Bitcoin Payments in 2025: What to Consider

Articles

Relying only on bank transfers is a thing of the past. Nowadays, DeFi assets are becoming increasingly popular as payment methods for individuals and corporations to offer products and services.

Today, Bitcoin payments are accepted by many online stores and businesses. This widespread adoption is mainly attributed to the fast processing and advanced security offered by cryptocurrencies.

Entering the Bitcoin payments ecosystem market requires thoroughly reviewing providers and the supported assets used to receive Bitcoin payments. Here’s how you can offer BTC transactions.

Key Takeaways

- Cryptocurrency payments allow individuals and merchants to save money from exchange rates and financial intermediaries.

- Businesses are increasingly accepting cryptocurrency transactions to offer faster and safer means of payment.

- A BTC payment gateway is a tool integrated into a website’s checkout page that allows customers to use their Bitcoin wallets.

Importance of Bitcoin Payments

Bitcoin appeared around 15 years ago as a digital payment method and a way to store money online, in contrast to traditional bank currencies. For many years, cryptocurrencies were outplayed by centralised financial institutions, such as banks and online wallets backed by traditional payment processing systems like Visa and Mastercard.

However, blockchain utilities made it more popular as users became more aware of data security and financial privacy protection, giving rise to Bitcoin, Ethereum, and major virtual coins and tokens.

Today, Bitcoin is adopted in a huge number of online stores and platforms, which benefit from blockchain’s fast processing capabilities and improved performance.

Additionally, more centralised institutions are becoming crypto-friendly. The US financial regulator approved Bitcoin spot ETF trading last year, an unprecedented decision to integrate decentralised securities at leading centralised investment firms.

Other centralised payment processors such as PayPal, Stripe and Visa have recently started to accept Bitcoin payments online for e-commerce sites or trading platforms.

How Bitcoin Payments Processor Works

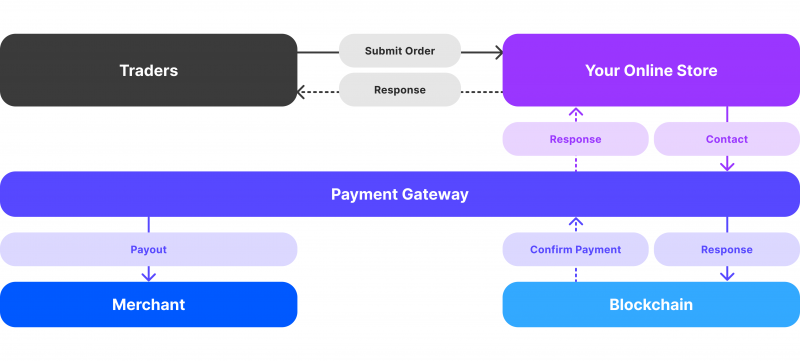

The Bitcoin payment gateway is a critical part of the process, which is the interface that users encounter when they choose to pay with Bitcoin.

On the front end, customers only need to link their crypto wallet or scan a QR code associated with the transaction amount and merchant. However, on the back end, APIs play a vital role in data exchange between the sender’s wallet, blockchain, and merchant account.

This process happens within seconds and ends with the API receiving confirmation from the blockchain once the payment is registered, which is communicated to the sender’s wallet with the transaction hash ID.

Why You Need to Accept Crypto Payments?

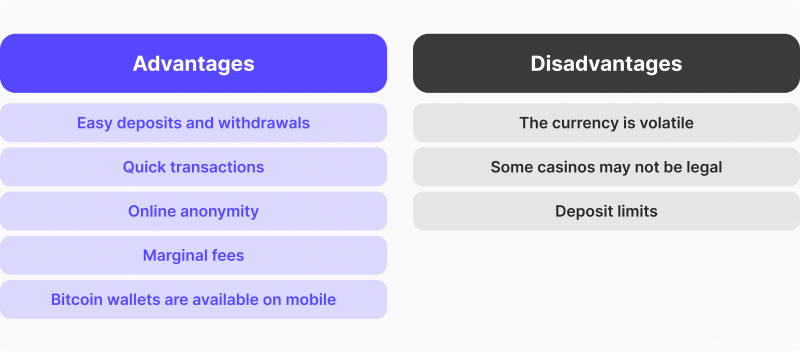

Integrating Bitcoin payments opens the door for more opportunities and users on your platform. You can grow your business by appealing to more customers of digital communities and crypto enthusiasts. Transacting with cryptocurrencies entitles you to the following benefits:.

