12 Best Forex White Label Solutions for Brokers in 2026

Global forex trading hit a record high in April 2025, with daily turnover exceeding $9.6 trillion. This level of activity creates a demanding environment for brokers and institutions.

For new and growing firms, building a full infrastructure from scratch becomes time-consuming and risky. Forex white label solutions provide a shortcut: they deliver a ready-made technology and compliance support under your own brand.

This guide explains what features define a reliable provider. You will also find a breakdown of the leading options for 2026.

Key Takeaways

- White label FX solutions let brokers enter the market fast with a ready infrastructure.

- Powerful trading infrastructure, risk controls, and deep liquidity access separate strong white label platforms from basic offerings.

- Pricing, scalability, and regulatory alignment remain the most decisive factors when choosing a long-term technology partner.

What Is a Forex White Label Solution?

A forex white label solution is a ready-made brokerage package that you operate under your own brand. The provider delivers the core technology, while the broker concentrates on commercial growth.

A complete white label trading software usually includes: the trading terminal, risk controls, a CRM for client management, and a back office for finance and compliance. All components work together as a single system, allowing your brokerage business to shape processes without worrying about the technology beneath.

To align terminology, it helps to fix a few core definitions:

- White label broker operates the business and brand while using another firm’s technology.

- White label platform is the trading and operations stack branded for that broker.

- Turnkey solution is a broader package that combines platform, liquidity, and supporting services so you can launch with a tested blueprint.

Key Benefits of a White Label FX Approach

White Label FX cuts the distance between idea and live brokerage. Here are the benefits of such a business model:

Brand Customization and Faster Launch

A white label framework lets you shape the client experience without touching low-level code. The platform carries your brand and product lineup, while the provider keeps the engine running in the background. Projects that would take a year of in-house work often compress into a few weeks of configuration and testing.

Cost Efficiency and Reduced Risk

White label adoption turns many upfront technology costs into clear operating expenses. You avoid long hiring cycles for engineering teams. Predictable pricing also helps with planning. Management can map platform costs directly against client growth, rather than guessing how much each new feature or upgrade will consume.

Access to Institutional Grade Liquidity

Strong white label partners open the door to deep, aggregated liquidity. They already connect to banks and market makers, then feed that access into your environment through a single integration.

Regulatory and Compliance Support

Regulation shapes every decision in a brokerage. A capable white label provider builds compliance into the architecture. They supply tools for onboarding checks, transaction monitoring, and record keeping that meet expectations in key jurisdictions. This removes much of the operational guesswork for new teams.

Your Brand, Our Technology

Get a fully branded trading platform with deep liquidity, CRM, and risk management tools, ready to launch in weeks.

Essential Features of a White Label Brokerage Platform

A white label platform lives or dies on its core features. Technology shapes how clients trade, how your team manages risk, and how easily you can scale into new products or regions.

Multi-Asset and White Label Stock Trading Platform

Power your Brokerage with Next-Gen Multi-Asset & Multi-Market Trading

Advanced Engine Processing 3,000 Requests Per Second

Supports FX, Crypto Spot, CFDs, Perpetual Futures, and More in One Platform

Scalable Architecture Built for High-Volume Trading

Modern brokers expect access to currencies, indices, equities, commodities, and often crypto instruments in one place. If the platform limits product range, you limit your addressable market and lifetime value per account.

Leading solutions handle this through a unified environment. B2TRADER, for example, supports a Unified Multi-Asset Account (UMAA). One account holds forex, stocks, crypto, commodities, and indices with cross-collateralised margin. That structure makes portfolio management clearer for both clients and dealing teams.

Robust Risk Management and White Label FX Tools

Risk tools decide how safely you grow. The platform must track exposure in real time, apply leverage rules without delay, and respect your A Book or B Book logic on every ticket.

B2TRADER adds control through adaptive commissions and swaps, together with Customisable Market Templates. You can tune pricing by client group, region, or instrument and align that with risk appetite and P&L targets.

Deep Liquidity and Aggregation

Deep, Reliable Liquidity Across 10 Major Asset Classes

FX, Crypto, Commodities, Indices & More from One Single Margin Account

Tight Spreads and Ultra-Low Latency Execution

Seamless API Integration with Your Trading Platform

Execution quality depends on how your platform sources and aggregates liquidity. Strong engines read multiple feeds and pick the best price at that moment. This keeps spreads competitive even when markets move quickly.

For brokers, a mature aggregation layer also simplifies connectivity. You plug in once and gain access to a curated set of providers, which is much more convenient than managing a web of separate integrations.

