Benefits of Bitcoin Payments and How to Start

Continually updating to keep up with ongoing trends and technologies is essential to ensuring business longevity, a lesson that many companies have learned the hard way.

However, with Bitcoin’s rising popularity and innovative blockchain technology driving advancements in the financial sector, large corporations and market players consider it inevitable to initiate tentative steps toward an overall transition towards decentralised ecosystems.

Integrating BTC payment methods, accepting Bitcoin wallets, and seeking Bitcoin-based investments are a few ways to grow in the DeFi economy. Businesses increasingly transact with BTC in response to increasing demands and evolving technology that facilitates flexible asset and payout management.

Let’s review some benefits of Bitcoin payments and the potential growth of adopting these contemporary technologies.

Key Takeaways

- Businesses integrate Bitcoin payments to simplify user experience and add more flexibility to their payment methods.

- Transacting with BTC coins is faster, more affordable and safer.

- E-commerce and online businesses rely on Bitcoin payments to combat chargeback fraud due to the immutability of cryptos.

- The recent SEC approval of spot BTC ETFs boosted investors’ confidence in cryptocurrencies, especially Bitcoin.

Bitcoin Overview 2024-2026

The year has been eventful for Bitcoin, and many businesses have been waiting for these updates and announcements to determine their Bitcoin adoption strategy. After stagnation in 2023, most cryptos, especially Bitcoin, were in the headlines for industry news and speculations.

Starting from the Bitcoin spot ETF news when the US Securities and Exchange Commission approved 11 applications from the leading US investment firms and banks to list BTC Spot ETF digital assets.

This decision was sufficient to send the Bitcoin and most altcoins prices skyrocketing. Prices slowed down a few days after the announcement as the market was getting ready. However, a couple of months later, the BTC price recorded a new all-time high of $75,000.

One month forward, and it is the Bitcoin halving event. This significant network update is introduced every four years to sustain the blockchain integrity and coin value. During the halving, miners’ rewards are decreased by 50%, which lowers the number of coins in circulation.

These two events significantly raised Bitcoin’s value, motivating more traders to invest in BTC markets for income. Additionally, it encouraged businesses to integrate a BTC payment method into their websites, as users prefer safer and faster transactions with virtual coins.

Transacting with Bitcoin for Your Business

Using Bitcoin as a business adds more flexibility to your capital management. It allows you to save costs and send cross-border payments without regard to exchange rates and currency differentials.

When users sign up at websites that involve monetary investment, like financial brokerage, gambling sites, or e-commerce shops, they prefer to keep their identity and financial information away from the internet.

This way, users can select Bitcoin on the checkout page to connect their wallets and pay with virtual coins. This process is faster and does not require identity verification or prolonged authentication that banks undertake.

On the other hand, companies benefit from faster settlements to better organise their capitals and issue payouts in shorter cycles.

Benefits of Bitcoin Payments

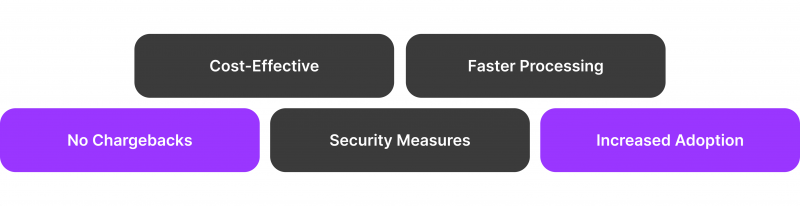

Sending and receiving digital currencies enables you to attract more customers from crypto enthusiasts and BTC users, which ultimately expands your business reach. There are various benefits that you can realise by accepting crypto payments.

Cost-Effective Option

Traditional payment methods, such as credit cards and bank transfers, involve multiple intermediaries and financial operations, especially when transacting worldwide. This structure increases the transaction costs because each channel will charge its own fees, which are deducted from your total payout.

Additionally, banks are profitable organisations that earn from services and administrative fees, while Bitcoin transactions involve gas fees, which are accumulated to reward network participants and develop the blockchain structure.

