What is a Pip in Forex: Values & Calculation

With its complex terms and extremely active nature, Forex trading can be a labyrinth for newcomers. One such term is pip, a fundamental concept in currency trading. But what is a pip in Forex, and why is it so crucial? Let’s discover.

Key Takeaways

- A pip is the slightest price movement in Forex trading, measured with four decimal places.

- Aspects like currency pair, trade size, and exchange rate influence the pip values.

- Individual forex trading strategy, risk tolerance, and market conditions are paramount in the number of pips traders make daily.

What is a Pip in Forex?

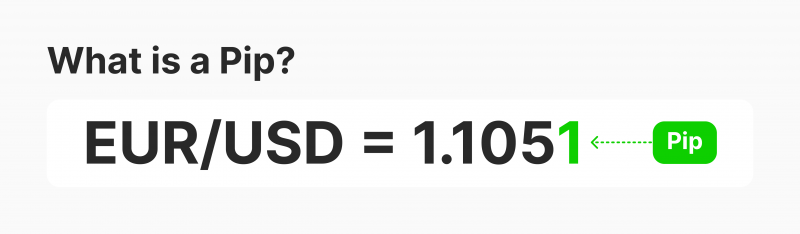

A pip, short for ‘percentage in point’ or ‘price interest point,’ is the smallest price movement in the exchange rate of a currency pair. It represents a standardised unit of movement, providing a quantifiable measure of price changes.

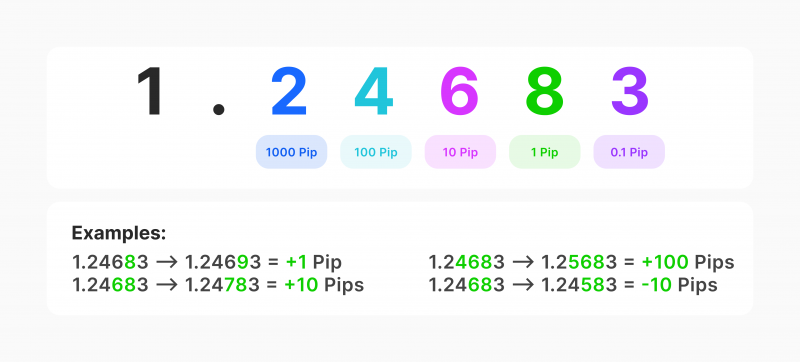

The forex pairs are represented through bid and ask spreads, with accuracy extending to the fourth decimal place. Changes in the exchange rate are quantified in pips, and due to the common quoting of currency pairs with a maximum of four decimal places, the minimal unit change for these pairs is precisely one pip.

To be more precise, if EUR/USD moves from 1.1050 to 1.1051, that .0001 USD rise in value is ONE PIP.

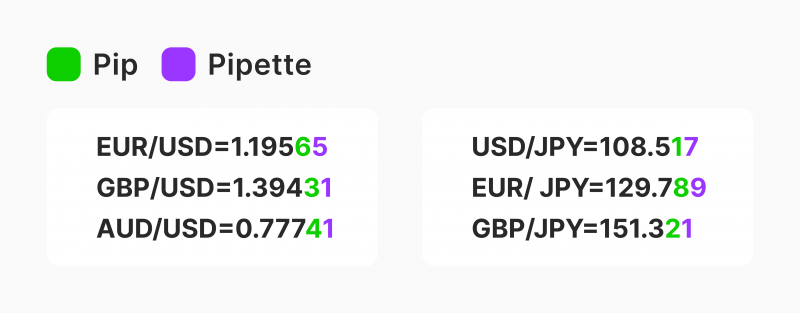

Some forex brokers go beyond the conventional “4 and 2” decimal point, quoting pairs with extended precision to the “5 and 3” decimal point. This additional precision involves quoting fractional pips, which are alternatively referred to as “points” or “pipettes.”

What is a Pipette, and How Does it Differ from a Pip?

A pipette represents a fractional pip, constituting 1/10 of a pip. Typically, they are calculated using the fifth decimal place (in the case of Japanese Yen pairs, the third decimal place is used).

To illustrate, in the EUR/USD currency pair, a shift from 1.10811 to 1.10812 signifies a rise of 1 pipette.

Why Do You Need to Understand Pips?

Knowing about pips is important for traders in the Forex market for several reasons.

First, pips are the universal metric for expressing price movements and changes in value between currency pairs. This standardisation allows traders globally to communicate and understand price changes in a consistent manner.

Secondly, understanding pips is essential for calculating profit and loss. Since the value of a pip varies depending on the size of the trade and the currency pair, traders use this knowledge to manage their positions effectively.

Explore Deeper Industry Insights

Learn from experts shaping the future of financial services — get the latest strategies and trends.

Finally, awareness of pips is vital for risk management. Traders determine the risk per trade and set stop-loss and take-profit levels in pips, making it a fundamental concept for strategising and safeguarding investments in the volatile Forex market.

How to Find the Pip Value in Your Trading Account?

To determine the pip value for a trade, you can use the Pip Calculator by inputting the number of units in the ‘Trade size’ box in your trading account. Understanding this is essential for calculating the commission per forex trade.

