How to Create a Sound Cryptocurrency Exchange Business Plan

Cryptocurrencies are steadily cementing their place in the global financial ecosystem. Cathie Wood, Ark Invest’s founder, projects a staggering potential for the price of Bitcoin to reach $1,500,000 by 2030, a 24-fold increase from its current levels.

Despite drawing interest from the world’s most prominent financial powerhouses and increasingly becoming a standard payment method, it’s evident that the market is still at its dawn. That’s why entrepreneurs who start their businesses this early will gain an immeasurable advantage in the digital asset market.

Today’s era commands cutting-edge strategies for running businesses and generating wealth. Although launching a cryptocurrency exchange is inherently challenging, fortune favours the bold. The key is to formulate a foolproof cryptocurrency exchange business plan that can guide your startup toward success. This article aims to equip you with tips and guidance on creating one for your future startup.

Key Takeaways

- A comprehensive business plan serves as a guide for business expansion, helps forecast future cash flows, and is a prerequisite for securing funding.

- The plan should cover critical components such as company description, product and services, market analysis, and a comprehensive financial plan.

- Regular financial performance comparisons, addressing management structures, and including critical details strengthen the plan and prepare the venture for securing finances.

Why Does Your Exchange Need a Business Plan?

The necessity of a business plan for your cryptocurrency exchange cannot be overstated. Like a blueprint, a business plan outlines clear, precise details about your exchange’s scope, objectives, and structure. Before delving into the specifics of creating a business plan, let’s first discuss the reasons why such a plan is essential for your exchange.

A Guiding Map for Business Expansion

A well-detailed business plan acts as an operational compass. The business landscape is continually changing due to economic fluctuations, evolving technologies, regulatory developments, and the emergence of new competitors.

Failing to have a clear strategy in this dynamic environment equates to navigating a stormy sea without a map or compass, which is perilously risky. Therefore, a substantial cryptocurrency exchange business plan is indispensable for sustainable growth and success.

To build a robust plan, evaluate your current position (if you’re already running a business) and envision where you intend to steer your platform in the upcoming several years. Once your destination is clear, you’ll need to define:

- the resources you require to reach your target;

- the pace at which your exchange should evolve to achieve your milestones;

- the potential risks you’re likely to encounter during your journey.

Forecasting Future Cash Flows

An effective business plan provides foresight into future financial flows. Regularly aligning your actual financial performance with the forecasts in your business plan enables you to systematically audit your exchange’s financial well-being and make prompt adjustments if needed. Such diligence helps you to identify and address potential fiscal hiccups, like unanticipated cash shortages, before they balloon into critical issues.

Additionally, it exposes growth potential, like surplus cash flow, that could be channelled into introducing new features or extending into new geographical regions. Maintaining regular check-ins with these financial comparisons allows you to make sound decisions regarding how much funding your platform may need or the surplus revenue you may generate from your main operations.

Securing Financing

A comprehensive business plan is a prerequisite for securing funding. Whether you’re a startup or an established platform, a meticulously crafted business plan is vital when seeking financial backing from investors and companies. Lenders and investors will scrutinise your blueprint to gauge whether their investment will yield desirable returns.

To confirm this, they will seek evidence that your cryptocurrency exchange has viable prospects for consistent growth, profitability, and crypto exchange revenue generation over time.

Preparing to Write Your Business Plan

As you gear up to draft your cryptocurrency exchange business plan, it’s essential to lay the groundwork by addressing certain foundational aspects:

- Clearly define your objectives—both for your cryptocurrency business and the business plan itself. What scale of success are you aiming for?

- Gain a comprehensive understanding of the cryptocurrency industry, the competitive landscape, and your potential clientele. Understanding these elements will aid in strategic planning.

- Identify the intended recipients of your business plan. Are they investors, potential partners, or other stakeholders? Understand their interests and apprehensions to tailor your plan effectively.

- Your choice of a business plan format should align with your goals and audience. Whether it’s a conventional, detailed format or a lean startup one, ensure it meets your objectives.

Key Components of a Cryptocurrency Exchange Business Plan

When crafting a compelling cryptocurrency exchange business plan, it is essential to include several crucial elements that serve as the pillars of your proposed venture.

These elements help paint a comprehensive, detailed, and holistic picture of your business. They cover every aspect, from the company’s overview to its forecasted financial health, ensuring all business bases are covered. Let’s take a deep dive into these imperative sections:

1. Executive Summary

As an intro to your business plan, the executive summary is where you encapsulate the key points of your entire plan. This section presents a clear, concise overview of what follows, acting as a glimpse into your cryptocurrency exchange business’s future.

