Whale Scoop Trading Strategy Explained

In the financial markets, the actions of a few powerful players can cause significant ripples. These influential market participants, often called “whales,” include institutions, hedge funds, and high-net-worth individuals whose large trades dramatically increase prices.

Understanding and tracking whale behaviour offers retail traders a unique opportunity to capitalise on these market movements. This is where the whale scoop trading strategy comes into play.

This strategy is designed for traders looking to “scoop” gains by monitoring and mimicking the actions of these whales. This strategy has gained increasing popularity, especially in markets like stocks and cryptocurrencies, where transparency tools and analytics allow real-time tracking of large-scale movements.

This article explains the principles behind the whale scoop trading strategy, its key components, and important practices that allow you to use it with the greatest efficiency.

Key Takeaways

- The whale scoop trading strategy allows retail traders to profit by tracking and mimicking the large trades of “whales,” including institutions and high-net-worth individuals whose actions significantly move markets.

- Traders use tools like volume spikes, price reactions, and whale-tracking platforms (e.g., Whale Alert, Glassnode) to identify and follow whale movements in both traditional and crypto markets.

- Patience, using multiple confirmation indicators, focusing on liquid markets, and managing risk through stop-loss orders are essential to effectively executing the whale scoop strategy.

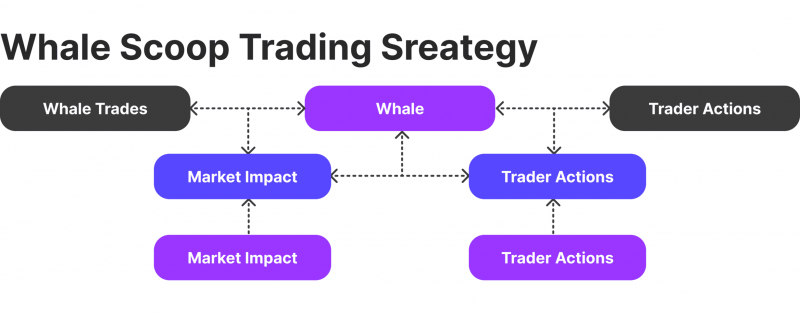

What is the Whale Scoop Trading Strategy?

The whale scoop trading strategy is a method retail traders use to profit by tracking and mimicking the market activities of large, influential traders known as “whales.”

These whales — such as institutions, hedge funds, or high-net-worth individuals — make substantial trades that can move markets due to the sheer size of their transactions. The strategy aims to “scoop” gains by identifying and following the trading patterns of these market participants as they accumulate or distribute assets.

The concept of following whale movements dates back to the early days of modern markets when large institutional investors significantly impacted price fluctuations.

In traditional markets like stocks, bonds, and commodities, large players’ actions were often indirectly revealed through order books and volume spikes, allowing smaller traders to observe and try to capitalise on these movements.

With the rise of cryptocurrency markets, whale-watching became even more prevalent. Blockchain transparency allowed traders to track large wallet transactions in real time, offering unprecedented insight into whale behaviour.

This gave rise to the idea that by following these large-scale trades, smaller traders could ride the coattails of whales and capture part of the resulting price movement.

In trading, “whale” comes from poker, referring to a high-stakes player who impacts the game.

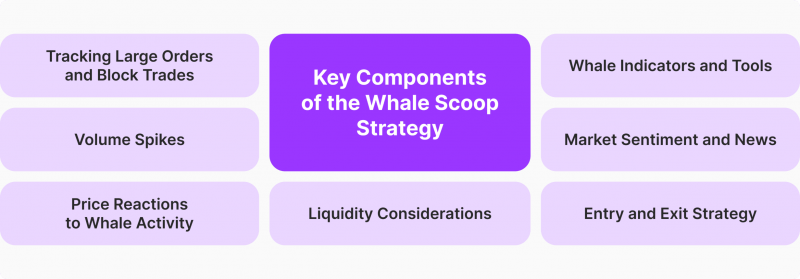

Key Components of the Whale Scoop Strategy

Whale scoop trading strategy advanced trading is one of the fastest growing strategies in terms of popularity in all capital markets because it offers great opportunities for earning based on the analysis and collection of statistical data on the behaviour of large market participants. At the same time, such a strategy has several key components, including the following:

Tracking Large Orders and Block Trades

Traders monitor order books to spot large buy or sell orders, often initiated by whales. Level II data provides insights into market depth and reveals large institutional orders in stock markets. Similarly, block trades — large transactions outside the public exchanges — are telltale signs of whale activity.

