Why You Shall Invest in Fortune 500 Companies – Complete Guide

Stock investors have a plethora of choices when it comes to investing in equities, given the massive number of public corporations listing their shares in secondary markets.

Some risk-takers switch between growing stocks and developing markets to secure some short-term returns. However, professionals and executives invest in Fortune 500 companies to attain longevity and stability. The collection of the US’s best 500 publicly traded companies plays a significant role in investors’ portfolios, especially for those who want to achieve long-term profits without worrying about short-term fluctuations.

However, filtering through hundreds of shares is not an easy task. In this guide, we will discover the best Fortune 500 companies to invest in.

Key Takeaways

- Fortune 500 companies are US firms with the largest revenues.

- The Fortune Magazine publishes the rankings annually, considering reported earnings before taxes and liabilities.

- Institutional investors and firms invest in Fortune 500 shares to secure reliable returns from the US best stocks.

- Walmart is the richest Fortune 500 organisation, followed by Amazon and Apple.

What is a Fortune 500 Company?

Fortune 500 is a listing published by Fortune Media Group Holdings in its annual Fortune Magazine, which specialises in business, trading, and financial news. The counting started in 1955 and includes the top 500 organisations in the United States with the highest revenue from the preceding year.

The magazine holds a highly rated prestige that is comparable to the Bloomberg Businessweek’s Forbes magazine. Being named a Fortune 500 company gives significant status and global recognition.

Fortune 500 companies are active in various industries, including technology, healthcare, trading, supply chain, and pharmaceuticals, and the ranking takes into consideration the previous year’s income.

Is it Good to Invest in Fortune 500 Companies?

The Fortune 500 includes blue-chip companies and hundreds of the best-performing businesses and stocks. To be named in the list, organisations must have an operating office in the United States and be registered within the local frameworks and governmental agencies.

Top-tier financial institutions and entrepreneurs invest in Fortune 500 companies as reliable assets that provide a stable income and are less likely to fluctuate widely.

Apple, Microsoft, Amazon, and Nvidia are a few examples of Fortune 500 companies that might not offer the best stock growth rate but have been consistent over the years for optimised investment portfolio allocation.

Some of these names include the highest dividend-paying stocks and the best trading option for long-term investments.

Fortune 500 vs S&P 500

Fortune is often confused with the S&P 500, an exchange-traded fund (ETF) that uses a capitalisation-weighted index methodology.

This approach gives more value to companies with higher market capitalisation. Therefore, the top 10 companies in the ranking can primarily affect the overall ETF because they hold the most considerable value.

However, the Fortune 500 revenue listing is more straightforward, which directly ranks companies based on their realised earnings.

For example, Nvidia ranks 2nd in the S&P ETF due to its colossal market cap and overall company growth. However, it ranks 65th in the Fortune 500 listing based on the company’s 2023 revenue.

Nvidia stocks have grown massively over the past year due to its AI and machine learning developments. This increased earnings and growth moved Nvidia 87 up in the ranking.

Top Fortune 500 Stocks

The magazine publishes the annual list based on the previous year. Therefore, the 2024 Fortune 500 stocks ranking is based on 2023 annual 10-K reports that companies submit before December 31st 2023.

#5 Berkshire Hathaway

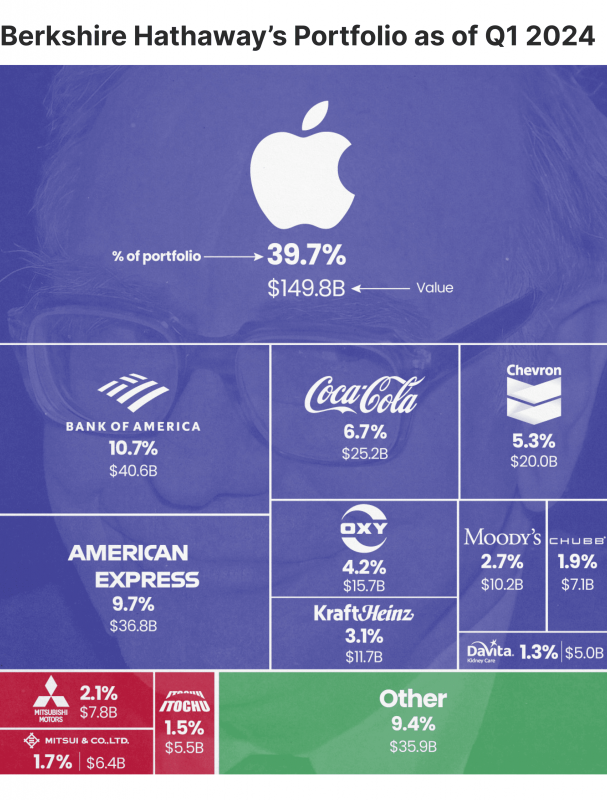

Berkshire Hathaway is a multinational conglomerate that has numerous business lines and is owned by the billionaire and 8th richest person in the world, Warren Buffet.

