What Is a Short Squeeze, And How It Boosts Stock Prices?

Articles

The trading landscape is full of fascinating strategies employed by observant traders who wish to get ahead of the curve. Various mechanisms and complex trading techniques allow investors to set long-term plans for lucrative returns. Naturally, not all plans come to fruition, and traders sometimes have to cut their strategies short to alleviate losses before it’s too late.

However, in some instances, the failed strategies might lead to unforeseen consequences on the market and create an interesting phenomenon called a short squeeze.

This article will explore how short squeezes transpire and the tips for recognising this market development in a timely manner.

Key Takeaways

- A short squeeze event refers to a stock price increase due to short sellers abandoning their positions.

- A short squeeze is triggered when a particular stock is expected to go down, but for various reasons, it goes up instead, forcing short sellers to reconsider their positions.

- The short squeeze phenomenon can be highly lucrative for contrarian investors, but recent events have raised the awareness of short squeezes in the short-selling market.

What is a Short Squeeze?

First, let’s define the short sellers who are the culprits for the short squeeze event. Short sellers are traders who have effectively borrowed a certain amount of stocks from brokers with the obligation to pay them back in a predetermined period. If a particular stock falls in price dramatically, short sellers get to keep a substantial amount of their borrowings to themselves.

For example, suppose investor X borrows 100 shares of Google at a $100 valuation and has to purchase them in three months. In ninety days, Google’s stocks have fallen to $50 per share unit. Now, investor X only has to repay $5,000 for the entire borrowed amount, while their initial borrowing was $10,000. Thus, investor X gets to pocket the $5,000 difference. While simplified, this example showcases the nature of short-selling.

The Risks and Realities of Short Squeezes

Of course, the short sellers don’t always get their dues, as their entire strategy depends on the failure of a particular stock. In this case, the biggest success was the 2008 housing market, where numerous individuals predicted the market collapse and opened short positions to reap unprecedented profits. In many cases, however, the short sellers might soon realise that their strategy isn’t going as planned, and the short position must be closed to minimise the trading losses.

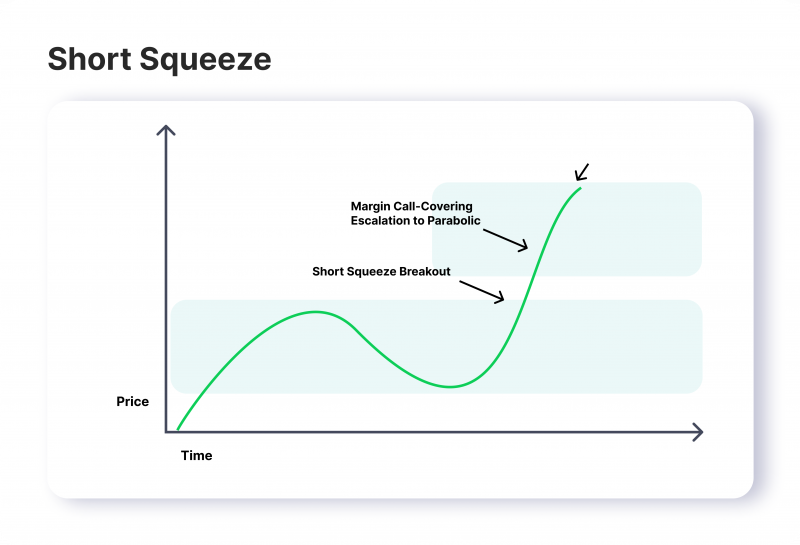

For example, if investor X sees that Google’s stocks have reached $120 two months before the purchasing deadline, they will most definitely cut their losses, fearing the price will increase. In some instances, this is where the short squeeze occurs.

