What is a Fill or Kill Order, and When Do You Use It?

The modern trading field is fast-paced, with profit opportunities appearing and disappearing in hours or even minutes. Many profitable deals in a vacuum can be dramatically unsuccessful if the window of opportunity is missed.

Naturally, it is tough to control every trade manually and perfectly time their execution. While some traders succeed at manually monitoring their deals, most suffer from slippages and ultimately get a deal they weren’t looking for.

With a Fill or Kill (FOK) order, traders can acquire greater control over their dealing outcomes.

This article will explore the FOK orders and their significance in executing time-sensitive deals.

Key Takeaways

- Fill or Kill orders are automated trading protocols that execute the deal entirely or cancel all of it.

- Traders can specify their desired asset price and volume in the FOK preconditions.

- FOKs are best suited for high-volume markets with lower profitability margins.

- FOKs have a lower chance of execution than popular time-sensitive orders like IOC.

Understanding Time-Sensitive Trade Orders

The online trading age has introduced numerous valuable tools and mechanisms to simplify the hectic process of executing deals. From analytics and live data feeds to social trading practices, there are multiple ways to get an additional boost in the trading landscape. Automatic order executions are among the best improvements digital trading solutions offer.

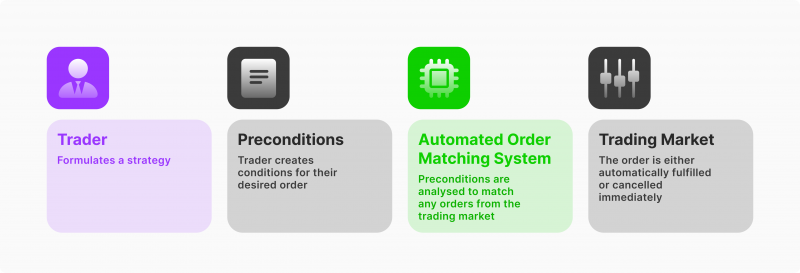

These protocols allow traders to set predetermined conditions for their traders. The trade order is executed immediately if all the specified conditions are honoured. However, the order is cancelled automatically if the conditions are not met.

With such a system, traders can ensure that they either receive the deal they desire in the first place or avoid incurring losses from slippage or other changing market conditions. Investors no longer have to manually cancel deals, which previously led to human error and unfavourable scenarios.

The time-sensitive orders come in many shapes and sizes, including Fill or Kill, Immediate or Cancel, All or None, and Good Till Cancelled orders. Each automated order serves its specific purpose and helps traders in distinct situations.

These protocols share one joint strength – they let investors build a reliable trading strategy and avoid being at the mercy of frequently changing asset prices.

Defining a Fill or Kill (FOK) Order

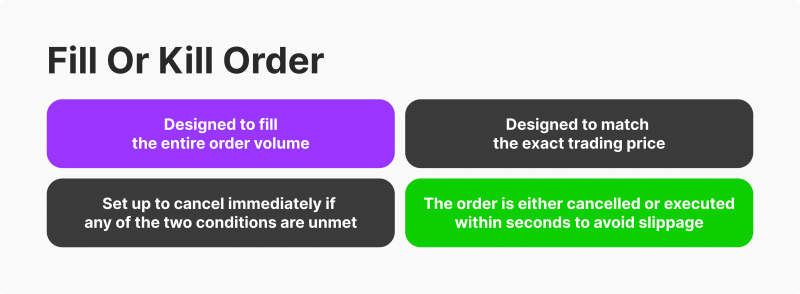

A FOK order comes from the family of automated trading orders. FOK orders are designed to fulfil an entire order or nullify the deal. This way, traders can be sure that their created order is filled immediately or completely cancelled.

The FOK order was designed to safeguard active traders from placing a buy or sell order in the online trading system and receiving returns at different times and prices.

As discussed above, many deals are only profitable at particular prices and short time windows, so FOK cancels the whole agreement if any preconditions are not honoured. Traders can simply specify their desired quantity and price in the FOK order protocol.

After that, they can simply wait for the automated matching orders to survey the market and either find a favourable deal or close down the entire position without incurring any losses.

