How Do You Start a White-Label Crypto Exchange?

White-label practices have spread across the digital landscape like wildfire, encompassing most of the global commerce and giving newcomer businesses a tangible way to enter the market. From eCommerce and software solutions to digital trading and numerous other fields, the white-label approach allows smaller companies to avoid technical complexities and focus on creating an effective business workflow.

White-label solutions are not as customisable as bespoke options, but they make up for their constraints with efficiency, affordability and growing flexibility. In 2025, the gap between in-house and white-label software has never been smaller, with numerous improvements in customisation options being added to the mix.

The white-label technique has reached the crypto exchange market, allowing small companies to level the playing field. But are the WL solutions worth it? And if yes, what does it take to set them up? Let’s discuss.

Key Takeaways

- White-label crypto exchanges have gained massive popularity due to their affordability and a good balance of features.

- White-label exchanges save time and money without sacrificing essential exchange features and premier technical performance.

- To start a WL crypto exchange, selecting a reliable and feature-rich WL provider is critical.

- Other considerations include the initial setup, security protocols, licensing and complementary systems.

Download the free PDF guide covering the key decisions, common mistakes, and real costs of starting a crypto exchange.

Why Has Crypto Exchange White-Label Become So Popular?

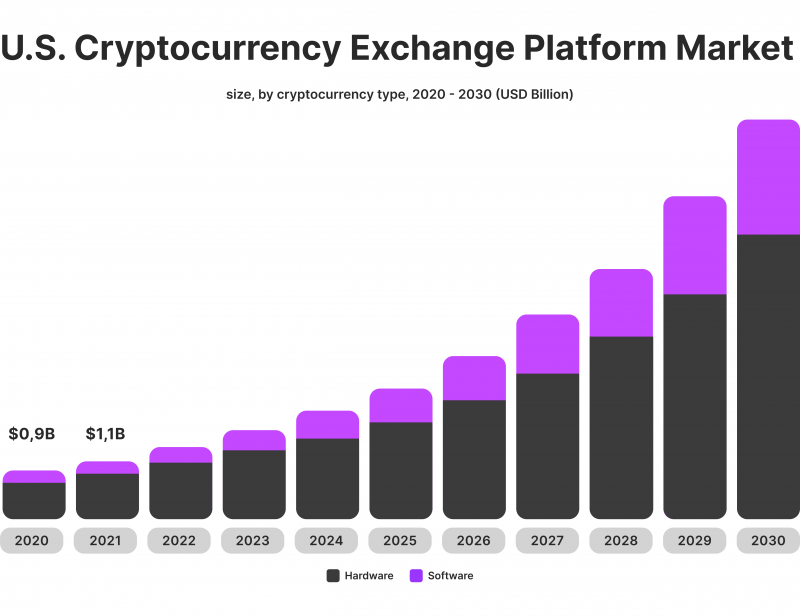

White-label crypto exchange software has made the rounds in the crypto landscape. There are 600 registered crypto exchange companies in the world, underscoring a 50% growth rate over the past year’s number of 400. This unusually high growth trend is caused by simplifying crypto exchange development with the white-label crypto exchange software.

In the current climate, crypto exchange startups no longer have to undergo an arduous and resource-intensive development process. While it might seem that software development is just a small step in the overall business flow, it implies the presence of many expenses, including programmer salaries, extra hardware and software required for development and indirect costs like bigger office rentals.

White-label crypto exchange development has created a new niche in the blockchain landscape – mid-sized crypto exchanges that couldn’t exist before. Even a couple of years ago, starting a trading platform was only feasible with massive budgets, substantial investor backing and access to extensive human resources. With white-label, the cost to start a crypto exchange is just a fraction of that, considerably lowering the entry barriers.

Crypto exchange platforms are the most promising business ideas in the current blockchain environment. The ongoing bull runs and the emergence of value-driven projects have convinced millions of crypto investors to re-invest in digital currencies, raising the demand for affordable, efficient and trustworthy exchange platforms.

White-Label vs In-House Solutions

While the general concept of white-label is quite simple, most crypto enthusiasts and business owners are still dubious about its practical implications. Most investors and companies still believe that white-label crypto trading platforms will not give them enough flexibility to satisfy their target audience. After all, how can cookie-cutter software stack up against a completely bespoke and customisable in-house solution? The answer to this question is, surprisingly, far from being one-sided.