The company’s largest incomes come from underwriting and owning shares in other businesses. Berkshire Hathaway has seven business segments: insurance, BNSF Railway, Berkshire Hathaway Energy, Manufacturing, McLane Company, Pilot Travel Centers, Service and Retailing and Investment and Derivatives.

The company is a significant shareholder in other businesses, such as Apple, Coca-Cola, American Express, Bank of America, Chevron Corporation and other firms from leading industries in the US.

Berkshire Hathaway stocks are one of the most consistent and steadily growing. Its stock price is valued at $410 in July 2024, a 13% increase in YTD.

#4 UnitedHealth Group

UnitedHealth Group is a US multinational health insurance company that provides medical services and insurance products powered by advanced technology and big data.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

The company operates through its four businesses, UnitedHealthcare, the largest source of earnings, followed by OptumRx, OptumHealth, and OptumInsight.

The company has one of the most stable stock valuations. The stock price has been ranging between $480 and $520 since 2022, achieving 100% share growth over the last five years.

#3 Apple

The famous technology and software corporation makes the top-three list of Fortune 500 stocks after achieving over $383 billion and just below $100 billion net profit in 2023.

Needless to say, Apple is one of the most successful and growing companies in the world. Despite the company’s decline in 2020, it doubled its stock price in 2021 and was currently traded at $213 in July 2024, achieving an 11% year-over-year growth rate.

In June 2024 alone, Apple increased its stock price by 10%, making it a great option to invest in Fortune 500 companies. It is worth noting that over 30% of the company’s ownership is held by institutional investors, such as Vanguard, Fidelity, Invesco and Warren Buffet.

#2 Amazon

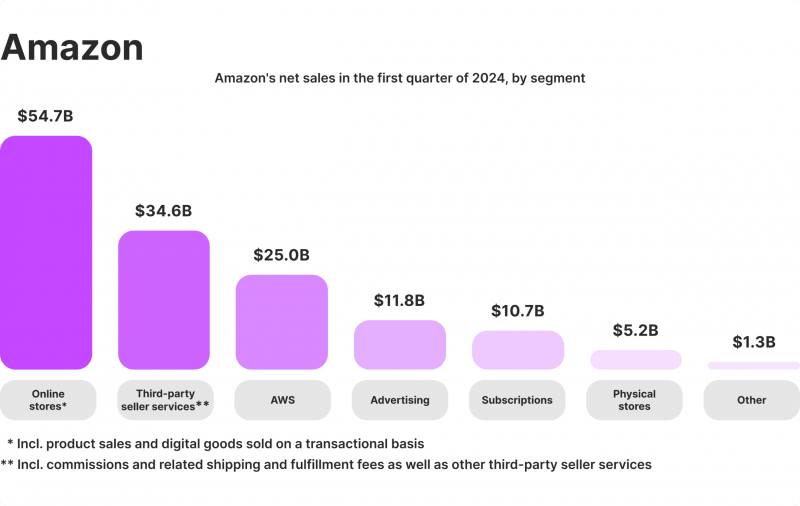

Amazon is a multinational tech company with a diversified portfolio spanning e-commerce, cloud hosting, artificial intelligence, online marketing, retailing, supply chain management, and digital streaming.

Amazon is owned by the 3rd richest businessman, Jeff Bezos, who founded the company and is the current executive chairman.

After suffering a significant tremble in 2022 as stocks dipped due to rising inflation and shrinking consumer spending, the company bounced and outperformed its pre-2022 figures.

The stock price has grown by over 130% since 2023, with a massive YTD growth of 30%, making it a great Fortune 500 choice for investors.

