How Do Crypto Exchanges Make Money? — An In-Depth Look

In 2024, the global cryptocurrency market cap reached a staggering $2.7 trillion, underscoring the massive appeal and momentum within this space. Crypto exchanges, where the most activity happens, handle trillions of dollars in annual trading volume, and the largest ones host millions of transactions daily.

Crypto exchanges have proven to be immensely profitable. In 2021, Coinbase reported $1.4 billion in revenue—comparable to established traditional banks. Binance, the largest exchange by trading volume, handles over $15 billion in trades on an average day, with its annual revenue estimated in the billions. These exchanges profit through a complex crypto exchange business model beyond simple trading fees.

So, how do crypto exchanges make money? This article explores their revenue model in depth—from trading fees to staking services and more.

Key Takeaways

- Exchanges make money through diverse revenue streams, including trading fees, withdrawal fees, staking services, and lending products.

- Trading fees are the primary revenue source for most exchanges, with top platforms handling billions in daily transactions.

- Starting a crypto exchange involves significant costs, from security and compliance to infrastructure and customer acquisition.

What Is a Cryptocurrency Exchange?

A cryptocurrency exchange is a digital marketplace where users can buy, sell, or trade cryptocurrencies and other digital assets. These platforms are the lifeblood of the crypto economy, creating liquidity, setting market prices, and offering various financial services.

With global crypto trading volumes regularly hitting $100 billion a day, exchanges play a key role in connecting millions of users worldwide and driving the explosive growth of digital assets.

Types of Crypto Exchanges

Not all exchanges are created equal. They fall into two major categories, each with unique features, benefits, and drawbacks that appeal to different kinds of users.

Centralised Exchanges (CEX)

CEXs like Binance, OKX, and ByBit dominate the market, facilitating the majority of all crypto trading volume. These exchanges operate much like traditional financial institutions, where a central company oversees and manages all trading activities. This structure enables high liquidity, extensive trading pairs, and advanced security measures.

However, CEXs require users to trust a third party with their assets and data. While they provide a user-friendly experience and strong security measures, the centralised model means that users must place their trust in the exchange to protect their funds.

Decentralised Exchanges (DEX)

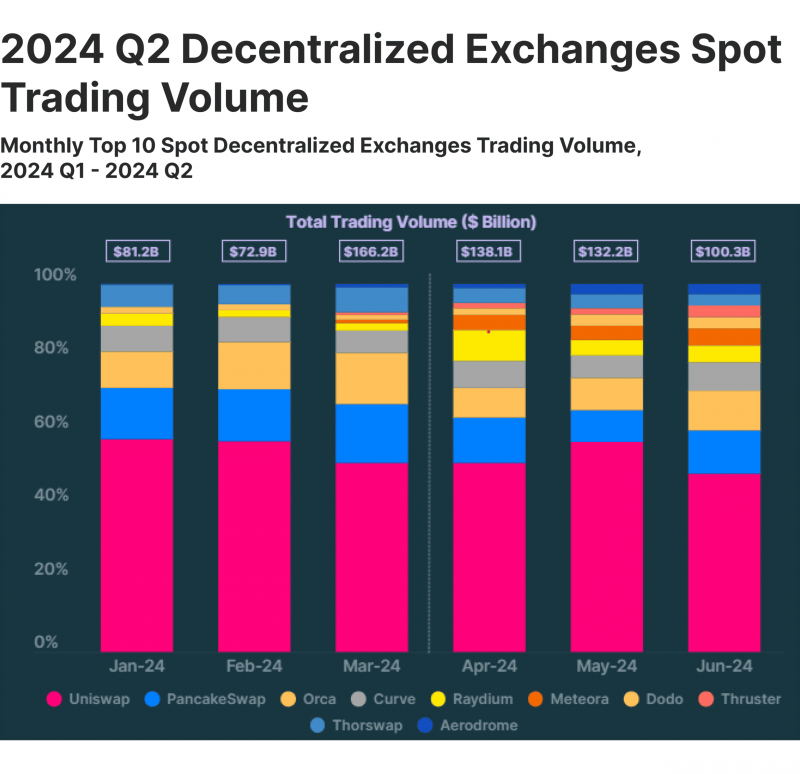

DEXs like Uniswap, Raydium, and PancakeSwap provide an alternative model that eliminates the need for intermediaries. Built on blockchain technology, DEXs facilitate direct peer-to-peer trading, which offers greater transparency and autonomy. DEXs are growing quickly, with Uniswap alone handling billions of dollars in daily trades on the Ethereum blockchain.

