Why is AML Screening Important?

Money laundering, a major financial crime, has become prevalent over the past few decades. The United Nations Office on Drugs and Crime estimates that the amount of money laundered globally in one year is around $800 billion – $2 trillion, accounting for 2 to 5% of global GDP. This alarming situation has led to the development of Anti-Money Laundering (AML) policies, with AML screening playing a crucial role in combating these financial crimes.

Key Takeaways

- Money laundering disguises illegally obtained money through complex transactions, making illicit assets appear legitimate.

- AML practices, like AML screening and transaction monitoring, combat money laundering and other financial crimes, ensuring regulatory compliance and financial integrity.

- Effective AML rules flag suspicious activities based on your organisation’s risk profile and customer transactions. Regular updates are vital to keeping pace with financial crime patterns.

Understanding Money Laundering

Money laundering is the illegal process of concealing the origins of money obtained through illicit means by passing it through a complex sequence of banking transfers or commercial transactions. The ultimate aim is to convert the illegal asset into clean money, returning it to the launderer in an obscure and indirect way.

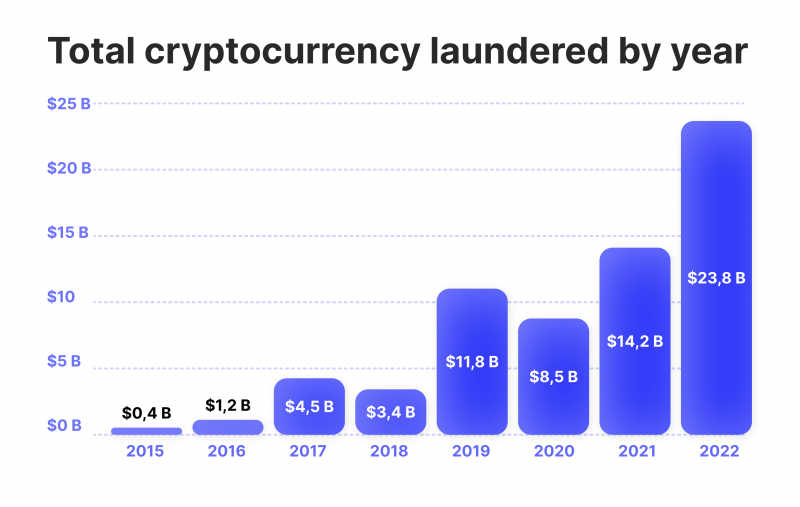

ML has become a broad practice in cryptocurrencies. The anonymous nature of crypto transactions has become a critical target for illegal activists. This has given rise to prevention methods, such as AML screening software and crypto transaction monitoring rules, which are employed to ensure the legitimacy of transactions. For instance, any large and unusual transfers of cryptocurrencies could trigger an alert in the system, prompting further investigation.

What is AML Screening?

AML screening is a method used for risk assessment of a company’s existing or potential customers under AML guidelines. The process includes payment transaction monitoring, ensuring that customers are not present in sanctions lists, PEPs, banned or wanted lists, and adverse media data. greylists and blacklists, PEP lists, and conducting other profile-based checks on the customer. This analysis is carried out to meet KYC/AML/CFT requirements and to fulfil reporting obligations set forth by financial watchdogs.

AML screening is a key component of AML regulations devised by authorities.

The Purpose of AML Screening

The primary aim of AML screening is to identify and thwart illicit activities such as money laundering, financing of terrorism, and fraud. AML screening is typically implemented during the onboarding of a customer, thereby proactively preventing unlawful activities from occurring.

Moreover, AML screening is not merely an ideal practice but a mandatory requirement. It is a regulatory compliance measure, ensuring individuals and organisations adhere to AML laws and regulations.

The specific goals of AML screening encompass the following:

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

- Providing safety, security, and assurance to all parties involved, including individuals, organisations, customers, and potential customers.

- Safeguarding the reputation of entities that diligently execute their AML screening operations.

- Keeping the information used in AML checks current enables companies to remain compliant with changing legal requirements as entities are added to relevant sanctions lists.

