What is Pre-Market Trading, and How Does it Work?

It’s intriguing to watch what happens when the stock market is officially closed. Many traders take advantage of this time to respond to overnight news and anticipate potential price swings before the next session begins. This activity makes pre-market trading highly popular, as it provides an opportunity to adjust strategies and positions based on fresh information, potentially gaining an edge before regular trading hours begin.

While there are potential benefits, such as early access to price fluctuations, there are risks as well. In this article, we will explain the concept and discuss the characteristics of pre-market trading.

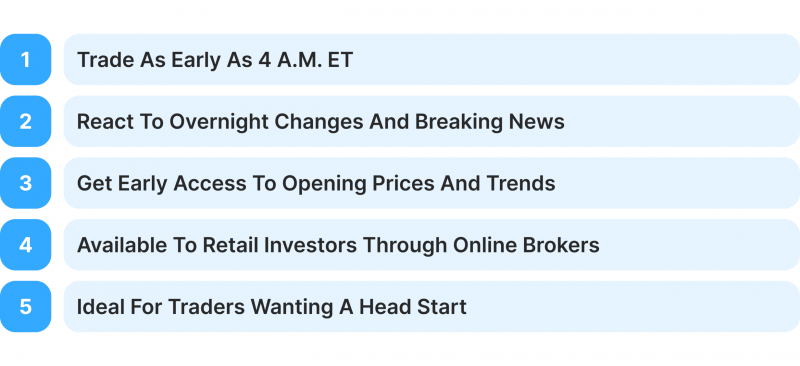

Key Takeaways

- Pre-market trading allows investors to react swiftly to changes, enabling price adjustments before regular trading hours.

- Decreased liquidity could lead to wider bid-ask spreads and higher volatility.

- Larger institutional traders frequently dominate pre-market hours, which presents difficulties for individual investors.

What is Pre-Market Trading?

Buying and selling stocks before world market hours start, usually as early as 4 AM Eastern Time on the New York Stock Exchange, is known as pre-market trading. Participants in this trading session can execute trades and react to overnight changes, business announcements, or other economic news that may affect stock prices.

This trading period allows traders to position themselves advantageously before the regular session begins, offering early insights into opening prices and initial market reactions.

Historically, only institutional traders and large investors, who had the necessary resources and procedures, could engage in pre-market trading during hours of low liquidity.

However, with the advent of online brokers and technological advancements, many investors now have the ability to conduct pre-market trades directly through their brokerage accounts.

This accessibility has significantly increased the popularity of pre-market trading, allowing individual traders to place or limit orders based on stock quotes and data available after hours.

How Does Pre-Market Trading Work? Hypothetical Scenario

Imagine a big tech company announces its quarterly earnings after the market closes on a Tuesday. The report unexpectedly shows significant growth in revenue and earnings, catching the attention of traders. This scenario is a classic example of a moment when pre-market trading becomes particularly active, as traders rush to adjust their positions based on the new information before the next trading session begins.

- Social media and financial news channels are burning with activity as soon as the earnings report is made public.

- During this period, some traders with automatic trading systems or getting up early might immediately start purchasing the company’s shares. The stock price rises as a result of this early buying activity.

- The momentum carries over into the regular opening. The stock price may rise further as more traders, including institutional investors, enter the market to exploit the good news.

- In anticipation of the favourable effects of the earnings release, traders who purchased shares during the session might be able to sell them for more during the regular trading session, making a profit.

When considering pre-market trading, it’s important to understand its unique aspects. This trading period can be more volatile due to lower volumes and potential for significant price changes, often influenced by news and events that can cause sharp movements. While it offers opportunities to capitalise on developments such as earnings reports, it also carries risks.

Traders should carefully assess their strategies and risk tolerance before engaging. Additionally, not all brokerage accounts permit pre-market trading, so it’s essential to check with your broker for accessibility and any associated fees.