#1 Walmart

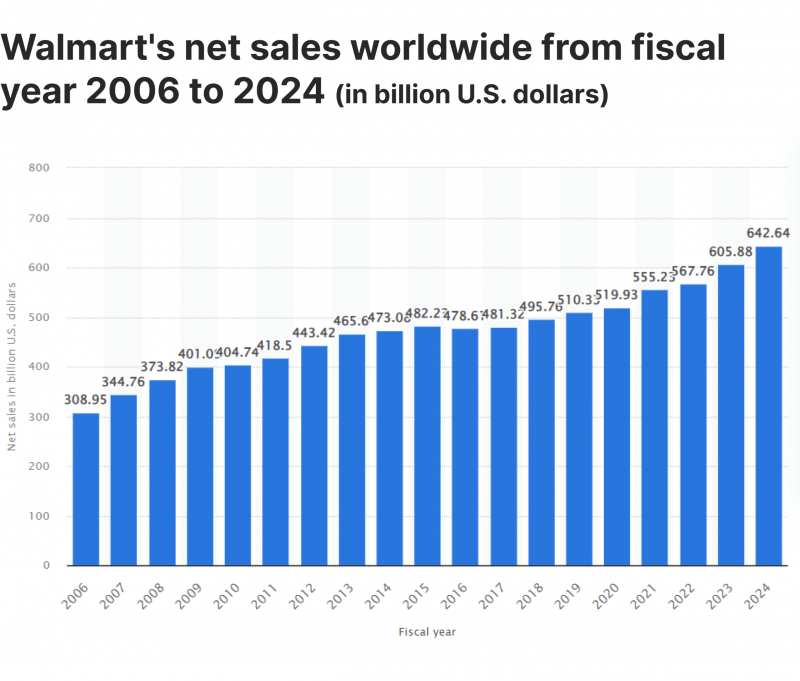

Walmart has been at the top of the Fortune 500 stocks list since 2010. The company reported over $640 billion in revenue last year and has steadily growing shares.

Walmart stocks are currently trading at $67, with a 27% YTD growth rate and 28% YOY growth. The corporation earns income from its three business segments: Walmart US, Walmart International, and Sam’s Club.

This long-term growth and stability make Walmart an excellent choice for traders who want to invest in Fortune 500 companies and achieve long-term financial gains.

How to Invest Money in Fortune 500 Companies

Investing in Fortune 500 companies is similar to trading any stocks. First, you must identify your goals because shares move with different market volatility and growth rates. Some of them suit short-term or long-term investors.

Here’s how you can invest in Fortune 500 stocks.

Find an Investment Platform

Search for a reliable and trustworthy online brokerage firm through which you can interact with the stock market, invest, and control your portfolio.

Inspect the platform’s reputation, range of services, financial advisor, and available instruments, including the top Fortune 500 stocks you want to invest in. Also, check the payment options available and ensure the deposit and withdrawal methods are supported in your country.

Research The Market

Do your research to understand how Fortune 500 stocks move, what affects their growth rate and the other factors that affect the overall market.

Determining your investment relies on your financial goals and time horizon. Some fast-growing stocks are suitable for short-term investments at some considerable risks. On the other hand, some long-lasting stocks bring more stability and continuity in the long term.

Determine Your Budget

Deposit funds, most brokers offer a taxable brokerage account, which will be your investment budget, which you will use to open positions and process buy/sell orders. Check out for any minimum deposit requirements or procedures to ensure the timely arrival of your funds to your account.

Some brokerage platforms allow you to buy fractional shares, offering a more cost-efficient option than paying for the entire stock price.

Oversee Your Investments

After depositing your funds and selecting suitable stocks, you can start opening positions in the trader room, utilising charts, dashboards, technical analysis tools, the expense ratio and newsfeeds.

Closely monitor your investments to make timely decisions if markets experience unexpected movements and to avoid excessive losses.

Highest Dividend-Paying Stocks in Fortune 500

Another strategy when investing in Fortune 500 companies is to find those that pay dividends. Dividends are shares of earnings that enterprises pay to shareholders quarterly. Some companies pay dividends monthly or semiannually.

Fortune 500 stock dividends can seem tiny, but most shareholders own hundreds of shares, accumulating percentages to a significant number.

Altria Group (Yld: 8.52%)

Altria is an American tobacco corporation known for producing and retailing tobacco, cigarettes, and medical products for treating illnesses caused by cigarettes. Altria Group Inc. owns famous brands like Philip Morris and Marlboro.

