Stop Order vs Limit Order: Key Differences to Consider

Automated orders and trading mechanisms are a big part of the recent digital trading revolution, allowing investors to select desired prices and navigate the market at their preference. This article will discuss three indispensable trading mechanisms – stop orders, limit orders, and a combination of two – stop-limit orders.

The trading field has come a long way from manual interactions and physical trader’s rooms. Today, the global investment scene is available at the fingertips of each retail trader, making the entire industry much more accessible and convenient.

Key Takeaways

- Limit orders allow traders to set specific prices for desired deals and automatically execute the transaction when the price is matched.

- Stop-order prices are thresholds for buying or selling assets when they pass a particular value.

- Limit orders are designed to be precise trading tools, while stop orders are more market-oriented.

- Using these tools in combination could be beneficial in numerous trading situations.

What’s a Limit Order?

Limit orders are convenient trading mechanisms that allow traders to set a desired price quote for their planned asset purchases or sales.

Thankfully, this mechanism safeguards against setting prices above the fair market value. For example, if a trader decides to place a limit order at $105 for a specific tradeable asset, but the current market price is only $102, the order will simply not allow it.

While this seems like a fundamental contingency, it is beneficial in high-volatility markets that witness chaotic price changes within a single trading session. So, the specified limit price should always be equal to or less than the current market price.

Aside from this, limit orders are transparent announcements of a desired price that are visible on the market. If a trader places a sell limit order, the same laws apply – it is impossible to set a sell order below the current price offered by the market.

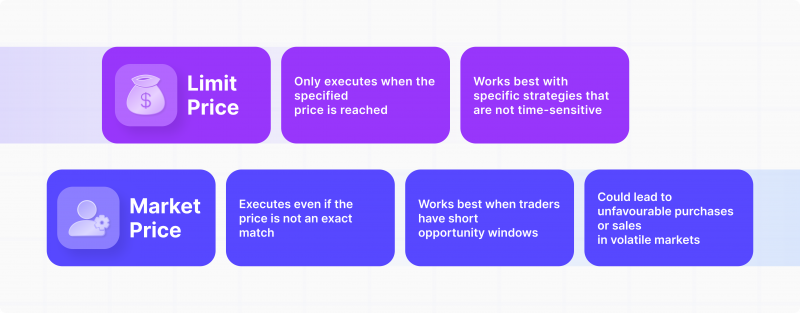

Limit Price vs Market Price

There are two distinct variations of a limit order. The first is the limit price, which is a hard constraint on the specified price. This means that the deal will only execute when a trader places an order type limit if the exact price is matched on the open market. On the other hand, a market order allows traders to have a less constrained limitation on the price.

The preferred quote is still selected, but the price is not required to match exactly. Instead, it can simply be a close match if the market demand for the chosen asset is surging.

Explore Deeper Industry Insights

Learn from experts shaping the future of financial services — get the latest strategies and trends.

The order matching system will understand this demand spike and conduct the purchase. Naturally, this approach is risky in volatile markets, as the demand spike might be a fluke and eventually lead to investor losses.

Understanding the Stop Order

Stop orders serve as a great alternative to limit orders in specific circumstances. Like limit orders, stop orders can be set up with a custom price in mind.

However, unlike limit orders, they are not executed once the specific price is reached. On the contrary, stop orders are activated once the desired price has been met or exceeded.

So, stop orders are designed to purchase assets above a certain threshold, allowing investors to automate their strategies of investing in surging asset types.

The same is true for selling the assets, as the deal will activate on the market only when a price falls below a certain threshold. Both cases are great for risk management as well as opportunistic investing.

The price gaps are essential variables to consider when utilising the stop order since they could make or break your strategies in a significant way. A negative price gap means an asset price drops unexpectedly, and a stop order to sell could lead to a considerable interval between a desired selling price and a factual one.

