Spread Betting: What Is It, And How Does It Work?

Imagine being able to profit from the price movement of the world’s biggest markets — whether they’re soaring to new heights or spiralling downward — without ever owning a single asset. Welcome to the world of spread betting, a unique form of trading where speculation, strategy, and flexibility meet.

Popular mostly in the UK, spread betting offers an enticing combination of tax-free profits (in certain regions), leverage, and access to global markets around the clock. Want to profit from a bull market? Bet on the rise. Think prices are about to plunge? Bet on the fall.

It’s a high-stakes way to engage with the markets, but one where smart strategy and risk management can make all the difference.

This article will explain what spread betting is and its characteristics. You will also learn about the main mistakes market participants make when working with this strategy and the best strategies to get the most out of it.

Key Takeaways

- Spread betting enables traders to speculate on the direction of a financial market without owning the underlying asset.

- Often promoted as a tax-free and commission-free way to invest, spread betting allows participants to take positions in both rising (bull) and falling (bear) markets; however, it is currently prohibited in the United States.

- Like stock trading, the risks involved in spread betting can be managed through tools like stop-loss and take-profit orders, which help limit potential losses and secure gains.

What is Spread Betting?

Spread betting is a type of financial speculation that allows individuals to bet on the price swings of various markets — such as stocks, Forex, commodities, and indices — without owning the underlying assets.

Instead of purchasing a security or commodity, traders bet on whether its price will rise or fall. It’s popular in countries like the UK due to potential tax-free profits and flexibility, but it is also highly speculative and carries significant risks, especially when leverage is involved.

In spread betting, traders decide on the direction in which they believe an asset’s price will move without actually purchasing or selling it. For example, if a trader believes that a stock index will increase, they “go long” by placing a buy bet.

Conversely, if they expect the index to decrease, they “go short” with a sell bet. Unlike traditional investments, profits or losses are not determined by the amount invested but by the number of points the asset’s price moves in relation to the initial bet.

Every spread bet involves the “spread” — the difference between the bid (selling) and ask (buying) prices quoted by the provider.

This spread represents the cost of placing the trade, which traders must overcome to be profitable. When the market moves in the direction the trader has predicted, their profit rises proportionally to the points gained.

However, if the market moves against them, they experience losses in the same proportion. This mechanism allows traders to benefit from both rising and falling markets, giving spread betting flexibility that traditional investing does not offer.

Improved information access has limited arbitrage in spread betting, though it can still occur when companies set differing market spreads.

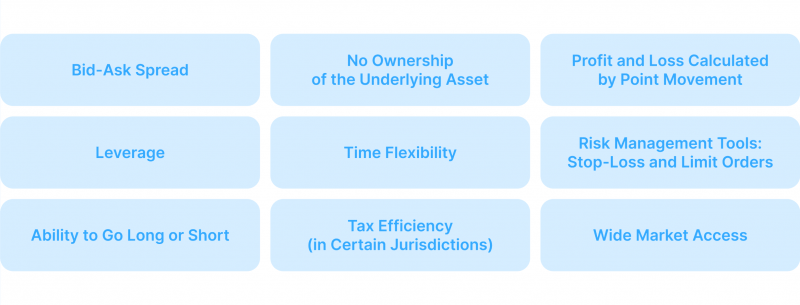

Key Features of Spread Betting

Spread betting is known for its unique characteristics, which differentiate it from traditional forms of trading and investing. Here are some of the most important features that make spread betting appealing to many traders:

Bid-Ask Spread

The “spread” in spread betting refers to the difference between the bid (selling) price and the ask (buying) price quoted by the spread betting provider. When traders open a position, they have to overcome this spread to make a profit.

For example, if the provider quotes a spread of $100/$102 for an asset, the trader would need the market to move beyond $102 to see a profit on a buy position or below $100 for a sell position. This spread acts as the cost of entering a trade and is a critical element in spread-betting profitability.

Leverage

One of the most attractive features of spread betting is leverage, which allows traders to control a prominent position with a small initial deposit known as a margin. Leverage amplifies potential gains and losses, as any price movement impacts a more prominent position size.

