What is Liquid Staking? Complete Guide

Imagine a world where your investments work for you in more ways than one—earning consistent rewards while remaining accessible for opportunities. Welcome to the realm of liquid staking, a groundbreaking innovation in the cryptocurrency space that merges flexibility with profitability.

Unlike traditional staking, which locks your assets away, liquid staking empowers you with liquidity and the freedom to explore DeFi opportunities without compromising network security.

Whether you’re a seasoned investor or new to blockchain, liquid staking reshapes how we interact with digital assets, creating a win-win scenario for crypto enthusiasts worldwide.

Key Takeaways

- Liquid staking allows users to stake assets while maintaining liquidity through tokenised derivatives, which can be traded or used in DeFi applications.

- Staked assets earn rewards and serve as collateral for lending, borrowing, and yield farming, maximising capital efficiency.

- Liquid staking lowers the technical barriers, making staking accessible to all, including smallholders and non-technical users.

What is Liquid Staking?

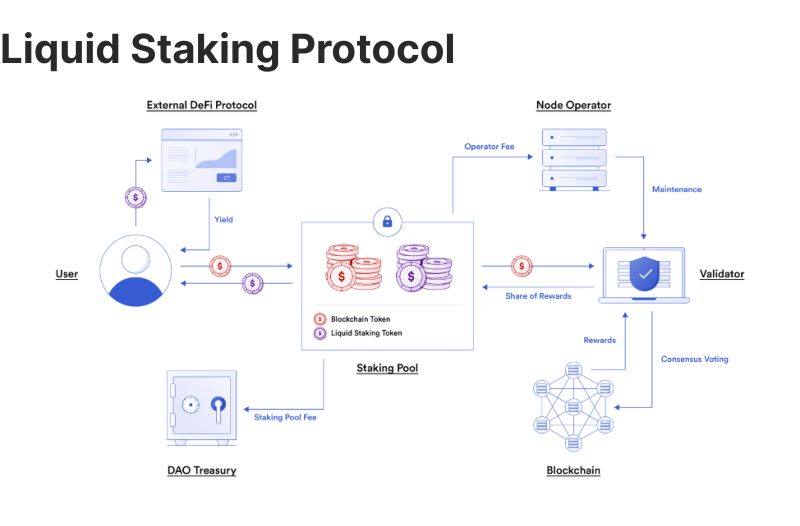

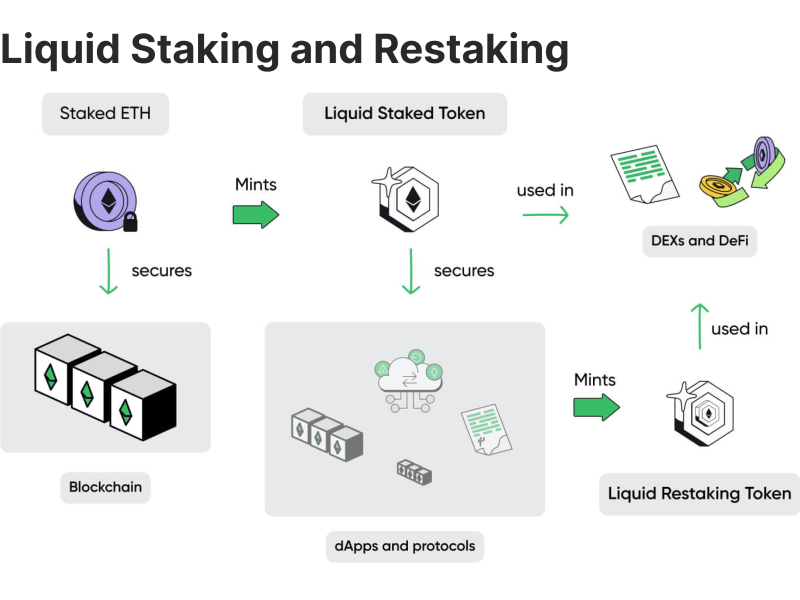

Liquid staking is an innovative evolution in cryptocurrency staking designed to enhance the flexibility and efficiency of locked digital assets. Traditional staking requires users to lock up their cryptocurrency in a blockchain network to support operations like validating transactions or securing the network.

