Bitcoin Options Trading Launch Spurs Record Activity and All-Time Highs

On Tuesday, the crypto market reached an important turning point with the opening of options trading for the iShares Bitcoin Trust (IBIT). IBIT options saw 73,000 contracts on the Nasdaq in the first hour of trading, making it one of the most actively traded non-index options. In tandem with this event, Bitcoin hit a new all-time high of $97,531 (at the time of writing).

What Are Bitcoin Options and How Do They Work?

Bitcoin options are financial derivatives that allow investors to buy or sell the underlying Bitcoin ETF at a predetermined price, known as the strike price, within a specified time frame. This allows traders to bet on Bitcoin’s future price movements—whether they expect the price to rise or fall.

Options trading is particularly attractive for those looking to hedge against Bitcoin’s notorious volatility or to speculate on price movements without directly holding the asset.

The options market allows for more nuanced strategies than simply buying or selling Bitcoin. Investors can use options to manage risk by locking in prices for future trades, enhancing their ability to navigate Bitcoin’s volatile market. Additionally, options contracts can be used to express directional views on Bitcoin without the need to invest large sums of capital upfront.

Immediate Impact: Record-Setting Volume

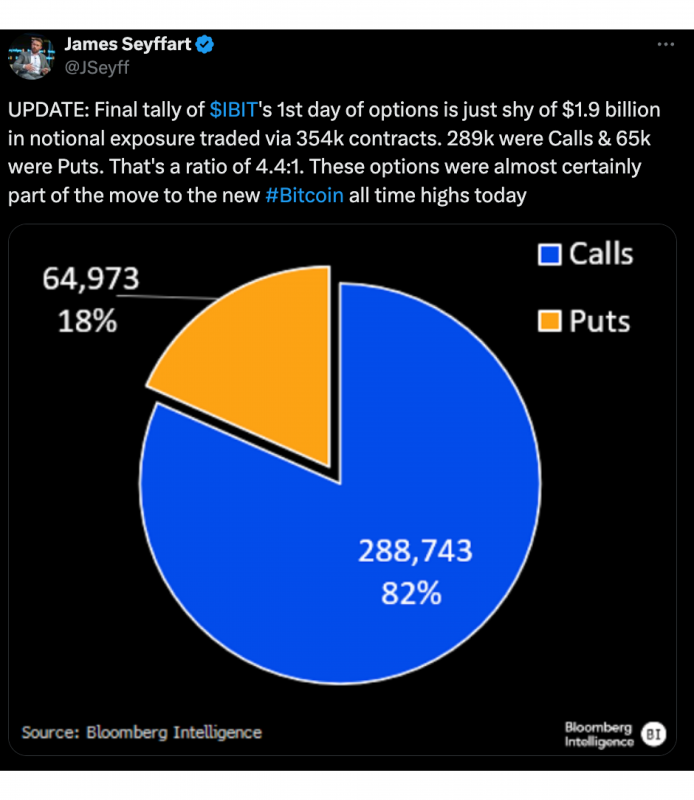

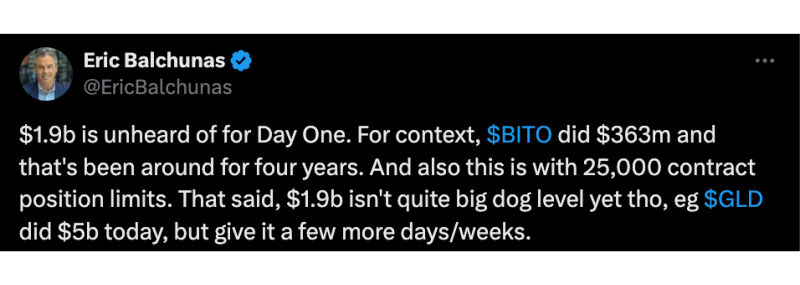

The debut of IBIT options on Nasdaq set a high bar for Bitcoin options trading. With 354,000 contracts traded on its first day, IBIT options’ notional exposure approached $1.9 billion. These had a call-to-put ratio 4.4:1, with almost 289,000 call options and 65,000 puts.

This massive volume quickly placed IBIT in the top 20 of the most active non-index options on the exchange. This highlights the immediate appeal of Bitcoin options for traders, signalling strong institutional and retail interest.

Explore Deeper Industry Insights

Learn from experts shaping the future of financial services — get the latest strategies and trends.

The launch also had a direct impact on Bitcoin’s price, pushing it to a new high. Bitcoin’s value has surged massively since the presidential election, fueled in part by investor optimism surrounding the new administration’s potential support for cryptocurrencies.

Institutional Involvement and the Role of Derivatives

While Bitcoin’s options market is still relatively small in comparison to more established asset classes, its growth has the potential to bolster investor confidence.

According to Noelle Acheson, an economist and author of the “Crypto is Macro Now” newsletter, the deeper onshore derivatives market will bring more institutional players into the fold.

This influx of capital will likely improve market sophistication, enabling investors to employ a broader range of strategies and potentially reducing volatility and downside risks.

The growing involvement of institutions also suggests that Bitcoin is gaining acceptance as a mainstream asset. Historically, Bitcoin has been largely relegated to retail investors and a few institutional players willing to take on significant risk.

However, the introduction of Bitcoin options presents a more regulated and familiar product for institutional investors. These players are accustomed to using derivatives in traditional markets, and options on Bitcoin ETFs could be an easier entry point for these institutions.

Final Thoughts

An important turning point has been reached with the introducing of options trading for BlackRock’s iShares Bitcoin Trust ETF.

The market is moving towards greater institutional involvement due to increased trading volumes and the growing demand for Bitcoin ETFs. This will eventually lead to increased liquidity and decreased volatility.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

The popularity of these options contracts and possible future offerings from other asset managers shows us how the crypto market is changing to support increasingly complex trading techniques.

Bitcoin’s position in the financial industry will likely be further cemented due to this surge in market activity, which is expected to draw even more investors.

Disclaimer: This article is for informational purposes only. It is not finance advice and should not be relied upon for investment decisions. Always do your own research and consult a financial advisor before investing.