What is Slippage Tolerance in Trading?

In the fast-changing field of trading, where each millisecond matters and can dramatically influence financial results, slippage tolerance emerges as a primary factor for traders. It acts as a safeguard, defending trades from the inexorable cycles of market instability while ensuring swift and efficient execution.

This article will provide a brief introduction to slippage tolerance, its advantages, and the factors that influence this indicator in trading.

Key Takeaways

- Slippage tolerance assures efficient trade execution in fluctuating markets, buffering against unexpected price variances while controlling costs.

- Customising slippage tolerance helps traders balance precision and speed, adapting to market conditions and risk choices.

- Effective slippage tolerance reduces missed chances, limits emotional decisions, and boosts manual and automated trading performance.

What is Slippage Tolerance?

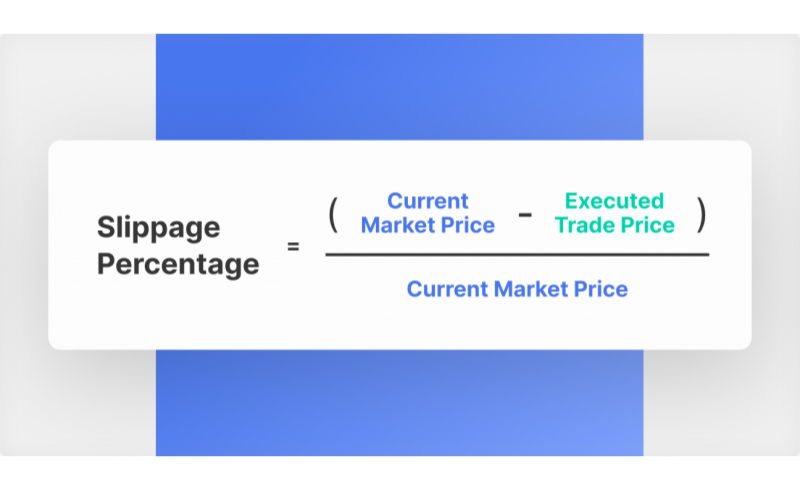

Slippage tolerance is a critical concept in trading. It refers to the predefined range within which a trader is willing to accept price differences between the intended and actual execution of a trade. This difference, known as slippage, can occur due to market uncertainty, low liquidity, or the rapid pace of price changes during high-demand periods. By designing a slippage tolerance, traders can safeguard themselves against unexpected price cuts while ensuring their orders are executed promptly.

In essence, slippage tolerance acts as a buffer against market unpredictability. It’s especially vital in fast-moving markets like Forex, crypto coins, and stocks, where prices fluctuate significantly within seconds.

For spiel, if a trader sets a slippage tolerance of 1%, they signal their willingness to endure a price disparity of up to 1% from the expected price when executing the trade. If the deviation exceeds this threshold, the order may be cancelled or not executed, depending on the trading platform and the type of order used.

Where is Slippage Tolerance Most Important?

Slippage tolerance is particularly imperative in automated and algorithmic trading systems. These systems rely on precise execution to capitalise on small price spikes. Without a well-defined tolerance, trades could fail or result in unintended outcomes, compromising the efficiency of the strategy.

For manual traders, it provides a means of balancing execution speed and pricing accuracy, especially during periods of market fluctuation or when trading less liquid assets.

Setting the right tolerance of slippage level is a nuanced decision influenced by factors such as market backdrop, trading objectives, and asset type. Tight tolerances may limit execution in unpredictable markets but ensure precision in pricing, while broader tolerances increase the likelihood of execution at the risk of unfavourable pricing. Understanding and effectively managing slippage tolerance is vital for traders aiming to optimise their performance and mitigate risks in dynamic market environments.

In HFT, even a 1-millisecond delay can result in slippage, highlighting the precision needed in algorithmic trading systems.

Factors Influencing Slippage Tolerance

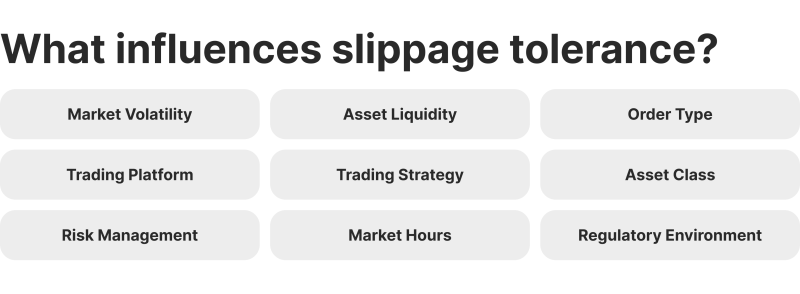

Several factors influence slippage tolerance, shaping how traders approach the balance between price accuracy and trade execution speed. Understanding these factors is fundamental for perfecting trading techniques and addressing risks smoothly.

