NASDAQ Composite Index — What is It And How to Invest In It?

Today, the NASDAQ Composite Index (^IXIC) is not just a metric that reflects the economic position of firms in the overwhelming technology area but is a benchmark for assessing the average performance of firms with strong economic outlooks both in the US and abroad, allowing us to analyse the stability of their financial position. But how to invest in it?

This article will explain what this index is, what components it consists of, and what the best ways to invest in it are.

Key Takeaways

- The Nasdaq Composite indicator refers to 3000 stocks publicly traded on the Nasdaq exchange.

- This index is market capitalisation-weighted and features various entities, including U.S. and international corporations.

- ^IXIC is significantly influenced by technology stocks, alongside substantial contributions from the private sector investment and healthcare sectors.

What is the NASDAQ Composite Index?

^IXIC is a common stock market index that examines the financial health of all the enterprises publicly traded on the NASDAQ stock exchange. It is widely recognised as a leading benchmark for the operation of science-based and innovation-driven business entities, though it includes a variety of sectors.

Unlike other major indices focusing only on the majority of corporations, the NASDAQ Composite metric accommodates a huge array of stocks, from large-cap industry giants to smaller, emerging firms.

The NASDAQ Composite Index is one of the most closely followed indices globally and is often viewed as a proxy for the technology sector, given its significant weighting in tech corporations.

Key Components of the NASDAQ Index

The NASDAQ Composite Index comprises over 3,000 businesses traded on the NASDAQ stock exchange, and engineering, bio projects, and consumer service firms lead it. Below are the key components that play a major role in shaping the index:

Technology

The NASDAQ Composite is well-known for its strong focus on tech firms, which make up the bulk of the index. Many of the world’s most valuable and influential tech firms are part of the index, including:

Apple (AAPL): A leader in consumer electronics, software, and services, Apple is known for its iPhone and Mac computers and expanding services like Apple Music and iCloud.

Microsoft (MSFT): Dominates in cloud computing (Azure), enterprise software (Windows, Office), and gaming (Xbox).

Alphabet (GOOGL): Google’s parent company, focusing on search engines, digital advertising, and innovations in artificial intelligence and autonomous vehicles.

Amazon (AMZN): Known for its e-commerce platform, Amazon also leads in cloud computing (AWS) and streaming services.

Meta (META): The parent company of Facebook, Meta focuses on social networking, digital advertising, and virtual/augmented reality development.

Healthcare and Biotechnology

A huge segment of the index comprises biotechnology and pharmaceutical businesses, many of which are involved in cutting-edge medical research and innovation.

Amgen (AMGN): A leading biotech firm focused on developing therapies for conditions like cancer, cardiovascular diseases, and inflammation.

Gilead Sciences (GILD): Known for developing antiviral drugs, including treatments for HIV/AIDS and hepatitis C.

Illumina (ILMN): Specialises in genetic sequencing technologies used in genomics research, driving advancements in personalised medicine.

Consumer Services

The index includes major consumer technology and services companies that have transformed how people shop, entertain, and communicate.

Tesla (TSLA): A leader in electric vehicles, renewable energy, and autonomous driving technologies. Tesla’s innovations in energy storage and vehicles make it one of the most prominent companies in the index.

Netflix (NFLX): A pioneer in online streaming services, Netflix offers a wide range of original programming and has reshaped the entertainment industry.

eBay (EBAY): An online marketplace that facilitates consumer-to-consumer and business-to-consumer sales of goods and services.

Telecommunications

Telecommunication companies also play a role in the index, helping to drive connectivity and digital infrastructure advancements.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

T-Mobile (TMUS): A major U.S. wireless carrier that offers mobile communication services and has been involved in the rollout of 5G technology.

Small and Mid-Cap Growth Companies

In addition to large-cap industry giants, the index covers small and mid-cap companies. These firms are often at the epicentre of development and progress in emerging industries like artificial intelligence, cloud computing, and clean energy. Some of these entities have the potential to become the next tech giants, making the NASDAQ Composite a unique blend of established leaders and high-growth potential firms.

