Building the Best White Label Forex Broker Business

Articles

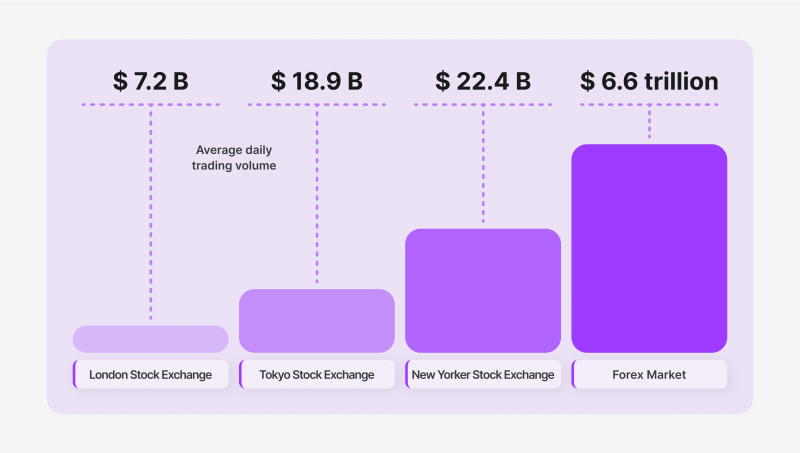

Modern technological developments have propelled the foreign exchange industry to the status of a worldwide powerhouse. Currently, most currencies can be traded across the globe with few restrictions or challenges, allowing beginners to enter the scene and try their luck. So, the increased demand in the Forex trading landscape has proportionally elevated the demand for Forex brokerages.

As of 2023, starting a Forex brokerage business has become much simpler due to the invention of a white label (WL) model. In this article, we will discuss how WL solutions simplify the lives of Forex brokers and how you can use them to develop a proper white label Forex broker company.

Key Takeaways

- White label solutions allow Forex companies to start their business in a fraction of the time and completely avoid a development stage.

- Creating a successful WL brokerage requires extensive research to find a perfect white label provider.

- Many white label Forex broker options on the market offer different features, functions and pricing packages. Selecting the best one depends on your distinct needs and target market.

Why You Should Start a Forex Brokerage Firm

The Forex scene is flourishing thanks to increased international trade and commerce. The emergence of e-commerce shops, cross-border payment systems and other innovations has greatly increased demand for currency trading worldwide. Forex trading has also experienced a massive bump in recent years thanks to impressive potential profits.

There has never been a greater demand for Forex brokerages to provide top-of-the-line trade execution and complementary services than now. Forex trading platforms are highly sought-after, especially if they present competitive pricing and excellent trading tools like copy trading or margin trading.

So, starting up a Forex brokerage firm in the current climate is a promising venture that could yield impressive profit margins in both the short and long runs. But what about the costs of entering the foreign exchange market? Creating a Forex brokerage platform is not an easy task, and previously, this undertaking was highly resource-intensive. However, the creation of WL solutions has changed this equation dramatically.

Understanding the Forex White Labels and Their Value

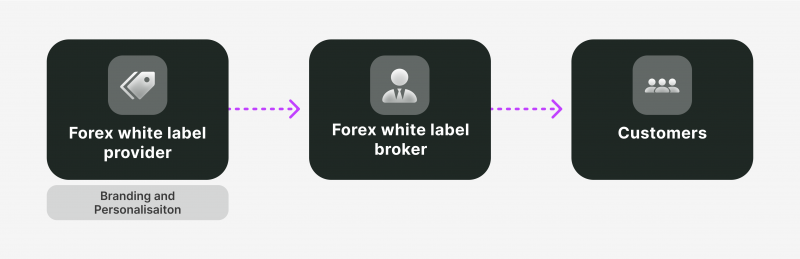

White label Forex broker technology has become a common practice in the digital world. The basic premise of WL solutions is simple yet genius – they allow companies to acquire pre-made software that can be modified and personalised to fit their own brand. Such a solution allows companies to avoid the arduous development and engineering process and go to market within a few months or weeks.

The WL practice has also reached the Forex industry, letting companies acquire a Forex trading platform template and create a distinct brand without requiring development resources.

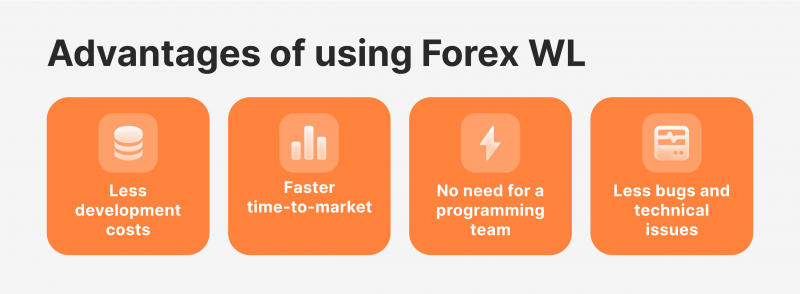

As a result, companies don’t need as much workforce and can reduce their time-to-market significantly. Previously, WL solutions used to be more limited in terms of customisation. Now, a white label brokerage can provide most trading instruments, options and features in custom-made platforms.

Benefits of a White Label Forex Trading Platform

As discussed above, a white label Forex broker has many advantages compared to building a trading platform in-house. The most considerable benefit is avoiding the development process from scratch.

Constructing a trading platform from square one is a highly complex process requiring software engineers, automated testers, project managers, solution architects, and several other team members. Before long, companies will need to create a separate department to keep up with the development.

Naturally, companies will require massive resources to achieve this and, in many cases, might not reach the end goal before running out of capital. With WL solutions, companies can construct a Forex trading platform without specialising in coding or design, allowing them to focus on the core product value and business planning.