For instance, with a 10:1 leverage, a $1,000 deposit could control a $10,000 position. While leverage can lead to significant profits on small moves, it also increases the risk, meaning losses can exceed the initial investment.

Ability to Go Long or Short

Spread betting allows traders to profit from both rising and falling markets. If traders believe an asset’s price will increase, they “go long” (place a buy bet). If they expect the price to decrease, they “go short” (place a sell bet).

This flexibility to take positions on both sides of the market provides opportunities in various market conditions and allows traders to hedge existing investments or take advantage of downward trends.

No Ownership of the Underlying Asset

Unlike traditional investing, spread betting does not involve asset ownership. Instead, it’s purely speculative, based on the asset’s price movement. For example, if a trader bets on the price of a stock index rising, they do not own any shares in the companies that comprise that index.

This feature reduces costs associated with asset ownership, such as stamp duty, brokerage fees, and, in some regions, capital gains tax.

Tax Efficiency (in Certain Jurisdictions)

In some regions, such as the UK, spread betting profits are exempt from capital gains tax and stamp duty, making it a tax-efficient trading option. However, tax treatment varies by country, and traders must understand the tax rules applicable to their location.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

This tax efficiency can add to the appeal of spread betting, especially for short-term traders who look to maximise their returns.

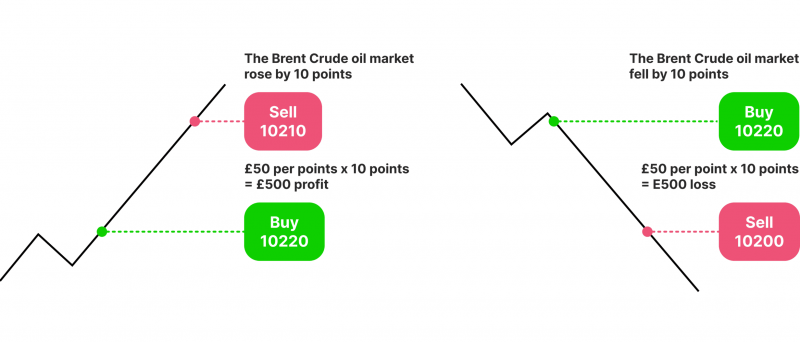

Profit and Loss Calculated by Point Movement

In spread betting, profits and losses are determined by the asset price movement in relation to the initial bet. Traders decide how much to stake per point (e.g., $5 per point) and then calculate profits or losses based on the difference in points between the opening and closing prices.

For example, if the market moves 10 points in the trader’s favour at a $5 stake per point, they make $50. If the market moves against them, they incur losses based on the same calculation.

Risk Management Tools: Stop-Loss and Limit Orders

Most spread betting platforms offer risk management tools such as stop-loss and limit orders to help traders control potential losses and lock in profits. A stop-loss order automatically closes a position once it reaches a specified loss threshold, protecting the trader from further losses.

Conversely, a limit order closes a position when it reaches a specified profit target, helping traders secure gains. These tools are essential in spread betting, especially given the high volatility and leverage involved.

Wide Market Access

Spread betting platforms provide access to a broad range of global markets, including stocks, indices, commodities, forex, and even cryptocurrencies. This diversity allows traders to find opportunities in different markets and diversify their trading activities.

For example, they might bet on forex pairs in the morning and shift to stock indices in the afternoon. This broad market access can be highly appealing for traders looking to capitalise on global market trends without opening multiple accounts.

Time Flexibility

Most spread betting providers offer round-the-clock market access, especially in forex and cryptocurrency trading. This allows traders to engage in spread betting at their convenience, even outside regular market hours, making it suitable for those with irregular schedules or those who wish to trade on international markets.

Common Mistakes in Spread Betting

Spread betting can be lucrative, but it also comes with substantial risks, especially for those new to this type of trading. Here are some common mistakes that traders often make, which can result in significant losses:

Over-Leveraging Positions

Leverage is a powerful tool in spread betting, allowing traders to control prominent positions with a relatively small deposit. However, over-leveraging or too much leverage can quickly amplify losses if the market moves against the position.

