Starting A Cryptocurrency Exchange Business in 7 Steps

Articles

The rise of digital currencies has significantly impacted the finance landscape for crypto projects and entrepreneurs, offering opportunities for innovative business ideas and problem-solving. With over 50 business ideas in the crypto market, only a few are truly worth pursuing. One such business idea is starting a cryptocurrency exchange platform, which can be life-changing if executed with a well-thought-out plan.

This article will explore the benefits of starting a digital exchange, explain how to start in crypto and provide you with a step-by-step guide to building your first crypto exchange.

Key takeaways

- Crypto exchange can be a lucrative business due to the predicted growth in the cryptocurrency market.

- When launching an exchange, take care of such features as an intuitive interface, matching engine, security, etc.

- The white-label solution is an alternative to in-house development, enabling quick and cost-effective entry into the market.

Reasons to Start Your Own Cryptocurrency Exchange

A cryptocurrency exchange is a virtual platform for trading digital assets. It enables traders to acquire or sell crypto coins by converting fiat currency into the user’s preferred digital currency. Exchange sites prioritise security and compliance, provide payment facilities, and ensure user satisfaction.

Cryptocurrencies have revolutionised the financial sector, providing a new revenue source for exchanges. Analysts predict growth in the crypto market, with commissions expected to rise due to increased users, making a cryptocurrency exchange launch a lucrative endeavour, as a secure platform fosters innovation in the blockchain space and allows businesses to collaborate with innovative projects.

Crypto exchanges offer valuable insights into market trends and user behaviour, enabling personalised services and enhanced user experiences. Building a crypto exchange business can help revolutionise financial services and promote financial inclusion, leading to fresh opportunities for profit and growth.

Crypto exchanges’ success relies on factors like market conditions, competition, regulatory environment, and user adoption. Proper preparation and a competent approach enable various benefits for business owners.

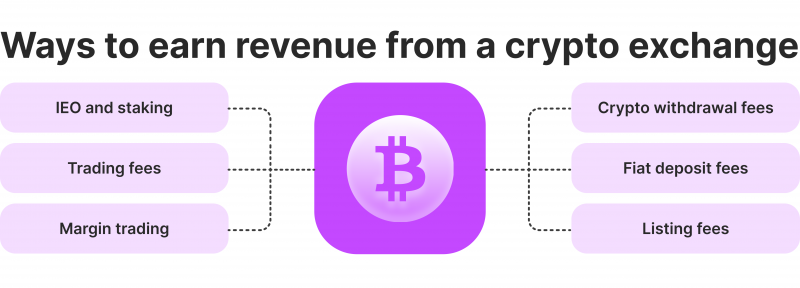

Revenue generation is the main benefit, with processing fees ranging from 0.1% to 5% per trade. Crypto exchanges can offer additional services like margin trading, initial exchange offering, staking, and lending, which can potentially bring huge profits to the exchange owners.

Starting a crypto exchange allows entrepreneurs to shape the industry and contribute to its growth. The technology of crypto exchanges is highly flexible and scalable, allowing businesses to operate globally.

Must-Have Features of A Crypto Exchange

When launching your own crypto business, you must take care of key features that it should have. A cryptocurrency exchange should be user-friendly, intuitive, and feature-rich to provide a frictionless user experience. Core functionalities include secure authorisation and verification, crypto wallets for storing, depositing, and withdrawing funds, a real-time order book, and a user-friendly interface.

A user-friendly interface allows traders to view their balances, place orders, and access other features.

Security measures, such as 2FA, SSL encryption, and cold storage, are essential to protect users’ funds and personal information.

A real-time order book should display current bids and trading pairs, allowing users to view market conditions and place orders.

To launch and operate a crypto business, you will also need multiple software components. Thus, the matching engine is crucial for facilitating trade execution, and the admin panel allows operational officers to monitor the system’s performance and make necessary adjustments.

Crypto exchange owners should integrate with liquidity providers to offer their clients narrow bid-ask spreads and smooth trade execution.

Implementing these core features allows the exchange to enter the crypto exchange market and gain first clients. As the platform grows, additional features like creating a tradable token, integrating NFTs and AI tools, or implementing crypto staking functionality can be added to enhance its user experience.

Step-By-Step Guide to Start Crypto Exchange Business

The following step-by-step algorithm outlines the process of building a cryptocurrency exchange.

Step 1. Start With A Cryptocurrency Exchange Business Plan

To create a crypto exchange platform, develop a detailed business plan by conducting a thorough technical and fundamental analysis of the target market and defining your operational strategy, revenue pattern, and cryptocurrency exchange business model. Also, consider project costs, including transaction fees or subscription-based services.

Research your competitors and identify legal requirements in your chosen jurisdiction. Additionally, consider software services, payment processing providers, KYC providers, liquidity providers, online marketing, and equipment.