DEXs have become increasingly popular, especially among users who value privacy, control over their funds, and the censorship resistance that blockchain technology enables. However, they tend to lack the high liquidity and ease of use found on CEXs, and trading fees can fluctuate based on network demand.

DEXs are experiencing remarkable growth as more users seek decentralised alternatives. In Q2 2024, trading volume on the top 10 DEXs surged 15.7% compared to the previous quarter, reaching $370.7 billion.

Primary Revenue Streams for Crypto Exchanges

Crypto exchanges have mastered a range of revenue-generating strategies, with trading fees leading the way, but their income doesn’t stop there. Let’s take a closer look at the primary revenue streams for crypto exchanges and the numbers behind them.

Trading Fees

Trading fees are the primary source of any crypto exchange revenue. Every time a user buys or sells a cryptocurrency, the exchange takes a small percentage of the transaction. With trading volumes often in the billions, these small fees quickly add up.

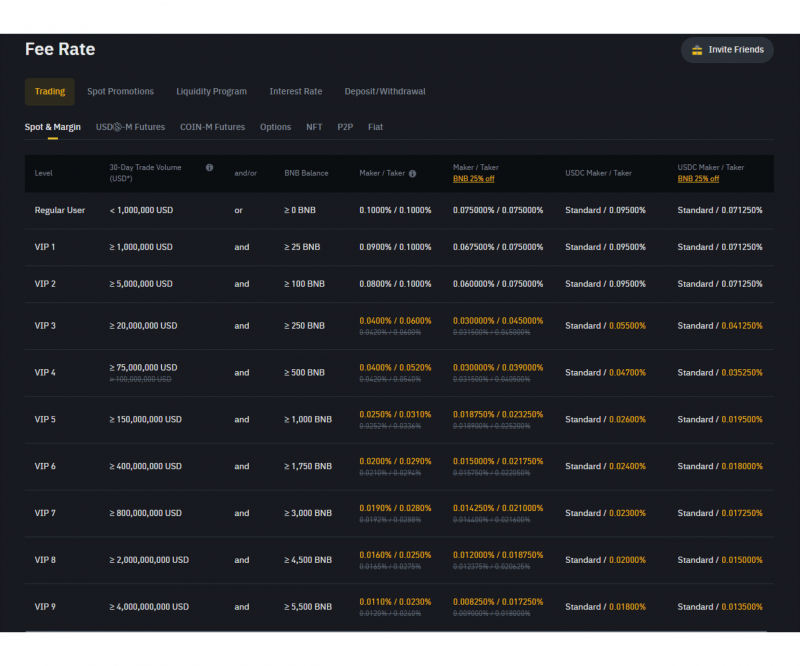

Most exchanges use a maker-taker model to determine fees. “Makers” are users who add liquidity to the market by placing limit orders, which are usually charged lower fees than “takers,” who remove liquidity by executing market orders. Fees typically range from 0.1% to 0.5% per transaction, depending on the exchange and the user’s monthly trading volume.

Fee Comparisons:

- Binance: Charges a flat 0.1% fee for both makers and takers, with discounts if users pay fees using Binance’s native token (BNB). For example, BNB users can save up to 25% on fees.

- Coinbase: Utilizes a tiered fee model, with fees ranging from 0.04% to 0.60% depending on the user’s trading volume. The more you trade, the lower your fees.

- Kraken: Charges makers 0.16% and takers 0.26% on average, rewarding users who contribute to liquidity with lower fees.