CRM and Back Office Integration

All-In-One CRM & Back Office for Brokers and Exchanges

Fully Customisable Trader’s Room with Modular Features

Built-In IB Module, KYC, Payment Integrations, and Reporting Tools

Intuitive Interface that Boosts Client Engagement

A white label stack only works when the front end connects smoothly to CRM and the back office. Onboarding and funding should sit in one coherent flow rather than in disconnected systems and spreadsheets.

Integrated workflows also help operational teams maintain accurate records for finance and regulatory reporting. With fewer disconnected tools, the brokerage reduces complexity and improves day-to-day coordination across departments.

Top 12 Best Forex White Label Solutions

This is a detailed review of the most capable white label providers for 2025, selected based on technology, liquidity quality, integration strength, support, and overall value.

1. B2TRADER by B2BROKER

B2TRADER is a multi-asset trading platform tailor-made for forex brokers and crypto exchanges. It supports diverse trading activities, ranging from spot cash transactions to leveraged crypto trading.

B2TRADER integrates with B2BROKER’s liquidity pool, giving brokers access to tight spreads and fast order execution.

Key Benefits

- Spot and Leveraged Trading: Flexibility to handle both traditional spot transactions and high-leverage crypto trades.

- Advanced Charting: Offers in-depth charting tools and customisable workspaces to adapt to different trading strategies.

- Dynamic Margin Engine: Real-time recalculations help brokers manage risk on the fly.

- Fast Deployment: Known for rapid setup, enabling brokers to be operational in days.

Pricing

B2BROKER provides tailored packages to suit individual brokerage requirements.

2. cTrader by Spotware

Developed by Spotware Systems, cTrader is lauded for its powerful suite of trading tools. Its accessibility caters to both novice users and professionals.

Solutions like cTrader White Label by B2BROKER let brokers customise the trading environment while benefiting from its growing trader community. If you’re looking to attract professional traders, this is a go-to option.

Key features

- Comprehensive Charting: Multiple timeframes, robust technical indicators, and Level II pricing data.

- Algorithmic Trading: cTrader Automate (via C#) facilitates the creation of custom bots and indicators.

- Social Trading: cTrader Copy lets users follow and replicate top-performing traders.

Pricing

White Label Setup Fee: $5,000

Monthly Fee from $2,000

Bring cTrader to Your Brand

Launch a cTrader White Label with our team and offer demanding traders a familiar, high-performance interface.

3. Match-Trader

Match-Trader, created by Match-Trade Technologies, emphasises cross-device integration and a seamless social trading environment. Using Progressive Web Application (PWA) tech, it offers a unified experience across web, desktop, and mobile.

Key features

- PWA Technology: Consistent user experience and immediate updates, no matter the device.

- Built-In Social Trading: Integrated feed and copy trading functions let novices follow the trades of more experienced users.

- Comprehensive Charting: A solid range of indicators and chart types for traders of all levels.

Pricing

Offered under a Broker-as-a-Service model with a fixed monthly fee from $2,000, depending on the number of active accounts.

4. Leverate

Leverate specialises in solutions that support forex, CFD, and cryptocurrency brokerages. Their product suite includes white-label versions of MetaTrader 4/5, plus their proprietary Sirix platform.

Key features

- Sirix Platform: A streamlined trading experience with built-in copy trading capabilities.

- CRM System: Specifically designed for forex brokers, aiding in client acquisition and retention.

- Liquidity Connections: Connects brokers with top liquidity providers for better spreads and order execution.

- Payment Solutions: Integrates with a global network of payment service providers.

Pricing

Specific pricing details are not publicly disclosed. Leverate provides quotes based on the chosen package and add-on services.

5. Quadcode Brokerage Solutions

Quadcode offers a ready-to-go platform for brokerage firms looking to cover multiple asset classes. It supports over 800 instruments, spanning forex, options, indices, commodities, and cryptocurrencies.

Key features

- High Uptime: Boasts an impressive 99.5% uptime for uninterrupted trading.

- Flexible Trading Models: Supports A-Book, B-Book, and hybrid approaches.

- Zero Extra Fees: Pay once for a comprehensive turnkey brokerage.

Pricing

Quadcode offers three structured packages: Basic at $25,000, Advanced at $37,000, and Full at $50,000.

6. Soft-FX

Soft-FX delivers a Forex Broker Turnkey solution combining a powerful platform and institutional-grade liquidity. Their proprietary TickTrader terminal supports web, Windows, Android, and iOS clients.