Specialised platforms provide traders with real-time updates on large block trades, helping them detect massive movements as they happen.

Volume Spikes

Sudden increases in trading volume that break away from normal activity can signal that a whale is entering or exiting the market. In this strategy, volume analysis is critical to confirming whale activity, as such participants often execute trades in phases to avoid causing too much disruption in the market.

Traders often use VWAP to assess whether whales accumulate or distribute an asset. If the price starts deviating from VWAP alongside increasing volume, it may indicate whale activity.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Price Reactions to Whale Activity

Traders closely observe the market’s reaction after detecting whale activity. Whale moves tend to cause significant price swings, so understanding how the price reacts allows traders to align their positions with the expected direction (buying when they are buying and selling when they are selling).

Price consolidation occurs when a whale accumulates or distributes assets over time, followed by potential breakouts. Whale scoop traders often look for these patterns as entry points into trades.

Whale Indicators and Tools

Tools like Whale Alert, Glassnode, and Nansen provide insights into large cryptocurrency transactions. These tools monitor wallet activity and large transfers across blockchain networks, giving traders real-time data on whale moves in crypto markets.

Dark pools are private exchanges where institutional investors execute large orders without revealing their intentions to the public. Tracking dark pool activity can give whale scoop traders an edge in identifying large trades not reflected in public markets.

Market Sentiment and News

Whale scoop traders also monitor market sentiment to identify potential whale-driven trades. Positive news about a stock or cryptocurrency might lead to whale accumulation, while negative news could prompt whale exits.

Following public statements or portfolio changes from influential investors like hedge funds or large market participants can provide indirect clues about upcoming whale moves.

Entry and Exit Strategy

Once whale activity is confirmed, the next step is timing the entry. Traders should enter positions after clearly confirming a whale’s movement — such as a breakout from a consolidation phase or a significant price reaction to large trades.

The strategy also emphasises exit strategies. Traders must set clear profit targets and stop-loss orders, as whale-induced price movements can be volatile and may reverse once the whale completes their trade.

Traders may also consider scaling out of their positions, taking partial profits as the market moves in their favour while holding a portion to capture further potential gains.

Liquidity Considerations

Whale scoop traders should focus on highly liquid markets where whale activity has enough volume to move the market without causing sharp reversals. Illiquid markets are riskier, as even small trades can create significant volatility.

Since timing is crucial, traders need fast execution to enter and exit trades efficiently. Depending on the situation, using limit orders or market orders ensures that traders catch the move without getting left behind.

Best Practices for Implementing the Whale Scoop Strategy

The trading approach of studying and analysing the behaviour of currencies in the capital markets, like other strategies used in investment activities, requires adherence to several specific practices and guidelines to maximise the benefits of its use. These include.

Be Patient and Wait for Clear Whale Signals

One of the most important aspects of the whale scoop strategy is patience. It is critical to wait for clear and confirmed signals of whale activity before entering a trade. Jumping in too early based on unverified signals could lead to false moves and unnecessary losses.

Whale trades often create recognisable volume, price, and liquidity patterns. Look for consistent trends or repeated whale movements that confirm their intention, such as accumulation or distribution over time.

Use Multiple Confirmation Indicators

Relying solely on one indicator can lead to false signals. Use a combination of volume spikes, price action, and other technical analysis tools to confirm whale activity. This provides a more reliable foundation for making trading decisions.

Indicators such as moving averages, the relative strength index (RSI), or Bollinger Bands can help confirm price momentum or potential reversals after a whale trade is detected.

Focus on Liquid Markets

Whale activity is most noticeable and impactful in markets with high liquidity, such as large-cap stocks or significant cryptocurrencies (e.g., Bitcoin, Ethereum). In highly liquid markets, whale movements are more accessible to follow and

A single whale trade can create extreme volatility and sudden price swings in low-liquidity markets. This can make it difficult for smaller traders to enter or exit positions without suffering from slippage or erratic price moves.