Trading fees are highly profitable, especially during high-volume periods. In 2022, the ex-CEO of Binance revealed that 90% of the platform’s revenue comes from transaction fees. To encourage higher volumes, exchanges often offer discounts for high-frequency traders.

Withdrawal and Deposit Fees

Withdrawal and deposit fees offer another revenue stream for exchanges, though they vary significantly based on the type of transaction and the currency involved.

- Withdrawal Fees: When users withdraw cryptocurrencies, exchanges typically charge a fixed fee to cover blockchain network costs, which vary depending on the asset. For example, withdrawing Bitcoin on Binance incurs a 0.0005 BTC fee (approximately $17 as of recent BTC prices). These fees contribute substantial revenue for popular exchanges with millions of daily users.

- Deposit Fees: Fiat deposits (such as USD or EUR) are often free via bank transfer but incur fees if made with credit or debit cards. For example, Coinbase charges up to 3.99% for card deposits, a significant revenue boost that helps offset processing fees.

While not as lucrative as trading fees, withdrawal and deposit fees still generate millions annually. With the sheer number of transactions processed by top exchanges, these seemingly small fees accumulate into a significant source of income.

Listing Fees

Projects usually pay exchanges to list their tokens and gain visibility with millions of potential users. For a new cryptocurrency project, a listing on a major exchange can mean exponential growth in adoption and visibility, and exchanges capitalise on this demand.

Listing fees can vary widely. For smaller exchanges, fees can start around $10,000, while major platforms like Binance reportedly charge as much as $1 million per listing. These fees are justified by the high exposure and potential trading volume a listing on Binance or Coinbase can bring.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Examples:

- Binance: Known for its stringent listing requirements, Binance has charged substantial fees to projects wanting visibility on its platform.

- OKX and Huobi: Both exchanges have also charged high fees for token listings, though they sometimes negotiate rates based on the project’s potential trading volume.

In order to stimulate trading, some exchanges offer free listings for high-profile tokens, recouping the cost through increased trading fees from the high-volume trades these tokens often bring.

Margin and Leverage Crypto Exchange Fees

Margin and leverage trading allow users to borrow funds to make larger trades, amplifying both potential gains and risks. Exchanges make money here by charging interest on borrowed funds and additional fees based on the level of leverage.

- Leveraged Trading: Binance, for example, offers up to 20x leverage on certain trading pairs, allowing traders to borrow up to 20 times their initial investment. Interest rates vary depending on the asset and market conditions, and borrowers are typically charged an additional fee for accessing leverage.

- Interest Rates: Kraken, another popular platform, charges 0.02% per four hours for borrowed funds. These interest charges and fees accumulate quickly, especially during periods of high volatility when leveraged trading surges.

Margin trading fees, combined with interest from borrowed funds, represent a significant income stream. In some cases, margin trading can account for over 20% of an exchange’s revenue. However, offering leverage also brings increased regulatory scrutiny due to the heightened risk involved, leading some exchanges to limit or restrict leverage offerings in certain regions.

Crypto exchanges derive revenue from a variety of channels, with trading fees being the biggest contributor by far. These revenue streams can translate to billions in profits in a booming market.

Additional Revenue Streams and Monetisation Methods

Many platforms have diversified their offerings, tapping into additional services that boost revenue and enhance user engagement and platform loyalty.

From staking and lending to token sales and market-making, these supplementary revenue streams add to a crypto exchange’s profitability and offer users various ways to grow their assets.

Staking Services and Yield Products

Staking is a popular feature on major exchanges, allowing users to make money from crypto simply by holding it on the platform. In Proof-of-Stake (PoS) networks, users can “stake” their coins to support network operations, earning rewards in return.

Exchanges act as intermediaries for staking, taking a percentage of the rewards as service fees. For instance, Coinbase charges a 25% fee on staking rewards, letting users stake Ethereum, Solana, and other PoS assets directly on their platform.

Staking encourages users to keep their assets in exchange for maximising rewards, creating a stable and passive revenue source. Staking product revenue accounted for $62 million during Coinbase’s three-month period in 2022 – a whopping 10% of the company’s total revenue.