Comparing After-Hours and Pre-Market Trading

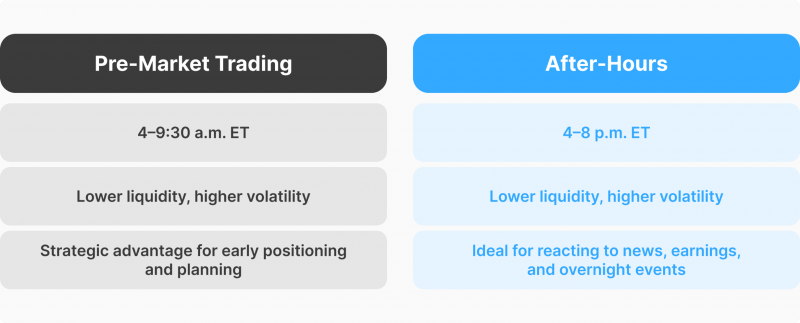

Pre-market trading typically occurs between 4:00 AM and 9:30 AM Eastern Time, while after-hours trading takes place from 4:00 PM to 8:00 PM Eastern Time, after the regular trading session ends. Around the world, stock exchanges operate their own versions of extended-hours trading, which are scheduled according to local times.

Differences Among Participants

Various participants, including institutional traders, major investors, and individual investors, engage in pre-market and after-hours trading sessions. These traders often use this time to position themselves for the upcoming trading day or react to overnight news.

In after-hours trading, activity often spikes in response to late-breaking news, earnings announcements, or significant movements in closing prices, as participants adjust their positions based on the new information.

Volatility and Liquidity

Compared to regular trading hours, pre-market and after-hours sessions are notorious for having less liquidity, with fewer buyers and sellers executing trades. Since stock prices respond quickly to news and market orders, this reduced liquidity may result in greater bid-ask spreads and higher volatility.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

However, this activity frequently shows how market makers modify prices in reaction to developments. After-hours data indicates that particular companies’ news releases or earnings reports may cause price fluctuations. Lower liquidity and higher demand in both sessions may impact price stability and trading expenses.

Purpose for Traders

In response to particular news developments, traders utilise these sessions to place their trades according to their timing preferences and personal finance strategies. To make changes before the opening, those who want early access to the information could concentrate on the pre-market trading period.

On the other hand, investors who keep an eye on events after hours could utilise that time to react to company announcements or prepare for the following trading day. To profit from extended hours insights, traders execute transactions in either session based on expected changes, bid-ask spread trends, and general sentiment.

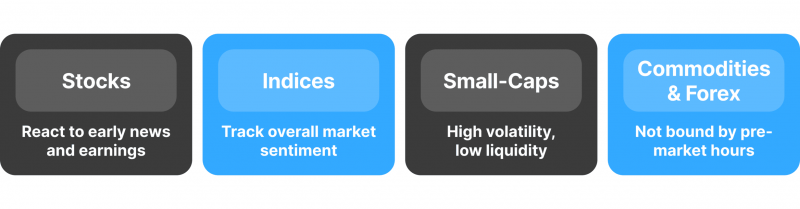

Assets That are Commonly Traded in Pre-Market

During the pre-market session, stock trading is the main focus. Many investors keep a close eye on these assets to be able to react to early news releases, earnings reports, and activity in foreign places. Before the regular session starts, investors can act according to the changes during pre-market trading hours. Some use this time to set limit prices or place transactions to affect the starting sums of the day.

Indices

These hours also see a lot of trading in indices, which are groups of equities that indicate the market’s health. In addition to reflecting pre-market trading activity and general economic news, trading indices give traders a more comprehensive picture of the general sentiment.

Investors and institutional traders can evaluate trends across international trading venues by using the performance of indexes to predict the probable direction when they open.

Issues with Liquidity in Small-Caps

During pre-market hours, small-cap stocks frequently face liquidity difficulties. Wider bid-ask spreads and increased volatility may result from these companies’ limited liquidity.

Because there are fewer buyers and sellers, small-cap companies may see more noticeable price volatility, making it difficult for investors to execute deals at their desired levels.

The ability of market makers to maintain price stability is impacted by this low volume, especially for stocks with little trading activity.

