given asset.

For example, if the trader believes the asset will increase in value, they will choose a long position. Conversely, for expected price decreases, traders open short positions. Once the traders set their positions, they will only have to pay a commission and interest rates for the duration of the position. Once the position is closed, the traders will receive their respective gains or losses from the CFD agreement.

While this process is similar to regular derivative trading, one crucial distinction exists. With CFDs, investors don’t have to purchase tradable assets to benefit from their price changes. With this structure, CFDs reward investors for their accurate forecasts without requiring substantial trading capital.

White Label CFD Solutions and Their Benefits to Aspiring CFD Brokers

With CFDs becoming increasingly popular in the general trading markets, establishing CFD broker firms has become one of the most lucrative prospects in 2023. The best part is that CFD brokers are not limited to specific trading markets. Any type of broker organization can become a CFD provider – from Forex brokers to the stock market, and even crypto brokers are eligible to implement CFD capabilities.

While it is a worthwhile venture, creating a CFD brokerage business from square one can be a massively expensive endeavor. CFD broker companies require huge amounts of initial capital, from development and marketing costs to operational expenses and sizable in-house teams. However, there is a solution to avoiding colossal business costs associated with CFD brokers – the White Label service.

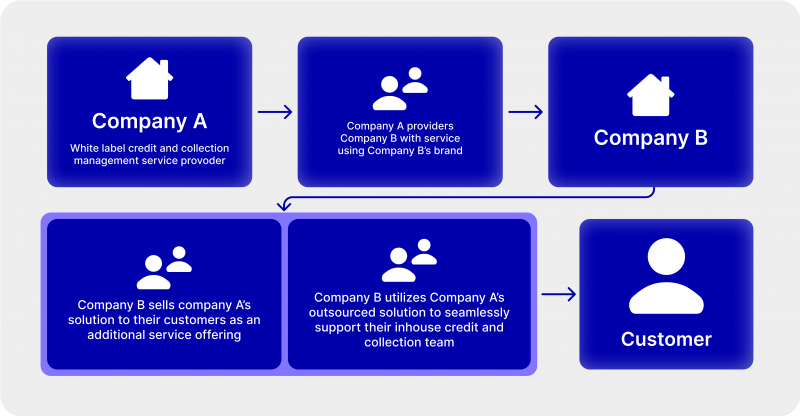

White Label solutions are a great way to jumpstart broker businesses since they readily provide pre-built trading platforms at a fraction of the cost. White Label solutions eliminate the need to develop broker platforms from scratch, letting business owners acquire ready-made software and severely reduce the time-to-market period.

By acquiring a White Label solution, businesses can construct their own brand around this software and market it as their unique broker offering. With such a solution powering their technology, companies can focus on branding, marketing and operational efficiency, increasing their chances of success.

Thus, White Label CFD software is a perfect starting point for aspiring businesses that intend to enter the market swiftly and focus on building a distinct and competitive brand. However, even with the assistance of White Label solutions, constructing a CFD broker business is still a complex process that entails numerous challenges.

CFDs are an excellent choice for traders with limited investment budgets to trade at high volumes without capital requirements.

Essential Steps in Establishing a White Label CFD Broker Business

As discussed above, White Label CFD broker companies are highly lucrative business opportunities in 2023. They liberate business owners from arduous development times, massive salary expenses and other challenges related to constructing a custom CFD platform. That being said, constructing a White Label CFD broker still includes numerous processes and milestones that must be respected and executed flawlessly. Below, this chapter presents the most crucial steps required to develop a successful White Label CFD broker.

Conduct Comprehensive Research and Develop a Business Plan

As with any other business development process, the first steps to creating a White Label CFD broker should start with rigorous research. Interested companies must research their local markets, analyze the competition, and identify the needs of their target audiences. The research process should cover all the relevant information necessary to build a sturdy business plan.