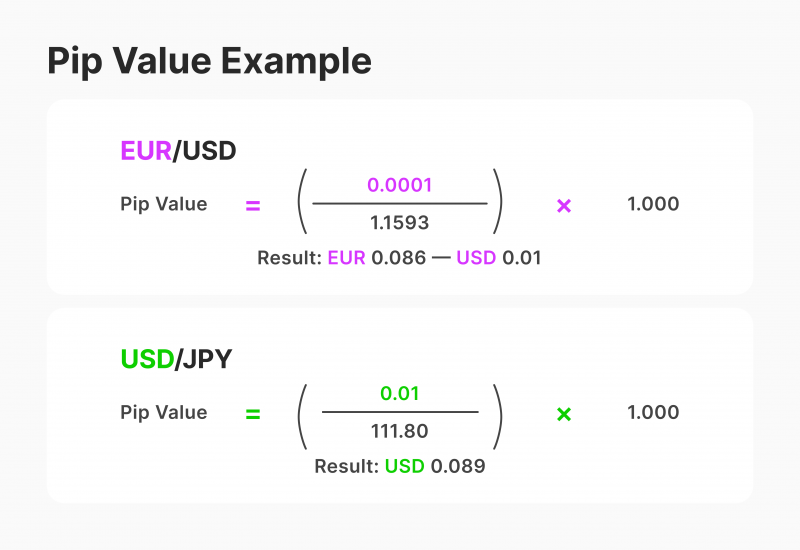

The formula for instruments priced to four decimal places is as follows:

Pip Value = Units × 0.0001 × Conversion to USD

This formula allows you to calculate the pip value by multiplying the number of units by 0.0001 and then further multiplying by the conversion to USD.

What Determines a Pip Value?

While the absolute value of a pip may seem small, its significance is magnified through leverage, potentially exerting a substantial impact on your open position. The pip value is determined by factors such as the currency pair being traded, the trade size, and the exchange rate.

Calculating the value per pip is crucial in evaluating the planned risk associated with each trade entry.

To illustrate, suppose your predetermined risk budget for each trade is $500, and you are preparing to execute a one-lot buy order for EUR/USD. If the value of one pip in the currency pair is $10, then your stop-loss budget for this specific entry is determined by dividing $500 by $10, resulting in 50 pips.

In this scenario, if the trade necessitates a stop-loss greater than 50 pips, you’ll need to adjust your trading lot size accordingly to ensure that the risk does not exceed the $500 limit.

If you are a novice trader and find it complicated to identify the value of a pip of different financial assets at a time, feel free to use a special Indicator that is extremely helpful in such cases.

The famous 100 pips a day strategy says that as soon as you get 100 pips, you must stop. Although this tactic may seem slightly annoying, it is believed to be the wisest action path for novice traders.

How to Calculate Pips in Forex Trading?

As mentioned above, the value of a pip depends on factors such as the currency pair, exchange rate, and trade value. When your forex account is denominated in U.S. dollars, and USD is the second currency in the pair (quote currency), the pip remains constant at 0.0001.

In this scenario, calculating the pip value involves multiplying the trade value (lot size) by 0.0001. For instance, for the EUR/USD pair, if you have a trade value of 10,000 euros, the pip value is determined by multiplying 10,000 by 0.0001, resulting in a pip value of $1. If you buy 10,000 euros against the dollar at 1.0801 and sell at 1.0811, your profit would be 10 pips, equivalent to $10.

Conversely, when the USD is the first currency in the pair (base currency), the pip value is influenced by both the exchange rate and the pip size. To calculate it, divide the size of a pip by the exchange rate and then multiply by the trade value.

For example, dividing 0.0001 by a USD/CAD exchange rate of 1.2829 and multiplying by a standard lot size of 100,000 yields a value of $7.79. If you buy 100,000 USD against the Canadian dollar at 1.2829 and sell at 1.2830, your profit would be 1 pip, totalling $7.79.

Example of a Pip Using Japanese Yen Pairs

An exception to the standard four decimal place rule is observed in Japanese yen (JPY) pairs, quoted with only two decimal places.

For currency pairs like EUR/JPY and USD/JPY, calculating the pip value involves taking 1/100 and dividing it by the exchange rate.

For instance, if the EUR/JPY is quoted at 132.62, one pip is determined as 1/100 ÷ 132.62, resulting in 0.0000754. In the context of a lot size of 100,000 euros, the value of one pip (expressed in USD) would amount to $7.54.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

How Many Pips a Day Do Forex Traders Make?

The number of pips a day that Forex traders make can vary widely and is highly dependent on individual trading strategies, risk tolerance, market conditions, and the size of trading positions. There is no fixed or guaranteed number of pips that traders make daily.

The outcome of a trader’s financial success or loss at the end of the day depends on the fluctuations in the exchange rate of a currency pair.

For instance, a trader opting for the EUR/USD pairing stands to gain if the euro’s value rises compared to the U.S. dollar. If the trader initiates the trade with a euro purchase at 1.1835 and concludes at 1.1901, the resulting profit would be 66 pips (1.1901 – 1.1835).

Though the numerical differences may seem tiny, these gains and losses can accumulate rapidly in the vast and dynamic foreign exchange market.

For instance, on a $10 million position closing at 112.01, the trader would realise a profit of ¥500,000. In U.S. dollars, this translates to $4,463.89 (¥500,000/112.01).

Final Remarks

Mastering the idea of pips in Forex is fundamental for any trader. Staying informed about concepts like pips in the dynamic Forex Market ensures that traders can make strategic decisions to achieve financial success.

FAQ

What exactly is a pip in Forex?

A pip is the smallest price movement that can occur in the exchange rate of a currency pair.

How do I calculate pips on gold?

Calculating pips on gold follows the same principles as with currency pairs. The key is understanding and applying the pip value to the gold market.

Why are pips important in day trading?

Pips are crucial in day trading as they help traders measure price movements and decide when to enter or exit trades.