Benefits of the FOK Order

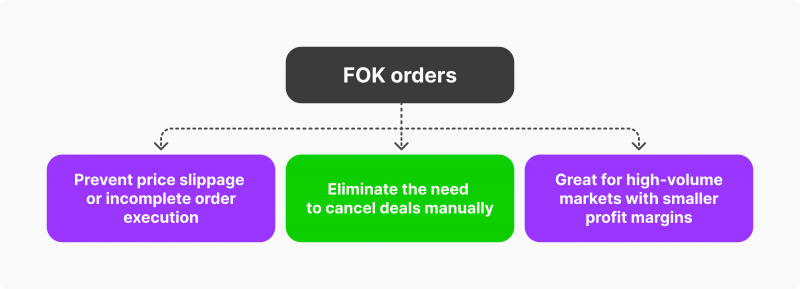

FOK orders are excellent for high-volume trading markets with tight profitability margins and high liquidity metrics. In such markets, traders mostly purchase and sell large asset quantities to make measurable gains. So, traders must execute the entire deal at a specified price or the best possible market price.

Without FOKs, investing or trading in high-volume markets can be risky, as many deals would not be filled within an acceptable time window. As a result, traders would only get a portion of a desired volume and often at unfavourable market valuation.

Naturally, such deals lead to losses of varying significance. However, a more critical problem in this case was the unreliability of markets. Traders could not formulate a dependable strategy and follow their blueprint without unforeseen consequences.

The FOK order prevents such scenarios and lets traders form clear expectations on their soon-to-be executed trader order, warranting immediate execution or nullification of the deal.

FOK orders are prevalent in the forex field due to tight profit margins and high trading volumes.

Fill or Kill Order Example

To further visualise the advantage of FOK orders, suppose investor X is looking to sell 2 million shares of Google stocks at a $50 valuation. Investor X places a corresponding FOK order in the trading system.

The market currently offers 1 million shares of Google stocks at a $50 valuation. While the price matches, the deal will be nullified since the volume is not even close to the desired amount.

While this might seem like a loss, many investors construct their trading strategies based on the asset volumes. If they can’t purchase or sell enough of the specified asset, the deal is not worth the trouble.

Suppose the market offers 2 million shares of Google, but the price has gone up to $50.5 in the meantime. Similarly, the FOK order will automatically close down the deal entirely.

Depending on the market conditions, the seemingly insignificant price decrease of $0.5 could lead to minimised or even negative profit margins for investor X. The FOK order prevents such a scenario and eliminates the potential deal.

With an FOK order at their disposal, trader X will only receive a market order that is both favourable in price and quantity. As a result, trader X can form reliable trading strategies and have a firm expectation of what deals they will execute immediately.

Fill or Kill vs Immediate or Cancel Order

The IOC vs FOK debate is prevalent in the realm of time-sensitive order executions. The immediate or cancel (IOC) orders offer partial fills of a specified deal, allowing investors to retrieve at least a fraction of the contract if the price matches.

The unfilled balance of the agreement will immediately be cancelled. So, the IOC and FOK orders share the robust quality of immediate execution, but the IOC order is much more likely to occur.

Simply put, the limit order of the IOC prioritises the deal’s price and only has a soft restriction on the volumes. IOC orders might be more beneficial for traders who wish to purchase assets and have a firm price preference, as they don’t cancel if the volumes do not match.

Naturally, the IOC orders are helpful in numerous situations and are more popular than FOKs due to their high likelihood of execution.

FOKs, due to their force fill, are more extreme orders with a lesser chance of being executed immediately. However, this can be an advantage in some markets since the deal execution is not always a sole priority in the trading field. So, both order types have their appropriate uses and should be sifted through by aspiring investors. Low-volume and price-sensitive markets prefer IOC orders, whereas high-volume market participants frequently employ the FOK.

Final Takeaways

The FOK orders are an excellent mechanism for controlling your immediate future in the frantic trading environment. While the FOKs might not be as frequently employed as the IOC orders, their specific preconditions allow traders greater control over their deals.

As a result, FOKs eliminate the risks of slippage or delayed execution. The trading landscape changes and shifts unpredictably, so having an automated safeguard to prevent undesirable scenarios is never a bad idea.

FAQ

What is a FOK order and how does it function?

A FOK order, or Fill or Kill order, is a type of trade order that must be executed immediately in its entirety or be canceled entirely. This fill or kill approach ensures that traders either receive the full quantity at the specified price or no transaction occurs, preventing partial fills.

When should traders use a Fill or Kill order?

Traders use a fill or kill order when they need to execute a large trade quickly and want to avoid partial executions. FOK orders are ideal in high-volume markets where securing the entire order at a specific price is essential for maintaining profit margins.

What are the benefits of using a FOK order?

Using a FOK order provides greater control over trade executions by ensuring that the entire order is filled at the desired price or not executed at all. This helps prevent slippage and ensures that trading strategies are implemented as planned, making fill or kill orders reliable for managing large trades.

Recommended articles

By clicking “Subscribe”, you agree to the Privacy Policy. The information you provide will not be disclosed or shared with others.

Our team will present the solution, demonstrate demo-cases, and provide a commercial offer