By offering to stake, exchanges add a passive income stream and boost user retention, as users are incentivised to stay with the platform long-term to maximise rewards.

Lending Services

Crypto lending is another lucrative service offered by exchanges, allowing users to lend their assets in exchange for interest, often paid out in crypto.

Exchanges like BlockFi offer lending services by pooling user-deposited assets and lending them out at higher rates than they pay to depositors. This spread creates a steady revenue stream as exchanges pocket the difference in rates.

With interest rates ranging from 2-10% annually, crypto lending has become popular among both retail and institutional investors. For example, Binance’s lending products offer flexible and fixed-term options, with interest rates varying by asset type and term duration. During high-demand periods, these products can bring in substantial revenue for exchanges by providing attractive returns on assets that would otherwise sit idle.

Crypto lending appeals especially to users looking to earn a return on their holdings without selling, while exchanges benefit from consistent revenue through interest rate differentials.

Token Offerings

Token offerings, especially Initial Exchange Offerings (IEOs), are also profitable ventures for exchanges. In an IEO, new blockchain projects sell their tokens directly on an exchange, providing immediate exposure to a large user base and benefiting from the platform’s credibility.

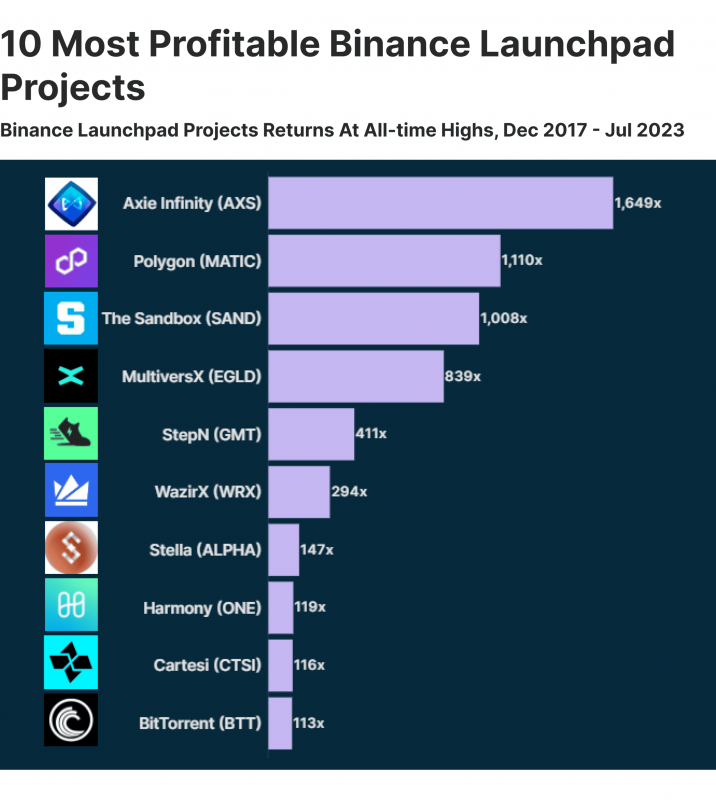

Exchanges typically take a cut from the funds raised in an IEO, often around 5-10% of the total amount. This model became popular after Binance’s Launchpad platform raised millions for projects like Polygon. By hosting IEOs, exchanges earn a commission and attract new users eager to participate in early-stage projects.

Token offerings also increase user engagement, as many investors seek opportunities to buy new tokens before they’re publicly traded. These offerings can drive significant trading volume, generating even more revenue through trading fees.

Market-Making Services

Liquidity is crucial for any exchange, and many platforms offer market-making services to help ensure that newly listed tokens have sufficient trading volume and stable pricing. Market makers place both buy and sell orders on a token’s trading pair, narrowing the bid-ask spread, which creates a more seamless trading experience.

Exchanges profit from market-making by taking a small fee or percentage on each transaction within the bid-ask spread. They may also earn through service fees for maintaining liquidity pools, particularly for smaller tokens or those new to the market.