Zoom Video Communications (ZM): A popular video conferencing platform that grew tremendously due to the shift to remote work during the pandemic.

Roku (ROKU): A company that manufactures digital media players and provides an operating system for smart TVs, contributing to the growing trend of cord-cutting and streaming.

Real Estate Investment Trusts (REITs)

The index also includes REITs, which are companies that own, operate, or finance income-generating real estate. These REITs invest in various sectors like data centres, industrial properties, and healthcare facilities.

Equinix (EQIX): A global data centre REIT that plays a key role in the growing digital infrastructure by providing connectivity and storage for cloud computing companies.

American Tower (AMT): A REIT that owns and operates wireless and broadcast communications infrastructure, including cell towers.

Differences Between NASDAQ Composite and Other Indices

The NASDAQ Composite is one of the most well-known stock market indices, but it differs significantly from other major indicators like the S&P 500 and the Dow Jones Industrial Average (DJIA). Below are the key differences:

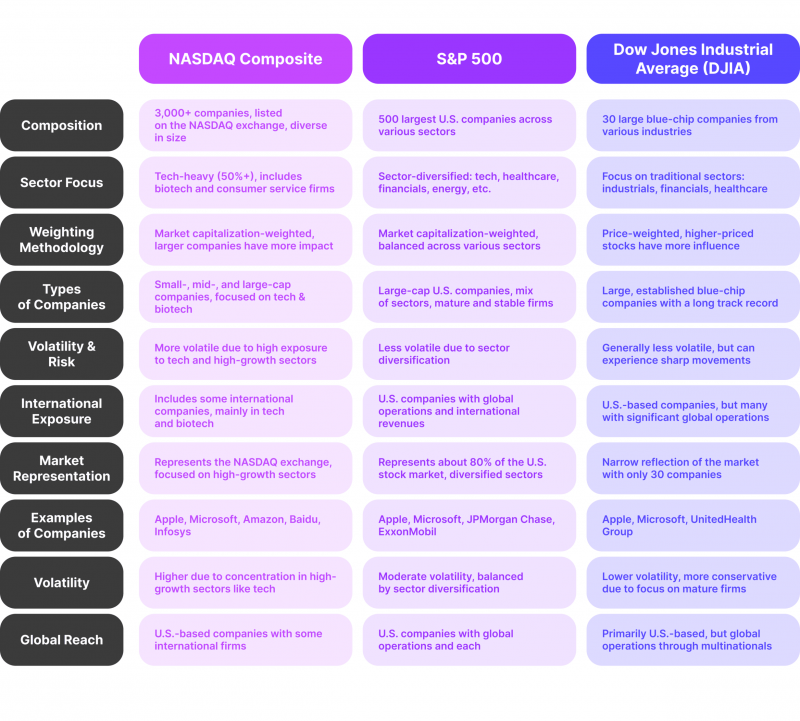

Composition

^IXIC caters to over 3,000 businesses presented on the NASDAQ exchange, covering many industries but focusing strongly on technology and innovation-driven sectors. The index also includes small-, mid-, and large-cap companies, making it more diverse in size.

The S&P 500 tracks 500 of the largest U.S. publicly traded companies across various sectors, representing about 80% of the total U.S. stock market capitalisation. It is more widespread across technology, healthcare, finance, and energy industries.

The DJIA is a much smaller index, tracking 30 large, blue-chip players. These businesses come from various fields, with more emphasis on traditional industries like manufacturing, consumer goods, and financial services, making it less tech-centric than the NASDAQ Composite.

Sector Focus

^IXIC is tech-heavy, with around 50% of its value tied to the technology sector. It also includes a significant number of biotech and consumer service companies. Because of this concentration, the index is seen as a proxy for the state of the tech industry.

The S&P 500 is sector-diversified, with technology making up a significant portion, but it also covers other critical sectors like healthcare, financials, consumer goods, and energy. This broader sector exposure makes the S&P 500 more balanced and reflective of the overall U.S. economy.

