How To Trade ETFs: Top 5 ETF Investment Strategies

Exchange-traded funds are tools that can help you reach your investing goals. Using ETF trading strategies, you can make more money and handle risks more effectively. In this article, we will discuss what ETFs are and how you can invest in them.

Key Takeaways

- Many types of ETFs exist, and you can trade them on a stock market.

- Trading strategies can be grouped by investment period, activity, and risk level.

- Some commonly used ETF trading methods are swing trading, seasonal trend trading, asset allocation and more.

Understanding ETFs

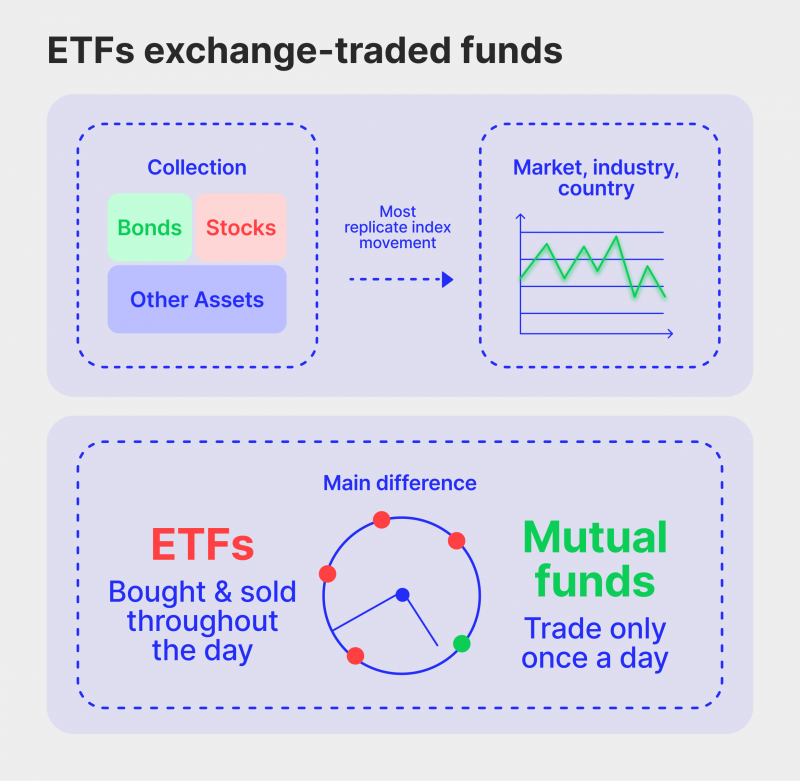

ETFs are investment funds that can be purchased on a stock market. An ETF is a collection of investments that you can put your money into. Buying a share of an ETF is equivalent to purchasing a security and means that a buyer has a portion of the ETF’s portfolio.

ETFs can track the performance of different asset categories, such as stock indices, company shares, bonds, commodities, currencies, etc.

ETFs are like mutual funds, but there is a significant difference between them: collective funds can only be bought or sold at the end of the day, while ETFs can be traded like shares anytime during the trading day.

There are many types of ETFs, and the number is growing constantly. Each exchange-traded fund has its characteristics; let’s explore some of the most common.

Index ETFs trace the performance of a specific index. These ETFs include, for example, S&P 500 ETF, Nasdaq 100 ETF, and DAX30 ETF. An index is an indicator that tracks changes in the price of a group of securities. This is a portfolio of securities grouped by some characteristics. For example, the S&P 500 ETF allows you to buy the American S&P 500 index, which includes 505 shares.

Bond ETFs provide access to almost all types of bonds, such as public, corporate, international, high-yield, etc. Meanwhile, commodity ETFs track the price movement of a particular commodity, such as gold, crude oil, etc.

There are also leveraged ETFs, which generate returns that can be multiplied by the index’s return daily. Leveraged ETFs use debt obligations, options, short positions and other methods to multiply the investor’s return. However, leveraged ETFs can magnify both gains and losses.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Overall, ETFs ensure the investor’s portfolio is diversified and professionally managed. Additionally, ETFs are very cost-efficient and have low entry thresholds. You can use ETFs to achieve your primary investment goal with very little money, which can be especially essential if you are a beginner trader.

How ETF Trading Strategies Work

A method for putting money into various asset classes over a predetermined time period to generate a profit is an investment strategy. It’s a strategy for buying and selling stocks and other investments. The investment objective, time frame, instruments used, and regulations for purchasing and selling are all part of the investment objective.

With a concrete strategy, investors can control their emotions, adapt to changing market circumstances, choose the right assets to purchase and sell, and make other well-considered choices.