Bitcoin Fees vs Credit Card Fees

Purchasing across currencies using credit cards includes financial intermediaries, rate converters, clearinghouses and card issuer fees. Ultimately, these accumulated fees result in the loss of thousands of dollars.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Conversely, the Bitcoin transaction fees are used to compensate network nodes and miners, incentivising them to continue validating transactions and ensuring network integrity.

Faster Processing Capabilities

The lack of network intermediaries and other services in Bitcoin cross-border payments speeds up financial transactions.

The blockchain uses automated algorithms to verify payments and operations based on network regulations. When a transaction meets these conditions, it is immediately settled.

Moreover, Bitcoin mining rigs work around the clock worldwide to register new blocks and continuously introduce new tokens in circulation.

On the other hand, sending fiat money between countries or conducting transactions that require currency conversion might be delayed for a few minutes to pass every intermediary protocol. Moreover, banks use traditional settlement cycles, where payments take a few days to settle despite being paid already.

Minimising Chargeback Frauds

One of the common problems that e-commerce shops and digital stores face is the not rightful chargeback claim, where users request a refund even after delivering the good or service they originally purchased.

This happens because only a few payment processing systems do due diligence to check if the claim is rightful. Therefore, once a chargeback is requested, it is automatically granted at the merchant’s expense. This practice opened the door for chargeback frauds to take place, costing businesses thousands of dollars.

Bitcoin eliminates these instances because crypto transactions are immutable. Once a transaction is registered on the blockchain, it cannot be reversed. This promotes trust among businesses but also increases the risk of illegal entities scamming users without being traced.

Elevated Security Measures

Banks collect user data, including contact information, physical address, employment status, etc. This data is stored in the bank’s database, which can reveal sensitive user information to the public in case of hacks.

Additionally, banks use third-party verifying services and KYC providers to process background checks and authentications, exposing the user’s submitted data to third parties.

On the other hand, businesses only need to create a blockchain wallet and integrate a BTC payment API to receive payments. Accordingly, users must own Bitcoins and connect their wallets to pay.

Increased Adoption Rate

Central banks and traditional investment firms have avoided mentioning crypto assets for almost a decade, whether for trading desks or payment methods.

However, recent actions by US financial regulators, including listing Bitcoin ETFs for trading and adding gateways to receive BTC payments, have started to instil confidence among centralised financial institutions.

As a result, more banks, businesses, and financial firms started accepting Bitcoin payments and technologies to appeal to a larger user category and boost their growth.

By March 2024, there were over $46 million active Bitcoin wallets holding at least $1 value of BTC.

How to Accept Bitcoin Payments

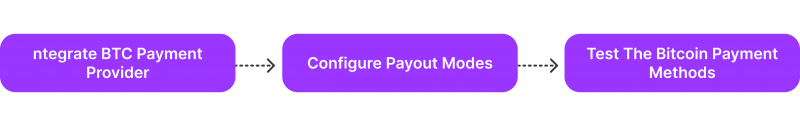

Receiving BTC money is easier than ever, thanks to the growing number of service and technology providers allowing you to enjoy the benefits of Bitcoin payments. The step-by-step process differs between payment processors. However, this is how most of them start.

Integrate a BTC Payment Gateway

Find a reliable crypto payment API provider and register on their dedicated server for Bitcoin payment. Request your unique API credentials and get your development team to add them to your website’s code file.

This will facilitate connection with the user’s BTC wallet and establish API requests with the blockchain to initiate the transaction.

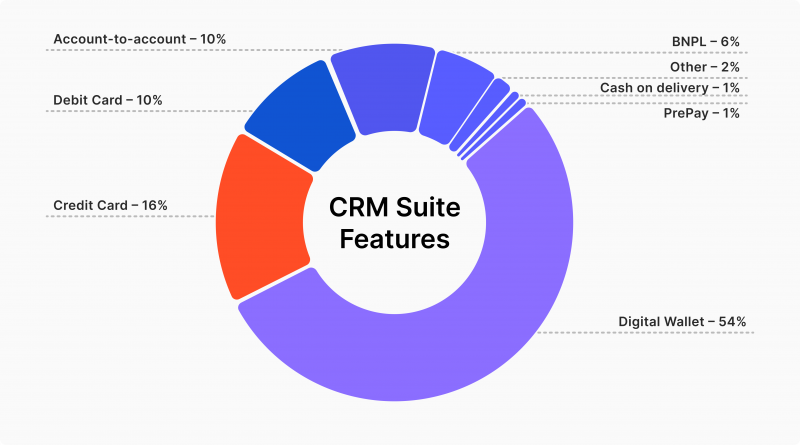

Configure Payout Modes

Crypto payment solutions are flexible, and businesses can manage the gateway to allow credit card payments or on-ramp exchangers to send Bitcoins using fiat money.