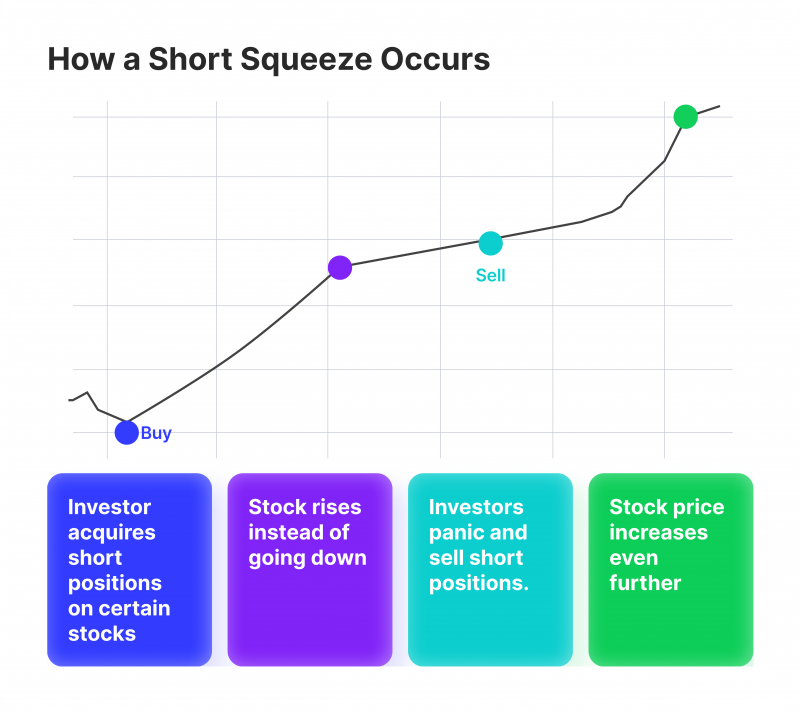

When a particular stock is expected to drop, numerous short sellers open short positions. If the stock decides to go in the opposite direction confidently, short sellers will likely panic and purchase the shares if the price is still reasonable. Thus, the stock price rises even further due to the aggressive purchases conducted by the short sellers trying to cut their losses.

The Phenomenon of Naked Short Selling

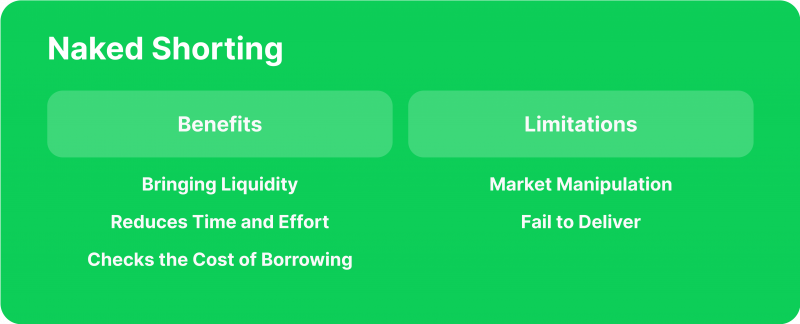

Then, there’s naked short selling, which is illegal in many markets but often facilitates the increase of short positions. In simple terms, naked short selling accommodates the market when there is a high demand for short positions.

If the naked short selling occurs, a potential short squeeze might be even more devastating than initially expected for short sellers. Thus, rising stock prices and short-selling reversals can cause a particular stock to appreciate beyond the wildest expectations and hit all-time highs.

The Tesla stock price increase in 2020 is one of the best short squeeze examples in history, where numerous individuals believed that Tesla was overpriced, opening massive short positions to prepare for its inevitable fall. However, Tesla’s prices continued to soar, leaving short sellers baffled and forced to minimise their losses. In the end, Tesla’s prices came down to earth but still managed to cause a total of $40 Billion in short-seller losses.

Thus, a completely new strategy was formed in the trading market, with contrarian investors buying stocks that were heavily shorted by other investors, hoping that a short squeeze might occur. While relatively rare, short squeezes can produce incredible returns for diligent investors under the right market conditions.

