Identifying the Most Reliable Liquidity Provider: What Criteria Should it Qualify?

In the modern world, doing business in any field without reliable and qualified partners is practically impossible. The financial market and trading industry are no exception. The right partner in this sphere, who can significantly impact your platform’s efficiency and influence execution speed, transaction costs, and overall market access, is a liquidity provider (LP).

Identifying a reliable LP is paramount for businesses seeking a competitive edge, but the extensive choice of potential partners in the market makes this process challenging.

In this article, we will delve into the essential criteria that a liquidity provider should meet to ensure the best execution and financial stability for brokers and their clients.

Key Takeaways

- LPs are crucial in financial institutions, impacting transaction efficiency, pricing, and trade execution.

- Key criteria for identifying the best liquidity providers include regulatory compliance, financial stability, robust technology infrastructure, competitive pricing, diverse instruments, etc.

Understanding the Significance of Liquidity

Liquidity is the lifeblood of any financial market, determining the ease with which assets can be bought or sold. For both retail investors and institutional traders, a reliable liquidity provider ensures smoother transactions, better pricing, and improved trade execution.

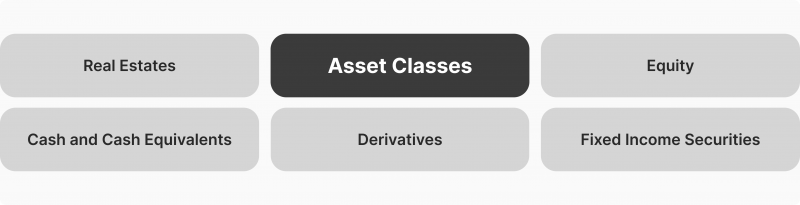

The ability to gain access to various financial instruments, including exotic currency pairs and less popular asset classes, is a characteristic sign of a top-tier LP.

Liquidity providers and market makers play a pivotal role in shaping market structures. They create market prices, enhance liquidity, and facilitate the seamless execution of leveraged orders for brokers.

Over the years, liquidity requirements have evolved, reflecting changes in trading patterns, technological advancements, and market dynamics. AI and machine learning have become integral to the trading business model, demanding liquidity providers to adapt and provide customised liquidity solutions.

The growth of passive investing and the rise of high-frequency trading have increased the demand for FX, CFD, or crypto liquidity, prompting multiple liquidity providers to enhance their technology infrastructure.

The Need for Multi-Asset Liquidity Providers

Liquidity is a lifeline for brokerage operations, and disruptions in liquidity services can impact the extensiveness of brokerage offerings. With the increasing convergence of capital markets, traders seek brokers offering access to a wide array of assets.

Multi-asset liquidity empowers traders with the ability to diversify their portfolios across various financial products. As markets become more interconnected, the traditional focus on a single asset class gives way to a more all-inclusive approach.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Traders can access equities, forex, commodities, and cryptocurrencies seamlessly through a single platform, allowing for effective risk management and enhanced portfolio stability.

Efficiency in resource utilisation is a key consideration for modern traders. Multi-asset liquidity streamlines trading activities by consolidating access to different markets within a unified platform. This not only saves time but also reduces operational complexities, allowing traders to focus on strategy execution and decision-making rather than managing multiple accounts across various providers.

So, as traders’ needs expand, brokerages should adapt and extend their offerings. To do so, they need a reliable liquidity provider partner, and below, we’ll go through key criteria that a reliable LP should qualify.

Qualifying Criteria for a Reliable Liquidity Provider

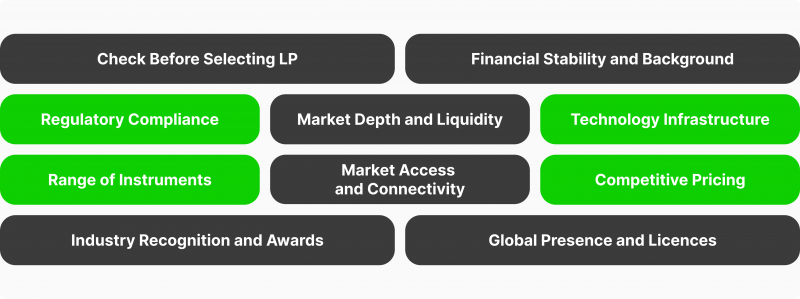

Selecting the most reliable liquidity provider involves a multi-stage, meticulous process. Factors such as regulatory compliance, financial stability, and reputation are paramount. Let’s go through the key considerations:

1. Regulatory Compliance

The first and foremost criterion for evaluating a liquidity provider’s reliability is regulatory compliance. A trustworthy provider operates under the jurisdiction of a reputable financial institution, ensuring adherence to strict standards and guidelines. LP’s regulatory compliance not only safeguards your brokerage but also increases your reliability in the eyes of traders.

2. Financial Stability and Background Checks

A reliable LP must demonstrate financial stability backed by thorough background checks. The provider’s ability to maintain liquidity depth even during market volatility is crucial for your traders looking to overcome uncertainties.

3. Market Depth and Liquidity

A reliable liquidity provider should offer ample market depth and liquidity. Your traders will benefit from quick order execution and minimal slippage when you have access to a deep and liquid market. Fast execution, minimal rejects or requotes, and post-trade transparency are crucial.

4. Technology Infrastructure

The technological prowess of a liquidity provider is a critical factor in ensuring you have a robust trading environment. Look for providers with cutting-edge technology, low-latency connectivity, and redundant systems to minimise downtime and ensure uninterrupted access to market data.

A secure and efficient technology infrastructure is paramount for executing trades promptly and mitigating risks associated with system failures. The best providers employ advanced algorithms and systems, leading to improved trade execution, tighter spreads, and better pricing for clients.

5. Range of Instruments

Versatility in trading instruments is another crucial criterion for evaluating a liquidity provider’s reliability. A provider offering a diverse range of assets ensures that your traders have access to various markets, enabling them to capitalise on emerging opportunities and diversify their portfolios effectively.

Whether dealing with equities, forex, commodities, indices or cryptocurrencies, a top-tier provider should have access to a broader range of financial products.

6. Market Access and Connectivity

Accessibility to different markets and connectivity to various liquidity sources are essential for brokers aiming to execute their traders’ deals seamlessly. A reliable liquidity provider should enable retail clients to access market data with ease, fostering a more inclusive trading experience. Explore connectivity options like FIX API and compatibility with popular trading platforms.

7. Competitive Pricing

Transparent and competitive pricing structures are indicative of a trustworthy liquidity provider. Evaluate spreads, commissions, and any additional fees to determine the overall cost of partnering with a particular provider.

Opting for a provider with fair and competitive pricing ensures that your traders maximise their profits without being overloaded by excessive transaction costs.

8. Industry Recognition and Awards

Look for liquidity providers that have earned industry recognition and prestigious awards. These awards reflect the provider’s commitment to excellence and the satisfaction of their clients. Awards can range from best execution to outstanding customer service.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

9. Global Presence and license

A widespread global presence and proper licensing indicate a liquidity provider’s legitimacy. Attending international Expos and Summits and operating under regulatory frameworks ensures that the provider adheres to industry standards, offering a secure environment for your operations.

Factors Influencing Broker’s Choice

Forex Brokers face a myriad of considerations when choosing a liquidity provider, with parameters varying based on region, size, and ambitions.

Reputation, liquidity depth, pricing competitiveness, range of financial instruments, technology infrastructure, and regulatory compliance are among the key factors. While loosely regulated liquidity providers may offer enticing offerings, brokers prioritise safety and stability.

Balancing the factors mentioned above in the intricate decision-making process ensures brokers establish strategic partnerships that contribute to their operational efficiency and enhance the overall trading experience for their clientele.

Conclusion

In conclusion, identifying the most reliable liquidity provider involves a comprehensive evaluation of various criteria. Beyond technological solutions and multi-asset support, industry recognition, awards, global presence, and proper licensing play pivotal roles in determining the credibility of a liquidity provider.

Businesses should conduct thorough due diligence, considering the provider’s ability to maintain financial stability, offer a diverse range of assets, and provide seamless trade execution.