What Is MT4 Strategy Tester And How to Use It

This comprehensive guide will explore the MT4 Strategy Tester, how it works, and how you can use it to improve your trading performance.

It’s well-known that the financial field, specifically trading, is full of surprises and risks. Without robust strategies for avoiding unexpected threats and tools for equipping yourself with a safe working environment, it would be hard to become successful in this highly competitive field. Let’s discuss the MetaTrader 4 Strategy Tester, an indispensable tool for traders looking to backtest and optimise their trading strategies.

Key Takeaways

- The MT4 Strategy Tester is a crucial tool for backtesting and optimising automated trading strategies using historical data.

- Its accuracy depends on factors like data quality, modelling settings, and strategy complexity.

- To use the MT4 Strategy Tester, open it, select an EA, configure parameters, optimise the strategy, start the test, analyse the results, and refine your strategy based on the findings.

- The Strategy Tester offers risk-free testing, performance analysis, optimisation, and confidence-building benefits.

What is MT4 Strategy Tester, and Why Do You Need it?

The MT4 Strategy Tester is a powerful tool integrated within the MetaTrader 4 (MT4) trading platform developed by MetaQuotes. It allows traders to evaluate the performance of trading strategies, known as Expert Advisors (EAs), using historical data. This tool enables traders to simulate trading scenarios, assess the viability of their strategy, and optimise them before applying them to live trading on MT4.

The primary purpose of the MT4 Strategy Tester is to provide traders with an environment to test and refine their strategies. By simulating real market conditions, traders can see how their strategies would have performed in the past, identify potential flaws, and make necessary adjustments. MT4 Strategy Tester gives traders the confidence to deploy their strategies in live trading by validating their effectiveness through rigorous testing.

Benefits of Using MT4 Strategy Tester

The MT4 Strategy Tester software offers several benefits that can help traders improve their strategies and overall trading performance:

- The Strategy Tester allows you to test your strategies without risking real money. This can be especially beneficial for new traders who are still learning the basics.

- By analysing historical performance, traders can identify strengths and weaknesses in their strategies, making it easier to refine and improve them.

- The ability to optimise strategies by testing different parameter combinations helps traders find the most effective settings for their automated trading systems.

- Backtesting trading strategies can boost traders’ confidence, making them more comfortable executing trades in live markets.

Setting Up MT4 Strategy Tester

To effectively use the MT4 Strategy Tester, you first need to install the MetaTrader 4 platform and then access the Strategy Tester within the platform. Below are the detailed steps to guide you through the process.

- Visit the MetaTrader 4 website or the website of your broker that supports MT4.

- Download the MetaTrader 4 installation file suitable for your operating system (Windows, Mac, etc.).

- Locate the downloaded file and double-click it to run the installer. Follow the on-screen instructions to complete the installation process.

- Once the installation is complete, open MetaTrader 4 by double-clicking the desktop icon or finding it in your start menu.

- Log in to your trading account using your broker-provided credentials (account number, password, and server).

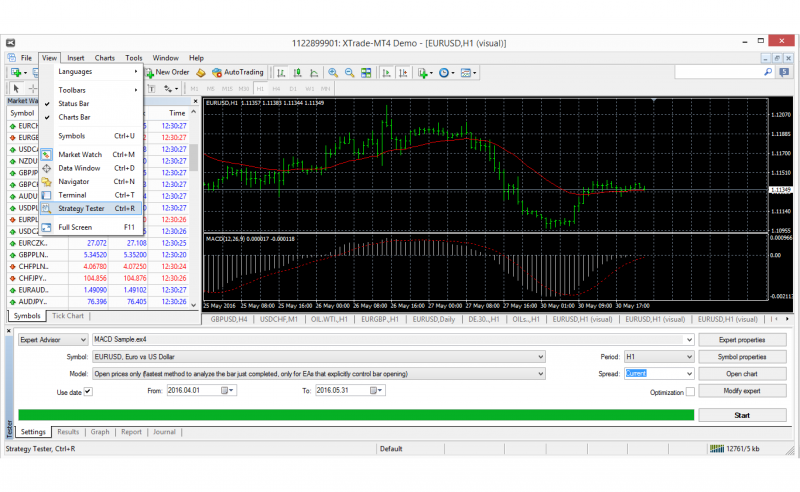

- Navigate to the Strategy Tester – Look for the “View” menu at the top of the MetaTrader 4 interface.

