Spot Algorithmic Trading – How to Automate Your Trades Successfully

The digitalisation of trading platforms was a remarkable development, facilitating investing for more market participants and lowering the entry barriers for brokers and traders. Moreover, the introduction of trading algorithms is considered far more effective.

Spot algorithmic trading allows investors to make instant decisions, contribute massively to market liquidity and make it easier to capitalise on marginal gain opportunities.

There are various venues where you can execute this advanced technique. So, let’s explain what does spot mean in trading and how automated algorithms make it superior.

Key Takeaways

- Algorithmic spot trading allows investors to improve their price analysis and trade execution in over-the-counter markets.

- Spot markets entail instant exchange of the traded asset, subject to settlement cycle and clearing house procedures.

- Spot trading with algorithmic capabilities lowers the margin of error and offers more reliable insights to make fact-based decisions.

What is Spot Trading?

Spot trading is buying and selling financial instruments and actually owning the underlying asset. It is also known as over-the-counter trading or cash markets because you physically own the product in a more direct way than other trading techniques.

Buying stocks in spot trading entails finding a seller to conduct the trade on the spot and transfer the security immediately. You can also find sellers through brokerage platforms that facilitate spot transactions for a large number of buyers and sellers.

Such trades go through various stages before arriving at the buyer’s possession, including clearing house, settlement cycle, post-settlement and finality.

Spot Trade vs Contract for Difference

The contract for difference and spot in finance work differently. CFDs are contractual agreements that speculate on the asset’s price and allow the trader to gain on the underlying security’s price fluctuations.

CFD traders do not physically own the instruments they buy. Instead, they gain or lose the price difference between the opening and closing market positions.

CFD transactions are more instantaneous, and assets are directly transferred. On the other hand, spot traders must wait for the settlement cycle that lasts 1-2 business days, depending on the asset.

As such, when buying stocks on the spot with a T+2 cycle, the transaction happens at the moment, but the assets are transferred in two working days.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

What Makes Spot Algorithmic Trading Beneficial?

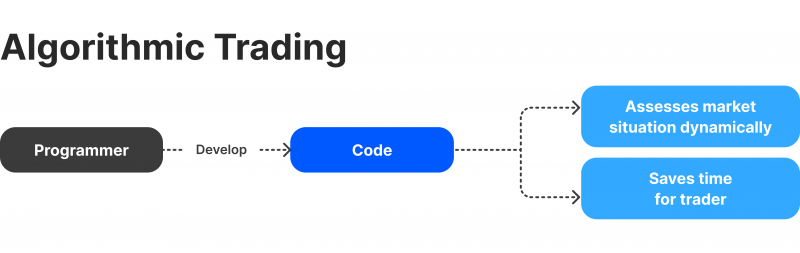

Algorithmic spot trading is another twist that makes this strategy much more effective. It implies developing and executing logical orders in analysing, trading and decision-making.

Automated spot trading relies on software to run algorithms and find the best market opportunities with minimum human interference. These developed machines will find gain opportunities, determine the entry points, execute traders, and exit the market whenever suitable.

All these activities are triggered by variables entered by the trader that determine the course of action for each event. This makes trading much more seamless and effortless, especially for beginners who lack the analytical skills to make the right decisions.

Spot Algorithmic Trading Process

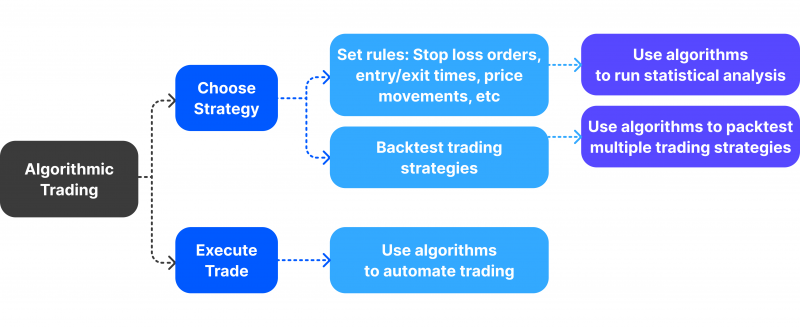

Automatic trading algorithms are coded and created by advanced developers who program these functions to take place according to traders’ instructions. Developers make this software editable, allowing investors to add their input, which dictates the course of action for each market event.