Businesses must understand their customer needs perfectly, devising numerous personalized benefits for a given CFD niche. Research is also essential in identifying all relevant business costs and developing realistic cash flow forecasts. Skillfully constructed business plans are indispensable assets in the early stages of business development, as they represent great signals for potential investors.

Both research and business plan milestones can be achieved in a variety of ways, but the most important aspect is being thorough. Most successful businesses always make an effort to analyze their markets exhaustively and look for any opportunities to stand out from the competition. The same is true for CFD brokers. Due to an increasing supply of CFD brokerage firms on the market, it is all but necessary to gain every bit of competitive advantage. Taking time to do comprehensive research and construct an airtight business plan is the key to this process.

Consider the Laws and Regulations Related to Broker Industry

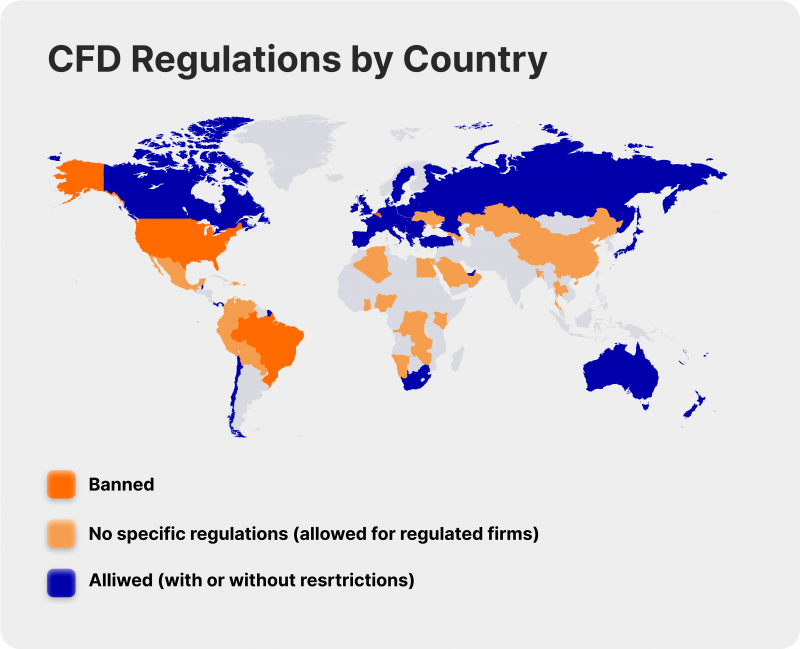

It is no secret that CFDs are controversial assets in the trading market. Many regulatory bodies, including the US government, have banned CFDs from regulated exchange markets, as CFDs do not pass all necessary laws and regulations outlined by the US regulators.

While CFDs are allowed in numerous other countries and markets, they are heavily restricted in certain regions. In other countries, the lack of regulation might signal that purchasing CFDs could lead to potential risks on both sides of the transaction. Thus, aspiring CFD brokers must become extremely familiar with their local laws and regulations to navigate the CFD market responsibly.

It is of utmost importance to identify if your respective CFD sector is properly regulated, but not overly so, as overwhelming regulations might limit the business opportunities related to developing a CFD broker business. Aspiring CFD brokers should either dedicate an adequate amount of time and resources from their in-house team to examine all relevant CFD laws or outsource this issue altogether.

In this case, third-party legal experts could provide swift and efficient assistance to CFD brokers, catching them up to speed regarding all essential regulatory implications.

Select the Perfect White Label Trading Platform

The White Label solutions market has massively expanded in recent years, with numerous White Label providers offering competitive fees and cutting-edge software. However, this market has no one-size-fits-all solutions, and aspiring CFD brokers must identify the perfect providers based on their specific requirements.

In this case, the most crucial aspects to consider are platform fees, the variety of platform functionalities and the freedom of customization. Some White Label solutions are more restrictive than others, providing limited modification options for CFD brokers. Conversely, other White Label solutions might offer nearly limitless customization features but have an unfeasible price tag for brokers with limited budgets.

