How Much Does It Cost to Start a Crypto Exchange?

The cryptocurrency market is booming like never before. In 2024, Bitcoin shattered its all-time high, surging to an astonishing $93,400. Meanwhile, the global market capitalisation of cryptocurrencies climbed to a staggering $3 trillion in November, showing the enduring appetite for digital assets. Analysts predict the market will continue to expand as institutional adoption accelerates and blockchain use cases diversify. For businesses, this isn’t just a trend—it’s a lucrative frontier.

One of the most profitable ventures in the space? Launching a cryptocurrency exchange. These platforms are the backbone of the crypto economy, generating billions annually in transaction fees. But creating an exchange is no small feat—it requires careful planning and a significant financial commitment.

In this guide, we’ll break down the cost to start a crypto exchange, explore the factors that influence expenses, and provide insights to help businesses tap into this trillion-dollar market opportunity.

Key Takeaways

- Developing a cryptocurrency exchange can cost anywhere from $30,000 to $350,000, depending on your approach and required features.

- Regional development costs vary significantly, with hourly rates ranging from $20–$250 in different regions, with Eastern Europe and Asia being cost-effective options.

- Budgeting for licensing, compliance, marketing, and scalability is crucial to ensure a successful and sustainable platform launch.

Download the free PDF guide covering the key decisions, common mistakes, and real costs of starting a crypto exchange.

Types of Cryptocurrency Exchanges

Cryptocurrency exchanges comprise the core of the crypto ecosystem, where traders, investors, and institutions converge to buy, sell, and trade digital assets. Beyond being mere marketplaces, exchanges shape the liquidity, accessibility, and growth of the entire crypto economy.

There are three types of exchanges:

Centralised Exchanges (CEX)

Centralised exchanges, like Binance, ByBit, and Coinbase, dominate the market, handling over 90% of global crypto trading volume. Operated by a central authority, these platforms offer unmatched liquidity, high-speed trading engines, and user-friendly interfaces.

For instance, Binance alone reported an average daily volume of $70 billion in November. Users rely on these exchanges to safeguard their assets and execute trades efficiently. However, centralisation comes with challenges, including vulnerability to hacking and regulatory scrutiny.

Decentralised Exchanges (DEX)

Decentralised exchanges, such as Raydium, Orca and Uniswap, take a radically different approach. These platforms eliminate the need for intermediaries, enabling peer-to-peer transactions directly on blockchain networks.

The global DEX trading volume hit $186 billion in July 2024, with the ratio of DEX trading volume to centralised exchanges reaching an all-time high, reflecting growing demand for privacy and security. While DEXs excel in user sovereignty and censorship resistance, they often struggle with lower liquidity and slower transaction speeds than their centralised counterparts.

Hybrid Exchanges

Hybrid exchanges aim to blend the best of both worlds: the high performance of CEXs and the security and transparency of DEXs. Although still a niche, hybrid exchanges are gaining traction among users who seek liquidity without compromising on decentralisation.

Crypto Exchange Development and Costs

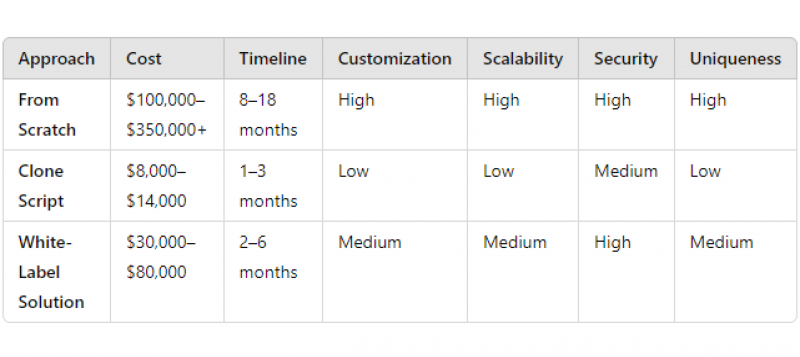

The path you choose for building your cryptocurrency exchange can drastically impact the budget and the timeline. From fully customised solutions to cost-efficient pre-built alternatives, each approach has advantages, challenges, and price tags. Here’s a detailed breakdown of the most common methods:

Building from Scratch: Tailored and Comprehensive

Creating a crypto exchange from scratch offers complete freedom to design every detail. This method ensures maximum customisation and control but is also the most resource-intensive.

- Estimated Cost: $100,000–$350,000 (or more, depending on complexity).

- Timeline: 8 to 18 months, depending on features and team size.

Why does it cost so much? The process involves extensive work:

- Custom Development: Every line of code is written to meet the specifics of your operations.