The DJIA includes a mix of companies from traditional sectors, such as industrials, financials, and healthcare. Technology institutions have a lower representation in the DJIA than the NASDAQ Composite, although companies like Apple and Microsoft are included.

Weighting Methodology

The NASDAQ Composite is a market capitalisation-weighted index, meaning that larger entities (based on their total market value) significantly influence the index’s movements. For instance, companies like Apple, Microsoft, and Amazon disproportionately impact the index due to their massive market caps.

Like ^IXIC, the S&P 500 is also market cap-weighted, meaning the largest companies in the index exert the most influence. However, its sector diversity mitigates the dominance of any one sector, making it less concentrated in technology compared to the NASDAQ Composite.

The DJIA is price-weighted, meaning the companies with higher stock prices have a greater impact on the index, regardless of their market cap. This method proportionately influences higher-priced stocks like Apple or UnitedHealth Group, compared to a company like Microsoft, which has a stock price but a higher market cap.

Types of Companies

^IXIC includes companies of all sizes and growth stages, ranging from small-cap emerging tech firms to large-cap giants. Most companies listed are U.S.-based, but the NASDAQ also lists international companies, especially in the engineering and bio initiatives sectors.

The S&P 500 comprises large-cap, established companies focusing on mature, stable businesses. It includes a mix of U.S. companies from all sectors of the economy and is a broad reflection of the U.S. stock market.

The DJIA is composed of large, blue-chip companies that are industry leaders. These are typically well-established firms with a long track record of stability and profitability. The companies in the DJIA are mature, profitable, and well-known household names.

Volatility and Risk

Due to its heavy exposure to technology and high-growth industries, the NASDAQ Composite is expected to be more cyclical than other indices. Tech stocks are often more sensitive to changes in market confidence, interest rates, and regulatory issues, resulting in sharper swings in the index.

The S&P 500 tends to be less volatile because of its sector diversification. While it includes some tech companies, it also has significant representation from less volatile sectors like healthcare, utilities, and consumer staples, which helps balance the risk.

The DJIA is also generally considered less volatile but can still experience sharp movements due to its reliance on large, established companies. It is considered a more conservative index than the NASDAQ Composite because it includes fewer high-growth tech names.

International Exposure

While the NASDAQ Composite primarily consists of U.S.-based companies, it includes several international firms in sectors like technology and biotechnology. For example, global tech companies like Baidu and Infosys are listed on the NASDAQ.

The S&P 500 also includes many companies with global operations and significant international revenue streams, but it focuses only on U.S. companies. However, many companies in the index are multinational corporations with global reach.

Like the S&P 500, the DJIA tracks U.S.-based companies, but many are global corporations with substantial revenue from overseas markets.

Market Representation

The NASDAQ Composite broadly represents the NASDAQ stock exchange, particularly emphasising newer, high-growth companies and sectors.

The S&P 500 is considered one of the best indicators of the overall U.S. stock market because it tracks various industries and large-cap companies.

The DJIA is one of the oldest and most recognised indices, but it is seen as a narrower reflection of the market because it tracks only 30 large-cap companies.

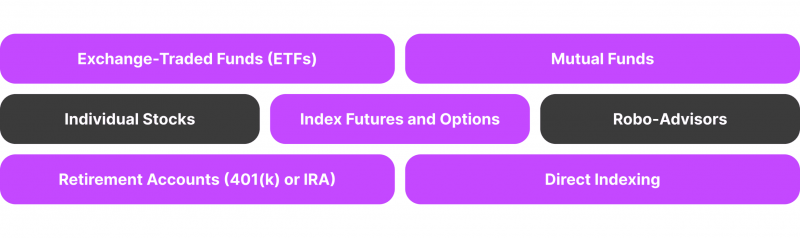

How to Invest in the NASDAQ Composite Index? 7 Options

Today, there are a number of ways in which it is possible to make investments in the index. Some of the most popular methods, among others, include:

1. Exchange-Traded Funds (ETFs)

ETFs are among the most common ways to invest in the index. These funds are designed to track the effectiveness of the entire index or a subset, like the NASDAQ-100. Examples include:

Invesco QQQ (QQQ): Tracks the NASDAQ-100, a group of the 100 largest non-financial companies.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

First Trust NASDAQ-100 Ex-Technology Sector Index Fund (QQXT): Focuses on non-technology sectors within the NASDAQ-100.

