Finding the Top Payment Gateway for Forex Brokers and Crypto Exchanges

Articles

Advanced technology led to significant developments in Forex trading on brokerage and crypto exchange platforms, as investing shifted from order calls on trading floors to digitalise and online platforms, where you can invest from anywhere around the world.

These introductions encouraged growth in the payment systems, and today, you can find tens of options to pay and transact with brokerage firms. Some standard payment gateway for Forex brokers could entail transacting with credit and debit cards, digital wallets and cryptocurrencies.

So, which one do you choose for your Forex brokerage business? How do you choose the best Bitcoin payment system? We will answer your questions in the following.

Key Takeaways

- Payment gateways process transactions between two parties through different intermediaries and banks.

- Payment gateway suppliers provide various transaction speeds, support multiple currencies and power integration capabilities.

- The payment gateway for Forex brokers and crypto exchanges deploys various APIs that connect the platform with different banks, payment method issuers and merchant accounts.

Understanding Forex Payment Gateway

Investors trade in financial markets through brokers, who offer the technological means to deposit, trade and interact with various markets. Trader deposit money in their account, which they use to execute various market positions.

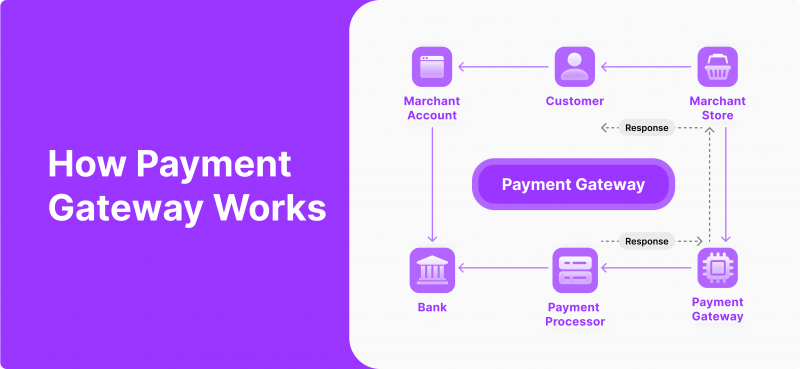

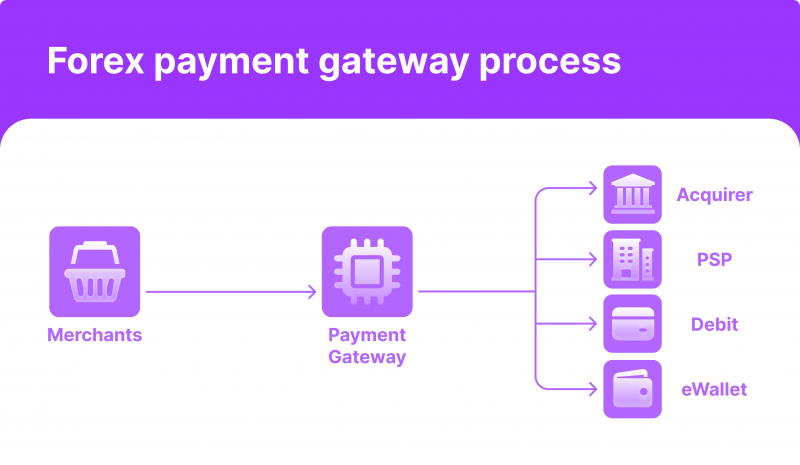

Once the users reach the checkout page, the payment gateway comes in turn, where traders insert their payment details and initiate the transaction. The gateway is responsible for payment processing, transferring it from point A to B and through multiple intermediaries and protocols.

Centralised Forex payment gateways, like credit/debit cards and digital wallets, can take longer times because they are processed through entities such as central banks. On the other hand, the revolutionary cryptocurrencies tend to be faster because they are decentralised and use peer-to-peer networks to send and receive online payments.

A payment gateway for Forex brokers works by several API integrations that facilitate transactions on the trading platform, linking several accounts and exchanging data with the payment method issuer.

Payment gateway providers charge fees in exchange for processing transfers, which vary according to some qualities like speed, coverage and other services they can provide, like managing settlements, powering quick withdrawals and creating invoices.

How to Choose a Payment Gateway for Forex Brokers

Selecting your Bitcoin payment system can majorly affect the growth of your business and the likeliness of clients using your services. If your platform provides seamless transactions at high speed, then more users will be willing to register on your platform.

Here are some qualities that you should look for in a payment gateway for Forex brokers or crypto exchanges.