Altria stocks are currently trading at $46, with a YTD growth rate of 10%. One Altria stock pays $0.98 quarterly at the moment, making it one of the highest dividend-paying Fortune 500 stocks.

Pfizer (Yld: 5.95%)

The famous pharmaceutical and biotechnology enterprise pays dividends to holders, with the last payment made on June 14th 2024.

Pfizer stocks peaked during the COVID-19 pandemic. Leading US investment firms like BlackRock, Vanguard, and Charles Schwab Investment Management Inc. hold PFE shares.

The stocks now trade at $28 and pay $0.42 quarterly. The longevity of Pfizer shares makes it a long-term investment choice.

Franklin Resources (Yld: 5.60%)

Franklin Resources Inc. is an international investment firm that offers mutual funds, ETFs, 529 investment portfolios, money market funds, and more.

Franklin stocks currently pay $22, which has decreased moderately due to industry factors. Each stock pays $0.31, but the ability to purchase numerous shares makes it a reliable long-term investment.

Chevron (Yld: 4.17%)

Chevron is an American multinational energy company that produces and distributes gasoline, diesel, marine and aviation fuels, premium oil, lubricants, and fuel oil additives.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

CVX stocks currently pay $156, which has been growing steadily since the beginning of this year. Chevron dividends pay $1.63 quarterly, making a high dividend payout per share.

Coca-Cola (Yld: 3.07%)

The famous American beverage company is known for being a long-term stock investment because it is one of the most consistently growing companies worldwide.

Coca-Cola stocks currently trade at $63 at a steady YTD growth rate of 5.7%. KO shares pay $0.49 quarterly in dividends, offering a reliable Fortune 500 stock investment.

Best Fortune 500 Stocks in ETFs and Index Mutual Funds

Exchange-traded funds (ETFs) are financial instruments that consist of stocks, bonds, and other instruments. They derive value from the underlying securities and fluctuate as their market prices change.

An ETF or mutual fund indices are reliable investments that offer consistent returns at moderate growth and relatively low risk.

Vanguard S&P 500 Index Mutual Fund: VOO includes assets like Microsoft, Apple, Amazon, Google, and other S&P 500 stocks. The ETF currently trades at $501 and has grown 15.5% YTD.

Fidelity 500 Index Funds: The FXAIX ETF includes Fortune 500 stocks like Google, Apple, and Amazon. It trades at $190 and has a 15.8% YTD growth rate.

Schwab S&P 500: SWPPX is an S&P 500-based index fund that includes Microsoft, Google, and Johnson & Johnson. The Schwab S&P 500 index currently trades at $84.50 with a 16% YTD growth rate.

iShares Core S&P 500: IVV ETF includes leading US firms, such as Google, Microsoft, Apple, Amazon, and Exxon Mobil. The ETF trades at $548 and has been growing steadily (15%) since the beginning of 2024.

SPDR S&P 500 Trust: The Standard & Poor’s Depository Receipts (SPY) ETF includes Apple, Amazon, Microsoft and other Fortune 500 firms. It currently trades at $545 with a 15% YTD growth rate.

Conclusion

Fortune 500 companies are US firms with the most significant annual earnings. Institutional investors invest in Fortune 500 companies to balance their portfolios and achieve long-term returns for many years.

Berkshire Hathaway, Amazon, Apple, and Walmart are some of the best Fortune 500 companies to invest in, while some investors prefer combining their portfolios with high dividend-paying stocks such as Chevron and Coca-Cola.

FAQ

Should I invest in Fortune 500 Stocks?

Investing in Fortune 500 stocks offers reliable returns, as the list includes the best US firms in terms of annual earnings. Fortune 500 companies include Apple, Amazon, Microsoft, Walmart and Coca-Cola.

How to invest in Fortune 500 Shares?

Find a reliable brokerage firm that offers stock trading, including Fortune 500 companies. Inspect the platform’s reputation and services. Register and deposit funds in your investment account. Research the market to find the most suitable stocks for your portfolio and start trading.

What is The Best Fortune 500 Company?

Walmart has led the Fortune 500 list for 24 years with the most significant reported revenue. The company pays a 1.23% annual dividend yield, making it a reliable investment.

Are the Fortune 500 and S&P 500 the same?

No. The S&P 500 spans companies with the largest market capitalisation, and it is a weighted stock market index that gives the largest companies more value, while the Fortune 500 directly lists companies with the biggest earnings of the preceding year.