While this process offers staking rewards, the locked assets become illiquid, meaning they cannot be traded, transferred, or utilised in other financial activities. Liquid staking addresses this limitation by allowing users to stake their cryptocurrency while maintaining liquidity through derivative tokens.

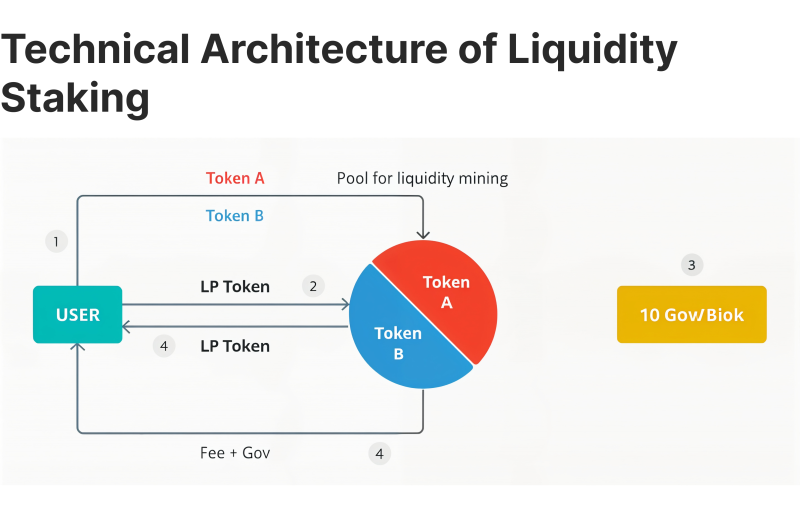

In a liquid staking setup, when users stake their assets, they receive tokenised derivatives representing the staked value. These derivative tokens are freely tradable and can be used in DeFi applications, such as lending, borrowing, or yield farming, without having to unstake the underlying assets. This mechanism provides a dual benefit: users earn staking rewards while keeping their assets productive across multiple DeFi platforms, maximising the utility of their holdings.

The appeal of liquid staking lies in its ability to improve capital efficiency and reduce the opportunity cost of staking. Enabling staked assets to remain liquid bridges the gap between staking for network security and leveraging DeFi opportunities.

However, liquid staking also introduces certain risks, such as price volatility of derivative tokens, dependency on third-party platforms, and potential vulnerabilities in the smart contracts that govern these protocols. Despite these challenges, liquid staking has become a cornerstone of the DeFi ecosystem, particularly during Ethereum’s transition to Proof of Stake and the increasing demand for financial innovation in blockchain networks.

Liquid staking derivatives like stETH (Lido) or rETH (Rocket Pool) accrue staking rewards in real-time, enabling automatic compounding without user intervention.

Why is Liquid Staking Important?

Liquid staking represents a significant leap forward in cryptocurrency and decentralised finance by solving a critical trade-off between liquidity and network security. In Proof of Stake systems, staking ensures the network remains secure and operational, but this often comes at the cost of asset usability.

For example, in traditional staking models, users might miss out on other lucrative opportunities in the rapidly evolving DeFi space because their assets are locked and inaccessible. Liquid staking eliminates this bottleneck by allowing assets to serve multiple purposes simultaneously, increasing their productivity.

The rise of liquid staking has also contributed to improving decentralisation within PoS networks. By lowering barriers to entry for staking, smaller holders can participate without worrying about the illiquidity of their assets.

Additionally, liquid staking enhances interoperability within the DeFi ecosystem, as staking derivatives can be utilised across various protocols and platforms, creating a web of interconnected financial opportunities. As blockchain networks grow and mature, liquid staking is poised to become an essential tool for maximising returns while supporting network sustainability.