Global Reach

Cryptocurrencies enjoy unified prices around the world, allowing you to onboard new clients and expand your reach to new markets. As such, you can conduct Bitcoin B2B payments without worrying about currency conversions, especially in markets that have restrictions on holding and dealing with foreign currencies.

Lower Costs

Bitcoin cross-border payments are much cheaper than traditional bank transfers, which involve currency converters and intermediary financial institutions that charge their own fees.

Blockchain payments are direct and powered by smart contracts and other mechanisms that automatically execute and fulfil transactions after the user’s confirmation.

US households would have saved over $70 billion by using cryptocurrencies over credit card payments, while companies have spent $125+ billion in banking fees.

Elevated Security

A BTC wallet only requires the public key and address to gather and send funds. On the other hand, banks collect various personal and financial information and store it in the system, which can be exposed to any third-party entity.

This allows you to accept Bitcoin payments on your website while safeguarding the user’s personal details.

Automated Processing

Advanced crypto processing gateways allow you to manage your receivables, whether you want to store them in crypto or fiat money or even in stablecoins to minimise price changes. Some providers will guide you on how to set up recurring Bitcoin payments for your network of partners or affiliates.

How to Integrate Bitcoin Payments on Your Website

Adding a cryptocurrency payment gateway can be technically challenging. However, there are some steps that you must undertake before starting the integration process.

Review Local Crypto Regulations

The legal ruling on cryptocurrencies differs between countries. Some states use Bitcoin as a legal means of payment, while others impose stringent regulations on holding or receiving Bitcoin.

Therefore, it is important to familiarise yourself with the applicable laws for conducting financial transactions with decentralised assets.

Find a Reliable Bitcoin Payment Provider

Determine your corporate objectives on how and why you need to accept cryptocurrency payments and set a priority list of supported coins. Then, start reviewing BTC payment gateway providers who match your requirements and offer features and functionalities that suit your needs.

Add Payment Gateway APIs

APIs are mechanisms that facilitate data exchange between websites and platforms. Thus, they play a major role in initiating transfers, starting the blockchain validation process and confirming the transaction once the operation is registered on the ledger.

Your chosen payment provider equips you with unique API keys that you can add to the checkout page code to accept payments in BTC and other coins.

Who Uses Bitcoin Payments?

Sending and receiving Bitcoin payments is not exclusive to a particular user class or industry. In fact, anyone can create a crypto wallet and store BTC, ETH, and thousands of coins. However, blockchain-based transactions are popular among the following industries.

Crypto Brokerage Firms

Platforms offering spot crypto brokerage services and OTC exchanges use a plethora of supported virtual coins and tokens to empower clients to trade and exchange decentralised assets.

Thus, they use Bitcoin payment gateways to facilitate BTC transactions and receive funds quickly.

E-commerce Stores

Accepting Bitcoin payments for e-commerce stores is becoming increasingly popular to attract more users from different countries without worrying about exchange rates. This encourages buyers to purchase products with quick processing and low transaction fees.

This also safeguards merchants from chargeback frauds, which has been eating away many businesses’ revenues.

Gambling Sites

The betting industry is known for adopting the fastest and safest means of payment, making Bitcoin the best choice in this matter.

Due to increasing banks’ regulations and policies towards iGaming platforms, gambling sites accept crypto payments to facilitate quick deposits and attract more players to their websites.

How to Find The Best Bitcoin Payment Provider in 2025

When searching for a crypto payment processor, you will find multiple companies offering similar services, which can be overwhelming. However, this guideline helps you prioritise and understand prospective providers.

- Identify your objectives: Whether you want to receive BTC for sales or offer brokerage services, it is vital to determine your business type and find a relevant supplier.

- List the support coins: Besides receiving instant Bitcoin payments, increasing your customers’ choice of cryptocurrencies will encourage more users to transact with you.

- Set your budget: Providers offer crypto payment gateway services in exchange for different charges. Some may impose fixed payment or percentage-based fees that can be considerable if you conduct mass Bitcoin payments.

- Determine your settlement mode: Some providers allow settlement in currencies other than those in which transactions are done. For example, as a risk mitigation approach, you can choose to store funds after conversion into USD.

Bottom Line

Due to the security features and fast processing of DeFi assets, transactions with cryptocurrencies are becoming a common practice for most websites and stores. Users are more appreciative of their personal and financial data, which encourages them to prefer decentralised currencies over centralised ones.

Therefore, supporting Bitcoin payments allows you to attract more users to your platform and boost your business operations, benefiting from low transactional costs and flexible settlement options.