Guide to Build Your Own Crypto Exchange with Turnkey Solutions

Articles

The crypto market has been through several rough patches in the recent decade. The global hype of crypto was often met with equally crushing bear markets that offset the industry’s advancements. However, the 2023 and 2024 periods have proven that crypto is finally maturing into a less volatile and hype-driven sector that strives to create value.

Numerous new projects emphasise utility and creativity, contributing to a robust industry-wide growth projection. With this sustainable growth trend, developing a cryptocurrency exchange platform has become one of the premier business ideas. In this article, you will learn how to build your own crypto exchange and why you should opt for a turnkey solution.

Key Takeaways

- Crypto exchange businesses have become globally popular thanks to the crypto’s steady growth pace in 2023-2024.

- Turnkey solutions can significantly reduce the costs and time-to-market for small and mid-sized crypto exchange businesses.

- Developing a WL crypto exchange requires finding a reputable WL provider, determining your unique niche, adding liquidity sources and establishing a distinctive brand.

Reasons to Create a Cryptocurrency Exchange in 2024

Despite the massive downturn of 2022, the crypto market has been on a steady uptrend in the last two years. According to Binance, the total market capitalisation of cryptocurrencies has once again cleared the $2 trillion mark without a significant bull run to pad the numbers. This development showcases the signs of sustainable growth devoid of empty hype or market manipulation.

As a result, crypto exchanges are thriving in the current climate. With crypto transactions rising in frequency every month, exchanges have reliably increased their bottom lines through commission charges and complementary trading services.

However, the crypto exchange market doesn’t just accommodate large players with massive capital. Small and mid-sized businesses can swiftly enter this market and generate healthy profit margins using turnkey solutions.

Why You Should Consider a Crypto Exchange Turnkey

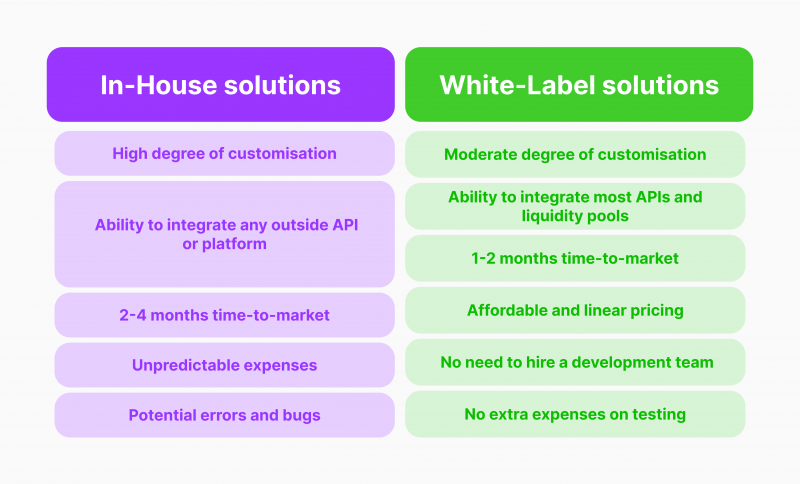

While crypto exchange platform development is possible in-house, this process is inevitably linked with numerous complications and technical challenges. A seemingly routine software development might lead to missed deadlines, bugs, system errors and undercooked features.

All this with bloated salaries and additional budget costs. So, acquiring a white-label trading platform instead is a dominant strategy for smaller and mid-sized businesses. Here’s why.

Accessible and Precitable Pricing

As outlined above, building your own crypto exchanges without any outsourcing can be extremely expensive and inefficient. On the other hand, the white-label crypto exchange cost is much smaller, allowing business owners to have solid expectations for their budgetary considerations. White-label providers charge fixed fees, a small commission on profits or a combination of both.

Even the highest WL solution pricing packages are much more affordable than in-house development costs for employee salaries, servers, additional software and equipment.

Faster Time-to-Market

Moreover, developing a new business and entering a competitive market is always time-sensitive. Nobody knows what trends and developments might occur in several months. So, it’s crucial to move when the opportunity is fresh. On average, turnkey solutions can be set up within a month or even less, giving businesses a rare chance to enter the market within their desired timeframe.

How to Make a Cryptocurrency Exchange

As discussed, creating a turnkey crypto exchange is the most dominant strategy today, especially with white-label providers bridging the gap between their solutions and custom crypto exchange platforms.

However, even the pre-made white-label crypto exchanges could be challenging for newcomer business owners. So, we present a high-level overview of how to make the right choices in creating a white-label cryptocurrency exchange business.