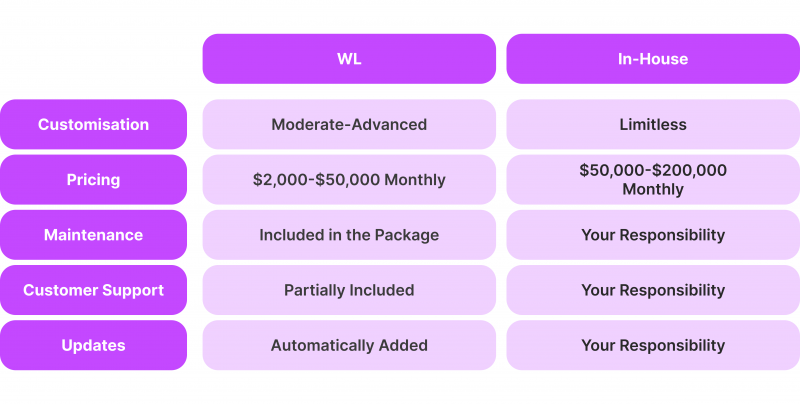

Costs and Capital Expenditures

First and foremost, let’s underscore the price difference between the two approaches. Suppose you have decided to construct a crypto exchange from scratch. The respective expenses will include the hiring process for engineers, IT specialists, testers and security specialists. Each of these employees will require monthly salaries and a place to work.

Then, you will need to purchase computers and various software tools, buy servers, and obtain access to data centres. There are numerous other miscellaneous costs involved in this process. In its entirety, the development will go on for at least 6-8 months in the most optimistic scenario. As a result, in-house development will cost you anywhere from $150,000 to $500,000, not including other business-related costs.

On the other hand, the basic white-label package costs anywhere from $2,000 to $10,000 per month, including essential security features, trading tools, and order execution capabilities. More advanced versions might cost anywhere from $25,000 to $50,000. On average, you will be able to save up to $100,000 on crypto development expenses during your initial launch period.

Customisation and Features

The customisation and flexibility factor is arguably the biggest detractor from white-label crypto exchanges. As mentioned, most business owners believe that white-label solutions can’t provide the depth and variety of features required to stand out on the global market.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

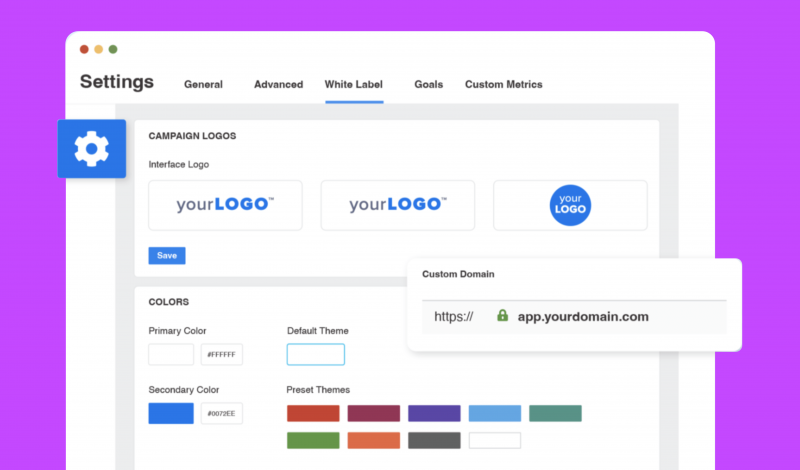

In reality, WL solutions have come a long way from presenting surface-level features and tools. In the current landscape, WL crypto exchange software allows companies to customise the front end completely and create their own unique design.

Secondly, most WL solutions feature robust security features, efficient payment processing systems and fast execution capabilities. Premier WL providers also offer advanced trading strategies like copy, algorithmic, and margin trading. Moreover, WL solutions have live price charting capabilities, allowing users to track their favourite coins and analyse their trends.

Finally, WL software solutions feature API integration options, letting businesses connect their platform to liquidity channels, implement effective payment processing systems and power up their capabilities in various ways.

In 2025, white-label services will showcase strong benchmarks against in-house solutions. Platforms like Wix, Shopify, and Salesforce have achieved a customisation level above mid-sized in-house software.

Platform Support

Supporting a crypto trading platform is an easy win for white-label solutions, as the WL providers handle most of the technical challenges in this case. Conversely, in-house solutions will require you to set up a dedicated platform maintenance team that fixes bugs, takes care of the servers and handles other routine maintenance duties.

Then, there are platform updates and the necessity of staging environments even for smaller improvements in the front and back end. All in all, maintaining your custom platform will cost you at least $20,000 each month, including staff salaries and all necessary tools. With WL software, all maintenance duties are included in the monthly subscription fee, costing you no additional fees.