- Click on “Strategy Tester” from the dropdown menu. Alternatively, you can press “Ctrl + R” on your keyboard to open the Strategy Tester window.

Understanding the Strategy Tester Interface

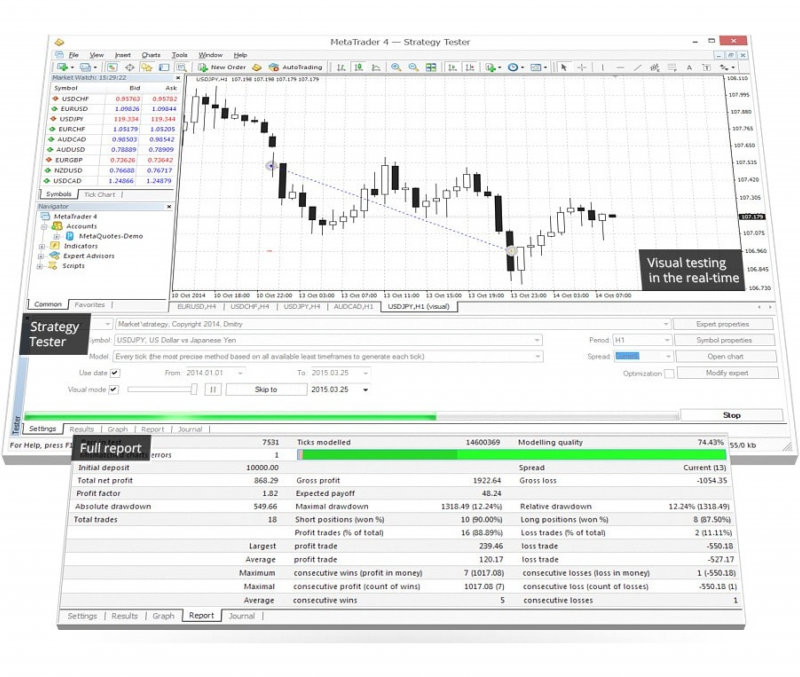

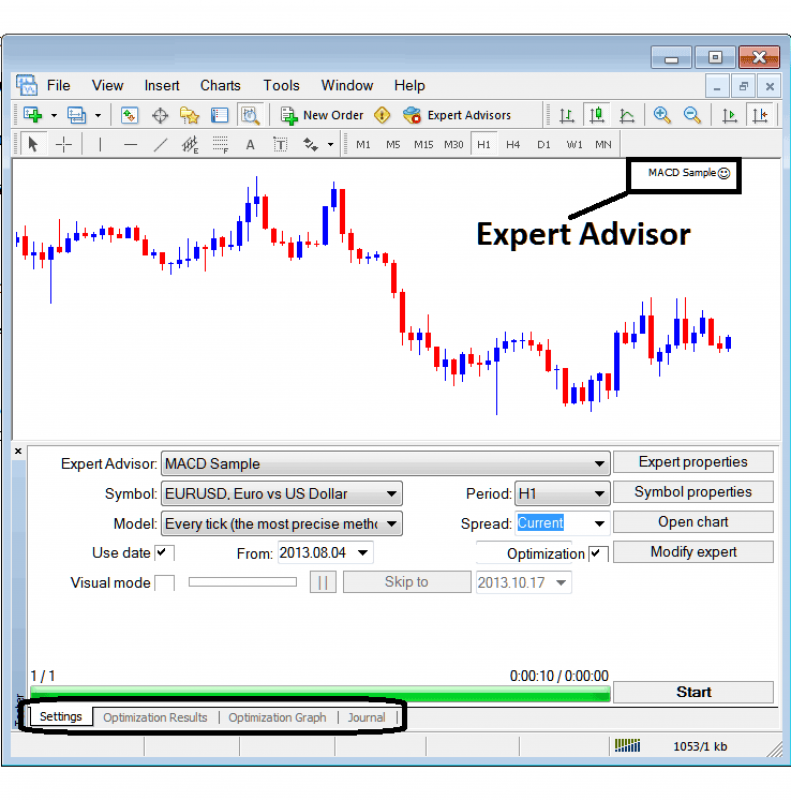

The Strategy Tester window will appear at the bottom of the MetaTrader 4 interface. You will see several options and settings to configure to run your strategy tests. Let’s outline the key components of the Strategy Tester interface.

Expert Advisor (EA)

Select the trading strategy you want to test. This could be a built-in indicator, a custom indicator, or an Expert Advisor (EA), which is a Metatrader 4 automated trading script.

In the “Expert Advisor” dropdown menu, select the trading strategy you want to test. If you don’t have an EA, you can download or create one and add it to the MT4 platform.

Symbol

Choose the currency pair or financial instrument you wish to test your strategy on from the “Symbol” dropdown menu.

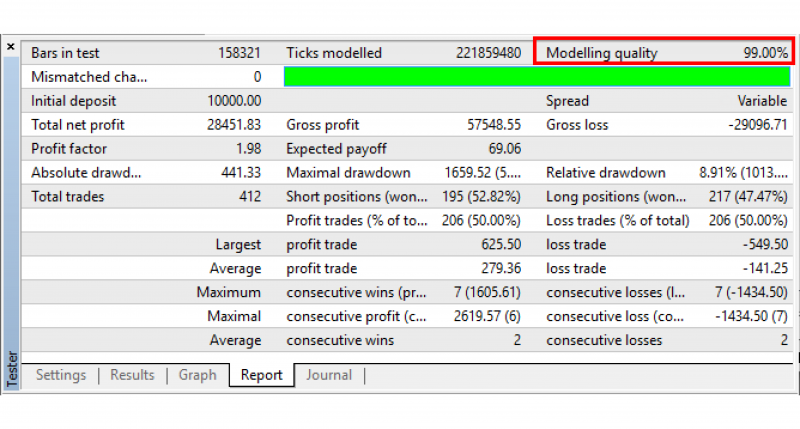

Modelling Quality

In the Strategy Tester window, choose a modelling method for you to backtest from the “Model” dropdown menu:

- “Every tick” provides the most accurate results by simulating every market tick. This method is the slowest but gives the highest precision.

- “Control points” use fewer data points, balancing speed and accuracy.

- “Open prices only” is the fastest method, using only the opening prices of each bar. This method is less accurate and best for strategies that don’t depend on intra-bar price movements.

Every tick testing requires high-quality historical tick data, which may not be readily available to all brokers.

Period

Select the timeframe for the backtest, such as M1 (one minute) or D1 (daily). Options range from M1 (1 minute) to MN (monthly).

Spread

Specify the spread (difference between the bid and ask price) to be used in the backtest. Ensure it reflects the spread offered by your broker. You can use the current spread or manually set a fixed spread.

Date Range

Define the start and end dates for the period you want to test by checking the “Use date” box and specifying the dates.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Optimisation Process

To optimise your strategy, check the “Optimization” box to enable optimisation methods. The Strategy Tester includes various optimisation algorithms, such as the Genetic Algorithm, to help find the best parameter settings for your strategies. Based on the backtesting results, the MT4 Strategy Tester will automatically test different combinations and suggest the most optimal settings.

By running multiple backtests with various configurations, you can identify the parameter set that yields the most promising results based on historical data.

Expert Properties

Click on “Expert Properties” to configure the EA’s parameters, such as lot size, stop loss, take profit, and other customisable settings.

