Market Maker vs Market Taker: Key Differences Explained

International financial markets involve a complex interplay of strategy and execution. Two distinct participants, market makers and market takers, stand at the core of this activity. Their combined actions form the trading ecosystem’s foundation, driving liquidity, aiding price discovery, and ensuring markets operate efficiently.

But what truly sets these roles apart? Why is understanding their unique functions critical? This article defines market maker and market taker. It also explains the fundamental differences distinguishing these key financial entities and their operational models, particularly in Forex business models.

Key Takeaways

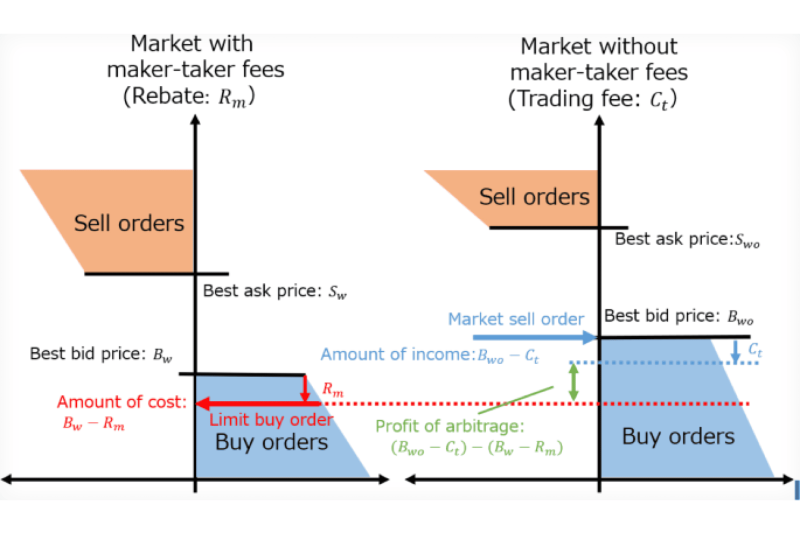

- Maker-taker fees, often called payment for order flow, incentivise liquidity providers by offering rebates for contributing to market activity.

- Market makers (“makers”) establish two-sided markets by consistently quoting both buy and sell prices. “Takers” then trade by accepting these posted prices.

- Takers who place market orders generally incur maker and taker fees for using available liquidity. In contrast, makers using limit orders can potentially earn rebates for adding orders to the book.

What is a Market Maker (MM)?

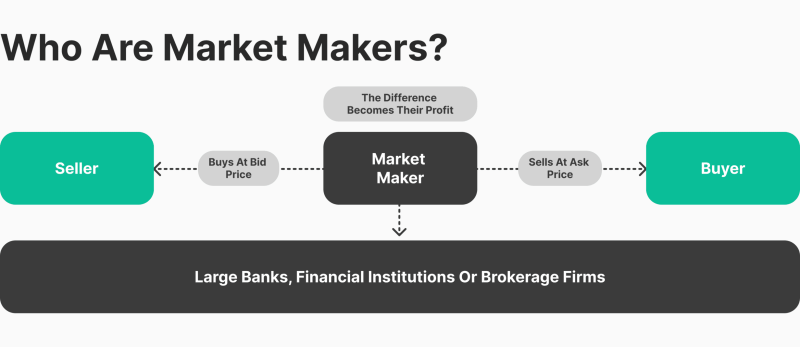

A market maker (MM) is a financial intermediary—often an institution—that directly provides liquidity to financial markets. They achieve this by continuously quoting both a buy and a sell price for a given security or instrument. These entities do not primarily aim to speculate on market direction; their main function is to facilitate trading activity for others.

MMs operate by publicly posting two distinct prices: a “bid” (the price they will pay for an asset) and an “ask” (the price at which they will sell an asset). The “bid-ask spread” is simply the difference between these two. This spread offers the MM potential profit from a round-turn transaction. It’s their compensation for the risk of holding an inventory and for their role in ensuring continuous liquidity.

