How to Choose the Best Crypto Wallet for Business: Tips and Recommendations

Cryptocurrency is attracting increasing interest from financial institutions and the business world thanks to recent big events in the sphere, including Bitcoin’s halving. Observing these developments, many e-commerce companies are starting to explore the advantages of accepting cryptocurrency payments from their customers.

Among the first important decisions these businesses have to make is choosing a suitable crypto wallet for their enterprise needs. However, not all crypto wallets are designed for business use, and a wrong choice can lead to potential risks and setbacks. In this article, we will discuss the most important factors to take into account when choosing the best crypto wallet for businesses.

Key Takeaways

- Crypto wallets are necessary tools for managing digital assets, offering diverse types such as hot and cold wallets with varying security levels and control.

- Choosing an appropriate business crypto wallet involves factors like security, control of private keys, legal compliance, and financial reporting capabilities.

- Top-rated wallets for businesses include Coinbase Wallet, B2BINPAY Wallet Solutions, Ledger Nano X, BitPay Wallet, and Trezor Model One.

- Businesses need a robust strategy for managing digital wallets, such as diversifying operations between wallets.

Crypto Wallet Basics

A crypto wallet is a digital tool that enables you to store, manage, and transact with various digital assets. It serves as the equivalent of traditional bank accounts in the digital world but with robust security features and control over your assets.

At the core of every crypto wallet are private and public keys. These keys are essentially long strings of alphanumeric characters that function as passwords for accessing and securing your digital holdings. The private key is exclusive to you and should always be kept confidential, while the public key serves as a unique identifier for receiving cryptocurrencies from others.

What Options Are on the Table?

The crypto wallet landscape is diverse, with a wide range of options catering to different business needs. Let’s delve into the key categories and their respective strengths:

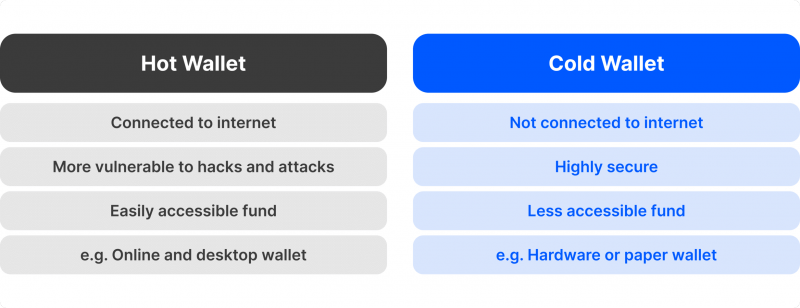

Hot Wallets vs. Cold Wallets

Hot wallets are crypto wallets connected to the internet, offering convenience and ease of use. They are well-suited for day-to-day transactions and frequent crypto activity. However, their online connectivity also makes them more vulnerable to cyber threats, necessitating robust security measures.

Examples:

- MetaMask

- KuCoin Wallet

- Exodus Wallet

In contrast, cold wallets, also known as hardware wallets, do not require an internet connection. These physical devices store your private keys offline, providing a higher level of security at the expense of accessibility. Cold wallets are ideal for long-term storage of your assets, serving as a secure vault for your corporate crypto reserves.

Examples:

- Trezor

- SafePal

- Ledger

Custodial vs. Non-Custodial Wallets

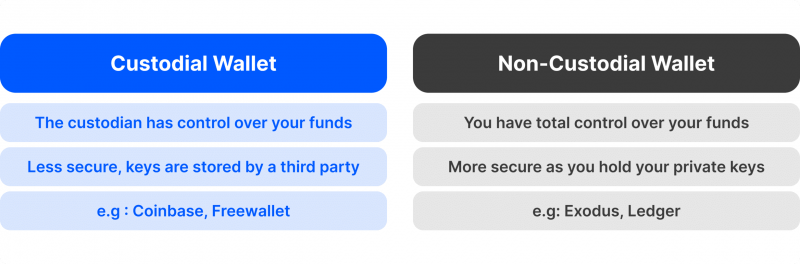

Custodial wallets entrust the management of your private keys to a third-party provider, similar to a traditional bank account. These solutions often integrate seamlessly with merchant services, simplifying the onboarding process for businesses new to the crypto realm.

