7 Best White Label Trading Platforms for Your Business

With the reduced barriers to entry and significant technological advancements, traders, fintech firms, and financial institutions are shifting towards this industry. However, it is challenging for new businesses to build such platforms from zero.

That’s where White Label Trading Platforms come in. These platforms provide ready-made infrastructure that can be customized and scaled.

It is imperative for your business to identify the right white label supplier because this will not only dictate your time to market and your readiness for regulations, but it will ultimately affect your profitability and client retention.

This guide examines the top seven trading platforms with a white label offering for 2026, based on tech, scalability, customization, and service quality, helping you gain a better insight into which one will work for your vision.

Key Takeaways

- White label trading platforms let brokers launch fully functional, customizable trading systems quickly without heavy development costs.

- Choosing the right WL provider directly affects speed to market, regulatory readiness, performance quality, and long-term profitability.

- The top WL platforms for 2026, such as B2TRADER, cTrader, Match-Trader, Leverate, TradingView, Interactive Brokers, and Quadcode, differ in technology, scalability, asset support, and user experience.

- Successful brokerages should prioritize execution speed, multi-asset capabilities, compliance tools, integrations, and strong vendor support when selecting a white label solution.

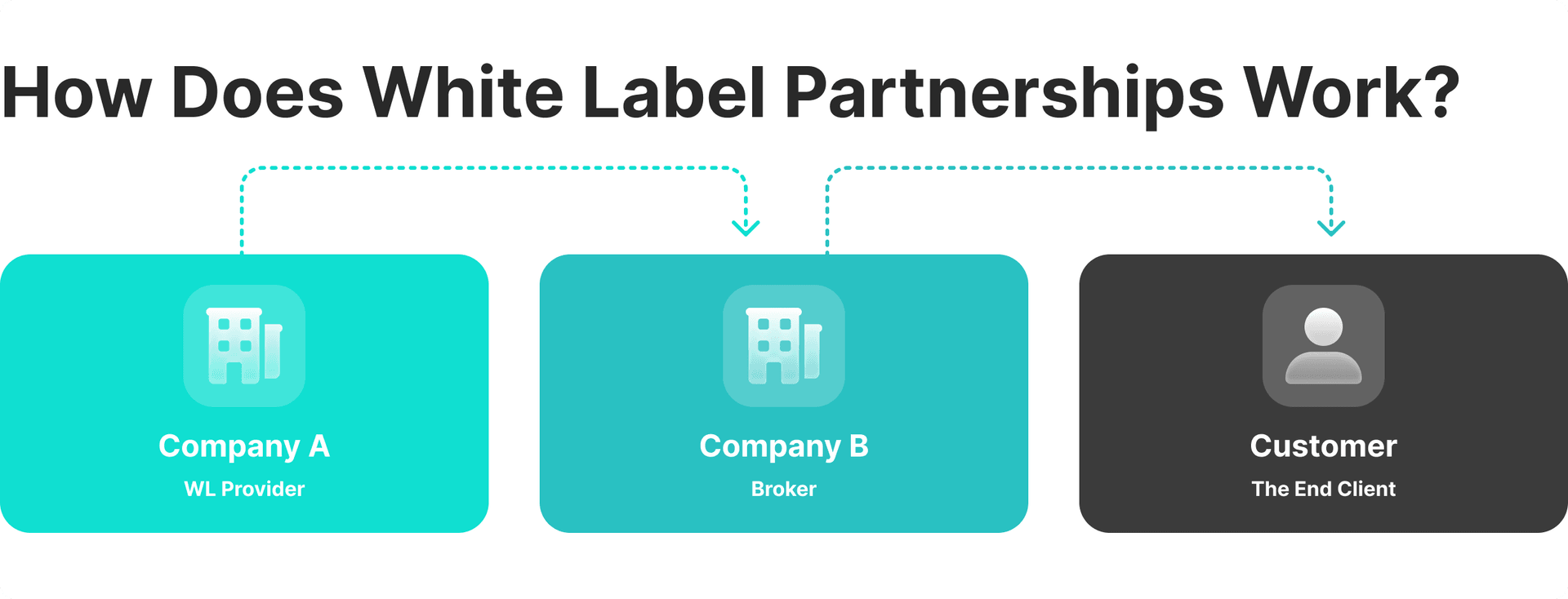

What Is a White Label Trading Platform?

A white label trading platform is a pre-built, customizable system that brokers can brand as their own. They usually come with built-in trading infrastructure required to operate a modern brokerage, including matching engines, risk management systems, liquidity bridges, CRM integrations, and compliance tools.

