Different Types of Liquidity Ratios: What Do They Tell Us?

Liquidity is a prerequisite for trouble-free business functioning, as it assures that a firm can fulfil its short-dated financial responsibilities without hindrance. Liquidity ratios serve as a yardstick to gauge a company’s ability to settle its floating charges promptly.

These metrics give insights into how efficiently a company can liquidate its assets to settle its debts. A high liquidity ratio conveys a more vital ability to manage debts and prevent payment delays. A business can safeguard its financial solidity and good standing in the market by maintaining a healthy liquidity position.

This article will explain the liquidity ratios and what types of them exist, and at the end, an example of calculating one of them will be given to demonstrate the conditions of their practical use.

Key Takeaways

- Liquidity ratio is a metric used as part of a financial examination of a company’s performance to determine its economic potential given its debt obligations.

- There are many liquidity metrics, including acid test, current and cash ratios.

What Do Liquidity Ratios Stand for?

A liquidity ratio is a statistical metric used to evaluate a company’s capacity to transform assets into cash to fulfil short-dated liabilities. This ratio is crucial in determining a company’s short-dated financial sustainability and aptitude to address immediate financial hurdles without causing disruptions or financial difficulties.

Liquidity metrics also play a significant role in economic analysis, offering essential insights to investors and creditors about a company’s capability to handle its fiscal responsibilities effectively.

When it comes to analysing liquidity ratios, they are most beneficial when used comparatively. This comparison can be either internal or external in nature.

Internal analysis of liquidity indicators involves examining data from multiple accounting periods prepared using the same accounting principles.

By comparing past periods with current financial performance, analysts can monitor changes within the organisation. Generally, a high liquidity ratio implies that a firm has better liquidity and is in a stronger position to cover its outstanding debts.

On the other hand, external analysis entails comparing a company’s liquidity ratios with those of other companies within the same segment or niche. This type of analysis helps evaluate the company’s competitive standing and set benchmark targets.

Conversely, the analysis of liquidity ratios might prove to be less efficient when evaluating companies from different sectors, as each sector may have distinct financing needs. In the same way, comparing how much money a business has in its bank account compared to other businesses in different places may not give enough useful information.

In contrast to liquidity ratios, solvency ones take into account a company’s capacity to fulfil its long-term debts and overall pecuniary obligation. Solvency pertains to the company’s willingness to comply with debt payments and sustain its operations, whereas liquidity primarily examines its current or short-dated financial accounts.

Liquidity Ratios and Financial Examination

All liquidity ratio types are important tools in the process of evaluating the micro and macroeconomic performance of any company, and their importance is due to the following provisions:

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

1. Evaluation of Short-Term Solvency

Liquidity metrics provide a transparent view of a firm’s capacity to fulfil its immediate financial responsibilities. Lenders, vendors, and shareholders rely on these metrics to assess whether a company possesses adequate liquid resources to settle its debts in a timely manner. A robust liquidity stance guarantees that a company can manage its routine financial commitments in lieu of encountering fiscal turmoil.

2. Financial Condition Assessment

Liquidity metrics are imperative financial assessment tools that help in evaluating a company’s overall financial performance. These ratios are used to evaluate a company’s ability to manage its cash flow, accurately utilise its assets, and mitigate financial risks.

Organisations that maintain a robust liquidity position are commonly regarded as financially stable and less vulnerable to financial uncertainties. In conclusion, liquidity ratios provide valuable insights into a company’s financial standing and can aid investors and analysts in making informed decisions.

3. Operational Performance Overview

Liquidity ratios can gauge the efficiency of a company’s operations. Overflowing inventory or slow-moving invoices may be indicated by low liquidity ratios, whereas high ratios may suggest underutilised assets. Businesses can pinpoint areas for enhancement in their operations and capital flow management by comprehending liquidity ratios.

4. Prior Alerting System

Monitoring liquidity ratios is crucial for businesses to predict potential financial challenges. A sudden drop in these ratios may signal problems with cash flow or even a looming liquidity crisis, necessitating management to take appropriate actions to mitigate the situation quickly and prevent it from worsening.