Examples:

- Binance

- Blockchain.com

- Gemini

Non-custodial wallets, on the other hand, give you full ownership of your private keys, granting you complete autonomy over your digital assets. This approach aligns with the decentralised ethos of cryptocurrencies but also requires businesses to assume greater responsibility for key management and security.

Examples:

- Electrum

- Zengo

- Phantom Wallet

Choosing a Crypto Wallet for Business: What to Consider

The basic concept of a crypto wallet is to store and manage digital assets securely, but not all wallets are created equal. Here are some key considerations to keep in mind:

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Security

The primary function of a crypto wallet is to provide security for your customers’ digital assets. However, the level of security can vary greatly depending on the type of wallet you choose. Hot wallets, which are connected to the internet, are more vulnerable to hacking compared to cold wallet options, which are offline.

Typically, hardware wallets, such as Ledger or Trezor, are considered the most secure option for crypto storage. These physical devices store your private keys offline and require physical access to make any transactions. They can also be treated like safe deposit vaults, providing an extra layer of protection for undeployed assets.

Aside from the type of wallet, there are additional security features to consider. Business crypto wallets should have fraud detection and prevention features in place to protect against malicious attacks. Two-factor authentication (2FA) is another layer of security that requires a user to enter a code from their mobile device before accessing their wallet.

Some crypto payment processing companies offer advanced security features: multisig wallets, for example, require multiple signatures from different parties to approve a transaction, making it more difficult for hackers to gain access.

Control of Private Keys

A crucial aspect of good corporate governance in the realm of crypto is having control over your private keys. Using a self-custodial wallet, such as Metamask or Trust Wallet, ensures you have full ownership and responsibility for your business’s digital assets.

On the other hand, using a third-party custodial wallet, like those found on centralised exchanges such as Binance or Coinbase, means that you are entrusting someone else to hold and manage your private keys. This ultimately puts your assets at risk of being lost or stolen if the exchange is hacked or goes bankrupt.

Therefore, businesses looking to accept payments in cryptocurrency should strongly consider using a self-custodial wallet to maintain control and security over their digital assets.

Legal Compliance

Managing financial transactions requires strict adherence to legal regulations and compliance standards. This is also true for businesses that deal in cryptocurrency, as they may be subject to anti-money laundering (AML) laws and tax reporting requirements. It is essential to choose a business crypto wallet that complies with these regulations and provides the necessary tools for reporting and compliance.

Some cryptocurrency wallets offer built-in AML features, such as transaction monitoring and reporting, to ensure compliance with regulatory requirements. Others may allow for easy integration with external accounting software, making tracking and reporting on financial transactions easier. Researching the wallet’s compliance capabilities is important before selecting one for your business.

Financial Reporting

Financial reporting is a crucial aspect of managing any business, including cryptocurrency businesses. Choosing a crypto wallet that offers comprehensive financial reporting tools can save businesses valuable time and resources.

Wallets that provide features such as transaction tagging and easy export of financial data to external accounting software can be especially beneficial for businesses. This can help streamline the bookkeeping process and ensure accurate reporting for internal and external stakeholders.

Reliable Business Crypto Wallets

What is the best crypto wallet for business? There is a diverse selection of wallets to choose from, including hardware, software, and online/web wallets. Here are some of the best business crypto wallets:

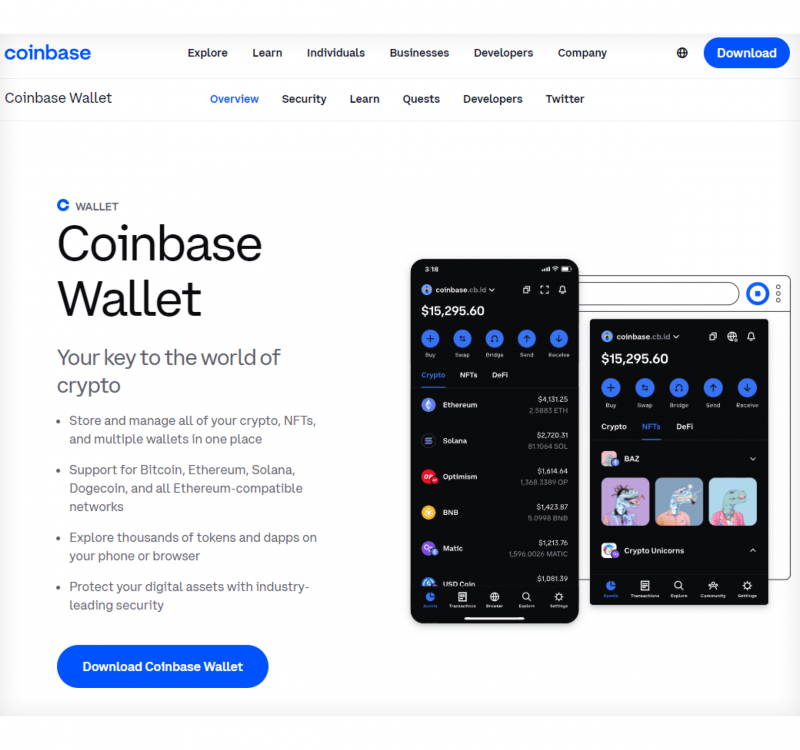

Coinbase Wallet

The Coinbase Wallet is a popular hot wallet choice among businesses due to its non-custodial nature and ability to store over 100,000 digital assets securely. Its seed phrase system ensures utmost security, but users must keep their seed phrase safe. Coinbase also offers automatic backup of the seed phrase to Google Drive, making it convenient for forgetful users.

Combined with Coinbase Commerce, an enterprise blockchain service for facilitating crypto transactions between customers and merchants, this crypto wallet solution allows businesses to securely accept a range of cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and more.

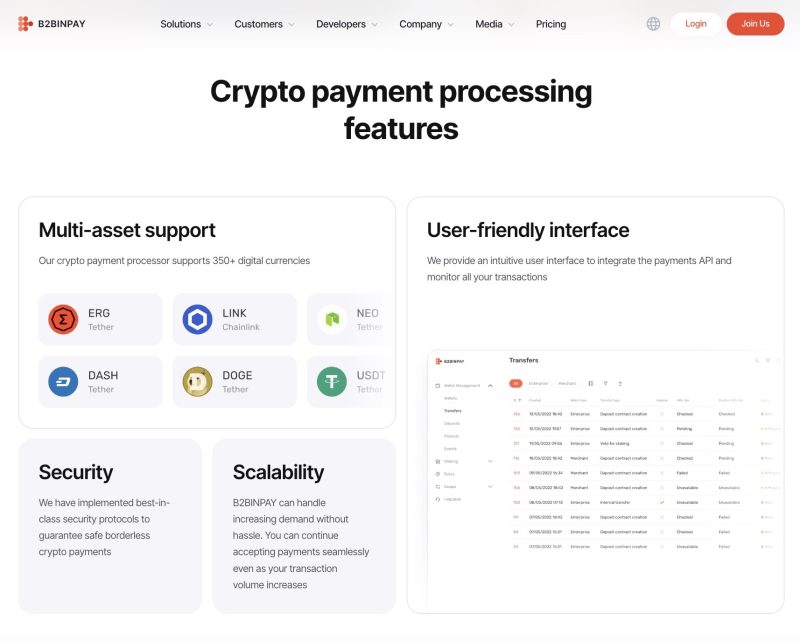

B2BINPAY Wallet Solutions

B2BINPAY is a leading blockchain-based payment processor that offers advanced wallet solutions for businesses. With B2BINPAY, companies can easily send, receive, store, and swap various cryptocurrencies while ensuring the safety of their funds.

B2BINPAY offers a unique single account that combines the functionalities of merchant and enterprise crypto wallet accounts. B2BINPAY’s wallets include Digital Wallets and Blockchain Wallets, both of which provide intuitive user interfaces and flexible cost structures.

Additionally, B2BINPAY offers gateways and integration solutions for brokers and exchanges to transact with various cryptocurrencies, including popular options like Bitcoin, Litecoin, and USDT.

Ledger Nano X

With support for over 1000 digital assets, the Ledger Nano X is a highly secure hardware wallet perfect for businesses. It utilises certified Secure Element chips and a passcode and seed phrase system to ensure utmost security.

Additionally, its free companion app allows businesses to easily manage their coins, make transactions, and keep track of their balance. The Ledger Nano X is a reliable choice for businesses looking to securely store their private keys offline and away from potential hacks.