Market Volatility

Market volatility is one of the most significant factors influencing tolerance of slippage. During periods of high activity, such as economic news releases or market openings, prices can rush within seconds.

Traders may need to set a higher slippage tolerance to ensure their orders are executed despite the price fluctuations. Conversely, a tighter slippage tolerance may be appropriate in stable market conditions to maintain precise pricing.

Liquidity of the Asset

The liquidity of the asset being traded plays a critical role in tolerance of slippage. Highly liquid assets, such as major Forex pairs or large-cap stocks, typically experience minimal slippage due to the abundance of buyers and sellers.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

However, less liquid assets, such as exotic currency pairs or small-cap stocks, are more prone to slippage as fewer dealers are lined up to match orders at the desired price. Traders dealing with low-liquidity assets may need to set a wider slippage tolerance to increase the likelihood of order execution.

Type of Order

The type of order placed by the trader also impacts tolerance of slippage. Market orders, which prioritise execution speed over price precision, are more susceptible to slippage, especially in fast-moving markets.

In contrast, limit orders allow investors to state the specified price at which they are willing to buy or sell. They eliminate slippage but increase the risk of the order not being executed. Traders must consider their priorities—speed or price accuracy—when determining slippage tolerance.

Trading Platform and Technology

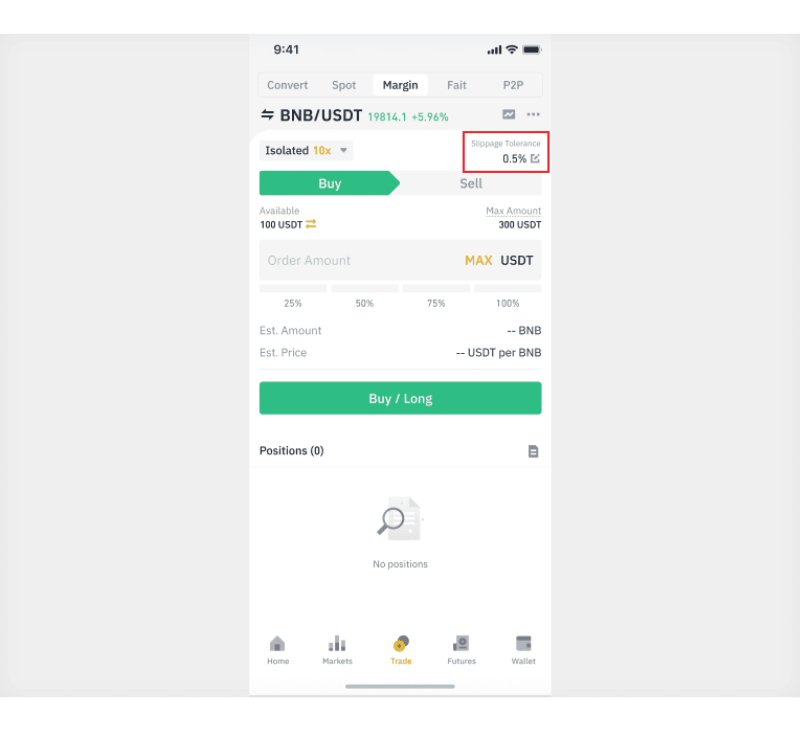

The capabilities of the trading platform and the underlying technology influence how slippage is handled. Advanced platforms may offer features such as customisable slippage settings, real-time data feeds, and fast order execution, which can mitigate the impact of slippage.

Additionally, latency between the trader’s device and the exchange can contribute to slippage. Platforms with low-latency infrastructure enable tighter tolerance of slippage, even in erratic markets.

Trading Strategy

Different trading strategies require different approaches to slippage tolerance. Scalpers and high-frequency traders often prioritise speed and may accept higher slippage to ensure the rapid execution of multiple trades.

On the other hand, swing traders or long-term investors prefer tighter tolerances to maintain price precision, as their strategies are less reliant on immediate execution.

Asset Class

The nature of the asset class being traded also influences slippage tolerance. For instance, cryptos, known for their high volatility and often fragmented liquidity, require traders to account for more considerable potential slippage.