Unlike first-hand development, which demands heavy financial investment and years of engineering effort, white label (WL) solutions let startups deploy a fully fledged infrastructure within weeks.

WL platforms are easier to manage, since the provider handles hosting, updates, maintenance, and support, enabling brokers to focus on core business activities and client acquisition.

This approach transforms complex operational procedures into a plug-and-play model, helping firms deliver institutional-grade performance with minimal technical overhead.

Key Benefits of White Label Trading Platforms

The surge in white label adoption aligns with the rising needs for agile, scalable solutions that do not reinvent the wheel and enable firms to launch more effectively. Some of the key benefits of WL trading platforms include:

Faster Time to Market: White labels can be deployed within a few weeks instead of years, supporting faster revenue generation and product testing.

Cost Efficiency: WL providers handle maintenance, compliance, and servers, reducing in-house staff and IT expenses.

Scalability: Pre-built platforms enable brokers to expand globally or expand asset class offerings without major restructuring.

Regulatory Compliance: Continuous alignment to global standards and jurisdictional frameworks helps brokers remain compliant and operational.

Performance Stability: White label platforms are pre-tested, ensuring uptime, fast execution, and institutional reliability.

These features allow brokers to focus on what matters most—building relationships with traders, optimizing acquisition strategies, and deploying marketing campaigns without worrying about their technology backbone.

Top 7 White Label Trading Platforms

Choosing the right white label partner is critical for balancing performance, cost, flexibility, and compliance. B2TRADER, cTrader, Match-Trader, Leverate, TradingView, Interactive Brokers, and Quadcode are among the best WL platforms offering robust brokerage solutions in 2026. Selecting a suitable provider depends on your business target market, resources, and strategic goals.

1. B2TRADER

B2TRADER, developed by B2BROKER, is a trading platform designed to meet the advanced needs of brokers. It supports multi-asset, multi-market trading across Forex, CFDs, and crypto spot markets, with centralized account management to accommodate traders of different expertise levels.

The platform handles up to 3,000 financial instruments, providing brokers with extensive trading options. It has a remarkable matching engine that can process up to 3,000 requests per second with execution speeds starting from 1 millisecond, ensuring fast and reliable performance even during periods of high activity.

Key features

- Ultra-Fast Matching Engine: Execute thousands of transactions per second with sub-millisecond latency.

- Institutional Liquidity Integration: Seamlessly connect with B2BROKER’s multi-asset liquidity pools.

- Advanced Risk Management Tools: Automated exposure and margin controls for real-time monitoring.

- Compliance and Reporting Suite: Built-in KYC/AML modules, powerful fraud detection, and compliant transaction reporting.

- Full Branding Flexibility: Customize UI, trading pairs, and quotes seamlessly to fit your brand.

- API & Modular Design: Integrate with world-leading CRMs, payment gateways, and analytic tools from one dashboard.

- 24/7 Global Support: Utilize enterprise-grade assistance for optimized user experience and uninterrupted operations.

Power your Brokerage with Next-Gen Multi-Asset & Multi-Market Trading

Advanced Engine Processing 3,000 Requests Per Second

Supports FX, Crypto Spot, CFDs, Perpetual Futures, and More in One Platform

Scalable Architecture Built for High-Volume Trading

2. cTrader White Label

The WL cTrader platform stands out as one of the most advanced trading solutions available today. It caters to both novice and experienced Forex and cryptocurrency traders, offering cutting-edge tools and features specifically designed for ECN (Electronic Communication Network) accounts.

The platform has exceptionally fast order execution, supporting access to real-time market data and the best possible prices.

In cTrader, users can trade CFD contracts and Forex currencies both manually and through automated systems. The platform supports an ecosystem where users can share and exchange execution robots, discuss trading strategies, and integrate custom indicators.

Key features

- User-Centric Design: Modern interfaces that suit beginner and advanced traders.

- Algorithmic and Copy Trading: Supported cTrader Copy modules and built-in cAlgo for automated execution.

- Regulatory Tools: Simplified compliance through audit logs, reporting, and segregation features.

- Multi-Device Access: Smooth interoperability between desktop, web, and mobile interfaces with seamless synchronization.

- Liquidity and CRM Integration: Works flawlessly with B2BROKER’s liquidity infrastructure and B2CORE’s back office.

- Custom Branding: Full flexibility to adjust colors, logos, and themes according to business specifications.

Launch your cTrader with our White Label Solution

Save resources on hiring and add a ready-to-use trading platform to your brokerage instantly

3. Match-Trader

Match-Trader is a sophisticated trading platform developed by Match-Trade Technologies LLC, tailored to the needs of both institutional and retail clients in the Forex market.