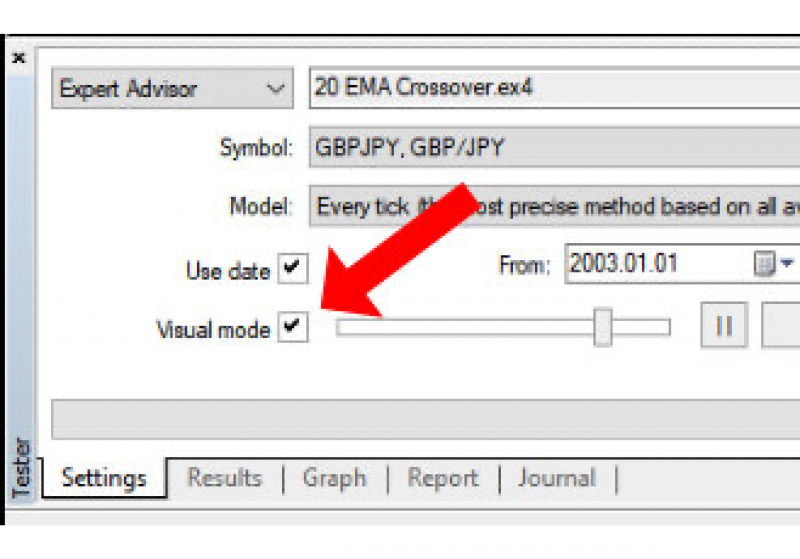

Visualisation

Use the visual mode box to watch your strategy in action on a simulated chart. The executed trades are overlayed on the price chart, allowing you to see how the strategy performed at specific points in time. This can provide valuable insights into how your strategy behaves.

Deposit

Set the initial account balance for the backtest.

Slippage

Set the slippage tolerance, which represents the potential difference between the requested price and the actual execution price.

Comment

Add a comment to the backtest for future reference.

Running the Backtest

Once you’ve configured the settings, click the “Start” button to initiate the backtest. The MT4 Strategy Tester will simulate your trading strategy based on historical data and generate a report upon completion.

Backtesting trading strategies is crucial because it provides insights into a strategy’s strengths and weaknesses, helping traders make informed adjustments to improve performance.

Forward Testing

After successful backtesting, use forward testing, also known as paper trading or demo trading, to validate your strategy in real-time or on a demo account to ensure its robustness. This method helps validate the strategy’s performance in current market conditions, ensuring it can adapt to live trading environments.

Forward testing is important because it provides a more accurate picture of how the strategy will perform in real market scenarios, including aspects like slippage and real-time execution.

Here are the steps to perform Forward Testing:

- Open a Demo Account

- Attach the EA to a Chart

- Set the EA Parameters

- Enable Automated Trading

- Monitor Performance

- Analyse the Results

By understanding and utilising both backtesting and forward testing, traders can thoroughly evaluate their trading strategies, making necessary adjustments to enhance performance and increase the likelihood of success in live trading.

MetaTrader 4 Strategy Tester will not show any trades for one of the following reasons: The settings are incorrect; It’s not a good market to use that EA with; There were no valid setups.