Moreover, you can manage your settlement method and determine whether you want to store your funds in Bitcoin or swap them into other currencies.

Test Your Bitcoin Payment Method

After integrating your Bitcoin payment solution, run a comprehensive test transaction and conduct quality assurance trials to ensure everything works as intended. You can start rolling out the service tentatively before a complete service launch.

Top Companies Using Bitcoin

Nowadays, many businesses from different industries accept cryptocurrencies, especially Bitcoin, to accommodate their users’ need for faster and safer payment methods.

Several years ago, only a few companies transacted with cryptocurrencies. Today, hundreds of service providers, corporations, and companies accept BTC payments.

- Microsoft: The tech giant facilitates Bitcoin payments across its comprehensive ecosystem, whether for professional services or games. You can pay with BTC for XBox games, Microsoft Office products and other services.

- Shopify: E-commerce merchants and customers can buy products and services using Bitcoin, other tokens, and stablecoins. Store managers can configure their payment systems to automate payouts and settlements between merchant and personal wallets.

- Expedia: The online tourism booking platform utilises Coinbase capabilities to facilitate BTC payments and manage itineraries with rapid transactions that overcome hefty exchange rates and handling fees.

- Twitch: The famous online streaming platform allows content creators to be compensated using various payment methods, including Bitcoin and other stablecoins, promoting a decentralised creator economy.

Pros and Cons of Bitcoin for International Payments

There is a broad range of Bitcoin benefits that you can realise by facilitating these payment methods. The network is consistently pushing security updates to boost confidence among users and sustain usability in the long term.

However, some believe that a decentralised currency remains risky because of its unpredictable and speculative nature. Let’s compare the strengths and weaknesses of using BTC cryptocurrency payments.

Advantages of Bitcoin payment

- Globality: Accepting BTC transactions allows you to tap into new markets and expand your reach to new clients without worrying about local currency restrictions.

- Affordability: Payments made with Bitcoin are subject to fewer deductions than those implied by traditional payment systems and financial intermediaries.

- Security: Businesses can conceal their financial activities from competitors by receiving funds and investing using BTC wallets.

- Unity: Bitcoin prices are almost identical around the world. Some discrepancies happen due to natural market imperfections but are much tinier than fiat money exchange rates.

- Convenience: Businesses can facilitate transactions with BTC without requiring users to go through a staged verification process that banks impose.

Disadvantages of Bitcoin Payment

- Regulatory changes: The laws of transacting and storing Bitcoin differ around the world, which may hinder business activity in some locations.

- Market volatility: The crypto market fluctuates broadly, and Bitcoin’s value can change multiple times in one day, especially during market booms or declines.

- Speculative nature: Cryptocurrencies lack centralised control, which makes them speculative. Relying on market sentiment and trends to drive traders’ activities lowers trust in the DeFi space.

Bitcoin Regulatory Landscape

After more than a decade of existence, centralised authorities and entities started realising the importance of Bitcoin as a tradeable digital asset and a reliable means of payment.

Traditional banks and financial institutions started using Bitcoin as collateral to store capital. However, the lack of regulation and mismanagement led to the collapse of three US banks, Silvergate Bank, Silicon Valley Bank, Signature Bank, and First Republic Bank.

Afterwards, the US financial regulator, the SEC, saw the need to regulate digital asset management in the banking sector. Some of these reforms include detailed scrutiny of asset allocation and the type of funds used to store investors’ money.

