What is an All or None Order, and How Do You Use It?

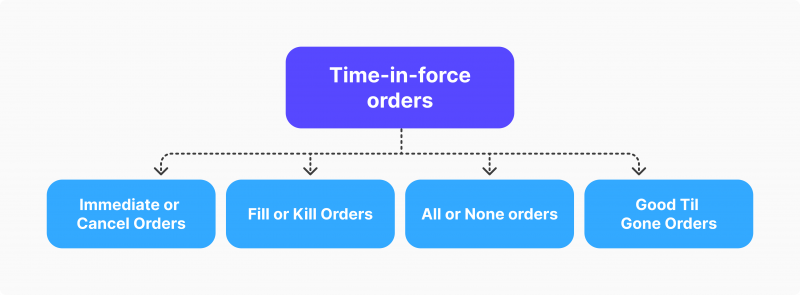

Time-in-force orders have proven their place within the realm of digital trading. Their presence allows investors to make diligent decisions, control deal outcomes more efficiently and eliminate scenarios where they get stuck with unfavourable deals.

All or none order is one of the most frequently utilised time-in-force mechanisms, letting traders acquire desired deals in a longer timeframe and increase the likelihood of their success. This article will discuss what differentiates the limit order all-or-none from other time-in-force orders and the best circumstances to utilise this tool.

Key Takeaways

- All-or-none orders are automated order-matching systems that allow traders to fill out their desired asset volumes.

- All-or-none orders require price and volume presets. However, the volume preset is the only hard constraint, as AONs are required to fill the entire order.

- AON orders are outstanding for illiquid and volatile markets, where the asset quantities are more scarce and hard to fulfil.

Catching up with Time-in-Force Orders

Before we delve into the meaning of AON orders, let’s get a quick refresher on the time-in-force trade types. These automated orders were created to solve the complexity of manual trade executions.

Previously, traders had to manually navigate their deals by hand, opening and closing positions. While some deals were easy to handle, active investors frequently made the mistake of not closing unfavourable positions.

As a result, traders could miss out on a desired price or even suffer from price fluctuations and acquire a deal that leads to portfolio losses. Moreover, it was simply too challenging to scour the market for a specified price thoroughly.

With time-in-force orders, each of the abovementioned processes is automated, and traders can merely set the preconditions to their buy or sell order.

With these automated helpers, traders receive a much-needed quality-of-life improvement in their day trading activities, letting them automatically select the market price and volumes of the entire order and avoid worrying about the deal execution.

Several prevalent time-in-force subtypes are frequently employed across trading markets – the immediate or cancel order, the fill or kill order, the good till cancelled order and the subject of this article – the all or none order.

Explore Deeper Industry Insights

Learn from experts shaping the future of financial services — get the latest strategies and trends.

The Definition of AON Order

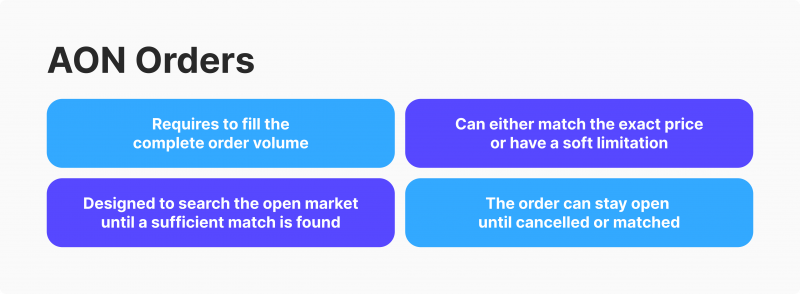

The all-or-none order comes from the time-in-force order family, offering traders great flexibility. With this tool, it is possible to set the preconditions for price and volume, but the execution timeframe is not necessarily immediate. Traders can specify the timetable for executing the transaction or cancel it if the deal is not matched on the market.

In most cases, AON orders are matched or closed down within several trading days. This structure allows AON orders to analyse the market propositions more thoroughly instead of shutting down the deal in a matter of seconds, a popular method with other time-in-force orders. As a result, AON orders are much more likely to be executed since there is more time to match the specified price and volume.

It is important to note that regulatory authorities often warn inexperienced traders to steer clear of AON and time-in-force orders, as they require experience and mastery. The Securities and Exchange Commission has issued several statements that describe the unfortunate outcomes of poorly implemented trading strategies.

Setting the AON Preconditions

The price preference is a soft limitation with AON, with two possible options. Either the traders utilise the limit order to set a limit price or set up a market order to match open market quotes closely. The first choice requires the exact price match, while the second is a more relaxed requirement depending on the current market conditions.