Updates and Improvements

The crypto trading market is evolving rapidly, introducing new trading mechanisms, updating established strategies and exploring new investment tools. With Bitcoin ETFs hitting the market and social trading gaining traction, all established exchanges had to add these options to their existing platforms. As a result, each year produces new and essential upgrades for crypto trading.

So, updating your crypto exchange platform is essential to satisfy your target market. Naturally, if you build an in-house solution, all the platform upgrades must be conducted by your staff, leaving you no choice but to hire a full department of IT specialists and engineers. With white-label exchanges, all relevant upgrades can be provided by WL service contractors, absolving you of responsibility.

How to Start a White-Label Crypto Exchange

Now that we have provided an in-depth analysis of white-label’s distinctive features and benefits in crypto, it’s time to go over a summarised setup process. While the WL software does most of the job for you, there are several important steps you need to take to ensure a proper launch of your white-label crypto exchange business. Let’s discuss.

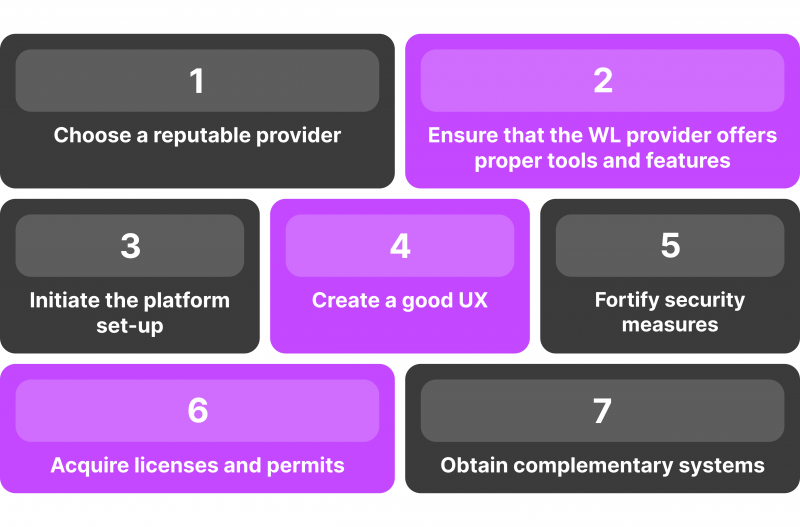

Select a Proper Provider

Choosing the right white-label crypto exchange development company is not easy, requiring extensive research and due diligence. Here are the critical aspects you should consider when looking at a prospective WL provider.

Firstly, define your target audience and the features crucial for their needs. Will they require basic spot trading or advanced functionalities like margin trading? Matching your platform’s offerings to user demand is essential.

Next, prioritise security. Ensure the provider has a strong track record, implements robust security measures like multi-signature wallets and cold storage, and undergoes regular security audits. Your users’ funds deserve top-notch protection. Otherwise, you risk losing your customer base due to potential security breaches.

Transparency in pricing is crucial. Get detailed quotes outlining the monthly cost, setup fees (if applicable), and any transaction fees associated with the platform. Understanding the full cost picture avoids surprises down the line. Finally, research the provider’s reputation and customer support. Look for established companies with a proven record of reliability and responsive customer service to ensure ongoing support for your platform.

Initiate the Setup Process

Once the rigorous and detailed selection process is finalised, it’s time to set up your white-label platform. Launching your white-label crypto exchange involves crucial steps after acquiring the software. First, configure the platform for your brand. This includes customising the user interface and integrating your logos and branding elements.

Next, you should focus on user experience. To make your exchange user-friendly and trustworthy, ensure smooth registration processes, clear tutorials, and reliable customer support. Remember that creating a smooth user experience is not just about user interface design or functionality. Instead, it is a combination of best practices that you can get right if you analyse the client’s behaviour.

Next, it is critical to set up your tech stack comfortably. The biggest challenge here is to connect your WL software with the rest of your IT infrastructure smoothly. This includes CRM solutions, reporting software and any other relevant systems your business will employ to function properly. In most cases, WL providers build software that can easily connect to existing systems. However, checking the compatibility before committing to a specific WL subscription is still advisable.

Set up Security Protocols

Implementing up-to-date security measures is essential for a crypto exchange. Since users trust you with their hard-earned funds, even a small security breach can motivate them to switch to a different platform and permanently lose trust in your capabilities.