Thus, choosing the perfect White Label provider comes down to your specific priorities as a CFD broker. Businesses must carefully consider their immediate needs and decide what factors are most crucial for their success in the current marketplace. Some White Label providers even offer package options, letting customers increase or decrease their fees based on their changing needs.

Transform The White Label Solution Into a Distinct Brand

While adopting White Label software liberates businesses from doing the technical heavy lifting, they must develop a recognizable and strong brand presence. This means providing unique and relevant benefits to target audiences, maintaining a strong digital presence and raising awareness through rigorous marketing campaigns.

This is arguably the most challenging part of building a successful CFD broker business, requiring creativity, experience, and dedication. Building a strong brand can depend on various factors, and it might not come to fruition in a short time. As a brokerage business, it might take months to accumulate popularity through word-of-mouth, strong CFD offerings and effective marketing efforts.

Businesses must also consider the social, political and cultural factors when building a brand presence. They must carefully analyze the successful branding efforts and replicate the most relevant strategies in their own roadmap. CFD brokers should not take this process lightly, as brand presence can dictate the success or failure of brokerage firms. Even the most advanced and feature-rich broker platforms might get lost in the sea of competition without a recognizable brand.

Set Up Flawless Customer Support Services

Having excellent customer support is vital for White Label CFD brokers, as they provide a digital product with numerous potential issues and errors. Regardless of the White Label solution quality, the software is prone to breakdowns, unforeseen errors and technical bugs. While these digital issues are usually annoying, they are especially detrimental for online brokerage firms.

As a White Label broker, It is important to remember that customers are extremely sensitive regarding their financial possessions and potential losses. Thus, if customers experience trouble interacting with CFD platforms, it’s crucial to provide timely support and remedy their issues as soon as possible. Otherwise, CFD brokers risk losing their customers for good.

Generally, it is best to have live customer portals with convenient chat rooms, letting users voice their complaints swiftly. Automated chatbots can help CFD brokers tremendously, answering frequently asked questions without human intervention. Many broker platforms also provide live calling options for customers to have a quick call with technical support specialists.

Consistently Update the CFD Features and Functionality

The trading markets are known for their fast-paced and relentless nature. With numerous new developments, strategies and tactics being developed rapidly, keeping the CFD broker platform up to date is crucial. Business owners must regularly survey their target audience to identify new opportunities for upgrading their CFD offerings.

From brand-new advanced trading tools, live price updates and analytics software to the intuitive user interface, companies must ensure that their CFD platform does not fall behind the competition. Adopting the latest tools and practices will help CFD brokers develop a sturdy reputation for quality and customer care. This will, in turn, lead to a stronger brand presence, customer loyalty and opportunities to increase the market share.

Ensure Maximum Security

Last but not least, CFD brokers must ensure the safety of their customers at all times. Any online broker must adopt the latest cybersecurity practices, ensuring that customer funds and portfolios are safe from malicious attackers and data disasters. CFD broker platforms also contain sensitive customer information, which must be secured and encrypted.

Tools like two-factor authentication, offline data storage, and data backups can significantly enhance CFD broker platform security. Businesses also utilize the services of third-party specialists to adopt the best security practices and provide learning materials on essential topics like phishing. Whether you have a Forex brokerage, stocks, and bonds exchange or a crypto platform, security is vital in every instance.

Final Takeaways

The increasing popularity of CFDs in trading markets has swiftly created a massive demand for CFD brokers. This emerging sector offers lucrative potential for aspiring brokers to move in and conquer a sizable market share. However, building a CFD broker platform in-house requires a lot of resources, time, and money. Thus, businesses with limited budgets might be unable to enter the CFD market promptly. White Label solutions alleviate this issue, letting companies forego the arduous development process and focus on establishing a brand presence and high-quality services by providing ready-made CFD platforms.