This platform provides brokers, liquidity providers, and other market participants with a comprehensive, fully integrated solution that enables efficient, transparent trading within a decentralized ECN framework.

Key features

- Web and Mobile Trading: Download-free software with a responsive design across devices.

- Built-in CRM: Integrated client management system and KYC modules.

- Liquidity Bridge: Direct connection to top-tier liquidity pools and providers for best-price execution.

- Automation Tools: Custom rule configuration for autonomous execution and risk control.

4. Leverate LXSuite

Leverate’s LXSuite is a comprehensive WL trading platform that provides a complete, turnkey solution for new brokers. Known as a “brokerage-in-a-box”, LXSuite encompasses a broad range of features and tools that cover every aspect of brokerage operations, from trading to client management.

Leverate’s LXSuite is a popular choice for startups due to its all-in-one approach that simplifies the setup and management of a brokerage. By offering a complete package that includes CRM, risk management tools, and extensive trading functionality, LXSuite enables firms to focus on growing their businesses while relying on a robust, adaptable platform.

Key features

- LXFeed Liquidity Engine: Liquidity aggregation from multiple sources for optimal prices.

- SIRIX Platform: Supported social trading and customizable user interfaces.

- CRM Integration: Back office infrastructure to manage user activities and automate and retain leads.

- Regulatory Frameworks: Strong tools to simplify compliance with KYC, AML, and MiFID requirements.

5. TradingView White Label

TradingView WL is a highly customizable solution for brokers and financial institutions. This offering enables trading platforms and crypto exchanges to provide their clients access to TradingView’s renowned advanced charting and analysis tools, all under the broker’s branding.

By leveraging TradingView’s sophisticated technology, brokers can enhance their service offerings and deliver a premium trading experience without the need for extensive development resources.

Key features

- World-Class Charting: Supporting 100+ indicators, multiple chart types, and full customization.

- Social Trading Network: Built-in trading community and idea-sharing space for increasing engagement.

- API Integration: Connects seamlessly with brokers’ back-end systems and third-party service providers.

- Cross-Device Support: Works flawlessly on browsers and mobile apps.

6. Interactive Brokers White Label

Interactive Brokers is the reliable option for large financial institutions seeking extensive global reach. Its White Label offering gives traders access to over 135 markets globally and a variety of instruments for equities, futures, Forex, options, and bonds.

It is unique for its expertise in analytics, algorithm trading systems, and institutional infrastructure. It has robust regulatory credentials in several geographies, which makes it fully compliant.

Although the entrance barrier and terms of compliance are above average, Interactive Brokers has unparalleled global accessibility and reputation, which makes it a great choice for firms looking to cater to a wide variety of markets.

Key features

- Global Market Access: Supporting 135 markets across 36 countries and 28 currencies.

- Advanced Tools: Advanced algorithmic trading, portfolio analysis, and real-time risk tracking.

- Institutional Reporting: Detailed regulatory and client reporting modules that comply with global standards.

- Trusted Reputation: Decades of compliance and financial resilience.

7. Quadcode

Quadcode is a user experience–centred trading platform designed for retail-focused brokers. It features a sleek and user-friendly design coupled with interactive features that encourage traders to stick with the platform.

The platform facilitates rapid deployment and comes with modular and flexible packaging, allowing brokers to design packages that suit their business scale and objectives.

Quadcode is ideal for startups and growing brokerages looking to effectively retain high-volume traders due to its emphasis on accessibility and design.

Key features

- Intuitive Interface: Clean, educational, and mobile-optimized navigation and user experience.

- Multi-Asset Support: Accessible Forex, CFDs, and crypto assets from one platform.

- Gamified Education Tools: Supporting novice users with built-in tutorials and achievement tracking.

- Rapid Deployment: Easy to deploy infrastructure that can launch quickly with a modular setup.

Core Features to Look for in a White Label Trading Platform

A high-performing brokerage depends on more than branding—it needs robust tech, scalable systems, and seamless integrations. When evaluating platforms, prioritize execution speed, uptime reliability, API depth, and multi-device usability.

Traders are more likely to register if your platform supports professional order types, advanced charting tools, and risk management modules that ensure compliance and optimal execution practices. Similarly, multi-device compatibility helps clients stay loyal for longer.

Customization and Branding

Brand identity drives trust. A fully customizable platform enables forex and crypto brokers to tailor colors, dashboards, and workflows to their specific requirements. This flexibility sets brokerages apart from their clients and potential traders.

Without this freedom, firms will look similar to other platforms and blend into competitors, weakening loyalty and retention.

