What Are Investment Funds, and Where Do They Find Liquidity?

Investment funds occupy a prominent place in the market today. According to research by Spherical Insights & Consulting, the global mutual funds market was valued at $66.3 trillion in 2023 and is expected to triple by 2032. But why are more and more investors attracted to investing in mutual funds and ETFs? What makes them stand out from other products?

This article will explore investment funds, their various benefits, and how they find and manage liquidity in the financial market.

Key Takeaways

- The main types of funds include open-ended mutual funds, closed-ended funds, ETFs, hedge funds, and private equity funds.

- Funds’ liquidity management ensures they can meet redemption requests and maintain investment flexibility.

- Regulatory changes and technological advancements have continually shaped and redefined the liquidity management landscape in investment funds.

What Is an Investment Fund?

The core purpose of an investment fund is to pool capital from multiple investors to create a portfolio with a variety of assets. These products are managed by experienced professionals who leverage their expertise to navigate the financial markets, aiming to generate returns that align with the fund’s stated objectives.

Funds let investors gain exposure to an array of asset classes that may be challenging or impractical to pursue individually. They entrust their capital to these funds and benefit from the collective bargaining power, professional oversight, and diversification that these vehicles provide.

Fund Managers and Liquidity

An investment fund’s success largely hinges on its fund managers’ skill and insight. These professional investors make strategic decisions regarding the fund’s asset allocation, security selection, and trading activities.

A defining characteristic of funds is their ability to meet investors’ redemption requests, which requires careful liquidity management. An asset manager must strike a delicate balance between maintaining sufficient liquid instruments to accommodate potential outflows and investing in less liquid, higher-yielding instruments to optimise returns.

Types of Investment Funds

The landscape of investment funds is vast and diverse, with a wide range of options catering to investors’ varied needs and risk profiles.

Open-Ended and Closed-Ended Funds

One of the primary distinctions among investment funds is the structure. Open-ended funds continuously issue and redeem shares, while closed-ended funds offer limited shares that trade on exchanges, similar to stocks.

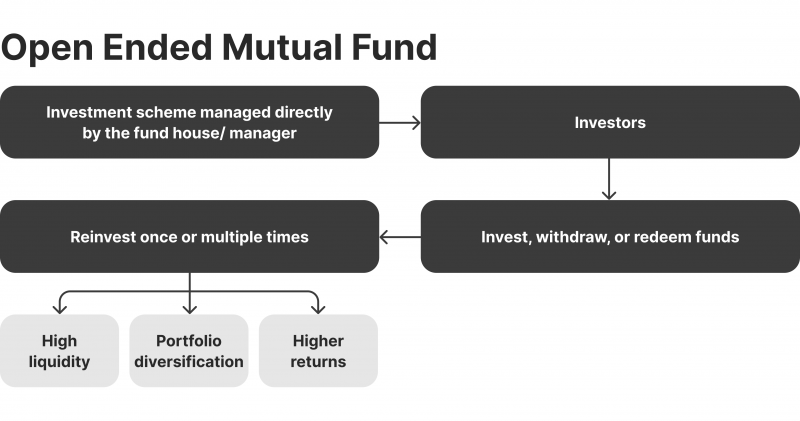

Open-Ended Mutual Funds

Open-ended mutual funds account for the majority of fund assets. These funds let investors purchase and sell shares at the fund’s net asset value (NAV), which is calculated each day at the end of the trading session. This structure provides a high degree of underlying liquidity, as the fund can create new shares to meet investor demand or redeem shares from those seeking to withdraw their capital.