Advantages of Liquid Staking

Liquid staking offers numerous advantages that address the limitations of traditional staking, making it an increasingly popular choice for cryptocurrency investors. Combining the benefits of staking rewards with the flexibility of liquidity has emerged as a cornerstone of DeFi.

Here are the key advantages:

Unlocks Liquidity

One of the most significant benefits of liquid staking is that it eliminates the illiquidity associated with traditional staking. In standard staking, assets are locked for a predetermined period, making them inaccessible for trading or other uses.

Liquid staking resolves this by providing tokenised derivatives of the staked assets. Users can use these tokens in other financial activities while still earning staking rewards.

Enhances Capital Efficiency

With liquid staking, assets can work in multiple ways simultaneously. The derivative tokens issued by liquid staking platforms can be utilised in DeFi protocols for lending, borrowing, yield farming, or collateralising loans. This dual utility maximises the potential returns on staked assets and significantly improves capital efficiency.

Reduces Opportunity Costs

Traditional staking often forces users to forgo opportunities in the dynamic DeFi space because their assets are locked. Liquid staking reduces this opportunity cost by ensuring users can access their staking derivatives. Investors can participate in short-term trading, hedge positions, or take advantage of emerging opportunities without unstaking their assets.

Simplifies Staking for Users

Liquid staking platforms abstract much of the complexity of running a validator node or managing direct staking. By delegating their assets through these platforms, users can stake without the technical expertise or infrastructure requirements traditionally needed, making staking accessible to a broader audience.

Supports Decentralisation

Liquid staking lowers the barriers to entry by enabling smallholders to participate without worrying about liquidity constraints. This democratisation encourages widespread participation in Proof of Stake networks, enhancing decentralisation and network security.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Flexible Redemption Options

Many liquid staking platforms offer flexible redemption options for staked assets. Users can redeem their derivative tokens for the underlying assets or trade them on secondary markets for instant liquidity. This feature gives users greater financial agility, even within a staking framework.

Compatible with DeFi Ecosystem

Liquid staking integrates seamlessly with DeFi protocols, allowing users to explore various financial strategies while earning staking rewards. Staking derivatives can be used for trading, liquidity provision, or as collateral for loans, creating a synergistic relationship between liquid staking and DeFi.

Compounding Staking Rewards

Since liquid staking derivatives accrue staking rewards in real-time, users can benefit from a compounding effect without manually reinvesting their rewards. This automatic reward accrual further boosts the efficiency and profitability of liquid staking.

Liquid Staking vs. Traditional Staking

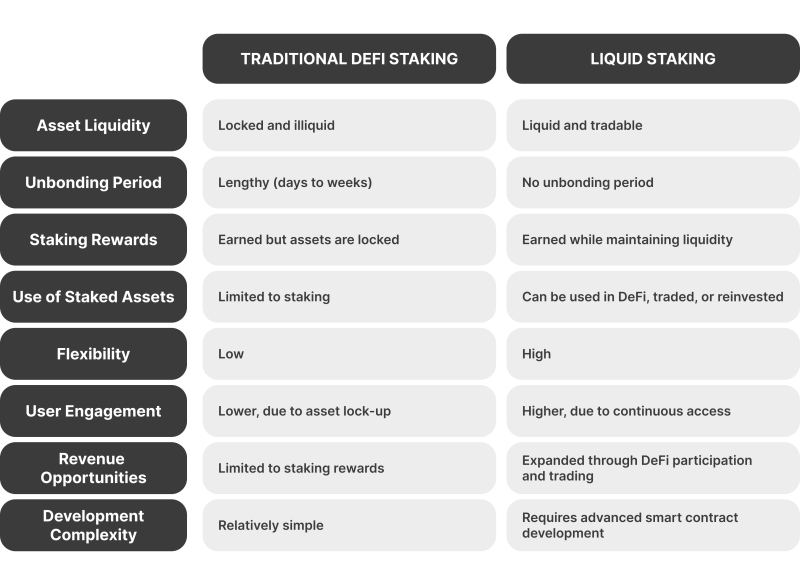

Liquid staking and traditional staking are two approaches to participating in Proof of Stake blockchain networks. While both methods enable users to earn rewards by contributing to network security, they differ significantly in their mechanisms, flexibility, and use cases.

