Selecting the Safest Stablecoin to Accept as a Payment

Stablecoins now make up 10% of the cryptocurrency market, with 75% of digital asset owners holding them. Governments worldwide are legislating for stablecoin crypto transactions to be regulated, accelerating adoption and innovation. Despite their scale, some businesses view stablecoin payments as risky due to their outsider status.

In this article, we will answer the question, “Are stablecoins safe?” explore why a stablecoin remains stable, and discover the key factors that contribute to its safety. Also, we will present the list of the safest stablecoins in 2024.

Key Takeaways

- Not all stablecoins are backed by traditional fiat currencies; some of the tokens are pegged to commodities.

- Consider stability, liquidity, and regulations when choosing a stable token.

- BUSD, USDC, and USDT are some of the most secure and stable tokens.

A Brief Overview of Stablecoins

Stablecoins are cryptocurrencies pegged to fiat money, with the majority tied to mainstream currencies like the US dollar and euro. They are backed by actual reserves of fiat currencies, commercial papers, bonds, or other cryptos. The backing of a stablecoin determines its value, which in turn affects its likelihood of loss. The core idea behind stablecoins is to address the volatility of digital money, which can cause fluctuations in value.

Stablecoins offer several advantages, including a safe store of value, borderless transactions, low cost, and a competitive advantage over traditional services. Also, transaction fees are typically less than a dollar, providing a competitive advantage for businesses.

Stablecoins are considered the safest crypto assets due to their value changing alongside their underlying assets. However, they may lack transparency and low return on investment, making it difficult for businesses to sell crypto during market fluctuations. The blockchain industry is still developing, and the mindset of owning stablecoins is often influenced by the risk of de-pegging events.

Choosing the Safest Crypto Stablecoin in 2024

When choosing a stablecoin, several factors are crucial in assessing its safety.

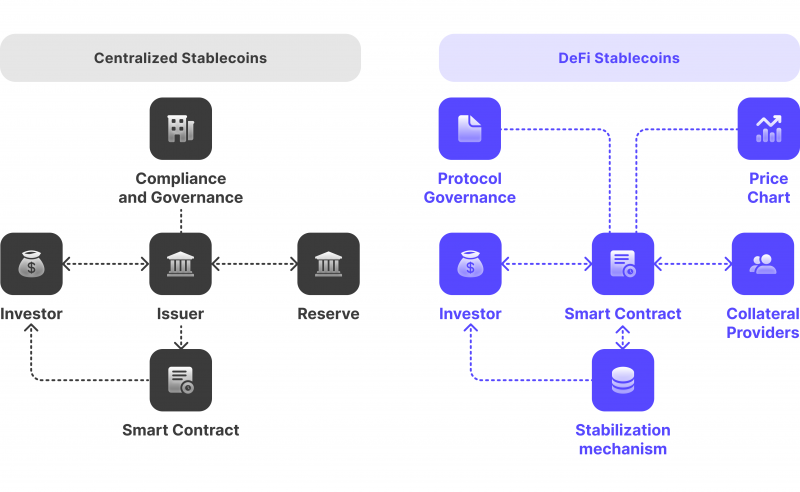

Stability

Stability mechanisms in stablecoins involve maintaining a peg to a stable underlying asset through collateralisation, algorithmic, or hybrid approaches. Collateralised fiat-backed stablecoins are considered more secure due to tangible assets backing them, while algorithmic stablecoins use smart contracts and algorithmic adjustments to control supply and demand. Hybrid stablecoins balance security and flexibility.

Transparency

Transparency and auditing are crucial for stablecoin credibility. Reputable stablecoin issuers should provide clear information about reserves, collateralisation ratios, and policies, allowing investors to verify their backing. Regular third-party audits ensure the stablecoin’s reserves match its supply. Independent audits and updated proof of reserves on an immutable blockchain also contribute to investor confidence.

Regulations

Choosing a safe stablecoin requires adherence to financial regulations like AML and KYC. Stablecoins that align with these frameworks are considered safer. Despite being in a regulatory grey area of the crypto market, centralised stablecoins like USDC and BUSD can receive approval from strict bodies like the NYDFS.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Liquidity

Liquidity and market presence are also crucial factors when assessing the safety of a stablecoin. A stablecoin with a market cap and high liquidity is likely to maintain its peg and offer a stable trading experience.

Historical Performance

To choose a stablecoin, consider the reputation, track record, and due diligence of the stablecoin issuer. Smart contract audits and security measures are crucial for decentralised stablecoins. Historical performance and risk management are also important, with companies’ reactions to historical performance issues being a major consideration. Tokens with minimal or no de-peggings are preferred.

Top 6 Best Stablecoin Options

What’s the safest stablecoin to invest in 2024? Also, you can select one from the list of the top 6 stable tokens highlighted for their safety. Let’s take a closer look at each of them.