The presence of market makers is vital for overall market efficiency. They work to ensure a counterparty is almost always available for traders wanting to buy or sell. This reduces delays and improves the quality of trade execution. This function becomes particularly important during periods of high market stress or volatility when natural liquidity might otherwise become scarce. A reliable market maker platform is essential for this activity.

Market makers can be individual professional traders, large brokerage firms, or major financial institutions. Consider equity markets: Designated Market Makers (DMMs) there have formal duties for specific securities, working to maintain orderly trading. For the Forex market, brokers often fill the role of market makers, ensuring constant pricing for currency pairs. High-Frequency Trading (HFT) has also profoundly changed market-making, and algorithms now perform a central function.

Introduced in the 1990s and early 2000s, the maker-taker model has become increasingly popular with the rise of algorithmic and high-frequency trading (HFT).

What is a Market Taker (MT)?

So, who acts as the counterparty to the market maker? This is the market taker. A market taker is any individual or entity executing a trade by accepting a price currently quoted by a market maker or otherwise available on the order book. Unlike MMs, who supply liquidity, MTs consume that liquidity by placing orders that match existing bids or offers.

Market takers often prioritise immediate execution. They generally use market orders, instructing their broker to buy or sell at the best available current price. This ensures quick transaction completion, a valuable feature in fast-moving markets where price opportunities can be short-lived.

The role of the market taker is integral to market function. By engaging with prices provided by MMs and the broader order book, takers facilitate the actual flow of trades. This interaction maintains market activity and contributes to price discovery, where the prevailing value of an instrument is shaped through ongoing transactions.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

However, consuming liquidity usually involves costs. Market takers frequently incur higher transaction fees than market makers. Many trading platforms apply a “taker fee” to orders that execute immediately against the order book. Additionally, understanding “what is a taker fee” becomes clearer as market takers may also face slippage risks during volatile periods, where the execution price differs from the expected price.

Key Differences Between Market Makers and Market Takers

Market makers and market takers play essential roles in financial markets, yet their functions, strategies, and impacts on market dynamics differ significantly. Below is a detailed explanation of the key distinctions between these two types of participants.

Role in the Market

Market makers fundamentally act as liquidity providers. They are constantly quoting both buy (bid) and sell (ask) prices for a financial instrument. Their core function is to ensure a counterparty is generally available for any trade. This facilitates smoother and more efficient market operations, preventing stagnation.

Market takers, conversely, are liquidity consumers. They accept the prices established by market makers or available in the order book to execute their trades immediately. Their primary function is to complete transactions by interacting with existing orders, thus facilitating the exchange of assets.

Impact on Liquidity

Market makers supply liquidity to the market. By continuously placing orders on both sides of the order book, they improve the availability of buy and sell options. Such enhanced liquidity usually results in tighter bid-ask spreads; trading then becomes more cost-effective.

Market takers consume liquidity. By executing against existing orders, they reduce the volume available on the order book. A large market order from a taker, for instance, can deplete sell–side liquidity, potentially causing price fluctuations. High levels of taker activity can contribute to wider spreads and increased volatility.