Multi-Asset Trading Support

The platform needs comprehensive coverage of different asset classes to cater to the diverse needs of traders—from Forex and stocks to commodities, indices, cryptocurrencies, and derivatives. This diversification is imperative because it allows brokers to attract and meet the needs of a wide array of traders with differing investment tastes.

Also, it is important for this platform to have seamless cross-asset trading capabilities. Such abilities will allow traders to conduct trades across various markets. Notably, this will improve client experiences because it will help multiple position managers change positions across different markets.

Whether launching or scaling a brokerage, choosing the right liquidity provider is essential. See why B2BROKER is a trusted leader in liquidity solutions.

28.05.25

Regulatory Compliance and Licensing

White-label solutions should have components like Know Your Customer, Anti-Money Laundering, and General Data Protection Regulation, to name a few. These components ensure that all regulations are complied with.

Also, it is important that this service is supplemented by jurisdiction-by-jurisdiction support because this will ensure it is compliant with all regulations in different regions.

For example, global brokers must respond to demands created by regulators such as the European Securities and Markets Authority in Europe and the Securities and Exchange Commission in America.

User Interface and Experience (UI/UX)

The WL trading platform must ensure an intuitive and user-friendly interface that accommodates the needs of novice and experienced traders. This includes easy-to-use navigation, convenient access to critical features, and the ability to adapt to mobile devices of all screen sizes seamlessly.

With the increasing trend of mobile traders, brokers must provide a smooth and efficient mobile trading experience. As such, all the features and tools available on the desktop should be easily accessible and fully functional on smartphones and tablets, ensuring a consistent experience.

Liquidity Solutions

Deep, Reliable Liquidity Across 10 Major Asset Classes

FX, Crypto, Commodities, Indices & More from One Single Margin Account

Tight Spreads and Ultra-Low Latency Execution

Seamless API Integration with Your Trading Platform

Dealers have to provide their customers with access to deep liquidity sources coming from multiple providers. This is essential in executing trades with the best market rates.

The system should incorporate risk management functionality with hedging, margin management, stop loss orders, and advanced risk management. Such capabilities will allow brokers to properly manage market exposure, ensuring a secure and stable market for traders.

CRM and Back-Office Integration

All-In-One CRM & Back Office for Brokers and Exchanges

Fully Customisable Trader’s Room with Modular Features

Built-In IB Module, KYC, Payment Integrations, and Reporting Tools

Intuitive Interface that Boosts Client Engagement

With such an efficient integration with CRM software, it will be easier for brokers to manage client engagement activities, facilitate client onboarding, and develop strategies for client retention.

This will enable brokers to obtain insightful information about behaviors and preferences on the part of clients. This will allow brokers to provide personal services and promotional activities. Also, brokers will be able to obtain beneficial analytical and reporting capabilities with CRM. These will assist brokers in deciding on business operations.

Integration Ecosystem and Vendor Reliability

Even the most sophisticated trading platform is only as effective as the ecosystem it connects to. As such, a robust integration network—linking liquidity bridges, CRMs, PSPs, KYC providers, and analytics tools creates a unified operational flow that keeps brokers agile and compliant.

Modern brokers require open APIs and modular architectures that allow seamless integration of new features, asset classes, or regional services without major redevelopment or downtime.

Moreover, the WL provider must ensure consistent uptime, transparent SLAs, and responsive 24/7 support. Before signing any agreement, brokers should evaluate a vendor’s historical uptime records, update cadence, and customer satisfaction metrics.

Multi-language and Multi-Currency Support

A global brokerage required flexibility across language and currency. As such, trading platforms should enable multi-language interfaces for traders and administrators alike, covering all major global markets.

Multi-currency functionality ensures smooth deposits, withdrawals, and account management across different fiat and digital currencies. Together, these capabilities empower brokers to expand internationally without friction or costly reconfiguration.

Advanced Trading Technology

Top-tier white label platforms are defined by their performance engines. High-speed order execution, low-latency data feeds, and multi-asset trading capabilities create a professional-grade trading experience.

Whether serving institutional or retail traders, advanced charting, real-time risk management, and algorithmic trading APIs enhance competitiveness.

Power your Brokerage with Next-Gen Multi-Asset & Multi-Market Trading

Advanced Engine Processing 3,000 Requests Per Second

Supports FX, Crypto Spot, CFDs, Perpetual Futures, and More in One Platform

Scalable Architecture Built for High-Volume Trading

How to Select the Right White Label Provider

Choosing the right white label provider affects every technical, operational, and financial dimension of your brokerage. This framework helps you evaluate candidates by combining market analysis, cost assessment, and hands-on due diligence.

Assess Your Target Market Needs

Every region and trader segment demands different trading conditions. Identify whether your audience is retail, professional, or institutional, then tailor your platform to their asset preferences, leverage limits, and regulatory requirements.