Key features

- Versatile Platform: Advanced charting, real-time data, and order book depth meet a range of trading needs.

- Multi-Language Support: Enables global accessibility for traders of various regions.

- Smooth Setup: Simplifies entry into the forex market with a comprehensive turnkey approach.

Pricing

One-time setup fee: €7,000-€25,000.

Monthly fee: €2,500-€6,500 per month.

7. X Open Hub

X Open Hub, regulated in the UK, provides multi-asset liquidity and advanced trading technology. Their platform and liquidity services cater to institutions and brokerage firms worldwide.

Key features

- Extensive Liquidity: Deep liquidity pool for over 5,000 global instruments.

- Customisable Platforms: Offers MT4/MT5 bridges alongside their proprietary xStation platform.

- Back-Office System: Features include advanced reporting, margin monitoring, and risk management tools.

Pricing

Pricing is available upon request.

8. Interactive Brokers White Branding

Interactive Brokers (IBKR) provides a comprehensive white branding program for brokers and professional advisors. Partners can incorporate IBKR’s Trader Workstation (TWS), Client Portal, statements, and PortfolioAnalyst, all under their own brand.

Key features

- Global Market Access: Reach over 150 markets across 33 countries.

- Advanced Platform Customisation: TWS supports a wide variety of instruments (forex, stocks, options, futures) and can be branded to match each partner’s identity.

- Robust Infrastructure: Real-time market data, extensive order management systems, and risk management tools.

Pricing

White branding fees are not publicly disclosed.

9. Saxo Bank White Label

Saxo Bank’s white label solution is aimed at financial institutions seeking to deliver comprehensive trading and investment services without building all the technology in-house.

Key features

- Wide Instrument Range: Over 71,000 instruments across forex, stocks, bonds, ETFs, mutual funds, and more.

- Proprietary Platforms: SaxoTraderGO and SaxoTraderPRO can be fully white-labeled, offering professional-grade charting and research tools.

- Scalability: Supports multiple client models: self-directed, advisory, and discretionary.

Pricing

Specific costs for the white label partnership are not publicly listed. Saxo Bank provides transparent transaction pricing on its website for most trading instruments.

10. FXCM

FXCM’s white label program caters to institutions aiming to deliver forex and CFD trading under their own brand. Partners can tap into FXCM’s liquidity, platforms, and back-office support.

Key features

- Multiple Platforms: Options include FXCM’s Trading Station and MetaTrader 4 (MT4).

- Back-Office Solutions: Comprehensive support for operations, risk management, and client service.

- Flexible Partnerships: Choose from various models to align with specific strategic goals.

Pricing

Pricing details aren’t publicly disclosed. Prospective partners are advised to contact FXCM for a custom quote.

11. UpTrader

UpTrader provides a CRM-centric white label solution built for brokers that need strong client management and flexible operational tools.

Key features

- Advanced CRM & Back Office: Tools for onboarding, verification, payments, and full operational control.

- Trader’s Room Across Platforms: A streamlined client portal for web and mobile.

- Liquidity Connectivity: Seamless integration options to connect trading platforms to external FX and crypto liquidity providers.

Pricing

Quotes are available upon request.

12. Tools 4 Brokers (T4B)

Tools 4 Brokers offers an all-in-one technology stack for brokers, prop firms and funds. Its ecosystem focuses on liquidity and operational automation.

Key features

- Trade Processor: A liquidity bridge with smart routing, private aggregation, and A/B-book switching.

- PAMM/MAM: Money-management tools for managed strategies with web and mobile access.

- TFB Toolbox: A central console for configuring plugins, automating tasks, and managing operational workflows.

Pricing

Pricing is customized and available on request.

How to Choose a Forex White Label Solution?

Choosing a forex white label provider means securing a long-term business partner that aligns with your operational goals. Here are the steps to choosing the best provider for your business requirements.

Define Your Business Model and Target Market

Before exploring WL providers, establish your brokerage’s business model and target clientele. Are you catering to retail traders or institutional investors? Do you want to focus on forex, or will you offer multi-asset trading? The answers determine the type of platform, liquidity depth, and risk management tools you’ll need.

Additionally, consider whether you want an A-Book or B-Book model. A-Book brokers act as intermediaries, forwarding trades to liquidity providers, while B-Book brokers take on client trades internally. Some providers specialise in one model, while others allow you to toggle between the two.

Ease of Deployment and Customisation

Time-to-market is a critical factor in launching a brokerage. The best WL solutions offer turnkey deployment, allowing you to go live in weeks. However, speed should not come at the cost of branding. A strong WL provider allows you to fully customise the platform, from the color scheme to trading conditions.