To ensure maximum security, you can go both ways. The first option is to search for a WL provider that takes care of security considerations and supplies you with two-factor authentication, KYC, AML, encryption, and firewall solutions. It is also crucial to ensure that your WL provider will regularly upgrade your security stack, employing safeguards against new hacking practices emerging in the market.

If you decide to acquire a cheap white-label crypto exchange, the second option is to obtain security measures and integrate them into the white-label solution. This process will be much more complex and demanding on your part, forcing you to conduct comprehensive research and purchase each solution separately.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

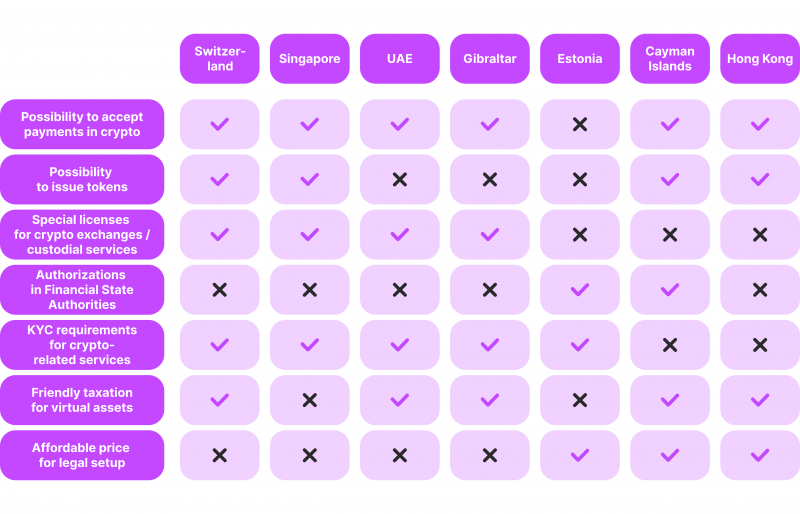

Take Care of the Licensing and Permits

Finally, any crypto exchange requires acquiring relevant licenses and permits, including an operating license and the right to store digital assets. Navigating the regulatory crypto field is challenging due to its frequently shifting nature. The new laws and legislations are being introduced rapidly, making it difficult to keep up without a sound legal understanding of regulations.

So, to streamline your licensing process, it is prudent to seek legal counsel proficient in the crypto market laws. As a result, you will have a much easier time and more success obtaining the licenses you require for operations. Premier WL providers might include legal counsel in the cost of starting a crypto exchange, providing you with licensing assistance and simplifying your path toward full compliance.

Optional: Select a WL Provider with a Feature-Rich Ecosystem

Aside from the standard white-label services, there are specific WL providers that could help you beyond setting up a crypto exchange platform. Instead, these WL service partners can equip you with a comprehensive suite of solutions that includes liquidity channels, payment processing APIs, CRM suites, advanced trading mechanisms and multi-asset class support.

B2BROKER is one such provider, offering white-label services that can be seamlessly integrated with the group’s other offerings. Such an approach can help you minimise the technical complexity around the entire business, not just with the platform setup. While the price for such a comprehensive service might be slightly higher, making your own crypto exchange with professional support is much more affordable.

Companies like B2BROKER will help you avoid newcomer mistakes and assist you in moving away from technical difficulties. As a result, operating a crypto exchange will become much smoother and more growth-oriented for you.

Final Thoughts – How to Start a Crypto Exchange the Right Way

White-label crypto exchange software development is responsible for creating a new niche of mid-sized exchanges in the blockchain field. As a startup, you can’t afford to neglect this opportunity, as it can drastically reduce the overall complexity in the initial stages of your business operations.

The selection of possible WL providers is extensive and feature-rich, balancing functionality and affordability. So, if you are looking for an efficient gateway into the cryptocurrency trading landscape, White-label solutions are the way to go!

FAQ

What is the White-Label Crypto Exchange cost?

The expenses associated with a white-label crypto exchange solution can vary depending on the extent of the provided features, the quality of services, technical capabilities, and other factors. You can pay as low as $2,000 and as high as $100,000 for white-label crypto exchange services.

How do you select the best white-label crypto exchange?

There are no objective leaders in this category, with each WL provider delivering unique solutions and advantages. Choosing the right option depends on your needs and budgetary capabilities.

Is the new crypto exchange launch difficult?

While certainly not as challenging as in-house development, a white-label crypto exchange platform requires at least six weeks of meticulous preparation, setups, license approvals, business planning and execution. The difficulty will vary depending on your business decision-making capabilities and financial backing.