By adhering to the method, investors may better manage their portfolios and incur less risk.

There exist a lot of different trading approaches. They all can be grouped as follows:

- By investment period, the strategies can be long-term, medium-term and short-term. Long-term ones are considered to have no strict end date for the investment time (typically, these last 7-10 years).

- Trading strategies can be active and passive. An active one involves constant attention to what is happening in the market, for example, reacting to news, studying company reports and frequent portfolio rebalancing. A passive one does not require the active participation of the investor and implies a small number of transactions.

- By the risk level, the strategies can be high-risk, moderate, or low-risk. The higher the risk, the higher the income, but losses can also be significant. High-risk ones use instruments with potentially high returns — for example, shares of the second and third tier or high-yield yet high-risk bonds.

The main advantage of broad market ETFs is that they allow the investor to expand the boundaries of their investment portfolio by including instruments of international markets or those classes of instruments that are not represented in the domestic market.

Moreover, ETF trading strategies add to the diversification of the portfolio. Investing in ETFs covers various asset classes or sectors and can reduce the risk of over-investing in a single area or asset.

Selecting the ETF trading strategy depends on the investment goals, risk tolerance, and time horizons.

5 Best ETF Trading Strategies

There are many trade strategies for ETFs. To select the one that suits you best, you have to follow several steps:

- Decide on the investment period and the type of the strategy: whether it is an active or passive strategy, and whether you are ready for high risks.

- Define your investment goals.

- Select the main asset types to invest in.

Here are instances of some commonly used ETF trading strategies that might be helpful for both beginners and experienced investors.

Swing Trading

This is a strategy that benefits from substantial price swings over short periods. ETFs are ideal for this strategy due to their diversified nature and protection against price movement. However, they may not gain as much during upswings as single stocks. Swing trading targets short-term to medium-term price movements and uses technical and fundamental analysis to identify entry and exit points. ETFs with high liquidity and predictable trading patterns are often preferred for swing trading.

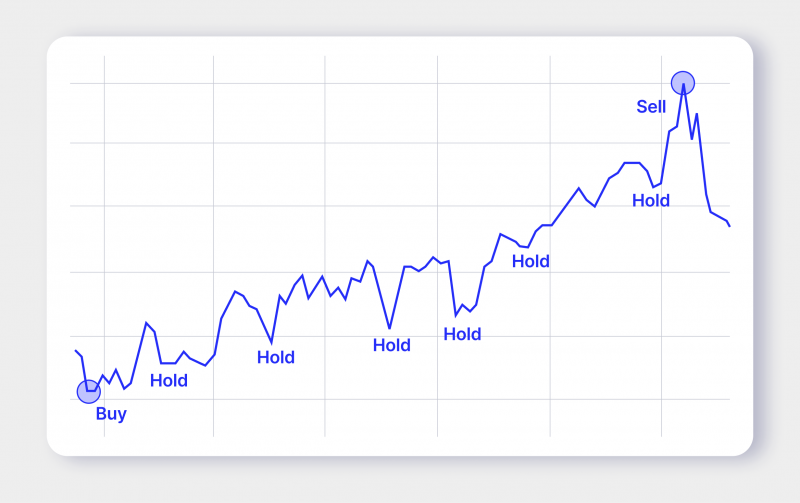

Buy-and-Hold Investing

This trading strategy means you buy and hold securities for a long time, typically ten years or more. ETFs are considered suitable investments for the long term because they are cost-efficient, diversified, and offer various options. Index funds with low fees, such as the S&P 500 ETF, have outperformed actively managed portfolios for ten years or longer. ETF fees are usually lower than those for most collective funds, making them a good choice for this strategy. The buy-and-hold strategy relies on believing that the markets generally increase and you can benefit from the growth of the assets.