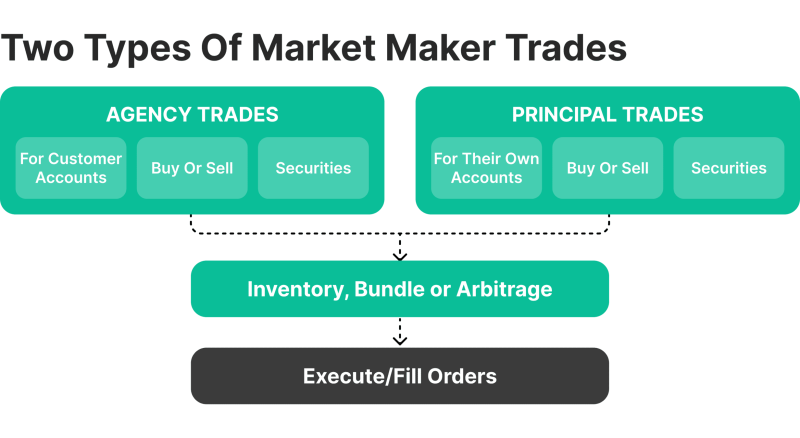

Order Types Used

Market makers predominantly utilise limit orders to post their bid and ask prices. These orders are not intended for immediate execution; they rest on the order book until matched by a market taker. This method allows market makers to strategically manage their inventory and earn the bid-ask spread.

Market takers generally use market orders. These are designed for immediate execution at the best available price. This approach prioritises speed. However, it often translates to higher transaction costs and potential slippage, particularly when liquidity is low or market volatility is high.

Revenue Model

Market makers mainly generate revenue from the bid-ask spread. This is the difference between their quoted buy and sell prices. For instance, quoting a stock at $50 bid and $51 ask allows them to capture the $1 spread if they facilitate trades on both sides. Separately, under the maker taker model, exchanges frequently offer rebates or incentives to market makers because they provide liquidity.

Market takers do not generate revenue directly from the spread in the same way. Instead, they incur transaction costs. These costs include the bid-ask spread and often specific “taker fees” for consuming liquidity. These maker and taker fees are generally higher for takers than for makers.

Influence on Price

Market makers affect prices when they continuously adjust their bid and ask quotes as market conditions change. Such actions can contribute to price stability. They also aid in the process of discovering a fair market value for the traded instrument.

Market takers influence prices through the execution of their trades. Large market orders, particularly in less liquid assets, can directly shift market prices. For instance, a substantial buy order may temporarily increase the price as it absorbs the available sell-side liquidity.

Risk Exposure

Market makers face continuous risk exposure due to holding inventory and maintaining two-sided quotes. They are vulnerable to adverse price movements in the assets they hold before they can complete an offsetting trade. To manage these risks, MMs employ sophisticated risk management systems and hedging strategies.

Market takers’ risks are generally confined to the specific trades they execute. Their primary concerns typically revolve around slippage (unfavourable price execution), increased transaction costs during volatile periods, and the difficulty of executing at desired prices when market liquidity is low.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Costs and Fees

Market makers often pay lower transaction fees; some exchanges even provide them with rebates. Exchanges offer these financial incentives because MMs supply liquidity. This practice encourages their active market participation and helps contribute to overall market stability.

The market taker model generally involves higher transaction costs. Many trading platforms charge a what is a taker fee for orders that consume liquidity. For frequent traders, this can represent a significant expense. Additionally, takers must overcome the bid-ask spread and may also incur costs from slippage.

Participation in Market Dynamics

Market makers actively shape market dynamics through their consistent placement of buy and sell orders. Their activity is crucial for ensuring markets remain functional, even during periods of low volume or high volatility. Without their presence, many financial markets would lack the depth needed for efficient operation.

Market takers drive market activity by executing trades. Their collective demand for buying or selling influences market trends and plays a role in price discovery. Without market takers, the liquidity offered by market makers would remain unused.

Conclusion

The relationship between market makers and market takers is symbiotic; it is the cornerstone of efficient market function. Market makers establish the framework of liquidity and pricing. Market takers provide the activity and volume that animate this framework. One cannot effectively function without the other.

FAQ

What is a market maker?

An MM is a participant who provides liquidity to financial markets by quoting both buy (bid) and sell (ask) prices for a security.

What is a market taker?

An MT is a participant who accepts the prices provided by a market maker or other traders to execute trades immediately.

How do market makers garner income?

MMs profit from the bid-ask spread. For example, if they buy a stock at $50 (bid) and sell it at $51 (ask), they earn $1 in profit.

What costs do market takers incur?

MTs typically pay transaction fees, known as taker fees, when consuming liquidity. These fees are generally higher than those for market makers.