Forex Broker Setup Guide for Beginners

The foreign exchange market remains the largest and most liquid financial market globally, recording daily trading volumes of approximately $7.5 trillion. This dynamic ecosystem presents a compelling opportunity for aspiring entrepreneurs seeking to carve out their own niche in the industry.

This Forex broker setup guide aims to equip you with the essential knowledge and insights to start a business in this competitive industry.

Key Takeaways

- A sound business plan, including financial projections and competitive positioning, forms the backbone of a successful Forex brokerage.

- Your choice of a business model, such as IB or WL, will significantly impact your business in terms of costs, control, and market entry.

- Obtaining a license, meeting regulatory requirements and implementing robust risk management protocols is a must for successful Forex broker setup.

- A strategic marketing approach, leveraging digital channels and unique service offerings, helps to secure and maintain a competitive edge in the market.

Forex Broker Setup: Start with Defining Your Goals and Target Market

As with any business venture, the first step is to define your goals and identify your target market. Success in the Forex industry hinges on understanding the diverse demographics and trading preferences characterising this dynamic landscape.

Conduct thorough research and consider customer needs, regional preferences, and competition before deciding on your target market. This will help you tailor your offerings to meet their specific needs and stand out in a highly competitive industry.

Financial Planning: Know Your Numbers

A comprehensive financial plan is the backbone of any successful business. A Forex brokerage business plan should include initial capital requirements, market entry strategy, competitive positioning, unique selling points, ongoing operational costs, realistic revenue forecasts, etc.

Start by determining your break-even point and projecting long-term profitability. Consider factors such as the potential volatility of the Forex markets and regulatory compliance costs in your financial projections.

There are many resources available online to help you and your team create a professional business plan. You can also seek guidance from experienced industry professionals or consult with a financial advisor for expert insights and recommendations.

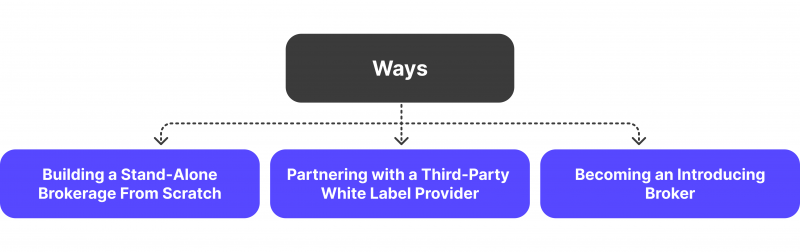

Choose a Business Model That Works for You

There are several business models to consider when deciding how to open a Forex broker business. Each model comes with its own unique set of benefits and challenges, so let’s review them:

Forex Broker Setup from Scratch

For those with a well-established business plan and ample resources, this model may be a suitable option. It involves building and managing your own Forex brokerage company from the ground up, including developing a proprietary trading platform and providing all services in-house. The benefits of this model include:

- Complete control over the business operations.

- Ability to differentiate services and develop a strong brand identity.

- Potential for higher profit margins.

However, there are also some challenges to consider:

- High upfront costs for technology development, regulatory compliance, and infrastructure setup.

- Extensive industry knowledge and expertise.

- Time-consuming process with potential delays in entering the market.

Forex Broker Setup with White Label Model

The white label model presents an appealing choice for entrepreneurs who aspire to quickly settle in the Forex market. This approach includes a partnership with a proven technology provider, who offers their Forex trading platform and associated services under the entrepreneur’s label. Consequently, brokers can primarily concentrate on promotions, client acquisitions, and customer services while capitalising on the infrastructure and technology provided by the solution provider. The white label model comes with the following advantages:

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

- Direct market penetration with a well-developed brand and infrastructure.

- Lower initial expenses and shortened development timeline for trading platforms.

- Availability of an assortment of services and support from the originating brokerage.

Nevertheless, brokers should also keep in mind some potential disadvantages:

- The provider charges Forex white label cost.

- Restricted versatility regarding technology adaptations and platform features.

Forex Broker Setup with Introducing Broker (IB) Model

The Introducing Broker model offers brokers to serve as a go-between for Forex traders and a larger brokerage firm. In the capacity of an IB, brokers direct clients to the brokerage and earn a commission or a portion of the spreads generated from their Forex trading activities. This model brings certain benefits:

- Lower setup costs and reduced operational responsibilities.

- Access to the infrastructure and support services of an established brokerage.

- Opportunity to earn passive income from directed clients.

However, there are also some potential challenges:

- Limited control over the business operations.

- Restrictions on offering additional services or features to clients.

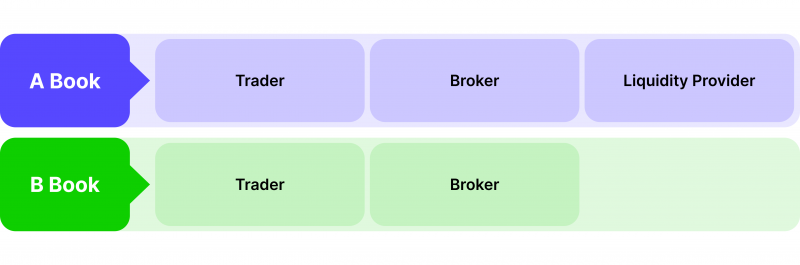

Operational Models: Choosing the Right Fit

The operational model you choose during Forex broker setup will significantly impact your risk profile, revenue structure, and overall market positioning. You can choose among several Forex broker types:

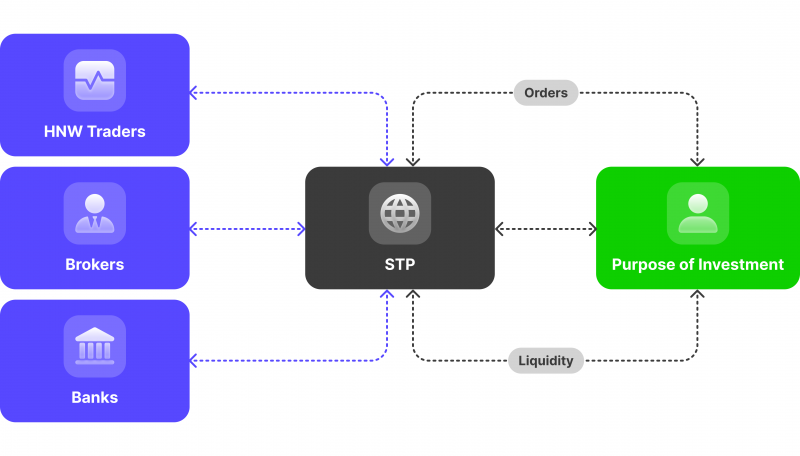

A-Book Model

Also referred to as Straight Through Processing (STP), the A-Book model represents a “direct access” strategy in which the broker serves as a third party, directing client orders towards liquidity providers. Due to its transparency, traders who desire fair and direct access to the market tend to prefer this model. The broker’s profit is derived either from transaction fees or from markups on the spread.

B-Book Model

On the other hand, the B-book, or Market-Making model, implies that the broker assumes the counterparty risk associated with client trades. Rather than forwarding trades to the market, the broker manages them internally by becoming the market maker itself. This model can lead to potential conflicts of interest between brokers and their traders. Effective risk management is pivotal to ensure the long-term viability of this approach.

Hybrid Model

As the name suggests, the hybrid model incorporates features from both A and B book brokers. The brokerage can choose either to route trades directly to the market or internally process them based on various factors. Many brokerage firms are attracted to its flexibility because it allows for optimal risk management and execution.

Obtain a License and Meet Regulatory Requirements

Forex broker setup and operation without proper licensing and regulatory compliance is not only illegal but also highly detrimental to your business’s credibility and success. The process of securing a Forex business license can be complex and time-consuming, depending on the chosen jurisdiction.

While prestigious regulatory bodies offer added credibility, their licensing requirements can be daunting for new brokerages. Consider alternative offshore jurisdictions that provide a more accessible entry point while maintaining reputable standards.

Enlisting legal experts or specialised consultancy firms can greatly assist in navigating through the complexities of obtaining a Forex brokerage license and ensuring adherence to all necessary regulations before attempting to start your own Forex broker.

Partner with a Technology Provider

There are several types of technology that a Forex brokerage requires to operate efficiently, which include Forex trading platforms, back-office systems, liquidity connections, Forex broker payment gateway services, and risk management tools. These are only the basic necessities, and you may also need to consider copy trading services and other innovative technologies to differentiate your brokerage in a crowded market.

Look for a technology provider with a proven track record in the industry and robust integration capabilities. The trading platform should offer an intuitive user interface, advanced features to enhance client engagement, and strong technical capabilities to handle high trading volumes.

Similarly, the back-office and CRM system must have essential modules such as sales management, reporting, marketing tools, IB module, and compliance protocols, among others. This system serves as the operational core of your business, impacting everything from client management to financial reporting and compliance.

If you opt for a white-label solution, your chosen technology provider will take care of all the necessary technology and system setup.

Connect with Liquidity Providers and Aggregators

For a brokerage to succeed, it must provide clients with competitive pricing and low transaction costs. Forex liquidity providers and aggregators play a vital role in achieving this goal by offering access to deep liquidity pools and competitive pricing.

The chosen liquidity partners should be reputable and reliable and offer efficient execution. Some top-tier providers offer value-added services such as risk management tools or automated trading solutions.

Aggregators can further enhance the liquidity offering by pooling together different LPs’ pricing streams to provide the best possible bid/ask price for clients, helping minimise spread costs and improve overall trade execution.

Take Care of Potential Risks

A fundamental element of any Forex brokerage company is the implementation of robust risk management protocols. These measures mitigate the risks associated with trading operations.

Set sensible leverage limits, conduct due diligence on Forex liquidity providers, and draft protective agreements. Address operational risks by tackling technological failures, cybersecurity threats, and regulatory compliance. A strong IT framework with regular maintenance, advanced cybersecurity, and fail-safes is also essential in your ecosystem. Staying updated with regulatory changes and fostering a compliance-centric culture ensures operational stability and risk awareness.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Implement a Marketing Strategy

A sound marketing strategy is crucial for attracting and retaining clients. Utilise digital marketing channels to reach potential clients globally and employ targeted campaigns to attract specific demographics.

Leverage social media platforms, webinars, and content marketing to establish your brand’s online presence and educate potential clients about your offerings. Collaborate with industry experts, influencers, or partners to enhance your reach and credibility.

Find creative ways to differentiate your brokerage from the competition, such as offering unique trading products or exceptional customer service. Remember that ongoing marketing efforts are essential for long-term success in a competitive Forex market.

Download the free PDF guide covering the key decisions, common mistakes, and real costs of starting a brokerage.

Forex Broker Setup: Should You Do It?

Forex broker setup in 2025 offers an exciting opportunity in the dynamic financial markets. However, it requires strategic execution and careful planning, from identifying your target audience and crafting a detailed business plan to navigating regulations, selecting the ideal trading platform, and implementing robust risk management protocols.

At the end of the day, in this fast-paced industry where trends shift every day, the competition heats up, and technology moves forward, it’s wise to go for a turnkey solution provider. A ready-to-use tech stack doesn’t just save you time and money; it also frees you up to concentrate on marketing and growing your business.

With such all-encompassing solutions at their disposal, aspiring brokers can effectively tackle the market’s complexities and carve out a successful niche for themselves in the competitive world of forex trading.