Assets Not Included in Pre-Market Schedules

Pre-market timetables are typically not followed by assets such as commodities and forex. Unlike stock exchanges, which have established pre-market hours, these assets trade almost constantly across global marketplaces. Investors can place trades without depending on long trading periods because their prices always change in response to world events.

In the early 1990s, the major U.S. stock exchanges permitted trading before and after the typical hours due to the growth of electronic trading networks and a need to remain competitive.

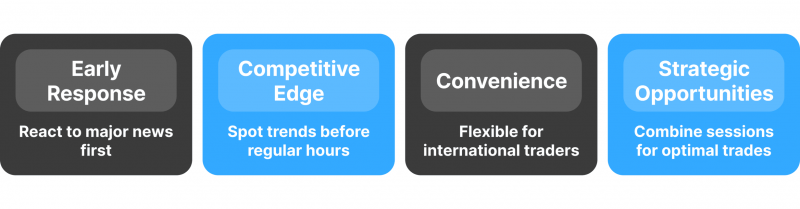

Why Pre-Market Trading is Beneficial

One of the advantages might be an initial response to news. By engaging with it, investors can respond to significant news events, financial reports, and other important information before the regular market hours. Traders can sell stocks, modify pre-market orders, or get ready for opening prices when such news affects stock prices.

Because of this early access, investors can adjust their positions in response to news from foreign markets or earnings announcements, which may cause significant price swings before regular business hours start.

An Advantage Over Competitors

By examining early data and spotting trends before others, seasoned traders frequently obtain an edge during these sessions. As the market responds, there may be an opportunity to seize advantageous prices with fewer players. This activity is accessible through some online brokers, enabling traders to place limit and market orders in reaction to changes.

Convenience

Pre-market hours offer international traders convenient periods to make trades outside of regular business hours, taking into account various time zones. Investors who might have other responsibilities or operate in multiple marketplaces benefit from this flexibility.

Special Techniques

It also creates new opportunities by enabling traders to combine pre-market and typical trading sessions. This strategy lets traders take advantage of rising demand and price changes throughout the day by optimising their entries and exits based on movements during extended-hour trading.

Some of the Risks and Challenges

Because of the less activity, liquidity is typically lower than during regular business hours. It may be challenging to sell stocks or conduct trades without seeing price effects. A trader’s ability to effectively exit positions may be impacted by the delayed execution and restricted liquidity experienced by, for example, many NASDAQ pre-market trading participants.

Wider Bid-Ask Spreads

The bid-ask gap greatly widens with decreased trade volume, raising expenses. Because fewer orders are available, there is a greater spread, making every transaction more costly. Since these expenses can immediately affect profit margins in trading and other significant stock exchanges, traders must consider them.

Failure to Carry Out Limit Orders

Many brokers only take limit orders during pre-market trading to shield clients from sudden price swings. However, this kind of order is carried out only when the limit price is reached or exceeded. Even when a trader predicts movements, deals may not execute because the non-execution of limit orders becomes risky when prices diverge from the order limits.

Unpredictable Price Changes

Volatility is typical because the sessions have fewer participants and less liquidity. This variation frequently results from sharp price fluctuations and uncertainty in the environment. When opening prices diverge from pre-market levels, there is a possibility that stock prices will not correspond with regular session prices.

Competition Among Institutions

Individual traders compete with larger institutional investors, who frequently possess superior tools, access to market makers, and a more comprehensive understanding of the data. Large funds and other major investors typically have better resources to analyse the activity and can affect market movements before smaller traders do.

Technical Risks

Technical problems, such as possible delays and system faults on trading platforms, are another risk associated with online trading during pre-market hours. Minor interruptions could lead to delayed transactions, orders that are not processed, or system failures because many online brokers are managing reduced volumes. Because of these technological difficulties, traders must carefully plan ahead and closely monitor trades now.