The algorithms are developed on the trading platform’s premise, where access to historical market data and price action is required to provide quick analytics. Real-time market feeds must be connected using API infrastructure to facilitate communication and receive market updates.

Traders add their input to the algorithmic spot trading software, indicating the entry price, take-profit & stop-loss limits, preferred markets and assets and position size.

Algo trading in spot markets works similarly to HFT trading, which involves using advanced systems to execute large orders at a rapid speed. Institutional investors and experienced traders use these tools to manage multiple trading positions and multiply their income streams.

Prop trading firms and hedge funds use algorithmic spot trading to provide accurate analytics to their clients and improve their chances of landing gainful positions.

Key Benefits to Algo Trading in Spot Markets

Is spot market algorithmic trading the best way to capitalise on market gains? What makes this technique highly desirable to investors and institutions? Here’s what you can expect.

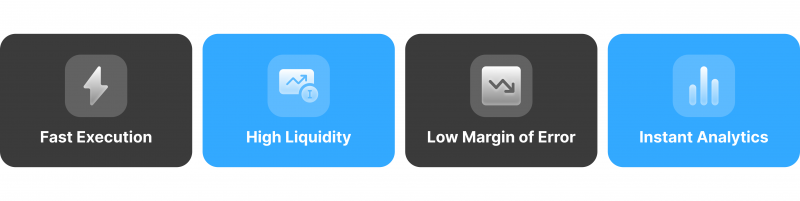

Fast Execution

Algorithms collect, process and analyse massive data within seconds or even milliseconds, making them capable of delivering predictions and information faster than any experienced trader.

Moreover, automated trading instantly adjusts to new market conditions and continuously finds lucrative opportunities as quickly as possible. This fast approach minimises price slippage and offers the best spread by scanning a broad range of order books and pools.

This feature comes in handy for highly volatile markets, such as cryptocurrencies, where every second matters and digital coins change their market prices rapidly.

High Liquidity

More investors demand spot trading markets with the increasing need for real asset ownership. This trend renders these markets more liquid, offering favourable trading prices and low spread rates.

Algorithmic trading systems scan a significant number of order books to find the best matching order to capitalise on price differences and minimise the chance of slippage.

Additionally, the frequent buying and selling instantly using algorithms makes assets highly available for other market participants and more liquid.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Low Margin of Error

Using automated machines to analyse and process trades minimises human errors and provides more accurate results. These systems understand and provide predictions over huge datasets quickly. Such activities can take hours and days if done by a trader.

Instant Analytics

Making the right investment requires accurate and fast analytics, especially in volatile markets. Using algorithmic spot trading capabilities provides traders with market insights and predictions quickly and accurately to make correct decisions.

Although financial markets cannot be 100% predicted, algorithmic trading software can increase the chances of making the right call at the right time.

Advantages and Disadvantages of Algo Spot Trading

Before hiring and setting up your own algorithmic spot trading software, it is crucial to note that there are pros and cons when using such an intricate trading system. Some of these challenges offset the benefits. Let’s explore these advantages and disadvantages.

Advantages

- Ultra-fast processing and executing speed that exceeds that of humans, allowing investors to capitalise on market trends faster.

- Making emotion-free decisions that are not affected by fear or greed but are rather based on data and inputs.

- Processing large datasets of selected timelines and historical data within seconds to make informed decisions.

- The ability to scale trading practices to multiple positions and diversify a trader’s investment portfolio.

- 24/7 market observation without requiring a break, especially during overnight activities.

Disadvantages

- The complexity does not suit any trader, especially beginners or those with no access to advanced trading technologies.

- Advanced development knowledge is required to design and program the spot trading algorithms.

- Overreliance on automated trading capabilities can diminish the trader’s analytical and decision-making skills.

- Software bugs and network disconnections can pose massive risks to the trader’s position.

Conclusion

Spot algorithmic trading strategies involve using advanced systems to execute trades in the over-the-counter markets. Spot trading entails buying and selling financial securities and owning the underlying asset. Embedding advanced algorithmic trading in these markets offers rapid analytics, faster execution and more reliable predictions.

This approach makes the spot market more accessible for investors, especially inexperienced ones, allowing them to automate their trading activities and lower human interference and error.