How Does a Broker-Dealer Work?

Broker-dealers are an example of those agents who trade for you in different exchanges for fees and commissions. Let’s discuss the details of a broker-dealer and how they work.

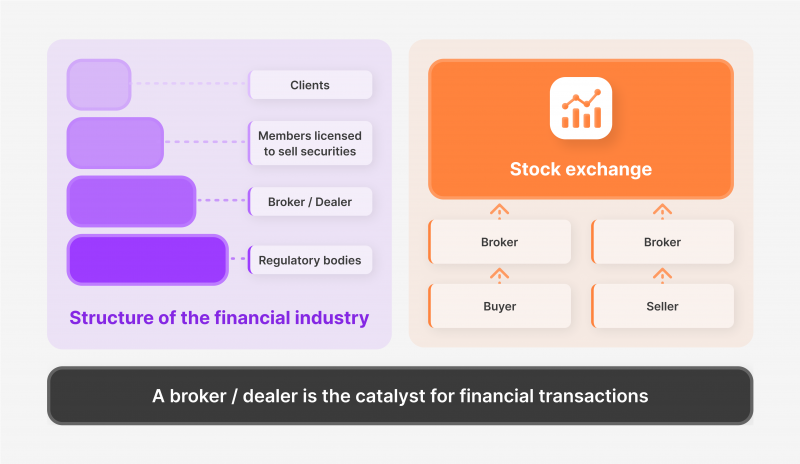

Trading in financial markets is no longer exclusive to businessmen and registered traders who spend their day in the Forex or stock marketplace with hundreds of traders exchanging news and trades.

Now, you can conduct a simple search, find an online broker and engage in different financial markets like stocks, bonds, commodities and more. You do not need to reside in the market or even physically own securities.

Key Takeaways

- Broker-dealers are financial entities that trade in financial markets on behalf of their clients on one hand and who also trade in the market for themselves.

- Broker-dealer firms provide full-packaged brokerage services or discount brokerage limited to placing market orders.

- Registered investment advisers are broker-dealers who work independently from any corporation and provide top-notch consultancy and advisory services.

- Broker-dealers charge different fees, with the spread as the most common one. However, RIAs usually impose higher fees for their advanced market expertise and knowledge.

Broker-dealer Definition

A market participant who deals for you or themselves is called a broker-dealer, and they can be an individual or a financial institution serving several clients. The name originates from the fact that they offer brokerage services to investors and act as a broker or pursue their interest in the market and act as a dealer.

Broker dealers have several functions in the market; they execute trades for their clients, provide financial advisory services, and conduct market research with the aim of increasing their clients’ capital.

One of the most crucial roles of a broker-dealer is market making, where they buy and sell securities repeatedly in different markets and improve their overall financial well-being.

This is important because it increases liquidity, making financial instruments more available, making prices more dynamic, powering fast order executions and enhancing market efficiency.

How Do Broker-Dealers Work?

Broker-dealer services exceed the sole order execution activity, as they can serve lots of clients on the one hand and trade for their own accounts on the other hand. However, broker-dealers clearly distinguish their roles to avoid conflict of interest as they play several roles.

As a Broker

A broker-dealer represent their brokerage firm when serving other investors or clients, offering a wide range of service. Their function is to execute market orders as required by the client, whether using their firm’s securities (stocks, commodities, etc.) or finding tradable assets at other broker-dealers and exchange markets.

However, a full-service broker offers consultancy services for their investors, especially for new ones or who do not have experience in a specific market. A broker can offer different trading functions like futures, options, margin trading, and more tools that aim at increasing the investor’s wealth.

Moreover, a broker may provide the technological means to trade, such as the trading platform, various charting and analysis tools, and crafting custom strategies to succeed and thrive in the financial market.

Brokers who offer margin account trading entail using leverage, which allows traders to place market orders with the broker’s borrowed money.

Fidelity Investments is the largest brokerage firm as of August 2023, managing over $11 trillion in assets under administration.

As a Dealer

A broker-dealer may trade for themselves or the brokerage company they represent; in this case, they are called Principals.

Dealer participates in financial markets, buying and selling securities to pursue their organisation’s interest and grow the company’s holdings of cash and assets. Thus, dealers purchase securities like company stocks and sell them in secondary markets for a higher price and make a profit for their brokerage firm.