Examples:

- Vanguard Market Neutral Fund Inv (VMNFX)

- AQR Long Short Equity N (QLENX)

- Fidelity Treasury Mny Mkt Cap Rsrvs (FSRXX)

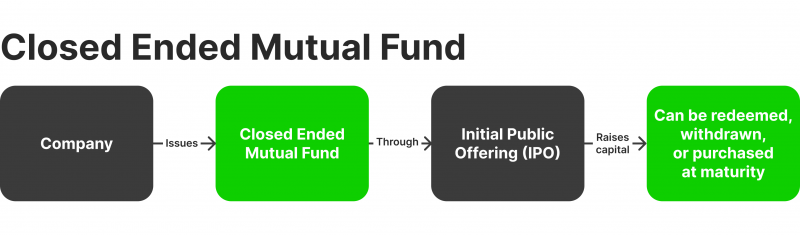

Closed-Ended Funds

Closed-ended funds trade on exchanges, with their prices fluctuating based on market supply and demand. Unlike open-ended funds, closed-ended ones do not redeem shares directly from investors. Instead, investors buy and sell shares on the secondary market, which can result in the fund trading at a premium or discount to its NAV.

Examples:

- BlackRock Corporate High Yield Fund (HYT)

- John Hancock Tax-Advantaged Dividend Income Fund (HTD)

- Eaton Vance Enhanced Equity Income Fund (EOI)

Mutual Funds and ETFs

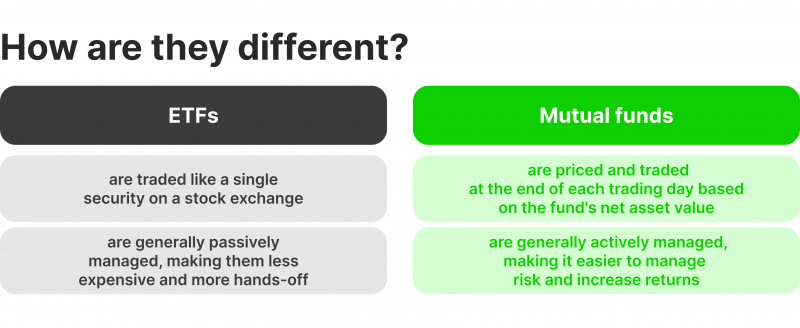

Two of the most prominent types of funds are mutual and exchange-traded funds (ETFs). Both offer investors diversified exposure to a certain asset class or industry, but their structure, trading mechanisms, and cost profiles differ.

Mutual Funds

Mutual funds are actively managed investment vehicles that pool investor capital to invest in a diversified portfolio of instruments. Mutual fund shares are purchased and redeemed directly with the fund company, with the market price based on the fund’s NAV.

Examples:

- USAA Nasdaq-100 Index Fund (USNQX)

- Vanguard International Growth Fund (VWIGX)

- Janus Henderson Balanced Fund Class T (JABAX)

Exchange-Traded Funds

ETFs are passively managed funds that track specific indices or market segments. They trade on stock exchanges throughout the day, allowing investors to buy and sell shares like individual stocks. The expense ratios of ETFs are often lower than those of actively managed mutual funds.

Explore Deeper Industry Insights

Learn from experts shaping the future of financial services — get the latest strategies and trends.

Examples:

- SPDR Bloomberg Investment Grade Floating Rate ETF(FLRN)

- VanEck CLO ETF (CLOI)

- Invesco DB US Dollar Index Bullish Fund (UUP)

Speciality Investment Funds

Beyond the traditional mutual funds and ETFs, the investment fund landscape includes specialised vehicles that cater to more specific investment strategies and risk profiles.

Hedge Funds

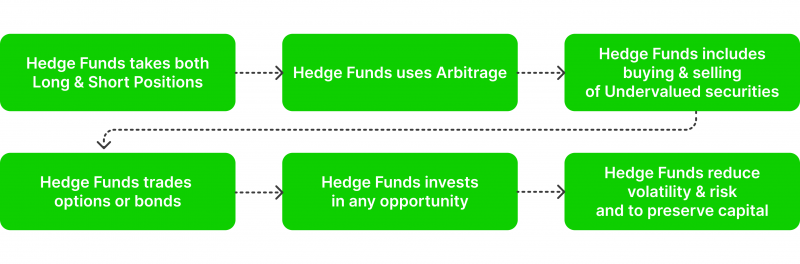

These are financial institutions that employ diverse strategies, including short-selling, leverage, and complex derivative instruments, to generate outsized returns. They are typically open only to accredited or institutional investors and are subject to less regulation than traditional investment funds.