By keeping an eye on liquidity ratios, businesses are able to make sure they have enough cash reserves to meet their fiscal obligations and keep their economy stable over the long term.

5. Investment Solution Taking

When it comes to making investment arrangements, liquidity ratios play a particularly important role. These metrics help investors determine a company’s capacity to generate cash and manage its financial duties effectively.

In addition, creditors utilise liquidity ratios to evaluate credit risk when providing loans or credit terms to a company. Consequently, these ratios are vital to gaining insight into a company’s financial stability and health, assisting stakeholders in making deliberate decisions.

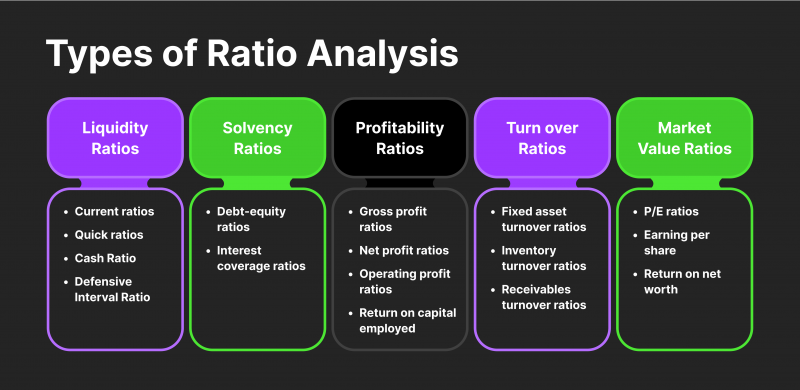

Different Kinds of Liquidity Ratios

Today’s practice is to assess the ability of a firm to turn assets (assets liquidity) into down money to fulfil short-range liabilities using a number of ratios, each of which involves using different indicators and variables to determine the degree of liquidity of funds. Here are the main liquidity ratio examples:

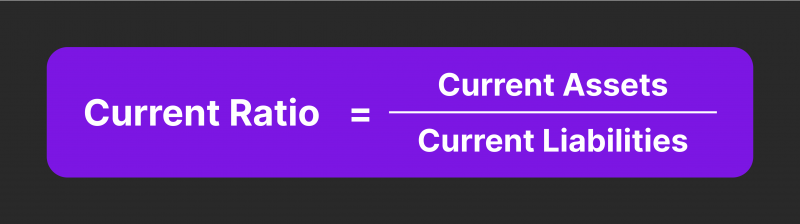

Current Ratio

The current ratio is a financial metric comparing a company’s assets to its current encumbrances. Current (or floating) assets encompass cash, issuable securities, debit indebtedness, and inventories, while current liabilities include all short-dated obligations that must be settled within a year or less.

Multiplying the current ratio by 100 can be expressed as a percentage. This percentage reflects the company’s capability to pay for its current liabilities using its current assets. A higher current ratio suggests that the firm has more resources and a stronger liquidity position.

If the current ratio exceeds 100%, the company possesses more current assets than it owes in current unsecured debts. This is typically considered a favourable scenario for a financially sound company.

Contrarily, if the current ratio falls below 100%, the company may struggle to repay its current loans with its existing assets. However, this situation should only cause immediate concern if it becomes a recurring pattern.