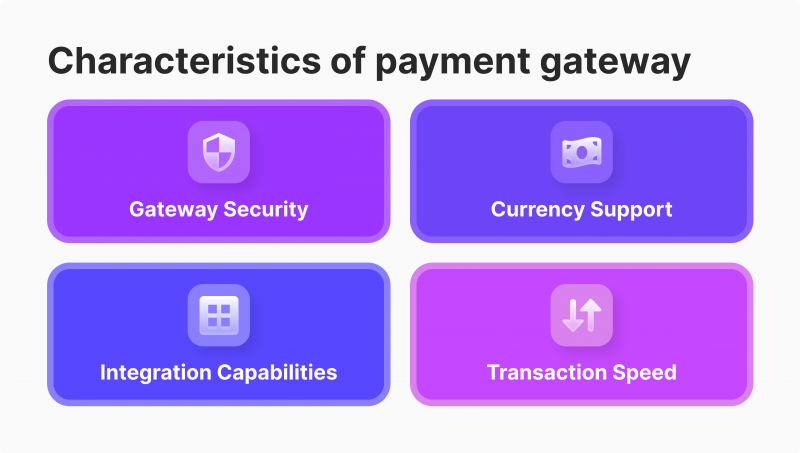

Gateway Security

Payment gateways process and exchange payment details, which carry sensitive information like credit card details, transaction amounts, and the receiver’s wallet information. Therefore, safeguarding all this information is crucial for your business and the safety of your users’ funds.

Ensure that the gateway provider adheres to industry standards and practices like anti-money laundering (AML) and know your client (KYC), which ensure that malicious actors and blacklisted identities are not involved in your transaction.

Currency Support

Providing different currencies is crucial for your service coverage and reaching as many customers as possible from different regions worldwide. This way, users do not have to exchange their local currencies for USD, for example, and pay additional fees.

Supporting multiple currencies helps avoid additional exchange fees between the Forex merchant account and the client’s local currency. Moreover, transacting this way is faster because the transaction goes through fewer intermediaries and channels, powering fast deposits and withdrawals.

Integration Capabilities

Compatibility with different service providers is crucial to attracting more clients to your platform and simplifying their payment experience.

Find a payment gateway that you can integrate with various international banks, financial institutions, exchanges and trading platforms to scale your business and provide more payment options to your clients.

Transaction Speed

Providing a fast payment method, where users can deposit and start trading within seconds, is one of the most important factors for brokerage companies. Moreover, quick payments also mean that clients can withdraw their funds almost instantly to increase customer satisfaction.

Also, a fast payment gateway helps your business receive payments and manage settlements seamlessly and with minimum delays.

How to Accept Crypto Payments Online

Finding a reliable payment gateway is crucial to promoting your name if you are launching a new company and growing your business further by offering the best conditions to send and accept payments.

Therefore, it is important to take careful steps to integrate a new crypto payment gateway as follows.

- Determine your needs from the payment gateway: Identify the unique solutions you want to provide using the payment processing system, whether supporting multiple currencies, fast cryptocurrency payments or highly secure transactions. Accompany this selection by identifying market needs and existing gaps that you can capitalise on.

- Assess your in-house capabilities: Onboarding a new payment software entails sophisticated technical knowledge to integrate and maintain the system. Therefore, ensure you have a qualified team to lead this transition or hire a capable team to avoid system failures and excessive costs.

- Find the best FX payment gateway provider: Enlist the top payment providers in the Forex industry based on the selected criteria like security, speed, reach and interoperability, and make your decision based on their pricing model and the customisation options that suit your business.

- Educate your team: Once you have integrated the new payment system, train your staff about payment streamlining and how to conduct transactions with the available payment options. This helps you better manage the system and respond to user inquiries that arise.

- Test the new Forex payment processing workflow: Run comprehensive tests to examine the payment system and check its performance and quality. Respond to any issues and apply fixes swiftly before you accept cryptocurrency payments online.

Choosing The Best Payment Gateway for Forex Brokers and Crypto Exchanges

There are many payment gateways that you can use for your platform, and each of them has distinct advantages and features. Therefore, it is possible to become overwhelmed while finding the right one for you.

Here are some dependable payment gateway providers leading Forex market transactions.

PayPal

PayPal is one of the most common digital wallet payment processors, where users can pay with credit cards and cryptocurrencies to another digital wallet.

PayPal is known for its reliable security system that protects merchants and users with advanced authentication standards. This method is a popular payment option for many online platforms, and it has recently introduced crypto payment services.

B2BINPAY

B2BINPAY is a leading payment gateway for Forex brokers and crypto firms that powers businesses worldwide to accept, store and transact with various digital currencies.

It is one of the most regulated crypto payment processors, supporting many currencies and operating across multiple blockchains to power rapid payment transactions.

B2BINPAY supports more than 300 cryptocurrencies with free-of-charge outgoing transactions.

Skrill

Skrill is a multi-currency digital wallet and a common payment method for e-commerce transactions and Forex broker platforms. This payment process deploys a robust security mechanism, including identity authentication and chargeback protection, to mitigate fraudulent activities and scam schemes.

This provider introduces frequent exchange rate updates to provide up-to-date prices and help companies scale their businesses.

Stripe

Stripe is a popular centralised payment gateway for Forex brokers that provides credit and debit card payments on various platforms like online banking, stores, e-commerce and Forex transactions.

Stripe credit card payments are powered by multiple integrations with central banks and financial institutions, besides payment technologies such as Apple Pay and Google Pay.

Conclusion

Choosing the best payment gateway for Forex brokers facilitates diverse payment methods that are quick and safe to attract more users to scale the business.

You can find several payment gateways, and each of them specialises in certain aspects, such as B2BINPAY for a smooth crypto transaction experience and PayPal and Stripe for a secure, centralised payment process.