- Security Features: Advanced measures like multi-signature wallets, encryption, DDoS protection, and compliance with international regulations are built from the ground up.

- Trading Engine: Developing a high-performance matching engine capable of handling millions of transactions per second is vital.

- Scalability: Building infrastructure that can scale to accommodate user growth ensures the platform remains competitive.

While this method provides unmatched control, it also demands a highly skilled team, from blockchain developers to UI/UX designers, and a considerable financial commitment.

Clone Scripts: Fast and Budget-Friendly

Clone scripts are quick to assemble and cost-efficient but offer limited customisation. A clone script replicates the core functionality of an existing cryptocurrency exchange or takes an open-source code with some tweaks to branding and features.

- Estimated Cost: $8,000–$14,000.

- Timeline: 1 to 3 months.

The affordability stems from the use of pre-built code. Popular clone scripts allow startups to enter the market quickly, providing essential features like user registration and authentication, wallet integration, and more.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

However, this approach comes with trade-offs:

- Scalability Limitations: Clone scripts often struggle to handle growing user bases without significant upgrades.

- Security Risks: Using pre-written code increases vulnerability to hacking, as attackers may already be familiar with the script’s architecture.

- Lack of Uniqueness: A generic design may fail to stand out in a competitive market.

Still, clone scripts are an attractive entry point for startups looking to test their business model without investing much money. According to recent data, 40% of new exchanges in 2024 opted for clone scripts, prioritising speed to market over custom features.

White-Label Solutions: Balanced and Scalable

White-label cryptocurrency exchanges offer a middle ground, providing pre-built platforms that can be rebranded and customised to a moderate extent. With this option, businesses can save on foundational costs while creating a platform that suits their requirements.

For companies exploring the crypto exchange white label cost, this approach delivers an excellent balance of affordability and functionality.

- Estimated Cost: $30,000–$80,000.

- Timeline: 2 to 6 months.

Key features of white-label solutions include:

- Customisable Frontend: You can design unique user interfaces to enhance branding and user experience.

- Pre-Built Backend: A robust backend system, including trading engines and wallet integration, comes ready-made.

- Compliance Tools: Many providers include KYC/AML modules to meet regulatory requirements.

White-label solutions are increasingly popular among mid-sized businesses and institutional investors.

For businesses looking to establish a cryptocurrency exchange efficiently and effectively, turnkey solutions deliver a comprehensive approach. An example of this is B2BROKER’s Crypto Exchange Turnkey, which integrates the provider’s flagship white-label products into a unified offer:

- B2TRADER: A high-performance crypto spot brokerage system capable of handling up to 3,000 requests per second, supporting up to 3,000 instruments, and delivering lightning-fast execution speeds starting from just 1 millisecond.

- B2CORE: A powerful front-end and back-office solution designed to manage user accounts, operations, CRM systems, and IB partners.

- B2BINPAY: A secure and efficient cryptocurrency payment processing platform that supports multiple digital assets and fiat currencies.

Turnkey solutions are especially appealing for companies aiming for rapid deployment without compromising reliability or scalability. Whether you’re a startup entering the space or an established business expanding into digital assets, a turnkey exchange ensures you have the tools to start a fully operational and low cost crypto exchange and succeed immediately.

Regional Variations in Development Costs

The cost of developing a cryptocurrency exchange isn’t just about the features and technology—it’s also heavily influenced by where your development team is based. Labour costs, expertise availability, and regional market conditions all play a critical role in shaping your overall budget.

North America and Western Europe

If you choose to hire a development team in regions like the United States, Canada, or Western Europe, you can expect higher costs. In 2024, average hourly rates for blockchain developers in these areas range from $120 to $250 per hour. While these regions boast highly skilled professionals and advanced technological infrastructure, the elevated labour costs can push your total development budget beyond the $350,000 mark for a custom-built exchange.

These regions are ideal if your business prioritises working with experienced teams who are well-versed in regulatory compliance and cutting-edge security standards. For example, many of the world’s largest exchanges, like Coinbase, rely on talent from Silicon Valley to maintain their competitive edge.

Eastern Europe

Eastern Europe continues to be a hotspot for exchange development, striking the perfect balance between cost efficiency and technical expertise. Countries like Poland, Romania, and Serbia are home to a rapidly growing pool of skilled blockchain developers, with hourly rates ranging from $40 to $80, making them attractive options for businesses looking for high-quality services at competitive prices.

For example, Poland has a workforce of over 400,000 IT professionals. Other countries also offer cost-effective yet skilled talent, making the region a rising star for blockchain development.

