Presidential Election Cycle Theory: How Will Trump’s Win Affect Your Stock Portfolio?

Now that the US election results are out for a Republican win to Donald Trump, the financial markets are reacting to these outcomes. Each candidate presented their economic agenda, including taxes, tariffs and nationally important stocks.

The presidential election cycle theory plays a major role in market dynamics, dictating much of traders’ and investors’ decisions. So, how should you adjust your investment portfolio now? Let’s review.

Understanding The Presidential Election Cycle Theory

The theory suggests that after every US election, stocks go through a predictable pattern of slumps and surges, affecting equities’ returns and overall market valuation.

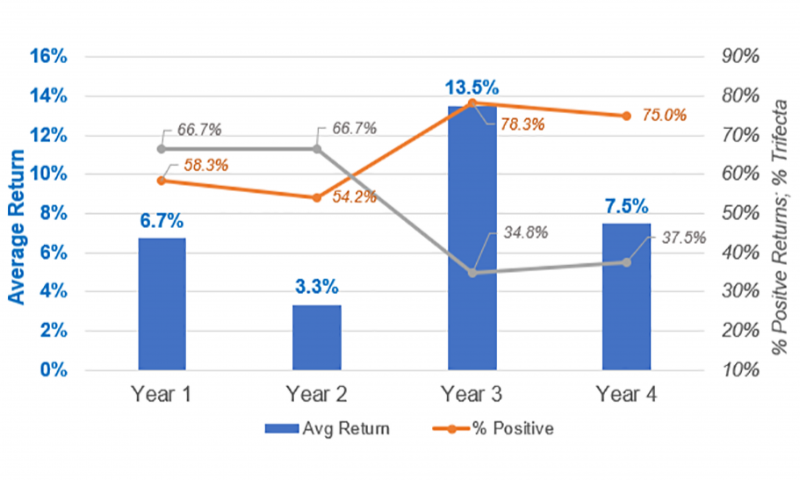

The 4-year presidential cycle in stock markets starts with a sluggish performance in the first two years after a new president is voted, followed by market growth in the third year, concluding with a slowdown in the fourth year.

The stock market analysist Yale Hirsch developed the theory in his book “Stock Trader’s Almanac” in 1967. The supposition was based on the fact that after a new president is elected, they tend to implement prominent agenda objectives and fulfil vital national security issues.

Then, when re-elections start looming, the focus is shifted to improving the economy and making decisions that benefit manufacturers and stock companies, leading to overall growth in the equity market.

Finally, new campaign agendas are presented, and the market participants speculate on the upcoming elections. Nevertheless, equities still experience an upward trend, though less than year three.

Historical Overview

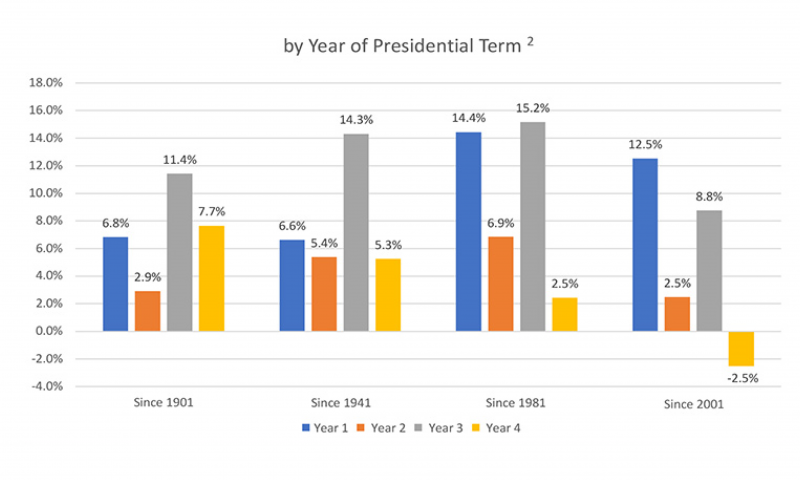

Some factors affect the cycle and do not guarantee it 100%. However, if we look at the historical performances of US indices, we see stocks after the presidential elections swinging between the two sides.

Charles Schwab researcher Lee Bohl analysed S&P 500 market data between 1933 and 2015 and found evidence that top US stocks included in this index follow this cycle.

Additionally, if we look at the NASDAQ index in the last two presidential terms, we see a similar display.

Explore Deeper Industry Insights

Learn from experts shaping the future of financial services — get the latest strategies and trends.

During the 2017-2020 term of Donald Trump, the NASDAQ 100 showed significant growth in the third year, which lasted until the fourth year. However, during the 2021-2024 US presidential election cycle, the third year presented massive returns of 53%.

US Elections Impact on the Economy

Many describe this election as one of the most crucial in the history of the United States due to the political, economic, social and financial challenges.

Coming back for a second presidency, Trump’s influence on stocks has been evident in the 2017 Tax Cuts and Jobs Act and the deregulation of energy and power sectors. On the other hand, Kamala Harris secured the Democratic nomination for Biden, who vowed to fix the Federal deficit and introduce new social programs if elected.

Let’s review Trump’s agenda in these sectors and how it will affect your portfolio.

Equities

Throughout his campaign, Donald Trump promised to boost national production and leadership in multiple economic areas, especially fossil fuels and energy production. This stance includes deregulation and fewer regulatory burdens on oil, gas, and coal extraction and production.

This will lead to more pipeline construction projects, new refinery drills, and extraction site discovery, meaning that stocks affected by the presidential election are more likely to be in the energy, power, and renewable energy sectors.

Tax Policies

Taxes have been a pivotal point in this election, and many attribute Trump’s victory to his promises on the Tax Cuts and Jobs Act (TCJA).

The TCJA brings the corporate tax rate down from 35% to 21%, which Harris planned to raise to 28% to finance social benefit programs and solve budget shortfalls.

Donald Trump promised to extend the TCJA upon its expiration in 2025, with plans to make it permanent. Moreover, he suggests lowering the corporate tax rate for domestic manufacturers to 15% to boost home production and job creation.

Other tax reforms include exempting social security benefits, tips and overtime earnings from federal taxes to increase disposable income and support the service industry.

Tariffs

Donald Trump is known for fierce competition with Asian markets, highlighted by his embargo wars and restricting tech product imports from Chinese companies. This time, his plans include a more rigid approach to increasing tariffs on Chinese goods to 60% to protect local companies.

Moreover, the plan is to set a universal tariff of 10-20% on all imported products to encourage local industries and production.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

This means that US tech companies and manufacturers are expected to experience a significant stock valuation, especially in year three, according to the presidential election cycle.

Conclusion

The dramatic US election was concluded in Donald Trump’s favour. Now, all eyes are on the promised agenda and fulfilling these promises.

The Republican candidate focuses on boosting local companies and industries by supporting domestic power and energy producers and US manufacturing firms to combat reliance on foreign products.

However, if you were to invest in US equities, the presidential election cycle theory suggests that most of these stocks will grow massively in the third year of the presidential term, offering lucrative returns in the long run.

Disclaimer: This article is for informational purposes only. It is not finance advice and should not be relied upon for investment decisions. Always do your own research and consult a financial advisor before investing.