What to Include:

Condense your entire business plan into one page, amplifying the facets of your cryptocurrency exchange business that would appeal to potential investors and creditors.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Your executive summary should paint a clear picture of what your cryptocurrency business brings to the table, who your target market is, and why you stand out from the crowd.

Additionally, a brief introduction of yourself and the key players in your business adds a touch of personality. Most importantly, realistic forecasts of your business’s performance will give your readers an idea of how they can expect your exchange to fare in the future.

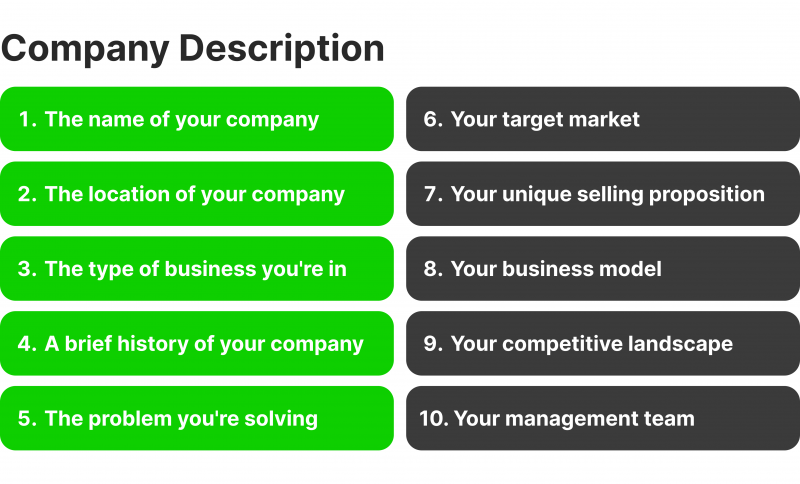

2. Company Description

The company description delves deeper into your business, allowing the reader to understand the nature of your cryptocurrency exchange. It dissects the company’s structure, ownership, location, and the team leading the helm. With this, stakeholders get a more granular view of your operation.

What to Include:

You should present a synopsis of the cryptocurrency exchange business model, its specifics about the proprietors, and their corresponding investments and ownership percentages. Do not forget about tax identification numbers, licences and permits. Provide an introduction to your executive team. Detail how many employees your company has, as well as their background and expertise.

Mission statements are also usually included in the company description. This is where you articulate the purpose of your business, highlighting its core principles and values.

3. Products and Services

This section becomes the highlight of what your cryptocurrency exchange business website will offer. Here, you unfurl your list of offerings, potentially including various types of cryptocurrency trades, digital wallets, crypto and fiat currency payment options, and supplementary services such as market analytics or automated trading modules.

What to Include:

Explain in detail the features and benefits of each product or service offered. Provide a comparison with existing competitors in the market, highlighting what sets your offerings apart.

Spotlight any unique aspects of your cryptocurrency platform. These could be things like low transaction fees, exclusive partnerships with trending cryptocurrencies, the capability to list in-demand or scarce coins leveraging your industry connections, bespoke customer support, or other distinctive qualities that set you apart from other crypto exchanges.

4. Market Analysis

This chapter involves an exhaustive study of your target market, customer profiles, competitor benchmarking, pricing strategies, and market trends. An insightful market analysis helps shape your business decisions and strategy.

What to Include:

Zoom into your specific target market. Clarifying their unique needs and illustrating how your services are the perfect fit. Subsequently, your business plan should identify the competition.

Also, address potential challenges and regulations applicable to your cryptocurrency exchange. This information will verify your understanding of the industry and exhibit your preparedness to operate within the legal framework.

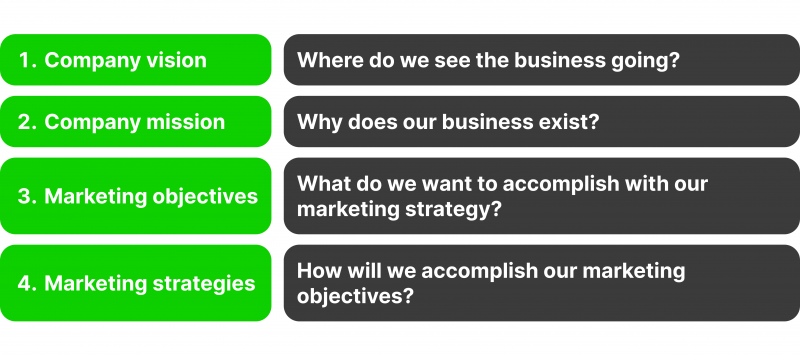

5. Strategy

Your business plan for crypto exchange should also include a detailed strategy section where you outline your approach to attracting and retaining customers and growing your business. Consider including information on marketing tactics, customer acquisition plans, pricing strategies, and potential partnerships or collaborations.