Conversely, trading in more stable asset classes like government bonds may allow for narrower tolerances due to predictable price spikes and higher liquidity.

Risk Appetite

A trader’s risk tolerance directly impacts their slippage settings. Conservative traders prioritise minimising unexpected costs and often set tighter slippage tolerances.

More aggressive traders, willing to take on additional risk to capture market potential, might accept broader tolerances to increase the likelihood of trade execution.

Market Hours

Slippage is more likely during periods of low market activity, such as after-hours trading or during regional market closures. Traders operating during these times may need to redefine their slippage tolerance to accommodate reduced liquidity and heightened price variability.

Regulatory Environment

Some trading environments are influenced by regulatory requirements that can affect slippage. For illustration, certain jurisdictions mandate specific order execution practices or disclosure of slippage statistics, which may shape how brokers and traders set tolerance levels.

By carefully evaluating these factors, traders can set appropriate slippage tolerances that align with their trading objectives and market conditions. This approach balances achieving favourable pricing and maintaining efficient trade execution.

Benefits of Using Slippage Tolerance

Slippage tolerance is fundamental for traders, especially in fast-moving or highly unstable markets. Setting an appropriate slippage tolerance can significantly advance trading yield and minimise unexpected losses. Here’s a detailed look at its benefits:

Assures Trade Execution in Dynamic Markets

Markets like crypto or Forex can experience major price shifts within seconds. Slippage tolerance assures that trades are executed even if the price shifts slightly. This is particularly beneficial during high volatility, where the risk of missing a trade due to minor price increases is high.

Prevents Missed Deals

When trading in highly competitive or low-liquidity markets, prices can change before the order is completed. These orders may fail without slippage tolerance, making traders to miss potential profit avenues. A well-set tolerance allows trades to progress despite minor deviations, helping secure positions.

Provides Flexibility for Scalping and HFT

Scalpers and high-frequency traders rely on rapid execution and deal with smaller profit margins. Slippage tolerance enables such traders to execute multiple trades quickly, even during slight price changes, ensuring that their strategies remain efficient and effective.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Enhances Efficiency in Automated Trading

Slippage tolerance is a key parameter for algorithmic or automated trading systems. It allows trading bots to execute trades seamlessly, accommodating minor market fluctuations without requiring constant manual intervention. This improves overall efficiency and reduces execution delays.

Helps Manage Expectations and Risk

Good slippage tolerance empowers traders to set conservative expectations about the price window within which their trades will execute. By controlling the deviation from the desired price they are about to accept, traders can more comfortably account for risk and avoid entering trades at significantly unfavourable prices.

Improves Trading in Illiquid Markets

Large orders can evoke sudden price variances in markets with low liquidity, resulting in slippage. Slippage tolerance accommodates this reality by allowing trades to execute within a predefined range, reducing the impact of illiquidity and ensuring smoother execution.

Minimises Emotional Decision-Making

Trading in unstable or hectic markets can be stressful, leading to impulsive decisions. Slippage tolerance automates part of the trading process, helping traders stick to their strategies and avoid emotional responses to minor price changes.

Optimises Execution During News Events

Major news events often cause rapid price surges that can exceed slippage tolerance. So, it assures that traders can still execute orders without getting locked out due to extreme volatility, allowing them to act on news-driven suggestions effectively.

Conclusion

Trading is as much an art as a science, and slippage tolerance is where precision meets strategy. It empowers traders to cope with market unpredictability, turning volatility into an opportunity rather than a threat. By tailoring slippage settings to reflect individual goals and market realities, traders can achieve the perfect balance between control and flexibility.

As markets evolve and technology reshapes the trading landscape, mastering slippage tolerance is no longer just a skill — it’s a competitive edge so whether you’re navigating the crypto chaos or the steady pulse of equities, realising and leveraging slippage tolerance is your gateway to smarter, more resilient trading in a constantly shifting financial ecosystem.

FAQ

What is slippage in trading?

Slippage is the price gap between the projection and actual trade performance, often caused by abrupt shifts or low liquidity.

Why is slippage tolerance valuable?

It ensures trades are executed despite minor price changes, preventing missed chances in shifty or illiquid markets.

How can market participants develop slippage tolerance?

Traders should modify tolerance as needed to market shocks, asset liquidity, and personal risk selections.

Does slippage tolerance eliminate risks?

No, it manages price departures but doesn’t eliminate risks like market swings or execution delays; use it with other risk tools.