A robust AML compliance program should address these finer details and broader functions of AML screening processes, ultimately ensuring financial stability, security, trust, and organisational compliance and intelligence.

AML Transaction Monitoring Rules: How Does The AML Screening Process Work?

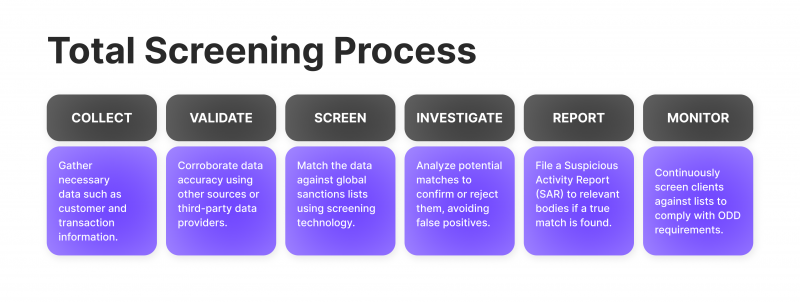

The AML screening process collects and scrutinises customer data, including identities and transactions. This data is then used to determine whether customers are legitimate or potentially suspicious. This identification process is primarily achieved by cross-referencing validated customer data with sanctions lists outlined by financial authorities or government agencies.

If a company operates in an industry regulated by AML legislation, new users approaching the website should undergo the AML screening process. The registration data they submit should be cross-referenced against watchlist databases. If the watchlist identifies the prospective customer as a known money launderer, this would be an example of a customer failing the AML screening process. In essence, the process works optimally by obtaining comprehensive customer information and cross-referencing it with the most authoritative databases available.

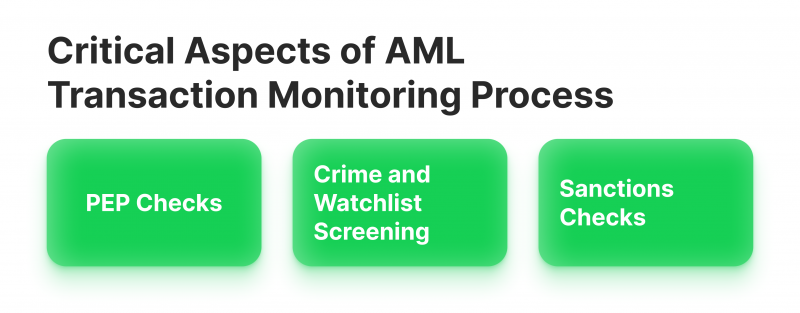

Critical Aspects of AML Transaction Monitoring Process

Several critical aspects must be covered during the anti-money laundering screening process. Let’s examine three major examples.

PEP Checks

Politically Exposed Person (PEP) checks are conducted to identify individuals holding prominent positions in government or other public sectors. These individuals, including their close relatives and associates, are identified as being more likely to engage in money laundering activity due to their political connections, wealth, and status. PEP checks are carried out to expose suspicious political figures and help organisations understand the broader risks associated with dealing with politically exposed persons.

Crime and Watchlist Screening

This process involves checking an individual’s details against one or more databases providing names of people registered as known or suspected criminals. Crime screening involves checking for people known or suspected of financial crimes, such as money laundering, while watchlist screening involves checking for people associated with high-risk activities, such as terrorism financing.

Sanctions Checks

These checks involve cross-referencing an individual’s details on specialised databases that cover government sanctions. Government sanctions are penalties or restrictive measures that one or more governments have placed against someone’s name.

Who Should Conduct AML Screening?

Depending on the local jurisdiction, AML screening should generally be carried out by entities dealing with financial transactions or in other high-value verticals commonly leveraged by money launderers. Organisations responsible for particularly large sums of money, such as financial institutions, stock traders, casinos, Forex businesses, investment companies, insurance companies, real estate agencies, and high-value retailers, should especially conduct AML screening.