Diversify Your Trading Approach

While the whale scoop strategy can be profitable, combining it with other trading strategies is wise. Relying only on whale moves can limit opportunities. Incorporate technical analysis, fundamental analysis, or other momentum-based strategy for a more well-rounded approach.

Consider using hedging strategies to manage risk, especially when trading volatile assets. For instance, if you’re trading crypto, you can hedge your positions with stablecoins or alternative assets to protect against sudden reversals.

Set Realistic Profit Targets and Stop-Losses

Whale-induced price moves can be sharp but short-lived. Set realistic profit targets based on the expected range of the price move after whale activity is detected. Partial exits allow you to secure profits while keeping some exposure in case the market moves further in your favour.

Place stop-loss orders at levels that limit downside risk. Since whale moves can create volatility, managing risk by exiting a position quickly is essential if the trade doesn’t go in your favour.

Use Automated Alerts and Tools

Many platforms offer tools to monitor unusual transactions and volume spikes. For example, in crypto markets, you can set up whale alert notifications to be informed when large transfers occur on the blockchain. Set alerts for large block trades or unusual order book activity in stock markets.

Automated trading bots can be configured to execute trades based on predefined whale activity parameters. This helps you react quickly when such activity is detected, particularly in fast-moving markets like crypto or forex.

Stay Updated with Market News and Sentiment

Keep track of whale-related news, such as significant fund moves, large institutional trades, or statements from high-net-worth investors. Publicly announced trades or movements by hedge funds or well-known investors can offer clues about future activity.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Sentiment analysis tools can help identify when whales might act on market-moving news. For instance, positive sentiment surrounding a company or asset may lead to whale accumulation, while negative news could signal distribution.

Adapt to Different Market Conditions

Whale activity can vary significantly depending on whether the market is in a bullish, bearish, or consolidating phase. In bull markets, whales may drive prices up with large buys, while in bear markets, they may sell off large portions of assets. Be adaptable and adjust your trading approach based on the prevailing market trend.

Whale behaviour may differ between markets (e.g., equities vs. crypto). In crypto, whales may transfer assets between wallets without immediately impacting the price, while in stock markets, large block trades typically have more direct price effects.

Test the Strategy in a Simulated Environment

Before applying the whale scoop strategy with real money, practice using it in a simulated environment (e.g., paper trading or demo accounts). This lets you understand how real-time whale signals manifest without risking capital.

Simulated trading helps refine your entry and exit strategies and test the effectiveness of your alerts and tools.

Manage Emotional Discipline

Whale moves can create excitement and FOMO (fear of missing out), but it’s essential to remain disciplined and only trade when there are clear signals. Overtrading or chasing moves without proper analysis can lead to poor decisions.

Whale trading can lead to significant market volatility, so sticking to your plan and avoiding emotional reactions to short-term price swings is important. Always follow your risk management rules, and don’t get caught up in the hype.

Conclusion

The whale scoop trading strategy offers a unique approach for retail traders to capitalise on the significant market movements created by institutional investors or large “whale” traders. By closely monitoring whale activity through volume spikes, large orders, or on-chain analytics, traders can ride the momentum initiated by these large players.

As with any strategy, the whale scoop trading strategy should be tested in simulated environments before committing real capital. By combining whale tracking with other trading approaches and staying informed about market sentiment and news, traders can maximise their potential while managing risks effectively.

FAQ

What is the Whale Scoop Trading Strategy?

The whale scoop trading strategy is a method where retail traders profit by tracking and mimicking the market activities of large, influential traders known as “whales.”

Who are considered whales in trading?

Whales are large-scale investors or institutions whose transactions are so sizable that they can influence the price of assets in the market.

Can I use this strategy in both stock and cryptocurrency markets?

Yes, the whale scoop trading strategy is versatile and can be applied in stock and cryptocurrency markets. In stocks, it focuses on monitoring institutional trades, while in crypto, it leverages blockchain transparency to track large wallet movements.

What is the importance of liquidity in the whale scoop strategy?

Liquidity is crucial because whale trades have a more predictable and less volatile impact in liquid markets. Even a single whale trade can cause extreme price fluctuations in illiquid markets, making it harder to manage trades and avoid slippage.