This assessment also determines regional payment systems, onboarding expectations, and local compliance rules, guiding platform configuration and entity establishment.

Compare Total Cost of Ownership

The real WL platform cost extends beyond the setup to licensing, liquidity, hosting, ongoing maintenance, and integration with CRMs or PSPs.

Evaluate both one-time and recurring expenses to estimate long-term profitability more accurately. A transparent cost structure lets you forecast scalability and ensures your business can expand without draining margins.

Evaluate Technical Support Quality

Client satisfaction and operational resilience are vital for business longevity and trust. Prioritize providers with multilingual, 24/7 technical assistance, dedicated account managers, and proactive monitoring.

Service Level Agreements should clearly define response times, escalation procedures, and system recovery benchmarks, while continuous support ensures uptime stability and trader confidence even under peak volatility.

Verify Regulatory Compliance Support

Compliance isn’t optional—it’s a differentiator. The right provider embeds KYC, AML, and other advanced reporting tools directly into the platform, easing the burden of regulatory oversight.

Ensure strong encryption, data integrity, and audit trails to protect against financial and reputational risks. Providers who regularly update compliance modules future-proof your brokerage against shifting global standards.

Test Platform Performance

Before launching your platform, test the performance, order execution speed, uptime reliability, mobile responsiveness, and compatibility with third-party systems through real-world trials.

Stress testing under high traffic and volatile markets ensures resilience and confirms that the platform meets institutional-grade performance standards.

Future Trends in White Label Trading Platforms

The white label market is growing, and more brokers are opting for this approach to own a proprietary trading platform while saving costs and deploying faster. As this trend continues to thrive, a few trends are emerging that can shape the industry’s future.

- Cloud-Based Infrastructure: Scalable, cost-efficient deployment with near-zero downtime.

- AI and Machine Learning: Predictive analytics, fraud detection, and smarter risk tools.

- Blockchain and DeFi Integration: Transparent settlement and tokenized asset support.

- Expansion of Multi-Asset Trading: Broader access to crypto, equities, and derivatives.

- Social and Copy Trading: Growing demand for community-driven trading ecosystems.

- Sustainability and ESG Focus: Increased emphasis on environmental, social, and governance responsibility and green investment options.

- Fintech Ecosystem Integration: Cross-platform data sharing and unified analytics.

- RegTech Automation: AI-driven compliance reporting and monitoring.

How Much Does a White Label Trading Platform Cost?

Costs vary widely based on functionality, scale, and customization. Entry-level setups start from $15,000–$50,000, while enterprise-grade platforms can exceed $100,000+. Factors influencing pricing include:

- Supported trading instruments and asset classes

- Liquidity streams and hosting fees

- CRM, KYC, and payment system integrations

- Level of customization and branding

- Technical support and SLA commitments

Therefore, you must weigh the total cost against expected trading volume, client retention potential, and long-term scalability to have a clearer picture of your brokerage cost.

Explore how much a white label crypto exchange really costs in 2026, including setup fees, compliance, and ongoing expenses for growing brokerages.

Transform Your Brokerage with Institutional-Grade Technology from B2BROKER

In an increasingly competitive trading landscape, selecting the right white label platform supports operational efficiency, global scalability, and compliance confidence.

B2BROKER offers end-to-end solutions tailored for brokerages of every size—from liquidity aggregation and risk management to PSP integrations, copy trading, and Back Office CRM.

Through B2TRADER, you can access institutional-grade performance, ultra-low latency, and a customizable ecosystem that evolves with market trends and grows with you.

Start your brokerage journey — launch your trading platform today to capture lucrative market opportunities.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

FAQs about White Label Trading Platforms

- What licenses do I need to operate a white label forex broker?

Licensing requirements vary by jurisdiction. Most brokers need a forex dealer or money transmitter authorization. Processing time and cost depend on local regulations and the business structure.

- How long does it take to launch a forex white label solution?

The typical launch timelines range from 2 to 8 weeks, depending on platform complexity, integrations, and required customizations.

- What is included in a standard white label forex agreement?

Most forex white label providers offer platform licensing, customization options, liquidity setup, payment gateways, technical support, and service-level terms. Additional features may vary in pricing and integration rights.

- Can white label platforms integrate with existing CRM systems?

Yes. Leading white label providers offer open APIs compatible with major CRMs, such as B2CORE, Salesforce, or HubSpot—usually implemented within one to two weeks.

- How much trading volume do I need to break even with a white label solution?

You may expect profits once your monthly trading volume reaches tens of millions, depending on spreads, fees, and operational efficiency.