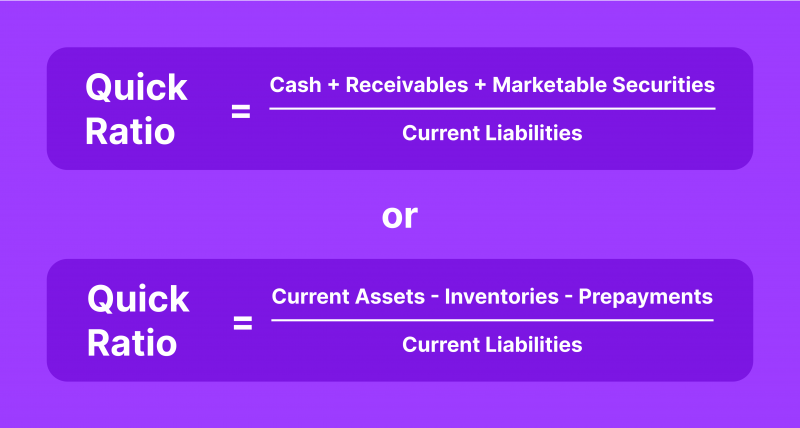

Acid Test Ratio (Quick Ratio)

The quick ratio is a financial benchmark that evaluates a company’s quality to carry out its short-dated liabilities using liquid assets, excluding inventories. It shares the same variables as the current ratio but without considering inventories in the calculation. The formula for the quick ratio is as follows:

Bonds that are easily sold are factored into the quick ratio computation, as they are considered registrable instruments. These instruments are highly liquid and can be readily turned into cash in a short period of time. By incorporating issuable securities into the quick ratio, a more precise evaluation of a company’s capacity to carry out its first debenture is obtained.

The quick ratio is an essential indicator of a company’s financial viability. It measures how much a company can rely on its liquid capital, excluding inventories, to keep up with its short-dated funding commitments.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

A higher quick ratio suggests that a firm has a more vital capability to pay off its debts and other liabilities without being dependent on the sale of inventories. This ratio is beneficial for assessing a company’s liquidity position and its capacity to deal with unexpected financial challenges.

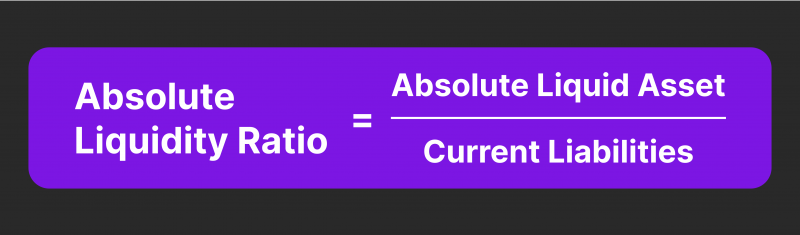

Absolute Liquidity Ratio (Cash Ratio)

The absolute ratio, or the liquidity cash metric, excludes accounts invoices and inventories when calculating the liquidity position. This liquidity ratio formula looks as follows:

By focusing solely on the most liquid funds, this ratio provides a more detailed analysis of the company’s willingness to adhere to its current engagements.

These liquid funds are readily available to the company, allowing for prompt payment of unexpected higher amounts when necessary. This aspect serves as a valuable advantage in managing short-dated fiscal commitments.

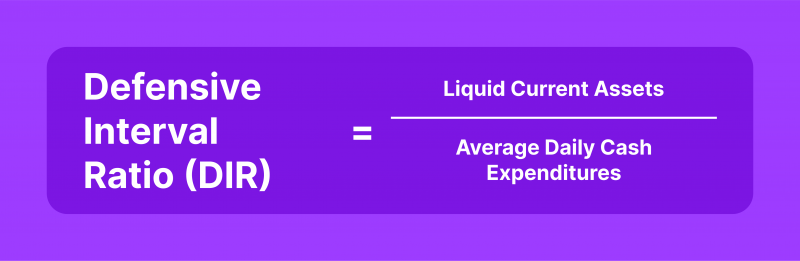

Defensive Interval Ratio

The defensive interval ratio (DIR), also known as the defensive interval period (DIP) or basic defence interval (BDI), is a financial measure that quantifies the number of days a company can sustain its operations without drawing on noncurrent capital or third-party financial resources. This metric considers long-term assets that cannot be fully realised within the current fiscal year.

Verdict

Liquidity ratios are an indispensable tool for the financial evaluation of different economic indicators of a firm. They help to accurately determine the state of the organisation’s economy and identify problem areas affecting business processes and the overall efficiency of its operation.