Regardless of the nature of your organisation, your security against money laundering is not just ideal; it is also a fundamental necessity and a legal requirement. If you are unsure of whether your organisation could be a likely target for money launderers, it is worth noting that money laundering methods evolve, and an increasing number of unsuspecting legitimate businesses can be targeted as a result.

How to Set Up Robust AML Transaction Monitoring Rules

Setting up effective AML transaction monitoring rules requires a comprehensive understanding of your organisation’s risk profile and the nature of your customers’ transactions. The first step is establishing a “normal” transaction behaviour baseline for your customers. This could be based on transaction size, frequency, and geographical location.

For example, if you’re a bank and a majority of your customers are individuals who make domestic transactions of around $1,000 to $3,000, a transaction of $10,000 or an international transaction of $5,000 might be flagged as suspicious.

Once you’ve established a baseline, you can set up rules to flag transactions that deviate from this norm. For instance, you might set a rule to flag any transactions over $10,000 or multiple transactions from the same account totalling over $10,000 in a single day.

Another rule could be to flag any rapid movement of funds, such as a large deposit followed by an immediate withdrawal. This could be indicative of layering, a typical money laundering technique.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

It’s also essential to set up rules for transactions involving high-risk locations known for money laundering or terrorism financing. For example, a rule could be set to flag any transaction involving countries on the FATF’s high-risk and non-cooperative jurisdictions list.

Remember, these rules should be regularly reviewed and updated to keep up with changing patterns of financial crime and changes in your customer behaviour. A robust AML transaction monitoring system will allow you to adjust these rules and provide a comprehensive regulatory compliance audit trail.

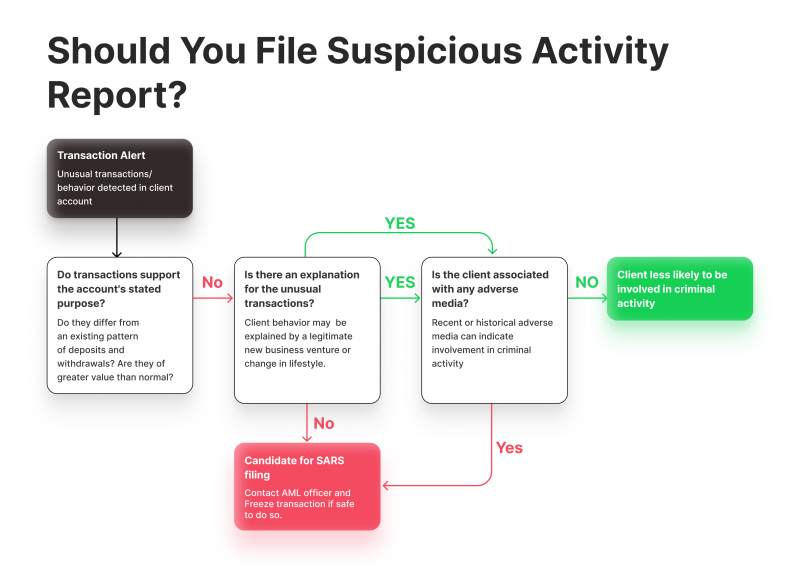

When to File an AML Screening Suspicious Activity Report

An AML Screening Suspicious Activity Report (SAR) should be filed when a transaction or a series of transactions appear suspicious or inconsistent with a customer’s known legitimate business or personal activities. This could be a transaction that is significantly larger than usual, a sudden increase in transaction frequency, or transactions that have no clear economic or lawful purpose.

It’s also crucial to consider the customer’s behaviour, such as reluctance to provide information or attempts to avoid reporting thresholds. Remember, the decision to file a SAR should be based on reasonable grounds for suspicion, and it’s always better to err on the side of caution when it comes to potential ML or other financial crimes.

Final Remarks

AML screening and transaction monitoring are vital tools in the fight against money laundering and other financial crimes. They not only help in identifying and mitigating risks but also aid in maintaining the integrity of the financial system. As technology continues to evolve, so will money laundering methods, making it imperative for AML policies to keep pace. The future of AML screening and transaction monitoring lies in leveraging advanced technologies and robust regulatory frameworks to ensure a secure financial landscape.