Brokerage as a Service: (BaaS): Who Needs It?

Articles

Today, in the heyday of e-commerce, many participants in the financial system have begun to actively adapt to changing market conditions. This is particularly true for banking organizations, which play a pivotal role in the capital markets’ ecosystem by offering customers access to investment instruments.

With the development of fintech, entirely new forms of cooperation have emerged that can provide a solid foundation for achieving mutual goals to provide the best quality products and services. One such form of collaboration is Brokerage as a Service (BaaS), which offers a convenient way to invest in different instruments within the banking system.

This article will explain BaaS solutions, their benefits, and where they are used.

Key Takeaways

- BaaS solutions are a way for a company to offer access to trading financial instruments on the capital markets without being a broker.

- The BaaS model offers benefits such as rapid scalability, easy integration, and multi-functional solutions that have as part of it.

What is a BaaS (Brokerage as a Service) Solutions?

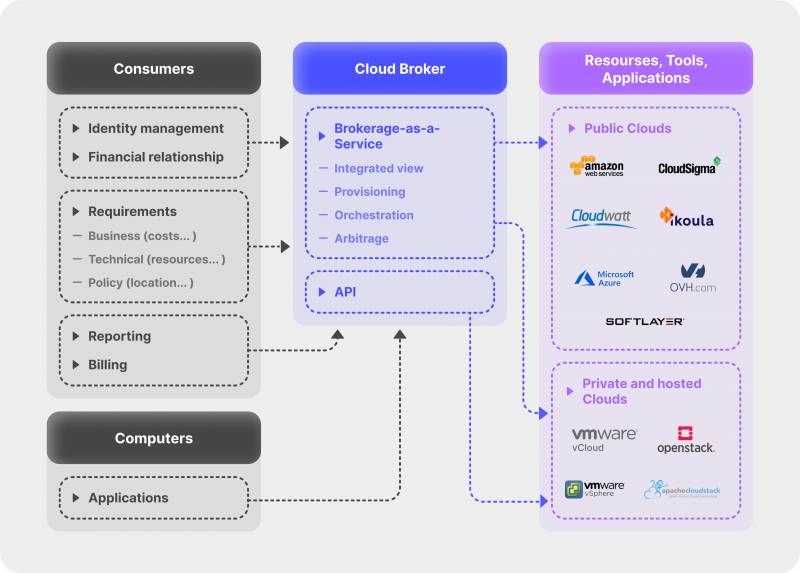

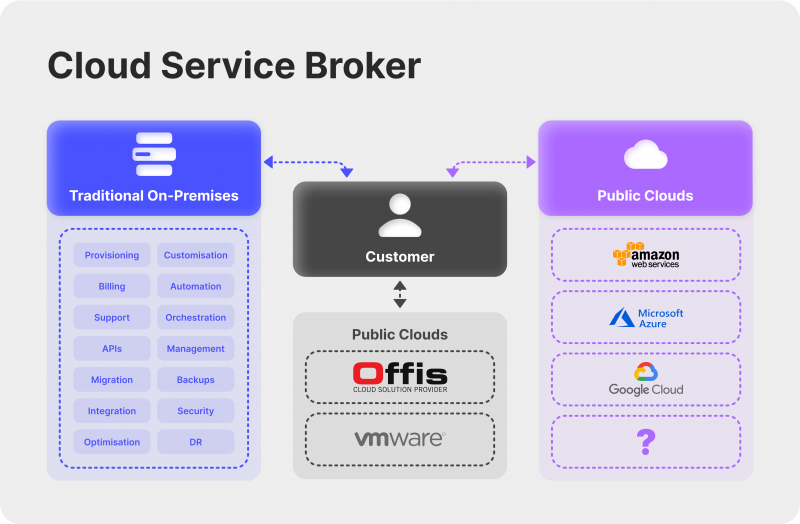

Brokerage as a Service or BaaS is a group of innovative professional white label solutions based on fintech partnerships with banking sector organizations and designed to integrate systems and essential tools providing access to trading on financial markets, mainly for retail investors. Within the framework of such cooperation, all necessary IT and brokerage financial infrastructure is connected to the bank’s infrastructure, allowing it to use client portals and connect its internal modules to external ones via API. This helps leverage the benefits of cloud computing combined with fintech company capabilities to provide the best possible customer experience when interacting with banking products.