Determine Your Business Model and Niche

Before making any financial commitments, consider what cryptocurrency niche your business can dominate. There are two primary choices to make here – either pursue the model of integrating as many exchange pairs as possible or offer a specialised but highly advanced exchange platform for specific currencies.

While the broad approach might seem superior due to the higher level of user freedom, numerous specialised cryptocurrency exchanges thrive in the current environment.

For example, an exclusive Bitcoin exchange can generate impressive profit margins by providing its customers complementary trading services, contracts for difference, copy trading tools, and advanced analytics. So, choosing the general strategy depends on your business strategies and aspirations.

Find the Top Cryptocurrency Exchange Turnkey Provider

After determining the extent of your service offerings and a preferred niche, it’s time to search for the WL providers that satisfy your needs.

There are several factors to consider here, including reputability, compliance and the extent of features offered by the provider. Reputation speaks volumes in the white-label business, as many providers might have seemingly optimal services but subpar support services, inconsistent software and problems with licensing.

So, it is vital to conduct due diligence and select WL providers with untainted track records. Moreover, you must also check their relevant licenses and jurisdictions, ensuring that their WL solutions are free to operate within your desired territories, such as Europe or the USA. The licensing also pertains to the extent of financial and trading instruments that can be legally offered to clients.

Analyse WL Features and Security Measures

Aside from the reputability, licensing and quality assurance from WL providers, it is crucial to review their portfolio of offerings and ensure that your desired features are present. Some WL solutions are simple, only providing currency pairs and other basic features like live data feeds and limited analytics.

However, to keep up with the current competition, it is vital to implement more advanced offerings. In the modern environment, providing simple currency exchange services is no longer enough, as successful crypto exchange companies now offer copy trading, CFDs, derivatives, margin trading and many other options.

Naturally, the cryptocurrency exchange software price tends to increase proportionally with the added services and tools, but the upside is worth the investment.

Assessing the security measures is arguably even more critical, as malicious individuals frequently target crypto exchanges. To maintain and grow your target audience, you must showcase the readiness to withstand cyber attacks and protect your customer funds without any exceptions.

To achieve this goal, you must check whether your provider has anti-money laundering and KYC protocols integrated into the white-label software. Moreover, your WL provider must regularly update their cybersecurity systems to stay resilient against emerging threats.

Add Liquidity and Other Essential Functions Through APIs

No crypto exchange platform can function without sufficient liquidity and other vital mechanisms powering the trading operations. WL providers might offer in-house liquidity and a turnkey platform in specific cases.

Otherwise, you can seek third-party liquidity from brokers, prime of prime providers and other sources. Regardless of your choice, it is crucial to select a reliable source of liquidity that integrates well with your trading engine. As a result, your clients will have instant access to fairly priced order books that eliminate slippage or delays.

Other API tools can include a white-label cryptocurrency wallet, third-party analytics tools, and other features that enrich your platform offerings further. However, to seamlessly integrate third-party tools into your infrastructure, selecting an open-source cryptocurrency exchange solution is crucial.

In simple terms, open-source WL software is compatible with numerous APIs, allowing you to create a more diverse product that stands out in the marketplace.

Front-End and Branding

Unique branding and strong marketing are invaluable to launching your own cryptocurrency exchange. Audiences respond to unique brand statements and creative front-end design. So, after figuring out all the technical details, it’s time to design a memorable, easy-to-navigate platform front-end that makes your clients comfortable.

Since the crypto sector is stereotyped as overly complex and technical, creating an intuitive user interface will go a long way toward converting prospects into loyal customers.

Deployment and Post-Launch Support

Once everything is set up, it’s time to launch the platform and make a solid first impression. WL partners provide ample support in launching your exchange and conducting all necessary tests to ensure the platform’s reliability. However, the most crucial aspect is the post-launch assistance from WL partners.

Even the white-label crypto exchanges demand a lot of maintenance and periodic upgrades to keep up with the frequently changing crypto market. So, choosing a WL provider that can fulfil your growing needs in perpetuity is essential.

Final Remarks – Lower Costs, Same Profit Margins

While the road to building a WL cryptocurrency exchange is still challenging, the current market conditions heavily favour this business model. WL providers now offer 90% of all possible features, tools and services that small or medium-sized businesses could develop in-house.

Moreover, acquiring a WL solution as a basis for your crypto business costs much less, decreasing your operating budget but maintaining healthy profit margins nonetheless.

So, if you have the workforce and business capital ready to go, considering a white-label crypto exchange platform is among the most prudent ideas in the current crypto field.