Step 2. Pick The Exchange Type

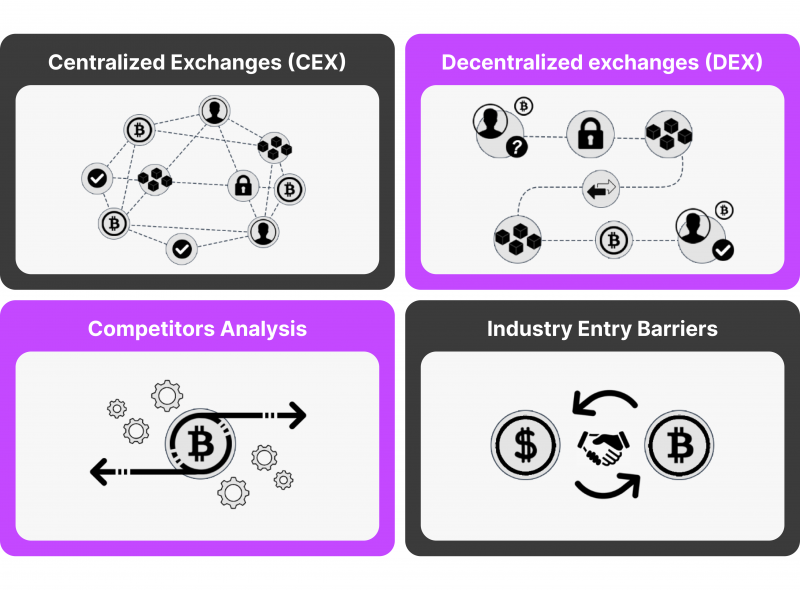

Starting a cryptocurrency exchange business is a profitable and easy-to-start venture in the crypto domain. However, to start, it is crucial to understand the various types of crypto trading platforms and their distinct characteristics.

There are four types of cryptocurrency exchanges: centralised exchanges (CEX), decentralised exchanges (DEX), peer-to-peer exchanges (P2P), and instant exchanges.

CEXs are widely used crypto trading platforms, centralised operators responsible for functionality, security, and partner selection. They charge a trading fee ranging from 0.1% to 8%, offering user-friendly features.

DEXs are a potential solution for crypto exchange businesses, enabling direct fund transfers between users’ wallets using blockchain technology. However, due to their decentralised nature and sometimes contradicting policies, DEXs are less popular and lack high trading volumes and liquidity.

P2Ps facilitate direct cryptocurrency transactions between users, using an escrow system to protect both parties’ funds. P2P exchanges are suitable for beginners but may take time, send money to the wrong user, and be challenging to dispute charges after transactions.

Hybrid crypto exchanges combine CEX and DEX, providing a central authority controlling some features and giving users some degree of control over their assets.

Instant exchanges act as middlemen, allowing users to exchange one crypto for another instantly. They offer high transaction speed, support for large orders, and no responsibility for stored assets.

Step 3. Take Care About Licences

Crypto and blockchain tech are relatively young and unevenly regulated, leading to ambiguity in legislation. Legal regulations vary by country, so it’s crucial to consult a legal counsel before launching a crypto exchange, as non-compliance could lead to legal or criminal consequences. If a country requires a crypto trading license, obtain it before investing in the exchange development.

Basically, cryptocurrency exchanges must adhere to strict legal and regulatory requirements, varying by country or region. These include obtaining licenses and permits from relevant bodies, conducting background checks and audits, and adhering to anti-money laundering and KYC regulations.

Step 4. Find A Service Provider

Crypto professionals should prioritise hiring a suitable service app provider for their exchange software. To launch a functional, admin-friendly, lightning-fast trading platform, build a sleek UI/UX front-end experience. Consider fee structure, cold storage integration, wallet management, and mobile app offerings.

Implement security measures like 2FA, cold storage, and regular audits to protect against threats.

Step 5. Pick The Liquidity Provider

To create a successful crypto exchange, attract liquidity providers to enhance transaction efficiency and reduce order price shift risks.

To improve user experience, it’s crucial to attract traders and market makers to your exchange by offering competitive fees, incentivising market makers, and listing popular pairs, such as BTC/EUR, BTC/ETH, BTC/USD, ETH/EUR, and ETH/USD.

Step 6. Create A Team of Professionals

Smart management and a well-orchestrated team are crucial for a successful crypto exchange. A wise hiring process ensures competent internal financial reporting, restricted access to client funds, protected wallets, and simple external audits. Choose experienced specialists with a clean reputation in the crypto field.

The development team for a project is shaped by emerging trends, focusing on Treasury, compliance, security, customer care, and marketing, implementing financial accounting standards, and organising custody.

Step 7. Promote Your Project

Before launching a cryptocurrency exchange, it is crucial to promote it to the target audience. This can be achieved through various marketing strategies, such as social media marketing, influencers, partnerships with crypto-related services, and PR.

Profitability in a business is directly linked to advertising and promotion investments. A good PR campaign involves understanding target audience needs, developing a marketing strategy, creating content, partnering with media and influencers, advancing technology, and implementing new features. Marketing tools include SEO, social media, event marketing, and CRM.

To meet customer expectations, the exchange should offer high security, transparency, a wide choice of coins, high liquidity, and exceptional customer support. After launching, gathering user feedback is essential for further platform development and support.

White Label Exchange

The white-label crypto exchange solution is highly sought after due to its numerous business benefits. This SaaS software is designed for quick launch and customisation, making it a popular choice for entrepreneurs looking to launch a new cryptocurrency business.

A white-label solution is a viable way to enter the crypto market quickly. It provides a ready-to-go, fully integrated business architecture that can be adjusted to meet individual needs. Additionally, white-label partners can offer a wide range of products and services, making it easier for businesses to diversify their offerings and reach a larger audience.

White-label outsourcing offers numerous advantages, making it essential for entrepreneurs to consider partnering with a competent service provider to deliver a top-notch platform quickly. This approach is beneficial for businesses lacking expertise, resources, or time to develop their own solution while the provider handles all technical aspects of running the exchange.

Final Thoughts

Cryptocurrency’s reputation is expected to increase in the coming years, making it an ideal time to enter the trillion-dollar market and create your own crypto exchange startup, either using white-label software or developing it in-house.

Independent of the approach you choose, launching a successful cryptocurrency exchange business is an exciting prospect that requires careful planning and execution. Staying updated with industry trends and regulatory changes and understanding how blockchain tech and crypto exchange work is crucial for establishing a profitable crypto exchange platform and gaining success in the dynamic world of digital currencies.