Examples:

- Field Street Capital Management

- Citadel Investment Group

- Mariner Investment Group

Private Equity and VC Funds

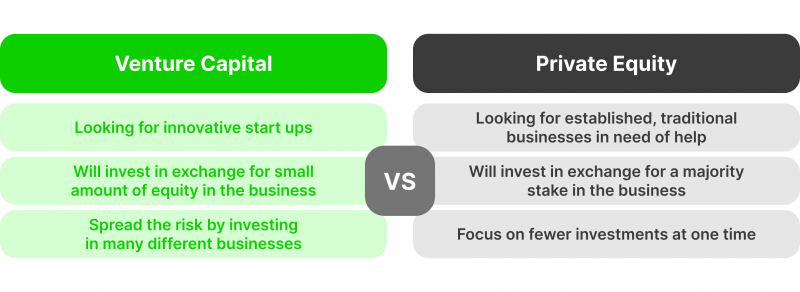

Private equity firms raise capital from investors in order to make investments in privately held companies, with the goal of restructuring and optimising these businesses to increase their market value. These funds offer the potential for higher returns but also carry greater risk and illiquidity.

Venture capital (VC) funds are similar to private equity funds, but they specialise in investing in start-up companies and small businesses. These funds are riskier as they target companies with high growth potential but may also offer higher returns.

Examples:

- The Blackstone Group Inc.

- The Carlyle Group Inc.

- Andreessen Horowitz (a16z)

Pros of Investing in Funds

With the concept of investment funds now clear, let us explore the benefits that they offer:

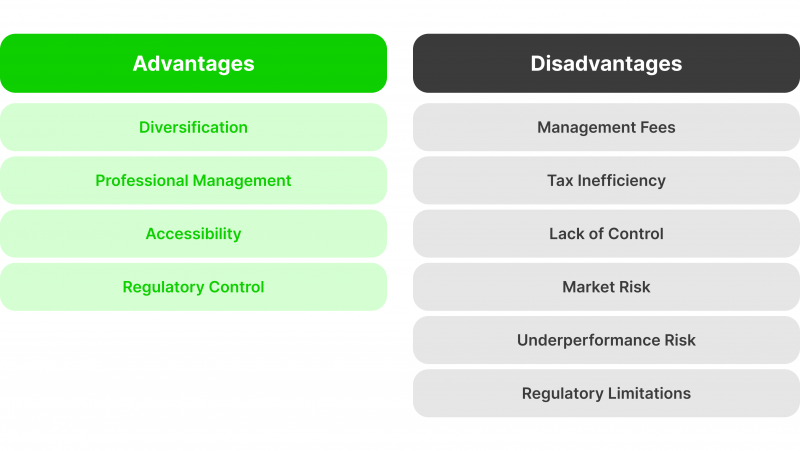

Diversification

Mutual funds and ETFs invest in a wide range of financial instruments, such as securities, commodities, and even cryptocurrencies. Funds are perfect for those seeking to spread the risk among various fund’s assets, reducing the impact of any single security’s performance on the overall fund.

Professional Management

One primary advantage of investing in funds is having experienced professionals manage them. Asset managers monitor market trends, conduct research, and determine how to maximise the returns for the fund and its investors.

Accessibility

Investment funds allow individuals to invest in assets that may otherwise be out of reach. For example, a small investor may not have enough capital to purchase individual stocks or bonds but can invest in a fund with a portfolio that includes the assets he or she would like to invest in.

Regulatory Control

Funds are subject to regulatory oversight by government bodies. Investors can rest assured that their investments are being monitored and managed in compliance with industry standards.