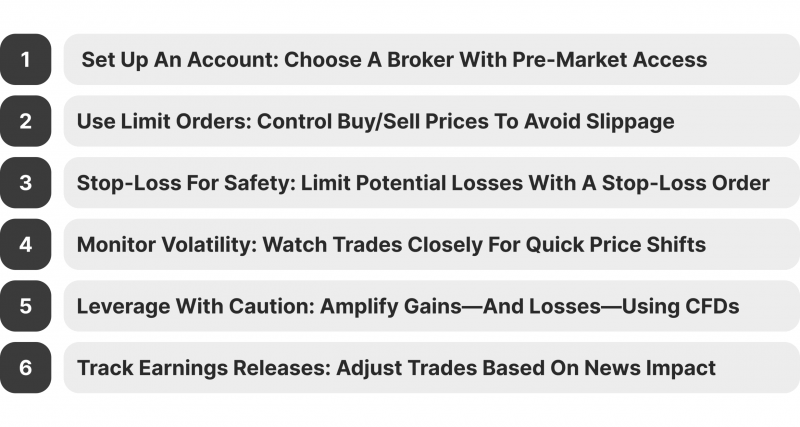

Procedures for Trading

Open the Brokerage Account

The first step is to open an account with a brokerage that provides pre-market trading access. Check for availability and review any additional costs or requirements, as not all brokers offer this option. Verify that your trading platform has the capabilities and tools to handle these trades efficiently.

Use Limit Orders

Limit orders are essential because they let you specify the price you want to purchase or sell a stock. Unlike market orders, which execute at the best price available and may cause slippage, this kind of order guards against the abrupt price changes typical during pre-market sessions. To control possible risks, include stop-loss orders, which cap the most significant loss you’re prepared to take. To enhance trade results, plan around price targets and risk control.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

If you’re interested in the stock that recently reported strong earnings and you think there is room for growth, this might be your strategy:

- Limit Purchase Order: You put in a $100 limit purchase order. This indicates that you will only purchase the stock if, during the pre-market period, its price drops to $100 or less. You can profit from possible stock price declines by using this tactic.

- Stop-Loss Order: You place a stop-loss order at $95 to protect your investment. Your order will automatically begin selling if the stock price drops below $95, limiting your possible loss.

Monitor Volatility

It is crucial to closely watch your trades because pre-market hours are frequently characterised by volatility. Early news releases or earnings reports can cause prices to fluctuate quickly, affecting the pre-market versus after-hours trading environment. By being present and keeping a careful eye on your trades, you can react swiftly to fluctuations in price and prevent needless losses.

Investors and traders greatly anticipate the announcement of results. If the report proves to be important, stock activity could be extremely erratic. The price may rise during the session if the report is released positively. However, the price can fall if the news is unfavourable.

The effect of the earnings release on the stock price could be rapidly evaluated by a careful trader keeping an eye on activity. They may choose to sell their shares to lock in profits if the price is rising in their favour. On the other hand, they might think about modifying their stop-loss order to reduce possible losses if the price is moving against them.

Use Leverage with Caution

Contracts for Difference (CFDs), which let you speculate on price fluctuations without owning the stocks, are a good option if you want to trade with leverage. Because they allow for both long and short positions, CFDs provide flexibility; however, bear in mind that leverage increases gains and losses. Exercise caution when using leveraged options because your prospective gains or losses could outweigh your initial investment.

You can manage a bigger position with a CFD than you could typically with your original deposit. For example, you could acquire $10,000 worth of shares with just $1,000 of your own funds if you had 10x leverage.

The leverage increases your potential profit if the stock price increases. In our case, your potential reward would be 100% (10% x 10x leverage) if the stock price rose by 10%.

Leverage has the drawback of magnifying losses, though. Your loss would equal 100% of your original investment if the stock price dropped by 10%.

Final Remarks

Pre-market trading presents certain dangers and opportunities and requires specific tools, techniques, and timing. It requires expertise, planning, and prudence due to the reduced liquidity, broader spreads, and possibility of erratic price swings. It can be an effective strategy for seasoned traders to respond to early market signals or news. It offers seasoned traders insightful information and chances to obtain a competitive advantage when used correctly.