Asia

Asia remains the most cost-effective destination for blockchain development, with hourly rates in India, Vietnam, and the Philippines ranging from $20 to $50. This affordability makes the region especially appealing to startups with limited budgets. India, for instance, is projected to handle a large share of global blockchain outsourcing in 2025, thanks to its vast talent pool and ability to scale large projects.

Another example is Vietnam’s blockchain sector, which has grown by over 30% annually in recent years. The country’s low-cost and high-quality developers have attracted businesses worldwide looking to build competitive platforms on a tight budget.

However, businesses opting for Asia should weigh the trade-offs. While cost savings are significant, challenges like time zone differences and varying levels of expertise can complicate collaboration.

Accounting for Hidden and Additional Costs

Setting up an exchange involves more than just the initial development investment. Long-term success requires careful planning for hidden and ongoing expenses that many businesses overlook. These expenditures are critical to ensuring a compliant, secure, and competitive platform, and they significantly impact the overall cost to build a crypto exchange. Let’s break them down step by step.

1. Licensing and Legal Compliance

Launching an exchange in today’s regulatory landscape requires a strong focus on compliance. Securing licenses and adhering to regulations protects your business and builds user trust, a cornerstone for attracting and retaining customers.

- United States: Registering with FinCEN and complying with state-level regulations can cost upwards of $100,000 annually, making the U.S. one of the more expensive jurisdictions.

- European Union: Under the new MiCA (Markets in Crypto-Assets) regulations, licensing fees vary but generally fall between €50,000 and €150,000, depending on the member state.

- Asia-Pacific: Jurisdictions like Singapore and Hong Kong provide clearer frameworks, but licensing costs can exceed $50,000.

Planning for compliance ensures your exchange operates legally while unlocking opportunities in lucrative markets.

2. Marketing and User Acquisition

Effective marketing is extremely important in a competitive market where thousands of exchanges vie for user attention. A well-planned marketing strategy ensures your exchange stands out, attracts active traders, and builds a loyal community.

- Performance Marketing: Campaigns on platforms like Google, Facebook, and crypto-specific forums often require budgets of $5,000> monthly for mid-sized exchanges.

- Community Building: Engaging with users via Telegram, Discord, and Reddit can demand investment in moderators, content creators, and giveaway campaigns, averaging $3,000–$10,000 monthly.

Exchanges like Binance have demonstrated the power of aggressive marketing, spending over $100 million in 2023 to solidify their global presence. Strategic marketing pays off by fostering user loyalty and driving growth.

3. Infrastructure and Operational Costs

Running a cryptocurrency exchange means providing a seamless, secure experience for users 24/7. This requires a robust infrastructure that can handle trading spikes, protect user data, and scale as your user base grows.

- Hosting and Servers: Using cloud providers like AWS or Azure can cost between $3,000 and $15,000 per month, depending on user activity and trading volume.

- Bandwidth Costs: Exchanges with high trading volumes often spend $2,000–$8,000 per month on bandwidth to ensure seamless transactions.

- Cybersecurity Tools: Protecting against DDoS attacks, phishing scams, and hacking attempts requires advanced solutions like firewalls, intrusion detection systems, and encryption protocols. Annual cybersecurity budgets typically range from $20,000 to $50,000.

Investing in infrastructure ensures the exchange remains reliable, scalable, and secure as it grows.

4. Unforeseen Expenses

Unanticipated costs can emerge at any stage of the exchange’s lifecycle. Businesses must prepare for these potential hurdles to avoid disruptions:

- Emergency Maintenance: Addressing critical bugs or downtime issues can cost $10,000–$30,000 per incident, depending on complexity.

- Security Breaches: Recovering from a hacking incident involves legal fees, compensation for affected users, and bolstering security measures. The average cost of a data breach in 2024 is estimated at $4.45 million globally, according to IBM.

- Regulatory Changes: Sudden shifts in legal requirements might necessitate additional compliance spending, such as upgrading KYC/AML procedures or hiring legal experts, which can cost $10,000–$50,000 per adjustment.

Building a contingency fund for these scenarios helps you navigate challenges without disrupting your operations.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Recommendations for Building a Crypto Exchange

Here are actionable insights to help you optimise your resources and ensure a successful launch:

Engage Experienced Developers

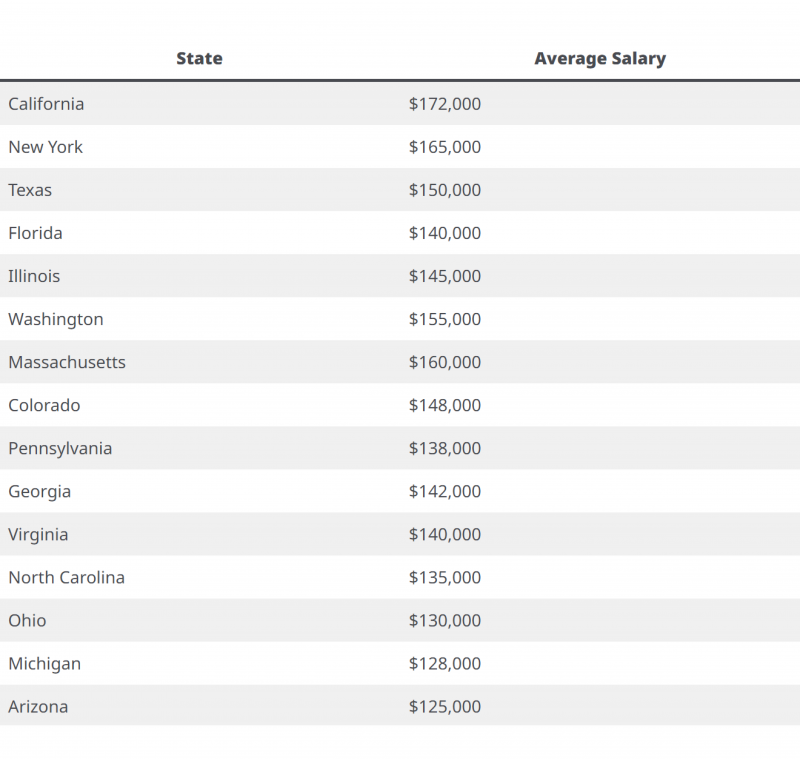

Collaborating with skilled and experienced developers is essential for creating a robust, secure, and user-friendly platform. The demand for blockchain developers has surged in 2024 year-over-year, with top talent earning upwards of $150,000 annually in North America and $50,000–$80,000 in Eastern Europe.

Working with professionals specialising in crypto exchange development ensures your platform meets industry standards and minimises vulnerabilities.

Look for developers with experience in building trading engines, wallet integration, and cybersecurity measures.

Prioritise Essential Features

Feature overload is a common pitfall for new exchanges. Start with core functionalities that meet your target audience’s immediate needs, such as a fast trading engine, secure wallets, and intuitive UI/UX. Advanced features like staking, margin trading, or DeFi integrations can be added as your platform grows.

By focusing on essentials, you can save up to 30% on initial development costs, leaving room for enhancements as you scale.

Plan for Scalability

Cryptocurrency markets are unpredictable, with trading volumes often spiking unexpectedly. In November 2024, Binance reported over 13 million visits on the app in a single day, highlighting the importance of scalability. Failing to plan for growth can lead to server crashes, delayed transactions, and lost users.

Invest in scalable cloud infrastructure (e.g., AWS or Google Cloud) and horizontal scaling solutions to handle growing user bases.

Platforms that scale efficiently can reduce downtime and improve user retention, which is critical for long-term profitability.

Stay Informed of Regulations

Crypto regulations are constantly evolving, with new policies introduced almost yearly. In 2024, the European Union implemented MiCA (Markets in Crypto-Assets), requiring exchanges to comply with stricter transparency and consumer protection rules. Non-compliance can result in penalties, legal disputes, or loss of user trust.

- Allocate at least 15–20% of your initial budget for compliance-related tasks, such as KYC/AML processes and legal consultations.

- Regularly consult with regulatory experts to keep your exchange compliant in multiple jurisdictions.

Start Your Crypto Exchange with B2BROKER

Building a platform isn’t just about starting—it’s about thriving in a dynamic, high-demand market. Exchanges that prioritise scalability, compliance, and user-centric design achieve higher user retention rates compared to their competitors.

At B2BROKER, we take the complexity out of creating a crypto exchange or brokerage. Our comprehensive suite of products equips your platform with a full spectrum of cutting-edge technology needed for a smooth start, as well as seamless scalability and unparalleled security.

Join the many businesses leveraging a white-label approach. Get started with B2BROKER today and launch your crypto exchange faster, better, and with less expense.

FAQ

How much does it cost to start a crypto exchange?

The cost of developing a cryptocurrency exchange ranges from $30,000 to $300,000+, depending on the features, security measures, and development approach.

How do I start a crypto exchange?

To start a crypto exchange, you’ll need to choose the type (centralised, decentralised, or hybrid), secure necessary licenses, and partner with experienced developers or providers to build the platform. Using turnkey solutions can significantly simplify the process by providing an all-in-one package.

How much does it cost to list on a crypto exchange?

The cost of listing a cryptocurrency on an exchange varies widely, ranging from $10,000 to over $1 million, depending on the platform’s reputation and the token’s demand.