What to Include:

Outline your marketing strategy to illustrate how you plan to garner new users and maintain existing ones, perhaps through loyalty rewards or exclusive deals.

The pricing model segment should provide a clear-cut pathway on how you intend to balance steady profit margins while also offering competitive prices to incentivise new users.

Specify the potential challenges and solutions segment and identify any potential setbacks hindering your operation. Share your proactive solutions to mitigate these issues, thereby reassuring potential investors or lenders of your foresight.

6. Management and Organisation

This section lays down your company’s hierarchy and team structure. It should offer insights into the management team, their roles, responsibilities, and credentials. It tells the reader about the people steering the company towards its goals.

What to Include:

Delve into the human resource aspect – your team. Unveil your staffing model, delineate the cardinal roles, and discuss your recruitment strategy designed to fuel the growth projected in your business plan. Shed light on the desired qualifications and experience for each role and your recruitment process, whether via job boards, referrals or recruitment agencies.

Clarify the operational hours of your Bitcoin exchange, enabling the reader to evaluate the sufficiency of your staffing. Also, expound any plans to adjust these hours during high-traffic periods and how customer inquiries during non-operational hours would be handled.

Thirdly, pivot to the essential assets and Intellectual Property (IP) necessary for the business’s operation. Detail any dependencies on licences, trademarks, physical assets (equipment or property), or lease agreements.

Enumerate your prospective suppliers along with a detailed account of their services, key commercial terms – pricing, payment terms, contract duration, etc. Investors will appreciate understanding why particular suppliers have been chosen – whether for the superior quality of their products/services or prior business relationships.

7. Financial Plan

This critical part of your plan offers a roadmap to your business’s financial future. It includes projections for income, expenses, and profitability, underpinned by practical assumptions and in-depth market research.

What to Include:

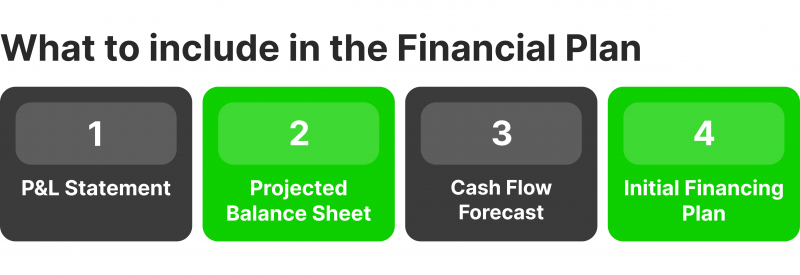

This financial roadmap consists of four pivotal components:

The Profit and Loss (P&L) Statement

The projected P&L statement offers a future financial snapshot of your business, helping stakeholders gauge expected revenues and profits. Key aspects that investors typically seek include growth surpassing inflation, expanding profit margins, and consistent net profit throughout the plan. Expectations would naturally vary for established businesses and startups.

Projected Balance Sheet

This pivotal fiscal document delivers a snapshot of your business’s economic health at any given time, comprising key components such as assets, liabilities, and equity. It is particularly crucial for lenders, investors, and other stakeholders aiming to analyse your crypto trading platform’s liquidity (short-term financial health) and solvency (medium-term debt repayment capacity).

Cash Flow Forecast

Understanding future cash flows is vital to ensuring your business’s success and operational longevity. The cash flow forecast in your plan should clearly indicate the cash generated or consumed by the business’s activities, invested in capital expenditure to maintain or expand the business’s capacities, and raised or distributed to financiers.

Assessing the cash flow forecast enables you to ensure that your business continuously has sufficient operating cash and aids in anticipating potential cash deficits.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Initial Financing Plan

Also known as the ‘sources and uses’ table, this tool is crucial to create a crypto exchange. It outlines where the setup capital will come from (sources) and how it will be spent (uses). This plan aids in deciphering the costs of setting up the exchange, understanding the risk distribution between shareholders and lenders, and determining the starting cash position.

Undeniably, a well-structured financial forecast is a mainstay of a sound cryptocurrency exchange business plan. Remember, it’s not just about the numbers; it’s about painting a clear, convincing picture of your business’s potential future to your investors.