The best Forex WL solutions have evolved dramatically in recent years, providing many advanced features that rival the best custom-made platforms. As a result, mid-sized businesses can level the playing field against industry leaders and acquire their share of the market.

White-label solutions first became popular in the early 2010s, allowing businesses to outsource their platforms and make indirect profits. Today, this is a multi-billion dollar industry that has entered numerous trading, investment and currency markets.

Things to Consider Before Choosing a White Label Solution

While a white label Forex broker approach is optimal for small and mid-sized businesses, the process of starting a Forex company involves several complex steps, some of which are more challenging than they first appear.

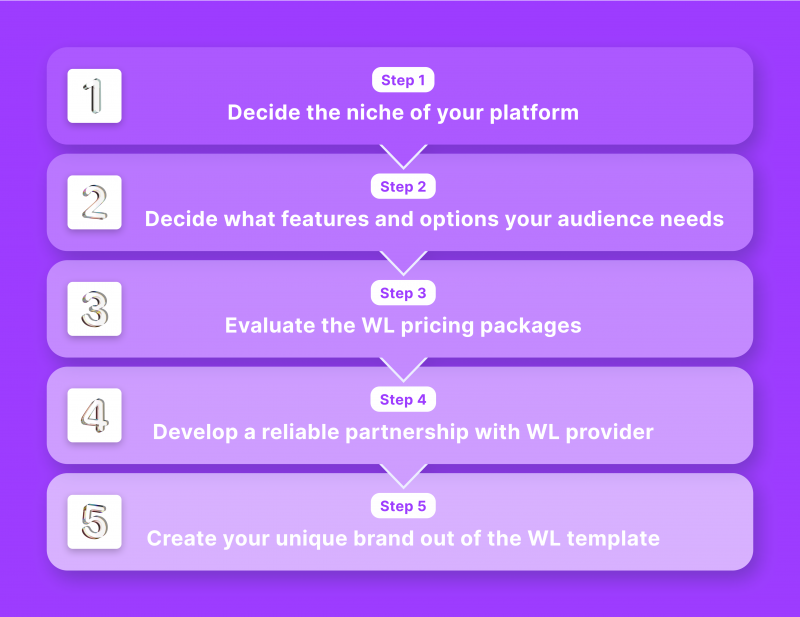

Decide What Kind of Trading Platform You Need

There are several niches to choose from, including different asset classes, trading solutions and other variations. For example, you can provide a single currency pairing, like USD or BTC, and build your entire proposition around this currency. This specialised service is top-rated since customers value boutique trading platforms.

On the other hand, you could prioritise variety and freedom of choice, providing as many currency pairings as physically possible. However, this approach is more complex and requires considerable expertise on the side of brokerage business owners. So, it is more advisable to start small, offer concentrated services, and branch out once you have more experience.

Finally, you should choose a brokerage firm jurisdiction that gives you the ability to provide brokerage services across different regions. There are several categories of Forex licences to select from, each presenting varying levels of jurisdictional freedom and difficulty obtaining them.

Examine the Features and Functionalities You Plan to Provide

After deciding what niche you want to fill with a Forex brokerage startup, it is time to search for a white label solution provider. While many excellent options are available on the market, your search should be dictated by what trading options and features you desire to build into your platform. WL providers offer different platform packages with various features, and choosing a package that fits your target market is essential.

Additionally, modern platforms offer clients many customisation opportunities, letting them set up their unique trader’s rooms with custom dashboards, live feeds and widgets. To provide a personalised experience for your clients, you must search for a WL provider that supports such advanced options.

Consider the Pricing Packages Carefully

Perhaps the most significant consideration when starting a white label brokerage in the FX niche is deciding on a pricing package. Such solutions have vastly different pricing ranges, some of which will exceed your budgetary capabilities. So, it is vital to assess the WL Forex broker cost diligently, considering all service expenses.

After all, constructing a successful business is about creating healthy profit margins and controlling the operating costs as much as possible. A hefty price package from a WL provider might bring your profits closer to zero, making your business more susceptible to failure.

On the other hand, the cheapest white label Forex broker is not a good idea either since the lacklustre platform will hurt user experience and ultimately decrease your profits. So, as always, moderation is key here, and you should choose an optimal mixture of pricing and features.

Develop a Long-Standing Forex White Label Partnership

Choosing a WL technology provider that will reliably support your evolving needs and help you with technical complexities is crucial. A strong FX white label back office support is essential to provide clients with a smooth user experience. It is also imperative to have scaling options available for your growing needs.

Equally important is adding new trading tools and practices to your white label subscription. These variables should be considered when starting a Forex white label partnership with any provider since they will play a vital role in your long-term growth.

One of the market-leading white label technology providers is B2BROKER, offering clients cTrader and B2TRADER to start an FX or crypto white label brokerage from scratch in the shortest time.

Design Your Unique Brand

The final step after dealing with technical details, licences, features and scaling abilities is to personalise the WL solution. The competition is fierce in the WL market, with many companies becoming adept at creating memorable and distinct brands.

The key here is to create a unique package of services and options and boost your chances of success with various deals and promotions. Good customer relationship management systems will also help your platform to stand out. CRM tools can often be provided by WL solutions as well.

Final Takeaways

Acquiring a perfect white label solution and constructing a functioning business around it takes a lot of determination and effort. While WL solutions take away technical complexities, choosing WL providers is still a considerable challenge. After that, you still have to figure out numerous business challenges ahead of you.

So, if you aim to jumpstart a white label Forex broker, spare no time or effort in finding the best possible WL software for your needs. A properly selected WL solution will get you firmly ahead of the competition.