Here’s a professional comparison of the two:

Liquidity

In traditional staking, assets are effectively locked for a predetermined duration, during which they cannot be transferred, traded, or utilised elsewhere. This lack of liquidity is a significant drawback for investors who need to access their funds for other opportunities or emergencies.

Unstaking assets typically involves an unbinding period, ranging from several days to weeks, depending on the blockchain. This further compounds the liquidity issue. For example, assets were locked indefinitely in networks like Ethereum 2.0 before the Shanghai upgrade.

Liquid staking introduces a groundbreaking solution by issuing tokenised derivatives of the staked assets. These tokens, such as Lido’s stETH or Rocket Pool’s rETH, represent the staked value and accrued rewards.

Users can freely trade these derivative tokens, providing instant liquidity, or use them in DeFi applications for lending, borrowing, or yield farming. This approach removes the liquidity barrier, enabling investors to participate in staking without sacrificing asset accessibility.

Deep, Reliable Liquidity Across 10 Major Asset Classes

FX, Crypto, Commodities, Indices & More from One Single Margin Account

Tight Spreads and Ultra-Low Latency Execution

Seamless API Integration with Your Trading Platform

Capital Efficiency

The primary benefit of a traditional staking model is earning staking rewards, which can be significant depending on the blockchain’s annual percentage yield (APY). However, the staked assets serve a singular purpose — securing the network and generating rewards. They cannot be deployed in other financial strategies, leading to a significant opportunity cost, especially in rapidly evolving DeFi markets.

Liquid staking maximises capital efficiency by enabling dual utility for staked assets. The staking derivatives can be used across various DeFi protocols for collateralisation, trading, liquidity provision, or yield farming.

For instance, a user staking ETH through Lido can use stETH to earn additional yield in liquidity pools, effectively compounding their earnings. This multi-layered utilisation amplifies the overall return on investment.

Accessibility

Participating in traditional staking can be technically complex and requires a deeper understanding of validator operations, including uptime maintenance, security measures, and potential slashing risks. Some networks also impose high minimum staking requirements, such as Ethereum’s 32 ETH threshold for running a validator, making it inaccessible to smaller investors.

Liquid staking platforms simplify the process by managing the validator infrastructure and lowering entry barriers. Users can stake any amount, even fractions of an asset, and the platform handles the technical details. This democratises staking, enabling retail investors to participate without the need for technical expertise or large capital commitments.

Risk Factors

The risks in traditional staking are largely confined to the blockchain network. These include slashing penalties for validator misbehaviour, downtime, or double signing. However, the risks are relatively straightforward and are often mitigated by choosing reliable validators.

While liquid staking carries the same risks as traditional staking, it introduces additional layers of complexity. These include:

Smart Contract Vulnerabilities: Liquid staking platforms rely on smart contracts to issue derivative tokens and manage staked assets. Any bugs or exploits in these contracts can lead to significant losses.

Peg Instability: The value of staking derivatives may deviate from the underlying asset, especially during market stress or liquidity crunch periods.

Third-Party Dependency: Users rely on the staking platform’s security and operational integrity, which introduces counterparty risk.

Flexibility

Exiting a traditional staking position often requires waiting through an unbending period, during which assets remain inaccessible. This lack of flexibility can be a disadvantage, especially in volatile markets where immediate liquidity may be needed.

Liquid staking offers unparalleled flexibility. Derivative tokens can be sold or exchanged in secondary markets for instant liquidity, bypassing unbinding periods. This lets users respond quickly to market changes or reallocate their assets without losing staking rewards.