The group of BaaS solutions contains a full range of necessary brokerage back office software that allows to easily, quickly and efficiently work with different modules related to market analysis indicators, monitoring clients’ trading activity, their portfolios, and a number of other important metrics in real time. These solutions also include a web portal and trading terminal, various API integrations, reporting systems and much more, allowing for a strong connection between banking systems, financial markets and clients. As a result, this allows the range of solutions offered by the bank to be significantly expanded, which not only benefits the bank’s operations, but also helps clients to use brokerage products while working with the banking services.

BaaS model is a new form of cooperation between fintech companies and companies offering services in other areas.

What Are the Advantages of BaaS?

BaaS White-Label solution is a helping hand for the bank network in today’s dynamic and constantly changing conditions, not only in the market environment but also in the technological equipment based on the development of innovative financial products. Digital brokerage services are becoming integral to bank fintech partnerships, enabling mutual benefits through the following advantages.

Easy Integration

BaaS platforms White-Label give the freedom to use brokerage services and functions using simple and easy integration with any of the existing banking information architectures, which allows one to start using brokerage WL systems within banking services quickly. This advantage is an important component of these solutions as it provides high speed and, consequently, high performance in interacting with financial markets.

Integration can be carried out using any existing ways of connecting external and internal modules and systems of one infrastructure to another. As a rule, API protocol is used today as the most popular way of integration.

Fast Scalability

BaaS White Label solutions are mostly highly scalable, which means that they are able to easily and quickly adapt to a possible expansion of requirements and an increase in the volume of tasks to be solved within the brokerage ecosystem. This allows you to increase the efficiency of the solutions used, as well as use third-party services to further expand the range of offered brokerage products for trading in the financial markets.

Multifunctionality

BaaS solutions provide an opportunity to use in practice the full potential of brokerage instruments within the framework of traditional brokerage sponsorship with a financial institution such as a bank. Such tools include full brokerage infrastructure with plug-in terminals, analytical platforms, systems for monitoring and analyzing investment portfolio, collection of trading analytics, and much more. Thanks to this advantage, it is possible to significantly expand the client base by offering a wide range of useful functions and systems as part of BaaS solutions.

Where BaaS Solutions Are Applied?

Thanks to the emergence of cryptocurrency technologies, the already high popularity of electronic trading in other financial markets, especially Forex, has become even greater, spurring the creation and promotion of various services that provide fruitful cooperation.

BaaS solutions have not become an exception and are actively used in practice in some areas of the financial world. Let’s consider a few of them.

Banks

Today, many banks, both freshly established and leading banks, are trying to cooperate with the best fintech companies in order to be able to use in practice modern, innovative and multifunctional solutions, including the brokerage format, and to provide access to superior brokerage services on the financial markets. Due to the fact that any solution within the brokerage white label model gives the freedom to use brokerage products and services that have a high popularity, banks are interested in offering among their products the possibility to work with financial markets, which is especially profitable if the bank is large and has a solid client base.

Hedge Funds

Today hedge funds are a large group of financial institutions whose role in the financial markets is as great as liquidity providers ensuring the stability of the markets and, as a consequence, the trading process. With a wide range of financial services for hedging risks, they work directly with investors and traders, helping them to effectively utilize their investment strategy.

Among other things, in the practice of such funds there are also activities aimed at providing WL solutions, among which BaaS are not the least popular and enjoy great popularity as part of the package of risk and money management services.

Investment Companies

Investment companies today are serious players in the financial markets, offering their clients, among whom the majority are retail investors, a wide range of services related to collective investment, its diversification, investment portfolio management, market analytics, while providing full support within the framework of using a set of solutions BaaS, which are also provided as part of packages of other services that are in great demand among individual and institutional investors with high requirements for the efficiency of the trading process.

Trading Exchanges

This group of financial organizations using BaaS brokerage solutions based on the White Label model consists mainly of stock exchanges and other trading exchanges providing access to financial markets and trading in various investment instruments. Having at their disposal a large list of markets where it is possible to trade, many exchanges develop their complex BaaS solutions to ensure the possibility of their integration into the systems of other organizations, thus providing more convenient and faster access to the necessary market without the need to use software from other companies and services offering similar systems for working with financial markets.

Conclusion

Thanks to BaaS providers, BaaS solutions, representing a multifunctional system of necessary tools for comfortable work with financial markets and trading of investment assets, have a high potential for wide distribution and application in different sectors of the financial system, offering a universal way for cooperation between different types of economic institutions and fintech companies, paving the way for the era of a new technological ideology in financial industry.