Liquidity and Execution Quality

Liquidity is the backbone of a forex brokerage. Poor liquidity can lead to negative trading experiences, which can drive clients away.

Your WL provider should offer access to deep, multi-tier liquidity pools from Tier-1 sources. Some solutions come with built-in liquidity aggregation, while others require separate third-party integrations.

When evaluating providers, ask:

- What is the average execution speed?

- Is liquidity aggregated from multiple sources?

- Are there any volume-based commission structures?

Technology and Scalability

A brokerage’s success is heavily dependent on the technology stack behind it. A sluggish white label trading platform will repel serious traders.

At a minimum, your WL provider should offer:

- Cross-platform trading (desktop, web, mobile)

- Multi-asset support (forex, stocks, crypto, CFDs)

- Advanced charting and analytics

- Risk management tools and reporting dashboards

Beyond these basics, consider the scalability of the solution. Will it support higher trading volumes as your client base grows? Does it integrate with external risk management systems or other modules?

Regulatory Compliance and Security

Regulatory scrutiny in the forex space is intensifying. Whether you’re operating in a heavily regulated jurisdiction (like the U.S. or Europe) or an offshore market, compliance should be your top priority.

Your WL provider should offer built-in compliance tools: KYC/AML verification modules, automated transaction monitoring, and risk assessment features. Some providers even assist with licensing and legal setup.

Cost Structure and Pricing Transparency

White label solutions range from budget-friendly entry-level packages to enterprise-grade systems with premium features.

Most WL providers charge:

- A one-time setup fee (ranging from $5,000 to $50,000)

- A monthly licensing fee (from $1,000 to $10,000)

- Additional costs for liquidity, regulatory compliance, and custom integrations

Some platforms operate on a revenue-sharing model, where the provider takes a percentage of your brokerage’s trading volume. While this may seem attractive for startups with limited capital, it can eat into long-term profitability.

Always request a fully transparent pricing breakdown to avoid hidden fees.

Customer Support and Training

Your WL provider should offer dedicated 24/7 technical support and ongoing consultation to help you navigate operational challenges. Many top-tier WL providers also offer marketing and business development support, helping brokers retain traders through promotional campaigns and affiliate program management.