Benefits of All or None Order Type

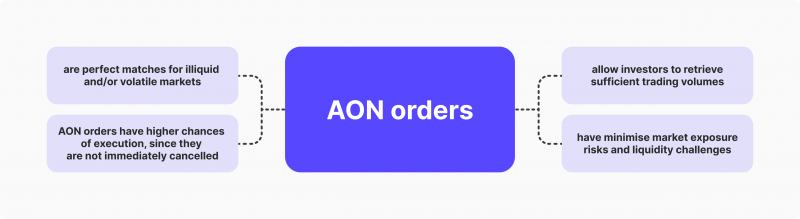

As discussed above, AON orders have several unique advantages in the time-in-force order subtype family. First, depending on your specific needs, AON is an excellent choice for both liquid and illiquid market conditions.

If the trading market is illiquid, then AON orders are great for ensuring sufficient asset volumes. Illiquid markets often struggle to provide enough assets to satisfy trader needs, and sometimes, the investment strategies only work with enough trading volumes. AON ensures that the deals either get executed or stay inactive.

On the other hand, some liquid markets have smaller profit margins. While stock orders can generate impressive returns, the forex market has many sectors and currency pairings with air-tight margins.

In such an environment, traders must invest in high currency volumes to make any meaningful profit. AON orders ensure that volumes are always matched on the trading floor.

All or None vs Fill or Kill Orders

By now, it is clear that AON orders are pretty similar to their close time-in-force relative, fill or kill (FOK) orders. The most significant distinction here is the timeframe of execution.

FOK orders are similarly designed to seek out a deal with a matching price and entire quantity. So, FOKs and AONs both eliminate the possibility of partial fills. However, instead of having a specific timeframe, FOKs are executed immediately.

Naturally, FOK orders have much less likelihood of execution since the automated matching system has a concise window to find any matches. However, FOK orders have unique applications in particularly illiquid and volatile markets. In such conditions, even several hours of waiting could lead to worse market prices, making the deal unfavourable.

On the other hand, AON orders could result in prolonged downtimes for traders, as the deal could take several days or weeks to find a match. In fast-moving markets, these timeframes can be unprofitable, which makes the FOK orders a superior choice. However, if the market conditions are not highly volatile and illiquid, AON orders are a logical choice due to their increased probability of success.

All or none orders are frequently interchanged with FOK orders depending on market conditions. Investors often switch over to the FOK model if liquidity and volatility metrics are critical.

All Or None Order Example

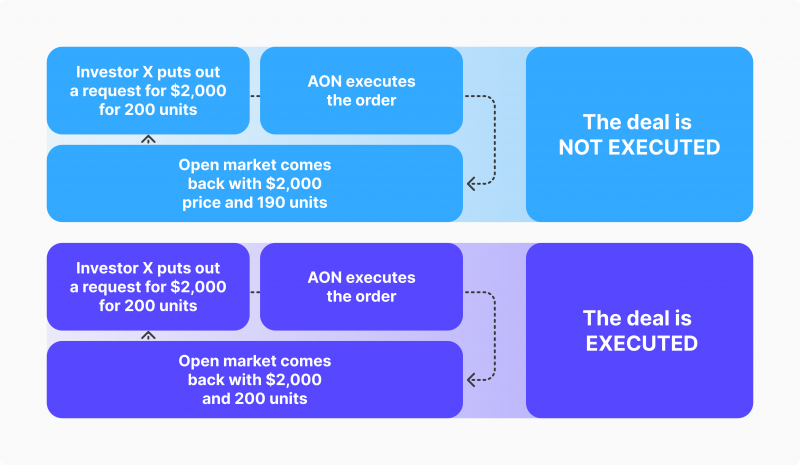

Suppose the investor X is currently trading in a volatile market with liquidity shortages. Investor X has chosen the AON order approach in their digital trading strategy and wishes to purchase a cryptocurrency Y at $ 2,000 per unit. The desired volume is 200 units.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Once investor X fills out the preconditions, the AON order is initiated and sent into the open market. After this, it all depends on the market offerings. If the order receives information that cryptocurrency Y is sold at $2,000 but only offers 190 units, the deal will not execute.

Now, another offering appears at $2,005 and 200 total units. In this case, the AON order execution depends on whether investor X specified a limit price or a market price for their desired purchase. In the case of the former, the deal will remain open, but with the market price, the contract will be executed immediately.

So, AON orders are significant for investors who prioritise asset volumes but don’t have any need to execute the deals immediately. However, AON orders still have their fair share of downsides. Most prominently, the prolonged market waiting time can be a drawback in specific scenarios where traders must execute deals swiftly.

Closing Remarks

All or none order is a core subtype of the time-in-force order family, letting traders acquire desired volumes with an increased success rate. Their automated features eliminate the possibility of purchasing deals with insufficient volumes, a great option in illiquid and even liquid markets. However, wielding this powerful tool requires knowledge and experience.

Otherwise, the placed orders could harm your long-term trading strategies. So, before you consider employing the AON order type, we advise you first to investigate all the relevant details and analyse the practical market examples.