Cons of Investing in Funds

Investment funds also come with some drawbacks that investors should consider:

Management Fees

Professional management comes at a cost. Investment funds charge fees for managing the pool of assets, which can eat into an investor’s returns.

Tax Inefficiency

Investment funds are subject to tax on any income and gains generated within the fund, which is then passed on to the investors. Taxation can reduce overall returns for investors.

Underperformance Risk

While fund managers strive to generate positive returns, there is always a chance that the fund may underperform its benchmark or target objectives, which could lead to lower returns or even losses for investors.

Market Risk

Investment funds are subject to market risk, and the value of their assets can fluctuate depending on market conditions. Volatility could lead to losses for investors, especially during times of economic downturn.

Regulatory Limitations

While regulatory oversight provides a sense of security, it also means that investment companies are limited in their investment strategies and may have restrictions on investing in certain types of securities or industries.

Lack of Control

When investing in a fund, investors hand over control of their investments to the fund manager, meaning they cannot decide about individual securities or asset allocation within the fund.

Historically, passive index funds have outperformed actively managed funds.

How Funds Manage Liquidity

Liquidity management is a critical aspect of investment fund operations, ensuring that funds can meet redemption requests and maintain the flexibility to pursue investment opportunities. Fund managers employ various strategies to manage portfolio liquidity and mitigate potential risks.

Defining Liquidity

Liquidity in the context of investment funds refers to the ease with which a fund can convert its portfolio holdings into cash to meet redemption demands or take advantage of new investment opportunities. Factors such as the trading volume and market depth of the underlying assets, as well as the fund’s cash reserves, contribute to its overall liquidity profile.

According to the Securities and Exchange Commission’s (SEC) Rule 2a-7, liquid assets are defined as those that can be readily converted into cash within one or five business days for daily and weekly liquidity needs, respectively. This rule also identifies specific types of fund holdings that qualify as daily and weekly liquid assets, including:

- Cash

- Direct obligations of the U.S. government

- Government agency discount notes with short-term maturities

- Securities with demand features or maturing within one to five business days

- Receivables are scheduled for payment within one to five business days

Liquidity Risk Management Practices

Investment funds employ a range of liquidity risk management practices to maintain a healthy balance between meeting redemption requests and maximising investment returns. These practices include:

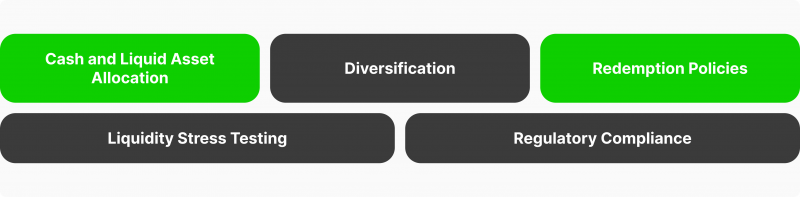

- Cash and Liquid Asset Allocation: Funds maintain a portion of their assets in cash or highly liquid investments, such as government securities or money market funds, to ensure they can readily meet redemption demands.

- Diversification: Funds diversify their portfolios across various asset classes and sectors to mitigate the impact of liquidity shocks in any particular market or investment.

- Redemption Policies: Funds may impose redemption fees, withdrawal limits, or notice periods to discourage frequent redemptions and promote long-term investment.

- Liquidity Stress Testing: Funds regularly conduct stress tests to assess their ability to withstand potential redemption scenarios and adjust their liquidity management strategies accordingly.

- Regulatory Compliance: Investment funds must adhere to regulatory guidelines, such as the 15% limit on more illiquid assets, to ensure they maintain sufficient liquidity to meet their obligations.

Liquidity Differences Across Fund Types

Investment fund’s liquidity management tools and practices can vary depending on their structure and investment strategies. For instance, open-ended funds generally have greater flexibility in meeting redemption requests by issuing or redeeming shares, while closed-end funds may rely more on the secondary market to control liquidity risks.