Integration with DeFi

Assets locked in traditional staking are excluded from DeFi applications, limiting their utility and the ability to compound returns.

Liquid staking tokens are fully compatible with DeFi protocols, enabling various financial strategies. For example, users can stake assets, receive derivatives, and use those derivatives in lending platforms like Aave or as liquidity in decentralised exchanges like Curve.

Reward Mechanism

Rewards are typically distributed directly to the staked account, but may require manual compounding to reinvest them. This process can be inefficient and may incur additional transaction costs.

Liquid staking derivatives often accrue rewards in real time, reflecting the increasing value of the staked assets. This automatic compounding simplifies the reward management process and enhances returns over time.

Best Liquid Staking Platforms

Liquid staking has become a pivotal innovation in cryptocurrency, and several platforms have emerged to offer seamless liquid staking solutions. Each platform brings unique features, supported blockchains, and operational models, catering to the diverse needs of investors. Below is an overview of some of the most popular liquid staking platforms:

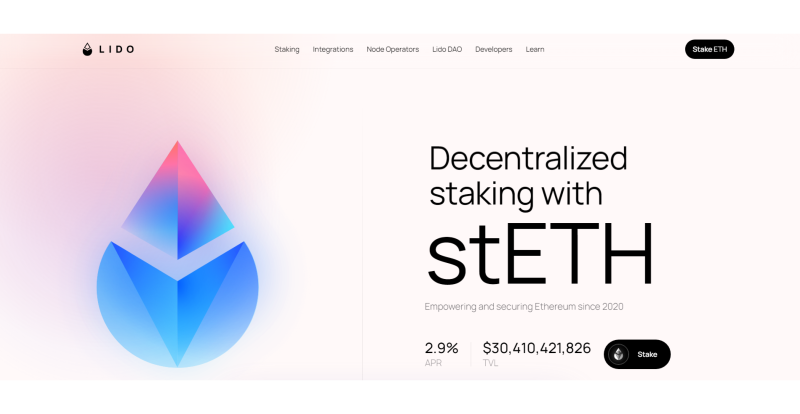

Lido Finance

Lido Finance is a leading liquid staking platform that supports multiple blockchains, including Ethereum, Solana, Polygon, and Polkadot. It lets users stake their assets and receive liquid staking derivatives like stETH (staked Ethereum). These derivative tokens represent the staked assets and their accrued rewards, allowing users to utilise their assets in DeFi applications while continuing to earn staking rewards. Lido addresses traditional staking’s liquidity issues, enabling greater flexibility and integration with the DeFi ecosystem.

Lido appeals to retail and institutional investors seeking an easy and efficient way to stake assets across various blockchains. Its wide adoption in the DeFi space makes it particularly attractive for users who wish to maximise the utility of their staked assets while earning consistent rewards.

Rocket Pool

Rocket Pool is a decentralised Ethereum liquid staking protocol designed to strongly emphasise decentralisation and trustlessness. Unlike traditional staking methods requiring running a validator node with a high ETH threshold, Rocket Pool allows users to participate with a lower minimum (16 ETH) while ensuring network security.

Participants receive rETH as a liquid staking token, which accrues rewards over time. This makes staking accessible for users who value decentralisation and wish to contribute to EEthereum’snetwork without fully committing to the technical requirements of running a validator.

Rocket Pool primarily targets Ethereum users who prioritise decentralisation and self-sovereignty. Its community-driven governance model and ability to reduce staking thresholds make it ideal for smaller investors and decentralisation advocates.

StakeWise

StakeWise is an Ethereum-specific liquid staking platform that provides a flexible and user-friendly experience. Using a dual-token system, users receive two separate tokens: sETH2 (representing the staked ETH) and rETH2 (representing staking rewards).