How Stop-Limit Orders Work

While the two above-described orders serve as great alternatives to each other, there is a way to combine both mechanisms. Aptly named a stop-limit order, this mechanism allows traders to effectively set a floor and a ceiling to their desired purchase or sale price. This way, traders can create acceptable intervals of buying or selling assets.

For example, if a trader wishes to purchase a specific asset within an interval of $100 and $105, they can simply set a stop price at $105 and a limit price at $100. This way, the deal will become activated once the stock price falls below $105 but gets cancelled if it falls beyond the $100 valuation threshold. The trailing stop-limit order will ensure that the asset in question will not be purchased above or below the specified interval.

As a result, traders will have a healthy valuation window and a higher chance to acquire an asset. After all, an interval of prices is much more likely to be matched than an exact price. Stop-limit orders are excellent mechanisms that combine the best of both worlds. However, it takes a certain level of mastery to become proficient with this tool and utilise it for maximum profitability.

Stop and limit orders are very popular in leveraged trading scenarios, allowing investors to gain more control over multiple positions at once.

What Circumstances Are Best for Each Order?

As discussed above, both stop and limit orders are designed to control the deal outcomes within the open market. The most significant difference between the two systems is that limit orders are precise, whereas stop orders need a prevailing market price anchor to execute. Thus, utilising each order type effectively depends on the specific market circumstances.

Therefore, limit orders are designed to reach specific goals in the market. They are best utilised when the trader has a custom strategy that hinges on precise price quotes. So, limit orders are especially effective in the low-margin and high-liquidity markets.

The Dual Purpose of Stop Orders

Conversely, stop orders are more effective as a risk mitigation strategy. Suppose an investor has bought an asset that is expected to devalue in the future. To control this undesirable outcome, the investor can set a stop order trade price at value X. If and when the asset goes down below the X valuation, the sale will automatically initiate, and losses will be cut short.

On the other hand, stop orders can also function as a triggering tool. It is well known that an asset is expected to enter an appreciation spike if it reaches a particular market price.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Thus, a stop order can automatically detect this and purchase the asset at a lower price or better valuation. This strategy is beneficial for traders who deal with numerous asset types within their portfolios.

As for the markets, stop and limit orders are helpful in forex, crypto, stock markets and even commodities, as every sector can experience dramatic price spikes or falls in specific periods. So, it is helpful to have a mechanism, like a stop limit activation price, to stay in tune with the changing market conditions.

Final Takeaways

Stop orders vs limit orders is a fascinating debate within the trading landscape. It is difficult to state that one method is better than the other since both have their specific use cases. Diligent investors will often combine or interchange the stop and limit orders depending on the market changes.

So, it is essential to know when to apply these mechanisms to maximise your profits and increase your portfolio growth metrics. Limit and stop orders can cover both sides – driving growth and minimising risks. However, as with every other trading mechanism, they are most effective in the hands of experienced professionals.

FAQ

What is the difference between a limit order and a stop order?

A limit order lets you buy or sell an asset at a specific price or better, ensuring price control but not guaranteed execution. In contrast, a stop order becomes a market order once the asset reaches a predetermined stop price, focusing on execution but not the exact price. This is the key difference between limit and stop orders.

When should I use a stop order versus a limit order?

Use a stop order when you want to buy or sell only after the price reaches a certain level, often to limit losses or enter a position during momentum. A limit order is ideal when you aim to buy or sell at a specific price or better. Understanding when to use limit vs. stop orders can enhance your trading strategy.

What is a stop-limit order, and how does it differ from a limit order?

A stop-limit order combines features of both stop and limit orders. It triggers a limit order once the stop price is reached. The main difference between a limit and a stop-limit order is that the latter activates only when the stop price is hit, adding an extra layer of control over your trades.

How do limit buy and stop buy orders differ?

A limit buy order allows you to purchase an asset at or below a specified price, ensuring you don’t overpay. A stop buy order becomes a market order to buy once the asset’s price reaches the stop price, often used to enter positions in rising markets. Knowing the difference between a stop buy vs. limit buy can help you execute trades more effectively.