For smaller or emerging tokens, market-making services help attract users by stabilising prices and ensuring that there is always an available buyer or seller. This attracts more trading volume, which in turn increases revenue through additional trading fees.

Market-making services are particularly beneficial for new or lower-liquidity tokens seeking greater exposure and stability on the platform, creating mutually beneficial partnerships that drive trading volume and revenue for the exchange.

Cost Structure and Operational Expenses

Running a crypto exchange is no small feat—it involves a hefty investment in security, infrastructure, compliance, and customer acquisition. While exchanges can be highly profitable, the costs of maintaining and scaling a platform are significant, and managing these expenses is essential to long-term success, especially for newer and smaller exchanges.

Development Requirements

How to make a crypto exchange? Is it expensive? Building a crypto exchange typically requires significant development resources. The crypto exchange development cost can range from $300,000 to $500,000 for a simple platform and $1 million+ for a more sophisticated setup.

However, businesses looking to reduce development costs can consider white-label (WL) solutions, which offer a customisable, pre-built platform at a significantly lower price point. White-label solutions allow new exchanges to enter the market more affordably, making them a popular choice for startups aiming to minimise initial expenses while still providing robust functionality.

Technical Infrastructure

A crypto exchange’s technical infrastructure must be robust enough to handle massive trading volumes, often in the billions of dollars daily. Exchanges require fast and reliable servers, trading engines, API integrations, and real-time data analytics to ensure seamless performance.

Depending on the exchange’s size, these costs can range from $50,000 to $500,000 per month. Smaller exchanges may opt for cloud services, while larger ones may need dedicated data centres to handle high volumes and low-latency trading. Binance, for instance, has reported processing over 1.4 million transactions per second at peak times, necessitating one of the most advanced infrastructures in the industry.

With technology rapidly evolving, exchanges must continually invest in infrastructure upgrades to remain competitive. High-frequency trading, mobile app enhancements, and improved security features are all ongoing expenses that require skilled engineers and developers.

Security and Compliance

Hacks and cyber threats are constant risks in the crypto world, and a single breach can lead to millions in losses, damage to reputation, and regulatory scrutiny. Exchanges invest heavily in cybersecurity measures to protect users’ funds and data from increasingly sophisticated attacks.

Security Costs: Leading exchanges like Binance reportedly spend over $10 million annually on security alone, investing in advanced encryption, multi-signature wallets, and real-time threat monitoring. This cost covers everything from routine security audits to employing top-tier cybersecurity talent.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Regulatory Compliance: Compliance is also critical, particularly as global regulations tighten around digital assets. Meeting Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements is costly but essential to operating legally in various jurisdictions. Large exchanges spend millions on compliance each year to remain within regulatory standards, which include extensive record-keeping and regular audits.

These measures are not just costly but vital, as regulatory fines can be steep, and a single security breach can be a death blow to an exchange’s reputation and user trust.

Customer Support and Marketing

Customer support and marketing are often overlooked but crucial expenses in running an exchange. As the market grows increasingly competitive, exchanges must offer excellent support and constantly seek ways to attract and retain users.

Customer Support: Support needs to be accessible 24/7, as users from all time zones require assistance with account issues, transaction errors, and technical problems. This often requires multi-language support teams and can cost hundreds of thousands of dollars annually.

Marketing and Customer Acquisition: With hundreds of exchanges vying for user attention, marketing is key to standing out. Large exchanges spend hundreds of millions on customer acquisition, leveraging social media, digital ads, sponsorships, and influencer partnerships to capture a larger market share. To build brand recognition and credibility, Binance has invested in high-profile sponsorships, including a partnership with FC Barcelona.

Case Study: How Major Exchanges Have Grown and Profited

The rapid success of crypto exchanges like Binance and Coinbase offers powerful insights into what it takes to build a successful exchange. Let’s take a closer look at how Binance and Coinbase have scaled, profited, and set the standard for other exchanges to follow.