Many traders underestimate how swiftly small price movements can lead to significant losses when high leverage is involved. Managing leverage carefully and avoiding excessive exposure is crucial for long-term success.

Failure to Use Stop-Loss Orders

A stop-loss order automatically closes a position once it hits a predetermined loss level, helping to limit potential losses. Failing to set a stop-loss can leave positions vulnerable to rapid market swings, particularly in volatile markets.

Without this safeguard, traders risk substantial losses that can wipe out much of their capital. Using stop-loss orders and setting them at appropriate levels is essential to protect against unexpected price changes.

Ignoring Risk Management

Effective risk management involves controlling position sizes, setting realistic profit and loss targets, and using tools like stop-loss and take-profit orders.

Many traders get caught up in the potential for quick profits and ignore risk management principles, leading to a few bad trades eroding their entire portfolio. Risk management is essential in spread betting, where leveraged positions can magnify losses.

Chasing Losses (Averaging Down)

Chasing losses, or “averaging down,” occurs when traders increase their positions in a losing trade in the hope that the market will eventually turn in their favour.

This can be especially dangerous in spread betting due to leverage, as losses on a more prominent position can spiral quickly. Instead of chasing losses, it’s often wiser to accept small losses and wait for a new opportunity rather than risking more capital on a losing trade.

Emotional Trading and Lack of Discipline

Spread betting can be emotionally intense, with market volatility and leverage heightening excitement and stress. Emotional trading — driven by fear, greed, or frustration — can lead to impulsive decisions and a lack of discipline, such as abandoning trading plans, overtrading, or failing to stick to stop-loss levels. Maintaining discipline, following a well-thought-out strategy, and managing emotions are crucial for consistent performance.

Overtrading

Overtrading, or placing too many trades, can occur when traders feel compelled to be constantly active in the market. This behaviour is often driven by impatience or the desire for quick profits.

Overtrading can lead to excessive transaction costs, increased risk exposure and mental fatigue. Focusing on quality over quantity — seeking high-probability trades rather than frequent trades — is generally a more practical approach.

Neglecting to Analyse the Market

Some traders enter spread betting without conducting proper research or technical analysis, relying instead on hunches or following trends without understanding the underlying factors.

This lack of preparation can lead to poor decision-making. In spread betting, conducting thorough market analysis — such as technical analysis, chart patterns, or fundamental factors — is essential for informed decision-making.

Unrealistic Expectations

Many beginners enter spread betting expecting quick profits, especially given the appeal of leverage. However, spread betting is not a guaranteed path to wealth, and unrealistic expectations can lead to over-leveraging, poor risk management, and impulsive trades.

Setting realistic goals, being prepared for losses, and focusing on consistency over time can help traders build a more sustainable approach.

Not Choosing the Right Markets

Different markets (such as stocks, forex, commodities, and indices) come with varying levels of volatility, liquidity, and trading hours. Some traders make the mistake of choosing unfamiliar markets or ones that are too volatile for their experience level.

Understanding the characteristics of each market and selecting ones that align with their knowledge, experience, and risk tolerance can make a significant difference in trading outcomes.

Ignoring the Spread Cost

Since profits in spread betting are only realised after surpassing the spread (the difference between buy and sell prices), traders often overlook how this affects potential gains. In volatile or high-spread markets, the spread can eat into profits or even turn slight winning trades into losses. Awareness of the spread and factoring it into profit calculations is key to realistic and profitable trading.

Key Spread Betting Strategies for Success

While bid-ask spread betting carries significant risk due to leverage and market volatility, specific strategies can help traders improve their chances of success. Here are some key strategies that experienced spread bettors use to manage risk and maximise potential returns:

Trend Following

One of the most popular spread-betting strategies is trend following, where traders identify and follow the prevailing market direction. This approach involves analysing price charts to determine whether a market is trending upwards, downwards, or moving sideways.

By going long (buying) in an uptrend and short (selling) in a downtrend, traders aim to capitalise on the continuation of that trend. Tools like moving averages, trend lines, and momentum indicators (such as the Relative Strength Index or RSI) can help traders confirm trends and time their entries and exits.