8. Appendix

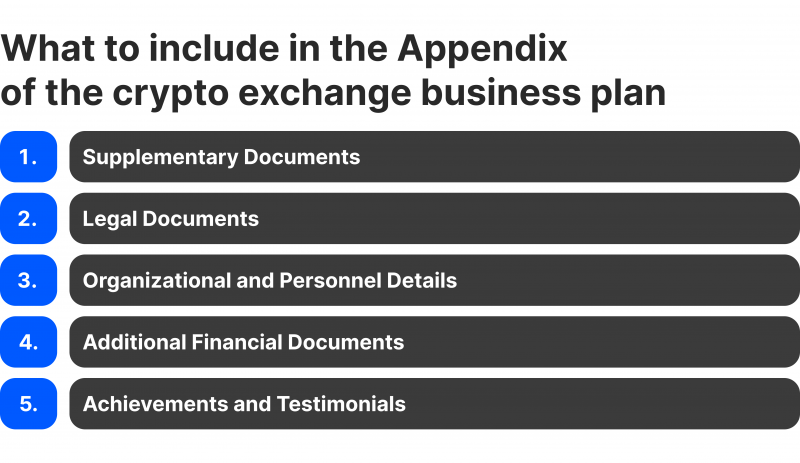

As part of your journey to creating a sound cryptocurrency exchange business plan, it’s crucial not to overlook the significance of the appendix. This element of your plan houses all additional documents that provide valuable context and support to the information detailed in your plan.

What to Include:

The broad range of inclusions can consist of, but is not confined to a record of your credit history, professional resumes, all pertinent legal forms, supplier contracts, etc.

How to Fundraise Money for Crypto Business Ideas

One significant challenge in establishing a cryptocurrency exchange business is addressing the funding issue. The initial excitement about starting the business soon gives way to the realisation that substantial financial resources will be needed due to the essential requirement of exchange software for such a business. The cost may vary, but it’s inevitable.

The good news is that, unlike other sectors, the cryptocurrency business enjoys the support of numerous benefactors ready to lend a helping hand. However, it is advisable to have a foundation of funds for a business startup.

Alternatively, beginning a fundraising campaign through an Initial Coin Offering (ICO) is another excellent strategy to raise capital for future crypto exchange development and marketing (alternatively, there are Initial Exchange Offering (IEOs), Initial Decentralised Offerings (IDOs) and other methods of fundraising in the crypto industry). The process involves creating a new cryptocurrency token and selling it to investors in exchange for funding. It allows you to tap into the fast-growing crypto market and establish your exchange business.

Another way to fundraise is through venture capital (VC) firms specialising in blockchain and cryptocurrency companies. These firms can provide financial support, valuable guidance, and connections within the industry.

Closing Thoughts

Starting a cryptocurrency exchange is a challenging yet rewarding endeavour. It’s a journey filled with complexities—from understanding the volatile crypto market and crafting a robust business plan to ensuring legal compliance, building a secure platform, and continuously engaging with customers.

Remember, your business plan is more than a document to attract investors or secure a loan. It’s a roadmap that outlines how you plan to start and grow your cryptocurrency exchange.

FAQ

What's the future of cryptocurrency exchanges?

Given the growing acceptance of cryptocurrencies, the future of cryptocurrency exchanges looks promising. Advances in technology, regulatory clarity, and increased adoption among institutional investors are expected to drive further growth.

Where can I find the best software for a crypto exchange?

If you’re on the lookout for top-notch software for crypto exchange platform, you can either build custom software by recruiting a team of developers or save time by opting for a ready-to-use, white-label solution.

Custom software, although more costly, grants you greater control and customisation. On the other hand, white-label solutions are pre-developed and include essential features such as a user interface, admin panel, and wallet services. They’re generally more economical and ensure a speedier launch. Both options are designed to handle high-volume transactions smoothly and provide a user-friendly trading experience.

Is the cryptocurrency exchange business profitable?

Indeed, the exchange business can be highly profitable. The earnings can fluctuate significantly as the value of Bitcoin itself has shown dramatic shifts over the years. The startup cost for developing your own crypto exchange ranges from $9,000 to $350,000, and top exchanges have been known to generate up to $3 million per day.

Each transaction on an exchange can bring in profits, with costs to users for transactions typically ranging from 0.2-1% of the withdrawal. Ultimately, gaining users’ trust and maintaining a steady stream of transactions is key. While no specific profit can be guaranteed due to varying factors, potential earnings can reach large sums if managed well.