What is a Bitcoin Payment Processor?

Articles

Bitcoin’s launch in 2009 shook up the global financial system, and now more and more transactions are being conducted in Bitcoin. As the world began to recognise the numerous benefits of crypto payments, several IT and e-commerce giants hopped on the trend. Naturally, this has increased demand for Bitcoin payment processors, which play a critical role in popularising Bitcoin and other digital currencies as payments. So, what exactly is a BTC payment gateway, and how can you find a good one?

Understanding Bitcoin Payment Processors

BTC payment processors operate as middlemen in Bitcoin transactions between merchants and their clients. They exchange Bitcoin for local currency, mitigating the dangers of Bitcoin’s volatility. This innovation has had far-reaching effects on the e-commerce and banking sectors.

By 2025, BTC payment gateways or processors have significantly advanced, providing many novel options. They provide real-time exchange rate calculations, guaranteeing accurate conversions between Bitcoin and fiat currencies. These platforms prioritise the security of transactions by deploying advanced measures like encryption protocols and two-factor authentication.

Another critical aspect is privacy, where these crypto payment gateways require minimal transaction data, protecting users’ sensitive information. Additionally, these platforms comply with local and international regulatory standards, underpinning their legality and commitment to user protection.

How Businesses Can Leverage Bitcoin Payment Processors

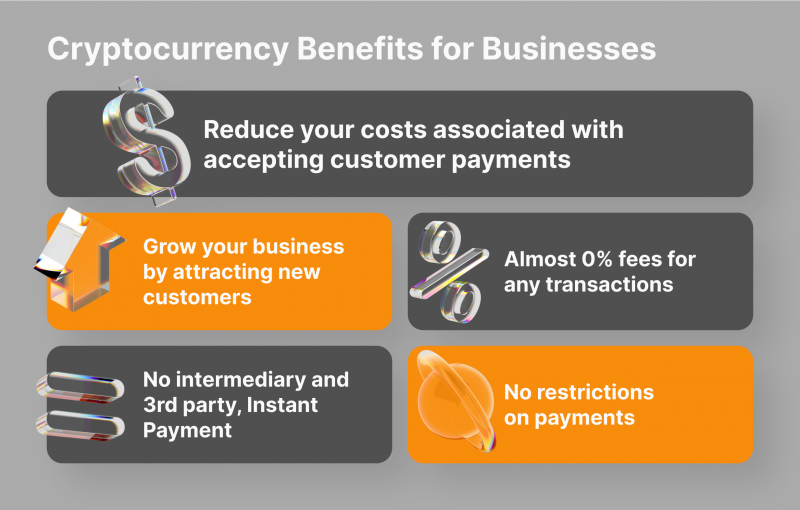

Businesses, especially in the e-commerce sector, are reaping the benefits of accepting Bitcoin as payment. Doing so can broaden their customer reach and open up new markets. Here are some benefits that could be brought by using BTC payment processors.

Access to a Global Market

Bitcoin payment processors allow businesses to engage in cross-border transactions effortlessly. This opens up a vast global market, providing an opportunity to expand the customer base and enhance revenue streams.

Low Transaction Costs

Traditional payment gateways often have somewhat heavy transaction fees, especially for international transfers. On the other hand, Bitcoin payment processors tend to have much lower fees, significantly reducing business costs.

Speedy Transactions

Bitcoin transactions are typically faster than traditional bank transfers, which can take several days to process, especially for international transfers. BTC payment processors enable near-instant transactions, improving cash flow and operational efficiency.

Improved Security

Bitcoin transactions are secured by advanced cryptographic techniques, providing a robust layer of security against fraud and chargebacks. Cryptocurrency payment gateways further strengthen this with additional security measures like encryption and two-factor authentication.

Enhanced Privacy

The additional benefit of BTC is that transactions require minimal personal information, enhancing privacy for both businesses and customers. This can appeal to privacy-conscious consumers, possibly driving more traffic and sales to your business.

Mitigation of Volatility Risk

Bitcoin’s notorious price volatility can deter businesses from accepting it. However, Bitcoin payment processors can instantly convert received Bitcoin into fiat currency, protecting businesses from potential losses due to price fluctuations.

Innovation and Brand Image

Accepting Bitcoin as a payment means your business is innovative and forward-thinking. This can improve your brand’s image, particularly among tech-savvy and younger customers who prefer cryptocurrencies.

Popular Bitcoin Payment Processors

1. B2BINPAY

B2BINPAY is a recognised crypto payment solution for merchants and enterprise clients. The platform enables users to hold, transfer, receive, and accept cryptocurrency payments within a safe, global network. Offering cross-border transactions at lower costs than traditional gateways, B2BINPAY stands out with transparent pricing – no hidden charges or recurring fees.

The platform provides real-time balance and transaction activity reports. Its features, such as automatic withdrawals, support for over 800 tokens, and secure checkout, make it a leading choice for businesses and enterprises in the cryptocurrency landscape.

2. BitPay

BitPay is one of the longest-running Bitcoin payment processors, offering instant fiat conversions since 2011. This feature allows businesses to mitigate the risks associated with cryptocurrency volatility. BitPay supports eight currencies and allows withdrawals in 38 countries, covering major regions and currencies.

Over time, BitPay has expanded to accommodate a wide range of businesses with customisable plugins and settings, reinforcing its position as a veteran.

3. SpicePay

Distinctive for its withdrawal options, SpicePay allows merchants to extract their Bitcoin payments through PayPal and debit cards, in addition to standard bank transfers. Merchants can choose to withdraw in either USD or Euro. Euro payments take up to 24 hours to process.

SpicePay’s pricing model is simple, with a flat rate of 1% on all transactions. Though it may not boast all the features of other platforms, it offers value to businesses relying heavily on PayPal.

4. BitcoinPay

For merchants seeking a low-cost solution, BitcoinPay stands out with its competitive transaction fees of just 0.8%. Despite this lower pricing, BitcoinPay does not compromise on the speed, providing super-fast withdrawals where funds are received almost instantly.

Supporting payments to Bitcoin wallets, other e-wallets, and bank accounts, BitcoinPay is a practical choice for merchants who prioritise cost-effectiveness without sacrificing efficiency.

5. CoinsBank

CoinsBank supports a wide range of fiat currencies and significant cryptocurrencies, providing convenience for cryptocurrency users. One of its key features is debit and credit card transaction support.

The platform offers mobile apps for both Android and iOS, ensuring 24/7 transfer capability. The fast, secure, and low-cost payment services can be accessed globally from any device. Its user-friendly nature makes it an excellent choice for those new to cryptocurrency.

How to Accept Bitcoin Payments

The process of accepting Bitcoin payments has been streamlined with the rise of cryptocurrency payment gateways. The first step is to choose a reliable processor based on your business needs and the processor’s features.

Once selected, you typically sign up on the payment processor’s platform, providing necessary business information. Most platforms then require you to set up a digital wallet, which is used to store your Bitcoins.

After setting up the wallet, you can integrate the payment processor with your business website or point-of-sale system. The processor will provide instructions or APIs for integration. Once integrated, customers can choose Bitcoin as a payment option during checkout.

It’s essential to note that each payment processor might have slightly different setup processes, so make sure you follow their specific instructions. Furthermore, the legal and tax implications of accepting Bitcoin vary across jurisdictions, so businesses should seek legal counsel to ensure compliance.

Final Remarks

Observing the latest developments, it seems Bitcoin isn’t just an investment asset but a universal currency. In light of these developments, businesses should consider integrating Bitcoin payment processors to stay competitive and forward-thinking.