Dai (DAI)

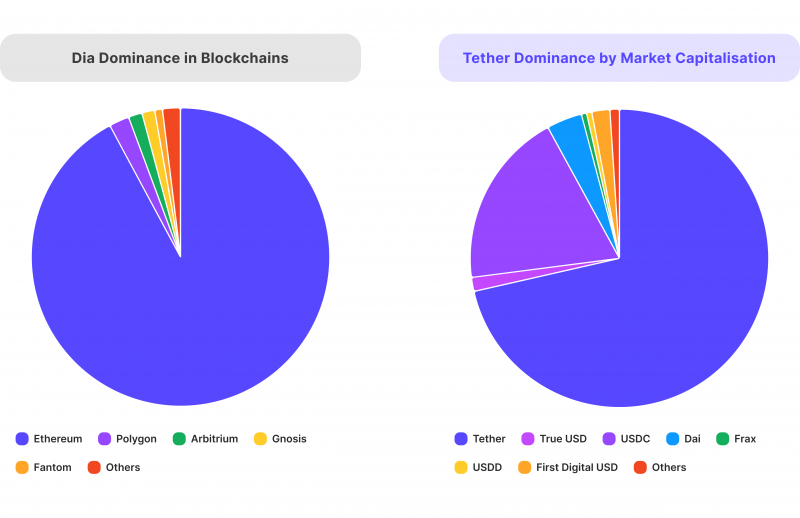

Dai, a decentralised stablecoin pegged to the US dollar, was created by Maker DAO on Ethereum’s Mainnet in 2014 to enable global participation in the economy. Dai’s stability is ensured through a sophisticated system of algorithms and incentives. Its market capitalisation is now over one billion dollars, making DAI one of the largest tokens in the market.

DAI is collateralised through other digital currencies, like ETH, and is an algorithmic stablecoin, with no one entity controlling a significant portion of its reserves. Users must deposit and stake ETH into a smart contract to “mint” new DAI tokens.

If the price exceeds $1, users can generate more DAI by adding collateral, while if it falls below $1, they can buy and eliminate DAI to decrease supply and increase its value.

Tether (USDT)

Tether, one of the major stablecoins in the cryptocurrency ecosystem, was launched in 2014 and now has a market capitalisation of over $110 billion.

The value of the largest stablecoin is pegged to the US dollar and is maintained through various finance instruments held in reserve. Tether is not regulated by major bodies, but developers believe this will change in the future. The company maintains a 1:1 ratio of USDT and equivalent cash reserves, a key metric of security for pegged stablecoins. Tether’s massive supply makes it less likely to destabilise due to high net-worth individuals.

However, Tether has faced criticism concerning its reserve adequacy and potential risks from regulators cracking down on its unlicensed status. Despite these issues, Tether remains popular for hedging against market volatility and facilitating seamless cash transfers without converting to fiat currency. Tether is the most widely-used stablecoin, but is often viewed as risky due to its past.

Binance USD (BUSD)

BUSD, the official stablecoin of Binance is pegged 1-to-1 to the US dollar. BUSD is a joint venture between Binance and Paxos Trust, a global asset-backed crypto issuer. BUSD is one of the few stablecoins fully regulated by the NYDFS due to its strict compliance and regular audits.

BUSD is widely used in the Binance Smart Chain (BSC) DeFi landscape, as well as in trading various BSC cryptocurrencies. As a stablecoin tied to the US dollar, it ensures stable prices and is less volatile than other cryptocurrencies.

However, BUSD is linked to the Binance exchange, which faces regulatory uncertainty and allegations of criminal fund laundering. This connection poses a credibility risk and could freeze addresses.

USD Coin (USDC)

USDC, managed by Circle and deployed on the ETH blockchain, has over $32 billion in circulation and is considered the safest stablecoin on the market.

The coin operates on the ETH Blockchain, is backed by 1:1 US dollar reserves, and is the second-most traded stablecoin, with 24-hour trading volumes of $5 billion. USDC is transparent, with regular audits proving 100% USD reserves. It is one of the few stablecoins to receive New York regulatory approval. The stablecoin achieves decentralisation through collaboration with other major businesses, each holding its own 1:1 USD/USDC cash reserves.

However, USDC’s structure can be a weakness, as it relies on third parties to issue and maintain reserves. Thus, USD Coin experienced its first de-pegging event in March 2023 due to the collapse of Silicon Valley Bank.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

PAX Gold (PAXG)

PAX Gold, an ERC-20 token on the ETH blockchain, is developed by Paxos and is backed by physical gold reserves. Launched in 2019, it is the leading stablecoin supported by commodities, with each token backed by a 400-ounce London Good Delivery gold bar, kept in vaults and approved by the NYDFS. The price of PAXG correlates with gold’s market value, making it a safe option for new stablecoin market investors.

aUSDT

Tether’s aUSDT is a smart contract-issued asset that combines the stability of the US dollar with the security of gold. It is a synthetic dollar, similar to Bitcoin-based Stablesats and Ethena Labs’ Ether-backed USDe. Unlike traditional stablecoins, aUSDT is over-collateralised by Tether’s tokenised gold (XAUT), backed by physical gold stored in Switzerland.

Tether plans to introduce XAUT as collateral in their upcoming digital asset tokenisation platform, ensuring transparency and stability through ETH-compatible smart contracts.

Closing Thoughts

Due to their peg to fiat currencies, stablecoins are considered more secure than other cryptos. However, they are not riskless, and individual security depends on the company issuing the stablecoin, the backing type, and potential future regulations.

To choose the safest stablecoin for your investments and start to accept stablecoin payments, take into account your risk tolerance and pay attention to such factors as stability, transparency, regulatory compliance, and track record.