BitPay Wallet

The official wallet of BitPay, the largest Bitcoin payment processor, is another good option for businesses. This option provides multi-signature support, secure private key storage, and its own servers to avoid third-party involvement in transactions.

BitPay also offers mobile apps for both iOS and Android devices, as well as desktop versions for Windows, Linux, and Mac OS. With a Chrome extension available for browser use, businesses have a wide range of options to manage their cryptocurrency payments with the BitPay Wallet securely.

Trezor Model One

Trezor is one of the most established hardware wallets in the market, and it is known for its premium security features. The wallet has been battle-tested for more than seven years and has not experienced any security breaches. It supports a wide range of cryptocurrencies, including Bitcoin and Ethereum, making it an attractive option for businesses dealing with multiple digital assets.

Trezor Model One has a touch screen and advanced security features like multi-signature support and a password manager. It can also be used as a two-factor authentication token for additional security. In addition to its top-notch security measures, Trezor offers excellent customer support, making it an ideal choice for businesses looking for reliability and safety in a crypto wallet.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Aligning Wallet Features with Business Needs

When selecting the optimal crypto wallet for your business, it’s crucial to align the wallet’s features and capabilities with your specific requirements. Consider factors such as the types of cryptocurrencies you plan to hold, the frequency of transactions, the need for multi-user access, and the level of integration required with your existing financial systems.

For instance, if your business primarily focuses on accepting crypto payments, a custodial cryptocurrency wallet might be the ideal choice, as it seamlessly integrates payment processing and accounting functionalities. Conversely, if your primary goal is to hold and manage your corporate crypto treasury, a hardware wallet like Ledger or a multi-signature solution like Safe may be more suitable.

Strategies for Using a Crypto Wallet for Business

Besides selecting the perfect wallet, you need to develop a robust strategy for managing your digital assets. You may need to diversify your wallet portfolio to mitigate risks and optimise security, implement multi-factor authentication, and regularly back up to safeguard against potential cyber threats.

Moreover, integrating various wallets into your company‘s overall crypto ecosystem can allow for seamless functionality and enhance operational efficiency. For example, utilising a combination of hot wallets, cold wallets, and custodial solutions can cater to different business needs such as daily transactions, long-term storage, and payment processing.

Integrating Crypto Wallets into Your Ecosystem

Seamless integration is an important factor when incorporating a crypto wallet into your business operations. The level of integration can range from crypto payment API solutions to frontend-only implementations, each with its own set of considerations.

Evaluate the wallet provider’s compatibility with their existing technology stack, including accounting software, payment gateways, and enterprise resource planning (ERP) systems. A smooth and secure integration process will ensure that your operations run efficiently and effectively.

Closing Thoughts

In recent years, the acceptance of cryptocurrency as a form of payment has become increasingly popular among businesses. With its numerous benefits, including lower transaction fees, faster processing times, and global accessibility, it’s no surprise that companies are eager to implement this new technology into their business models.

However, as cryptocurrencies are a relatively new asset class, businesses must learn to store digital assets securely. Just like with traditional bank accounts, businesses should avoid keeping all of their cryptocurrency in one place. Instead, it’s recommended that they have multiple wallets designated for specific purposes.

FAQ

How do I set up a crypto wallet for my business?

Setting up a crypto wallet for your business can be a simple process. First, choose the type of wallet you want to use. Then, adhere to the guidelines given by the wallet provider to register an account and safeguard your capital. With your wallet ready to go, you are equipped to begin receiving payments in cryptocurrency.

Can a business have a crypto account?

Yes, businesses can have a crypto account. In the US and many other countries, business entities have the legal capacity to own and use crypto accounts for various purposes, such as payment transactions, investments, and hedging against market volatility.

However, businesses need to comply with all relevant laws and regulations regarding cryptocurrency in their respective jurisdictions, including proper record keeping, tax reporting, and following AML and KYC procedures.

How can my small business accept cryptocurrency?

To start accepting cryptocurrency, you will need to set up a digital wallet that supports the type of currency you wish to accept. Alternatively, you can refer to a third-party payment processor that can handle cryptocurrency transactions on your behalf. Once you have set up the necessary infrastructure, you can then market and advertise your acceptance of cryptocurrency to attract potential customers who prefer this form of payment.