2. Mutual Funds

You can also invest in mutual funds that correspond to the NASDAQ Composite or NASDAQ-100. These funds pool investor money to buy a broad portfolio of NASDAQ-listed stocks. Popular options include:

Fidelity NASDAQ Composite Index Fund (FNCMX): Provides exposure to the entire index.

T. Rowe Price Global Technology Fund (PRGTX): While not directly tracking the NASDAQ, it offers exposure to many of its largest tech stocks.

3. Individual Stocks

Investing directly in individual NASDAQ-listed stocks allows you to focus on the index’s specific companies. Examples include Apple (AAPL), Microsoft (MSFT) and Amazon (AMZN). This method suits investors who want to concentrate on particular companies within the index.

4. Index Futures and Options

For more experienced investors, index futures and options offer a way to invest in the index. These derivative instruments allow you to speculate on the future performance of the index or hedge existing investments. Examples include:

NASDAQ Composite Futures: Contracts that allow you to buy or sell the index at a predetermined price.

Options on Invesco QQQ ETF (QQQ): These give you the right to buy or sell shares of the ETF at a specific price before a certain date.

5. Robo-Advisors

Many robo-advisors build portfolios, including exposure to NASDAQ Composite ETFs or mutual funds. These platforms automatically allocate your funds based on your financial goals and risk tolerance, and they typically include a mix of asset classes, including NASDAQ ETFs.

6. Retirement Accounts: 401(k) or IRA

You can participate in the index through a 401(k) or IRA by choosing ETFs or mutual funds that reflect the index. Many retirement accounts offer options like Invesco QQQ ETF (QQQ) and Fidelity NASDAQ Composite Index Fund (FNCMX). These are tax-advantaged accounts suitable for long-term investing.

7. Direct Indexing

Direct indexing allows you to replicate the growth rate of the NASDAQ Composite by buying the individual stocks that collectively make up the index. This method provides more investment control and can be tailored for tax-loss harvesting or specific sector exposure.

Conclusion

NASDAQ Composite Index is a market cap-weighted index primarily representing high-tech, bio innovations, and consumer service firms. It differs from other indices like the S&P 500 or Dow Jones because of its highly technological base and the wide range of company sizes it tracks. As a result, the index is often seen as a proxy for the health of the U.S. tech sector and innovation-driven industries.

FAQ

What does the NASDAQ Composite stand for?

Such an index is a market capitalisation-weighted indicator that quantifies the profitability of over 3,000 firms that operate on the NASDAQ platform.

Why should I invest in the index?

Owning a share in the NASDAQ Composite exposes you to a multitude of enterprises, particularly in high-tech and growth-focused verticals.

What is the difference between NASDAQ Composite ETFs and private equity units?

ETFs are traded on the stock exchange like individual stocks and generally have lower fees and more liquidity than mutual funds. On the other hand, mutual funds are typically bought and sold at the end of the trading day, and they may offer additional investment strategies but often come with higher fees.

Can I invest directly in the index?

No, you cannot invest directly in the index itself. However, you may invest in financial products such as ETFs or mutual funds that aim to mirror the profitability of the index.

How much money do I need to start investing in the index?

The amount you need depends on the method of investment. Many ETFs have no minimum investment requirement, and you can start with as little as a single share’s price. Mutual funds may have higher minimums, sometimes requiring $1,000 or more to get started.

Can I get involved in the index through a retirement account?

Yes, many retirement accounts such as IRAs or 401(k) plans offer options to purchase shares in ^IXIC ETFs or open-end funds.