Bitcoin spot ETF

A few months after the US banking crisis in 2023, leading investment firms, like BlackRock and Fidelity Investments, applied to the SEC to list Bitcoin spot ETFs on their dealing desks.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

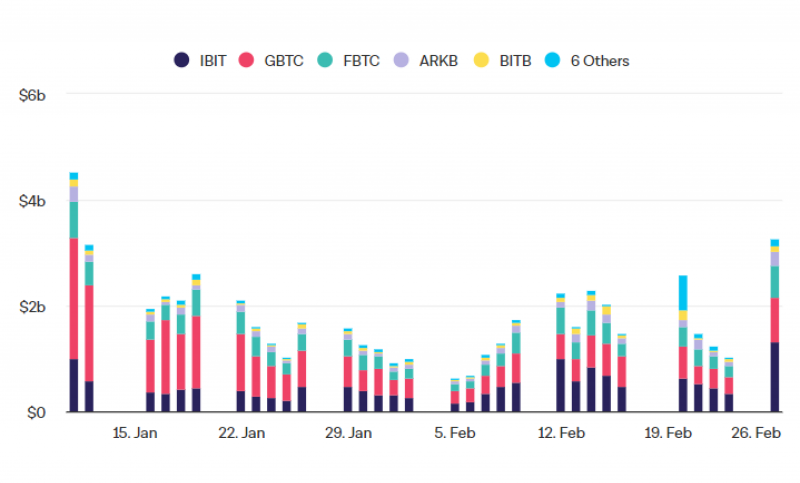

The SEC, after a long waiting period that lasted for more than six months, approved selling spot BTC ETFs at 11 Bitcoin ETF brokers, spurring investors’ demand for these financial instruments.

This announcement garnered massive attention from traditional traders and institutional investors, who ventured into these markets, driving significant demand and price surge to Bitcoin price today.

Bitcoin in Technology

With more developments poured into the decentralised economy and its components, such as blockchain, smart contracts, GameFi and cryptocurrencies, the range of decentralised applications reached different technological areas.

A whole set of non-monetary services and use cases harness Bitcoin blockchain technology. These can promote trust in the healthcare system, patents, ticketing, art, and digital creation, using the blockchain’s minting functionality to verify ownership.

Bitcoin Ordinals

The Bitcoin ordinal implies using the smallest storage space in the BTC coin to transfer data, such as texts, images or videos.

This feature is also called BTC NFTs because it performs the same functionality as NFTs in minting graphical content in the blockchain. However, Bitcoin ordinals (satoshis) have limited space, making them practical only for transferring textual or static visuals.

Artificial Bitcoin Intelligence

With the rising popularity and usage of artificial intelligence and its applications, artificial Bitcoin intelligence is rising on the horizon. This technology refers to efficiently building a crypto asset management system using AI.

Thus, non-tech-savvy businesses can build an entire decentralised infrastructure without writing codes. This development can promote finding the best Bitcoin investment opportunities, earning passive income with crypto or building a DeFi payment gateway using AI capabilities.

Conclusion

Transacting with Bitcoin opens a whole range of advantages. You can potentially expand your business, attract new customers, and simplify your asset management in a secure environment.

This digital currency is becoming more popular among centralised financial institutions and traditional investors, especially after the recent adoption of spot ETFs and network updates.

Finding and integrating a reputable transaction gateway provider allows you to enjoy the benefits of Bitcoin payments and overcome the hefty fees and procedures associated with classic banks’ transfers.

FAQ

What are some benefits of using Bitcoin as a method of payment?

Businesses accept BTC payments to facilitate fast transactions at lower costs and high security. Companies and online shops increasingly receive virtual coins to avoid chargebacks that most e-commerce stores face.

How do you accept Bitcoin as a business?

Find a reliable BTC payment gateway provider, register and receive your unique API credentials and integrate them into your website code. This addition allows users to pay with Bitcoin on your checkout page.

Is it wise to get paid in Bitcoin?

Yes. Businesses increasingly integrate Bitcoin processing technologies to expand their range of services and offer more flexibility in their payment methods.

Are Bitcoin payments safe?

Yes. With the increasing adoption rate among centralised institutions, transparent financial regulations and network updates, BTC transactions are becoming more safe and reliable.