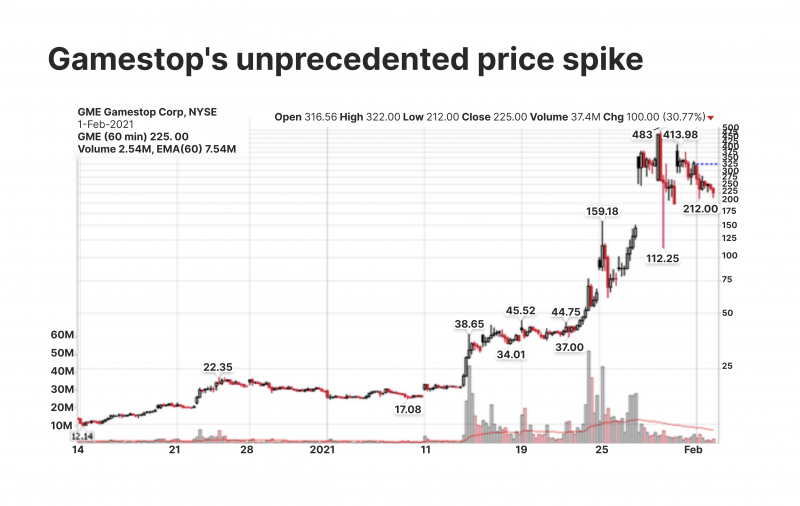

Gamestop’s short squeeze was by far the largest event of this type, causing the GME stocks to rise from $15 to $500 valuation.

A Practical Example — Gamestop Short Squeeze

Arguably, the biggest short squeeze in history is the curious case of Gamestop. In 2019, Gamestop was experiencing a lot of trouble keeping up with the evolving gaming environment. The sales were declining, and the business model started to become stagnant. Naturally, numerous investors began to take notice and acquire short positions on Gamestop shares.

In just a few months, Gamestop was up against millions of dollars in short positions, with investors counting on Gamestop’s inevitable demise. In 2020, everything seemed to go as planned, with Gamestop struggling to rebound from its dire financial situation. However, in 2021, a group of individual investors decided to create a short squeeze phenomenon with the power of united numbers.

These individuals understood that if Gamestop’s shares were to go up unexpectedly and rapidly, thousands of short positions would be abandoned. As a result, they would receive unprecedented returns on investment by simply purchasing the stocks.

While Gamestop contrarians expected substantial profits, the results were unprecedented. Gamestop’s shares skyrocketed from a $15 to $500 valuation in a couple of months after all the short positions were promptly abandoned. As a result, numerous retail traders became rich beyond their wildest expectations. All without doing anything illegal. Naturally, the SEC took notice of this event and investigated the entire short squeeze phenomenon, deriving that no unlawful actions were taken.

While highly profitable for contrarian investors, the Gamestop Short squeeze was a once-in-a-lifetime event that can hardly be replicated. Short sellers have learned a precious lesson from this: avoiding over-shorting the usual suspects. However, with proper conditions, another short squeeze can happen anytime.

How To Recognise the Short Squeeze and Act Swiftly

While correctly predicting a short squeeze is a tall order, several factors might lead to it in the future. First, checking the shorting interest in a particular stock is vital. After all, short squeezes cannot happen without an exaggerated short interest.

After that, investors should check the liquidity and volatility of particular stocks. Short sellers are more likely to panic and abandon their positions if the stock has liquidity concerns and a low float rotation. It is also crucial to check the company news and developments along the way.

Sometimes, the stock price uptick might be legitimate and short sellers will stay patient. However, in some instances, good company news might catalyse a disproportionate response on the stock market, increasing the company valuation rapidly and triggering the pre-conditions for a short squeeze.

Thus, it is crucial to monitor various variables on the market. Even if every condition is met, the short sellers might still not panic and prevent the short squeeze from happening. After the iconic Gamestop and Tesla examples, short sellers have become increasingly wary of short squeeze possibilities. As a result, short squeezes are less likely to happen in massive scopes, but the opportunity is always there for diligent traders.

Final Thoughts

Short squeezes are one of the most fascinating stock and securities market events. They showcase a free market’s power and contrarian trading strategies’ effects. Investors who recognise the short squeeze possibility can receive substantial returns on investment. However, the recent short squeeze events have forced the market to adapt, with short sellers becoming more aware of this possibility. So, it is pretty unlikely that the market will experience another event similar to Gamestop.