However, this flexibility can also lead to liquidity mismatches between assets and liabilities, making it more challenging for open-ended funds to meet sudden and large redemption requests. This can potentially cause procyclical asset sales and fund suspensions, posing risks to investors and underlying markets.

Where Do Funds Find Liquidity?

Investment funds derive market liquidity from several sources, including:

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

- Cash Inflows: Funds receive regular cash inflows from new investor contributions, dividend and interest payments, and the maturation or sale of portfolio holdings.

- Liquid Asset Holdings: Funds maintain a portion of their assets in highly liquid instruments, such as government securities, money market funds, and short-term commercial paper, to meet significant redemptions.

- External Funding Sources: Funds may have access to lines of credit or other arrangements with core liquidity providers and other financial institutions to supplement their liquidity during periods of heightened redemption activity.

The Evolution of Investment Fund Liquidity

The landscape of investment fund liquidity is constantly evolving, driven by regulatory changes, technological advancements, and shifting market dynamics.

Regulatory Developments

Regulatory bodies, such as the SEC, have introduced new rules and guidelines aimed at enhancing investment funds’ liquidity risk management practices. These include the SEC’s 2016 liquidity risk management program rule, which imposes additional requirements for funds to assess, manage, and report on their liquidity profiles.

Technological Innovations

Advancements in the fintech industry have also influenced the way investment funds manage liquidity. Automated trading systems, data analytics, and digital platforms have enabled fund managers to monitor and respond to liquidity conditions more efficiently.

How to Choose an Investment Fund

When it comes to choosing an investment fund, there are several factors to consider. Some of the most crucial elements include performance, risk, portfolio composition, management team, and cost.

Performance

The performance of an investment fund should be evaluated over a longer time horizon, preferably at least three to five years. This time frame allows for a more comprehensive assessment of the fund’s ability to achieve its objectives consistently. Some key performance metrics to consider include total return, risk-adjusted return, expense ratio, and fund size/liquidity.

Risk

Every investment involves risk, and the same applies to investment funds. Some funds may be focused on generating higher returns at the expense of greater risk exposure, while others prioritise lower-risk investments. It’s important to understand your risk tolerance and choose a fund that aligns with your investment goals.

Portfolio Composition

Different funds will have varying degrees of concentration in terms of asset classes, sectors, geographies, and individual securities. You need to understand the fund’s portfolio composition and how it fits into your overall investment strategy before investing. For example, if you already have significant exposure to a particular asset class or sector in your portfolio, you may want to choose a fund with a different focus for diversification purposes.

Cost

Investment funds come with various fees and expenses, including management fees, operating costs, and transaction costs. These can impact your returns, so it’s essential to understand the fund’s cost structure and compare it with other funds in the same category.

Final Thoughts

Investment funds are a powerful tool for those seeking to increase their wealth and attain financial goals. Diversification, accessibility, and professional management make funds appealing to novices and experts alike. They provide opportunities to invest in assets and markets that may otherwise be out of reach, allowing for greater risk management and potential for higher returns.

It is important to remember that investing involves inherent risks and potential for losses. Before committing your capital, it is essential to thoroughly research and understand the fund’s objectives, strategies, fees, and performance.

FAQ

Are mutual funds safer than ETFs?

The safety of a mutual fund or ETF is not determined by its structure but rather by the assets it holds. Stocks are typically riskier than bonds, and corporate bonds carry slightly more risk than US government bonds. So, neither one is inherently safer than the other.

Is it possible to lose money on an ETF?

Yes, losing money on an ETF is possible despite its low-risk rating. As with any investment, there are no guarantees of future performance, and you may not get back the amount you initially invested.

How to invest in a fund?

Investing in a fund, whether a mutual fund or an ETF, is similar to investing in individual stocks. You can purchase shares through a brokerage account or directly from the fund’s company. Before investing, research the fund’s performance and possible risks. It is always recommended to consult a financial advisor before making any investments.