Steps to Launch Your White Label Forex Broker

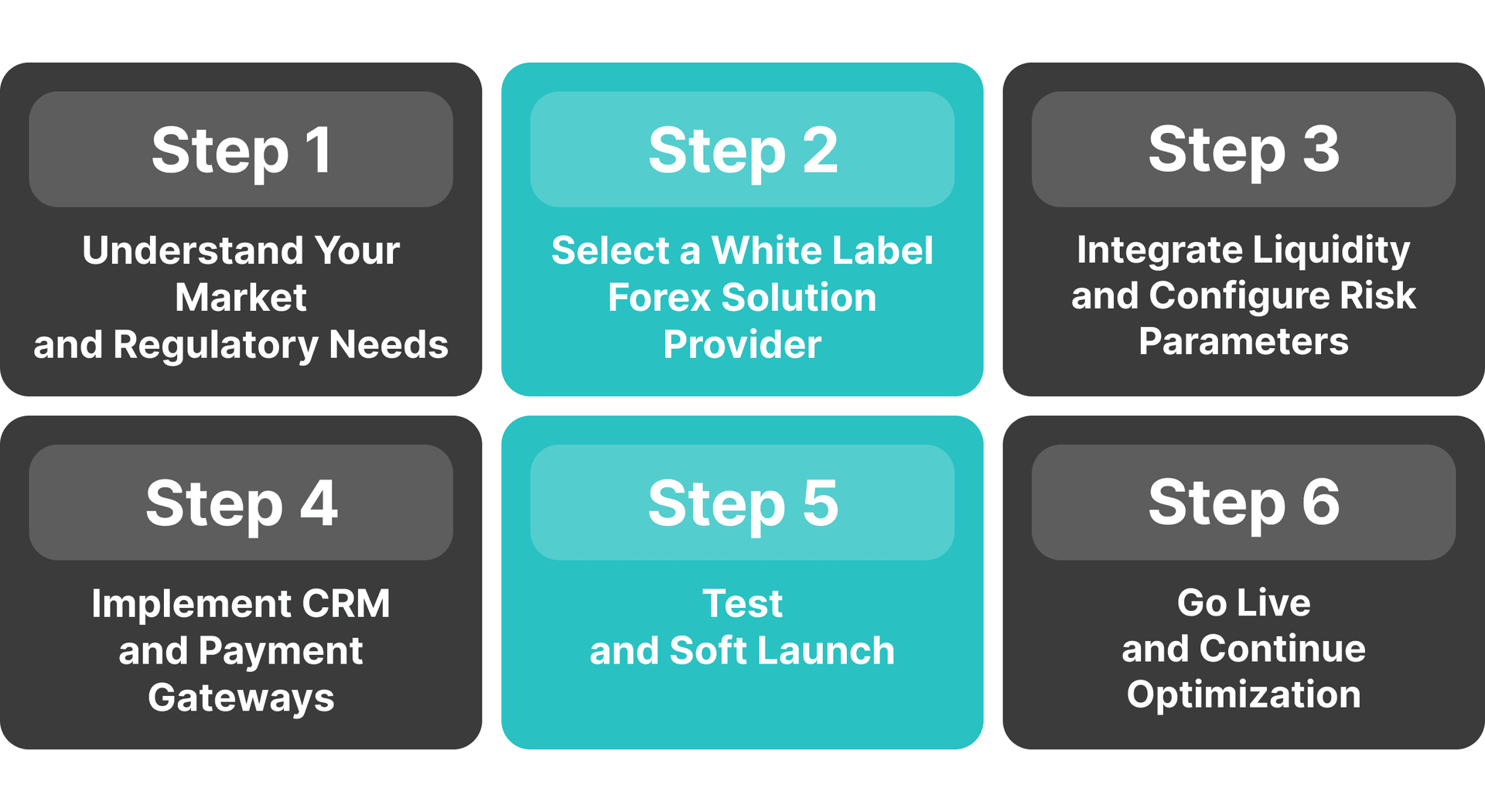

Launching a white label brokerage works best when you follow a clear sequence.

1. Understand Your Market and Regulatory Needs

Start with clarity on who you want to serve and where you plan to operate. Once the target segment is defined, evaluate local rules and licensing paths so your business model stays aligned with regulatory expectations.

2. Select a White Label Forex Solution Provider

Choose a partner after reviewing their platform in action. Focus on how it handles your use cases, how support responds during testing, and how contractual terms reflect real operational needs.

3. Integrate Liquidity and Configure Risk Parameters

After selecting the provider, connect to approved liquidity sources. Set your pricing rules and risk thresholds, then observe how the setup behaves when market conditions shift.

4. Implement CRM and Payment Gateways

Align CRM workflows with your onboarding steps. Connect payment channels so funding, verification, and client account actions follow a single, consistent process.

5. Test and Soft Launch

Conduct internal tests to see how the system behaves under real activity. Once the basics are confirmed, open the platform to a controlled group and monitor platform behavior closely.

6. Go Live and Continue Optimization

After full launch, track performance indicators and refine the setup as you gather more data. Review trading patterns and client activity regularly to guide platform improvements and product expansion.

Launch Your Forex Brokerage with B2BROKER’s Solutions

Start your Forex Brokerage in Weeks, not Months

All Technology, Liquidity & Payment Integrations Included

White-Label cTrader/B2TRADER with Full Back Office Support

Compliance-Ready Setup with Ongoing Technical Support

We at B2BROKER give brokers a full infrastructure built for long-term growth. Our company has worked in global markets for more than ten years and holds ten licenses, which helps new and established firms operate with confidence.

Our ecosystem includes trading platforms, liquidity services, CRM tools and payments that work together as one environment. This structure supports stable execution and faster scaling when your client base expands.

If you are preparing to build or upgrade your brokerage, our team can guide the entire process.

Launch Your Forex Brokerage Faster

Use B2BROKER’s Forex Broker Turnkey to move from planning to a fully branded live brokerage in weeks.

Frequently Asked Questions About Forex White Label Solutions

- How long does it take to launch a white label forex broker?

Most launches take around two to four weeks if the setup is standard. Heavy customisation or complex licensing can extend this timeline.

- What is included in a forex white label solution?

Typically, you get a trading platform, risk management tools, CRM, and back office modules, all branded for your firm. Some providers also bundle liquidity and turnkey compliance support.

- Is it profitable to start a white label brokerage?

Yes, if you control acquisition costs, spreads, and risk settings, a white label model can scale into a high-margin business. Profitability depends on volumes, retention, and disciplined risk management.

- What are the benefits of using a forex white label solution for new brokers?

New brokers gain faster launch, lower upfront tech costs, and access to proven infrastructure. This lets teams focus on sales, product strategy, and client relationships instead of engineering.