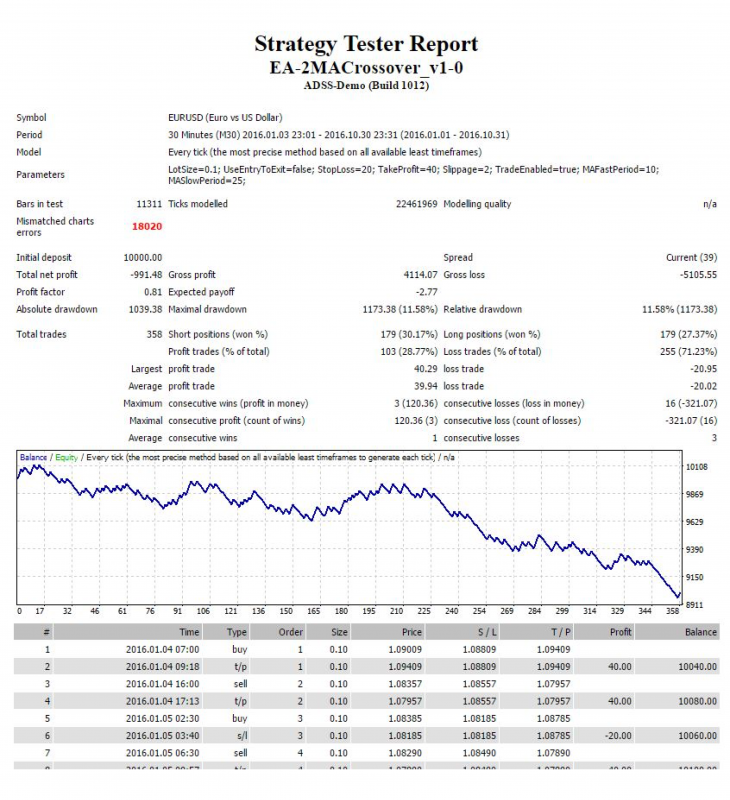

Analysing Test Results

The Results tab in the MT4 Strategy Tester provides a detailed breakdown of each trade executed during the backtest. This tab is essential for understanding how the strategy performed over the selected historical data period. Key components of the Results Tab include:

Trade List: Displays each trade executed, including entry and exit points, profit/loss, and other trade-specific details.

Order Information: This includes the order number, time of execution, price, type of order (buy/sell), and lot size.

Profit/Loss: Shows the profit or loss of each trade in both points and currency terms. Net Profit is the total profit made after deducting losses, and Gross Profit is the total profit made from winning trades.

Drawdown: Maximal Drawdown shows the largest drop from a peak to a trough in the equity curve, indicating the highest loss encountered, while Relative Drawdown indicates a percentage of the account balance, showing the strategy’s risk level.

Win Rate: The percentage of winning trades out of the total number of trades. A high win rate indicates a higher probability of profitable trades.

Trade Frequency: The total number of trades executed. This metric helps determine the strategy’s activity level.

Average Trade: Average profit or loss per trade. It provides insight into the profitability of individual trades.

Expected Payoff: The average profit or loss per trade, calculated as the net profit divided by the total number of trades. It indicates the strategy’s overall performance.

Interpreting the Graph Tab

The Graph tab visually represents the strategy’s equity curve over the testing period. This graph is crucial for understanding the strategy’s performance trends and stability. Key elements to observe are:

- Equity Curve: The line graph representing the account equity over time. A steadily rising equity curve indicates consistent performance, while sharp drops indicate high drawdowns.

- Balance Curve: Shows the account balance, excluding open trades. It helps differentiate between realised profits and potential profits from open trades.

- Drawdown Areas: Highlighted regions indicating periods of significant drawdown. These areas help identify periods of poor performance and assess risk.

Reviewing the Report Tab

The Report tab provides a comprehensive summary of the backtest, including statistical metrics and performance indicators. This tab is essential for a detailed analysis of the strategy’s effectiveness. Key sections of the Report Tab are:

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Summary Statistics

- Total Net Profit: Overall profit after losses.

- Total Trades: Total number of trades executed.

- Profit Factor: Ratio of gross profit to gross loss. A value greater than 1 indicates profitability.

- Expected Payoff: Average profit or loss per trade.

- Absolute Drawdown: The difference between the initial deposit and the lowest point of the balance.

Trade Statistics

- Longs/Shorts Won: Percentage of profitable long and short trades.

- Average Win/Loss: Average profit from winning trades and average loss from losing trades.

- Maximum Consecutive Wins/Losses: The longest streak of consecutive winning and losing trades.

Risk Metrics

- Sharpe Ratio: Measures the risk-adjusted return of the strategy. A higher value indicates better risk-adjusted performance.

- Recovery Factor: Ratio of net profit to maximal drawdown. It shows the ability to recover from losses.