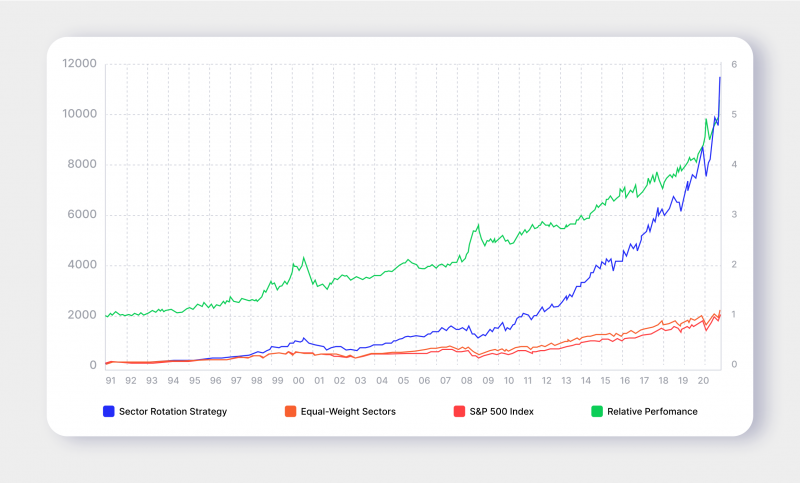

Sector Rotation

Experienced investors can use sector ETFs to handle their investments in different market areas, like technology, healthcare, energy, and banking. They can allocate some portion of their assets into areas they consider will do better than the overall market and then rotate (that is, sell and buy) other investment funds in those areas. This plan lets investors keep an eye on different sectors of the economy and change the ETFs they own depending on how well they think those holdings are performing. They can take advantage of changes in the economy and specific industries.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Seasonal Trend Trading

This trading strategy is similar to sector rotation, where investors try to follow seasonal market trends.

You can use ETFs for this strategy because you have to handle only a few ETFs instead of many individual stocks.

A beginner can make money by buying shares of a popular gold investment fund, like the SPDR Gold Trust, in late summer and selling them after a few months. However, it’s essential to know that seasonal trends don’t always happen as expected, so it’s a good idea to use stop-losses to limit the risk of losing money.

Asset Allocation

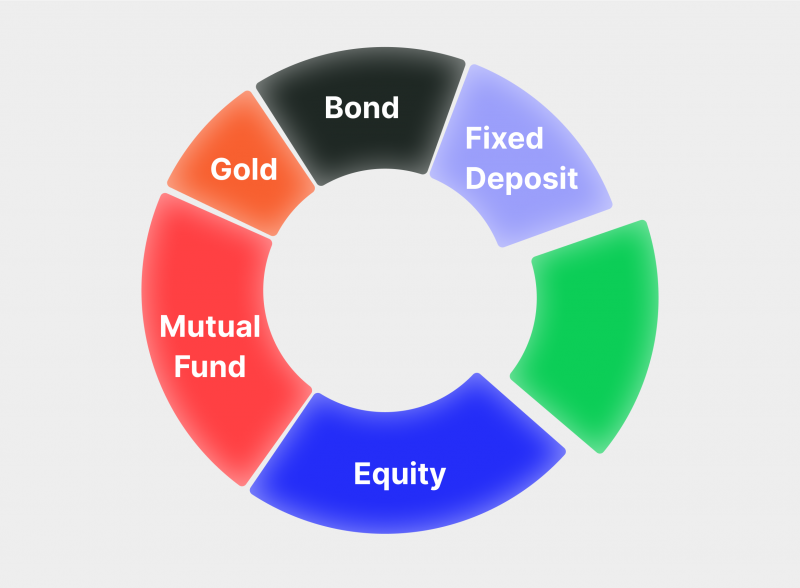

Allocating a portfolio’s resources among several asset classes is known as asset allocation. To create a portfolio, you must decide how to allocate your funds across various investment vehicles, such as stocks, bonds, commodities, and so on. Investing in ETFs is a wonderful method to diversify your holdings since you can access a wide range of asset classes at a reasonable cost. Even with a little sum of money, novices may get started investing in ETFs. They can choose a simple strategy based on preferred investment period and risk tolerance. ETFs can be used as the starting point for a well-rounded portfolio that includes all aspects of the selected market, with the stock market, bond market, and commodities all combined into one.

Final Thoughts

ETFs are a type of investment that anyone can use, whether they are new to the industry or have a lot of experience. There are many different ETF investment methods and ways to trade them. However, all of them are aimed at making money. To pick the best one, you need to decide what you want to achieve with your investment, how much risk you are comfortable with, and what kind of assets you want to invest in.

FAQ

What are ETFs and how do they differ from mutual funds?

ETFs (Exchange-Traded Funds) are investment funds traded on stock exchanges like stocks. Unlike mutual funds, ETFs can be bought and sold throughout the trading day, offering more flexibility and typically lower costs.

How does swing trading ETFs work?

Swing trading ETFs involves capitalizing on short- to medium-term price movements. Traders use analysis to find good entry and exit points, benefiting from the ETF’s liquidity and diversification to manage risks.

What are the benefits of using ETF trading strategies?

ETF trading strategies provide diversification, cost efficiency, and effective risk management. They allow investors to tailor their approaches to match their goals and risk levels, enhancing potential returns.

Recommended articles

Recent news