This separation gives users more control over managing their assets and rewards. StakeWise also offers automatic compounding of staking rewards, ensuring users can maximise their returns without manual intervention. Its intuitive interface makes the staking process accessible even to those new.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

StakeWise is well-suited for investors who value flexibility in managing their staking rewards and principal. Its straightforward approach and emphasis on maximising returns appeal to both novice and experienced Ethereum stakers.

Ankr

Ankr is a versatile liquid staking platform supporting many blockchains, including Ethereum, Binance Smart Chain, Avalanche, and more. It issues liquid staking derivatives called aTokens (e.g., aETHc for Ethereum), which can be utilised across various DeFi protocols.

Ankr caters to individual stakers and provides enterprise-level staking solutions through its staking-as-a-service offering. Thus, it is a comprehensive platform for investors seeking to optimise their staked assets across multiple networks.

Ankr targets retail investors seeking a simple, multichain staking solution and institutions requiring secure and scalable staking services. Its broad blockchain support and enterprise offerings make it highly versatile.

Marinade Finance

Marinade Finance is a liquid staking platform exclusively dedicated to the Solana blockchain. Users can stake SOL tokens and receive mSOL as a liquid staking derivative. Marinade has been deeply integrated into Solana’s DeFi ecosystem, enabling users to use mSOL for lending, borrowing, and other activities. It also promotes decentralisation by encouraging stakeholders to delegate their SOL to a diversified set of validators, improving the network’s resilience and security.

Marinade is tailored for Solana users seeking a native liquid staking solution. Its focus on low fees and seamless integration with Solana’s ecosystem makes it an attractive option for DeFi participants within the Solana network.

Persistence (pSTAKE)

Persistence is a liquid staking protocol designed to support multiple Proof of Stake (PoS) blockchains, focusing on Cosmos-based networks and assets like ATOM, XPRT, and BNB.

Through pSTAKE, users can stake their assets and receive liquid derivatives such as stkATOM and stkXPRT, which can be used in DeFi applications on Ethereum and other compatible blockchains. Persistence also bridges staked assets to Ethereum, expanding their utility and enabling users to access broader financial opportunities.

Persistence is ideal for investors in Cosmos and other PoS ecosystems who wish to bridge their assets to Ethereum for enhanced DeFi participation. Its emphasis on cross-chain interoperability appeals to users seeking to diversify their staking opportunities.

Stader Labs

Stader Labs is a liquid staking platform that supports multiple networks, including Ethereum, Polygon, BNB Chain, and Terra. It provides users with liquid staking derivatives such as ETHx for Ethereum and MaticX for Polygon. Stader Labs optimises staking yields through strategic validator selection while offering a user-friendly staking experience. Its multichain approach allows investors to stake assets across various ecosystems, ensuring diversification and maximising returns.

Stader Labs is suitable for investors looking for a cross-chain staking solution that simplifies the staking process while optimising yields. Its multichain capabilities and focus on accessibility make it a compelling choice for retail and institutional users.

Conclusion

As the crypto landscape evolves, liquid staking emerges as a beacon of innovation. It transforms investors’ thinking about staking and capital efficiency. It bridges the gap between security and utility, allowing assets to flourish in ways traditional staking never could.

Whether you’re exploring platforms like Lido, Rocket Pool, or StakeWise, the opportunities in this space are as boundless as the technology itself. Embrace liquid staking and take your investments to the next level — because flexibility is power in crypto.

FAQ

How is liquid staking different from traditional staking?

Traditional staking locks assets, while liquid staking provides tradable tokens, enabling DeFi use without losing staking rewards.

What are the benefits of liquid staking?

Benefits include liquidity, capital efficiency, reduced opportunity costs, simplified staking, decentralisation, and DeFi integration.

What are the risks of liquid staking?

Risks include smart contract vulnerabilities, token price volatility, platform dependency, and peg instability.

Which platforms offer liquid staking?

Top platforms include Lido, Rocket Pool, StakeWise, Ankr, Marinade, Persistence (pSTAKE), and Stader Labs.