Binance: From Startup to Global Leader

Launched in 2017, Binance has skyrocketed to become the world’s largest cryptocurrency exchange by trading volume. In just a few years, Binance went from an emerging player to processing over $15 billion in daily trades across hundreds of cryptocurrencies, with peak days reaching as high as $76 billion in trading volume. This exponential growth can be attributed to several key factors:

- Low Fees and High Volume: Binance offers one of the most competitive fee structures in the industry, charging a flat 0.1% per transaction. Users can further reduce fees by paying with Binance’s own BNB token, providing an added incentive to keep assets on the platform. This low-fee model has attracted millions of high-volume traders, solidifying Binance’s position as a global leader.

- Diverse Revenue Streams: Binance has skillfully diversified its revenue beyond trading fees. The platform offers staking services, crypto lending, and Initial Exchange Offerings (IEOs) through its Launchpad platform. Since its inception, Binance Launchpad has raised millions of dollars for new blockchain projects, supporting tokens like Polygon (MATIC) and Axie Infinity (AXS), which went on to become industry leaders.

- Global Expansion: Binance has a strong international presence, catering to users in over 180 countries. It has strategically navigated regulatory landscapes, sometimes restructuring operations to meet compliance standards, such as establishing Binance US for the American market.

Today, Binance boasts over 120 million registered users and a valuation estimated at over $300 billion, making it one of the most influential companies in crypto. By continually expanding services and adapting to new markets, Binance demonstrates the power of a user-centric, globally accessible model.

Coinbase: A Compliance-Driven Approach for Mass Adoption

Coinbase, founded in 2012, is a U.S.-based crypto exchange known for its regulatory compliance and focus on retail investors. Unlike Binance, which targets a broad global audience, Coinbase has honed in on the American market, where it has built a reputation for reliability and security. Its adherence to strict U.S. regulations has made it a top choice for both retail and institutional investors, leading to impressive financial performance.

- Regulatory Compliance and Transparency: Coinbase has always placed a high emphasis on regulatory compliance, which has paid off as crypto adoption grows in the U.S. In 2021, it became the first major crypto exchange to go public, listing on the NASDAQ with a valuation of $86 billion. In 2024, Coinbase further solidified its position as a trusted entity by partnering with major hedge funds to launch spot Bitcoin ETFs.

- Revenue Model Focused on Retail Investors: Coinbase charges higher trading fees than many competitors, with a tiered fee structure ranging from 0.04% to 0.60% depending on trading volume. Despite the higher costs, Coinbase has attracted millions of retail users with its user-friendly platform, excellent customer support, and strong emphasis on security.

- Expanding Product Offerings: To enhance its revenue model, Coinbase has added a range of services, including staking, crypto custodial services for institutions, and Coinbase Earn, which allows users to earn crypto by learning about new projects. This diverse suite of products has helped Coinbase generate consistent revenue, with $1.4 billion in revenue reported for Q2 2024 alone.

With its compliance-focused approach, Coinbase has become the go-to exchange for users seeking a secure and regulated environment, proving that regulatory compliance can be an asset rather than a burden.

Conclusion

Crypto exchanges employ a diversified revenue model that includes trading fees, withdrawal fees, staking services, and more. They provide significant profit potential but face high operational costs, security challenges, and regulatory scrutiny.

While there are ways to make money with crypto, running an exchange involves navigating these complexities. Businesses interested in entering this space should weigh the high revenue potential against the risks and consider whether they have the resources and compliance strategies needed for success.

FAQ

What is a crypto exchange revenue model?

Crypto exchanges primarily generate revenue through trading fees, which are charged on each transaction. Additional income streams include withdrawal and deposit fees, listing fees for new tokens, margin trading fees, staking services, and more.

How do exchanges make money from liquidations?

In margin trading, if a trader’s position moves against them beyond a certain threshold, the exchange may forcibly close (liquidate) the position to prevent further losses. Exchanges often charge fees for these liquidation processes and may profit from the difference between the liquidation price and the market price.

Is trading on Binance halal?

Spot trading is generally considered halal; margin and futures trading may not be, as they can involve interest and high risk. Consult an Islamic scholar for specific guidance.