Range Trading

In range trading, traders profit from markets moving within a defined price range, oscillating between support (the lower boundary) and resistance (the upper boundary) levels. When prices approach support, traders may place a buy bet, anticipating a bounce back to resistance.

Conversely, when prices reach resistance, traders may place a sell bet, expecting a pullback towards support. This strategy requires patience and precise timing, as traders must monitor the range closely and exit positions when the market nears the opposite boundary. Stop-loss orders are essential in case the market breaks out of the range.

Breakout Trading

Breakout trading is a strategy based on identifying points where an asset’s price breaks out of a defined range or trend line. This breakout indicates potential momentum in a new direction, allowing traders to catch a significant move.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Traders typically use support and resistance levels to mark potential breakout points. When a price moves above resistance, it’s a signal to go long, while a break below support is a signal to go short. To confirm a breakout and avoid false signals, traders may look for high trading volumes or wait for a close outside the breakout level.

News-Based Trading

Market-moving news, such as economic reports, corporate earnings announcements, and geopolitical events, can cause sudden price swings. News-based bid-ask spread trading involves taking positions based on how traders expect the news to impact the market. For example, positive earnings reports might push a stock’s price higher, while weak economic data may impact currency pairs.

To succeed with this strategy, traders must stay updated on relevant news and be prepared for rapid market movements. Given the volatility that news events can trigger, it’s essential to use tight stop-losses and manage risk carefully.

Scalping

Scalping is a high-frequency trading strategy where traders aim to make small profits from minor price changes over very short periods, often seconds or minutes. Scalpers open and close many trades throughout the day, aiming to accumulate small gains that add up over time.

Scalping requires quick reflexes, a keen eye on price charts, and access to a platform with fast execution. Since scalping is high-risk and intense, traders typically use tight stop-losses and focus on highly liquid markets with narrow spreads.

Swing Trading

Swing trading is a medium-term strategy where traders hold positions for several days or weeks, aiming to capture price “swings” within a more significant trend. This strategy focuses on profiting from short-term price fluctuations rather than attempting to follow long-term trends.

Swing traders often use technical indicators like moving averages, the RSI, and the MACD (Moving Average Convergence Divergence) to identify entry and exit points. Swing trading suits traders who can’t monitor the market constantly but want to exploit market movements.

Position Sizing

Position sizing is essential for managing risk and avoiding over-leveraging. Traders should determine the appropriate stake size based on their account size and risk tolerance.

A common approach is to limit each trade to a small percentage of the total trading capital (e.g., 1-2%), ensuring that no single loss significantly impacts the overall portfolio. Position sizing helps spread bettors withstand losing streaks and maintain their capital over the long term.

Keeping a Trading Journal

Maintaining a trading journal allows traders to track their performance, learn from their mistakes, and refine their strategies. Traders gain insights into their behaviour and strategy patterns by recording details such as the trade setup, entry and exit points, rationale, and outcome.

Reviewing the journal regularly can help identify areas for improvement, build on successful approaches, and eliminate recurring mistakes. This self-analysis can be invaluable for long-term success in spread betting.

Conclusion

Spread betting offers a unique and flexible way for traders to place bets on various financial markets without owning the underlying assets. With features like leverage, tax efficiency (in certain regions), and the ability to profit in both rising and falling markets, it appeals to many investors looking for new opportunities.

Success in spread betting requires discipline, consistency, and a commitment to continuous learning. By avoiding common mistakes, setting realistic expectations, and regularly analysing their performance, traders can build a sustainable approach to spread betting. For those managing the risks effectively, spread betting can offer a rewarding way to engage with global markets.

FAQ

How does spread betting differ from traditional trading?

In spread betting, you don’t buy or own the asset. Instead, you bet on the price movement.

Is spread betting tax-free?

In some regions, such as the UK, profits from spread betting are exempt from capital gains tax and stamp duty.

What is leverage in spread betting?

Leverage allows traders to control a more prominent position with a smaller deposit, known as a margin.

What types of markets can I bet on when spread trading?

Spread betting providers offer access to a wide range of global markets, including stocks, indices, commodities, Forex, and cryptocurrencies, providing ample options for diversification.