Tips for Effective Strategy Testing

First of all, historical data must be obtained from reliable sources. Many brokers provide high-quality data, but you can also use third-party providers. Verify that the data covers a sufficient period to test the strategy accurately under various market conditions. Ensure that the historical data is complete, with no missing data points. Missing data can lead to inaccurate backtesting results. Use high-resolution data (e.g., tick data) for precise backtesting, especially for strategies that rely on small timeframes and intra-bar price movements.

To optimise the strategy, determine which parameters of your strategy have the most significant impact on performance, such as stop loss, take profit, and position size. Use the optimisation feature in MT4 to test various combinations of these parameters. The goal is to find the settings that yield the best performance while maintaining a good balance between profit and risk. Evaluate the optimisation results carefully. Look for parameter settings that provide consistent performance across different market conditions, not just the highest profit in a specific period. But be cautious of over-optimization.

Test your strategy on a large sample of historical data that includes different market phases (bullish, bearish, and sideways markets) to ensure it performs well across various conditions. Split the historical data into multiple segments, such as in-sample data (for optimising the strategy) and out-of-sample data (for validating the strategy). This approach helps to ensure the strategy generalises well and is not overfitted to a specific dataset. Implement walk-forward testing parameters, where the strategy is continuously optimised and validated over successive time windows. This method helps to maintain robustness and adaptability in live trading.

Evaluate the strategy’s performance on different timeframes (e.g., M1, M5, H1, D1) to determine its effectiveness and stability across short-term and long-term trading horizons. Use historical data that includes periods of high volatility, low volatility, trending markets, and ranging markets. This approach ensures the strategy can adapt to various market environments.

Perform stress tests by introducing extreme market conditions, such as unexpected news events or market crashes, to assess the strategy’s resilience and risk management capabilities. Test the strategy on various financial instruments (e.g., different currency pairs, commodities, indices) to evaluate its versatility and robustness across multiple markets.

By following these tips, you can enhance the effectiveness of your strategy testing process, leading to more reliable and robust trading strategies that are better equipped to handle real-market conditions.

Common Issues and Troubleshooting

While the MT4 Strategy Tester is a powerful tool, traders may encounter challenges when using it. Here are a few common issues and solutions:

- Data Gaps: Incomplete or low-quality historical data can lead to inaccurate backtest results. To mitigate this, ensure you’re using high-quality, comprehensive data.

- Overfitting: Over-optimizing a strategy to fit historical data can result in poor performance in live markets. Aim for a balance between optimisation and robustness.

- Execution Delays: The Strategy Tester may not account for real-world execution delays and slippage. Consider these factors when interpreting backtest results.

- Complex Strategies: Testing very complex strategies can be time-consuming and may lead to errors. To improve reliability, simplify your strategy where possible.

Conclusion

The Strategy Tester MT4 is an invaluable tool for traders looking to enhance their strategies and gain a competitive edge in the markets. By understanding how to use the Strategy Tester effectively, you can backtest your strategies, optimise them, and build confidence in your trading decisions.

Remember to use high-quality data, avoid overfitting, and consider real-world factors like execution delays to get the most accurate results. With practice and persistence, the MT4 Strategy Tester can help you become a more successful trader.

FAQ

How to use strategy tester in mt4?

Open the Strategy Tester in MetaTrader 4 (Ctrl+R), select the expert advisor to test from the dropdown list, select the currency pair and timeframe, select the start and end dates, set the input parameters for the expert advisor, and press the Start button.

What is MT4 backtesting software?

MetaTrader 4 (MT4) is a popular platform for retail foreign exchange (forex) traders that offers a range of features, including the ability to perform backtesting on historical data.

Is MT4 the best backtesting software?

MT4 and MT5 offer built-in backtesting functionalities that allow traders to test their trading strategies using historical data. While less advanced than dedicated backtesting software, MT4 and MT5 are widely used for backtesting.

How accurate is the MT4 strategy tester?

When backtesting, use the test model “Every tick” and select variable spread. Then, you will get a 99.9% accurate backtest.