Therefore, they must carefully follow the market and track updates to find the right investment to bring gains. For example, they can buy company ABC stocks for $50 per share and sell them at $52 to land some revenues.

This repetitive dealer activity contributes to the market’s prosperity, making it more efficient by creating more tradable assets in the market and taking the counterpart side in multiple trades.

However, broker-dealers must execute their trades carefully to ensure full compliance with the laws of the SEC, the FINRA, and other regulatory bodies.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Underwriting

A dealer-broker may perform underwriting roles, whether as a consultancy service to their clients or to serve their brokerage firm, which means assessing the risks associated with a specific security before making investment decisions.

An underwriter evaluates the security, for example, a stock, and analyses its profitability and potential before buying and selling it at a higher price.

Underwriting is usually associated with IPOs when organisations plan to go public and release their shares to secondary markets. Underwriters work for investment banks or financial institutions, where they provide in-depth research about a particular IPO.

The vetting process (security evaluation) ensures that the stock price will increase after going public so they can sell at a higher price to other investors and markets and make profits.

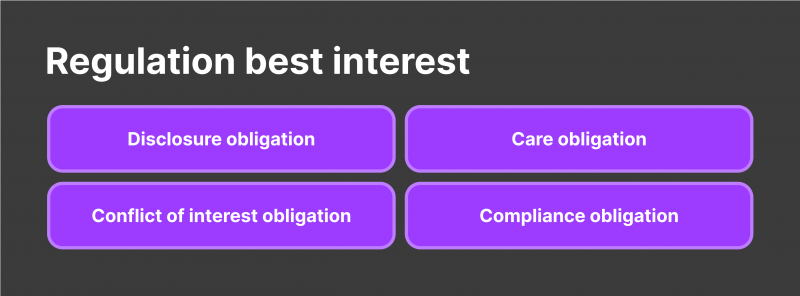

Regulations

Financial trading and investment are subject to stringent laws and regulations by US authorities like the Securities and Exchange Commission (SEC), the Securities Investor Protection Corporation (SIPC) and the Financial Industry Regulatory Authority (FINRA) that ensure market integrity and fairness.

Therefore, broker-dealers must fully comply with the applicable laws while executing market orders and offering consultancy to their clients to avoid illegal insider trading.

Thus, they must follow specific procedures in providing investment advice, like informing their clients if a trade may result in a conflict of interest and using logical reasoning while planning and advising.

Additionally, dealers are required by the law to inquire about their client’s financial information, investment patterns and objectives and tax status and identification to avoid unintentional participation in illegal activities.

Types of a Broker-Dealer

Broker-dealers are crucial market participants due to the various activities and roles they practice, which contribute to the overall market efficiency. Regardless of whether they work as a broker or a dealer, there are two types.

Wirehouse

Wirehouses are full-service brokerage firms that offer financial services for their customer base. Wirehouse brokers are non-independent employees who offer market research services, market order execution, investment advisory, and trading on behalf of the company they represent.

The term “Wirehouse” came from the fact that the brokerage firm’s branches and headquarters used to be connected via classic telephones and wired communication to receive market information and price updates. Wirehouse brokers used wired telephones to connect with their clients and deliver market information before executing any market order.

These brokers no longer use wired communication in light of the internet and cloud computing access, where everything can be broadcast live from the market within a few seconds. However, the term “wirehouse” is still used in reflection of the system’s crucial role in the rise of financial markets and services.

Wirehouse broker-dealers work in accordance with their organisational objective and benefits. Therefore, they offer tradable securities that their company owns or products that can sell at a higher price than the original purchase price.

Wirehouse brokers offer other financial services, including financial planning, where they help decide on which assets to invest and how much to allocate. They also offer asset management services, where they keep track of transacted securities, financial and cash flow statements, and portfolio risk management.

Independent Broker-Dealer

Unlike wirehouse firms that offer full-service or discount brokerage, independent broker-dealers work for themselves and pursue financial objectives that suit them and increase their wealth.

They are proficient traders who have gained enough experience and knowledge of the market and can cover their administrative expenses and marketing efforts.

Broker-dealer consultants hold series 6 or 7 licences that allow them to buy and sell a wide variety of securities and are registered in the SEC as independent representatives. Registered independent dealers (RIA) work with independent brokers who provide the technological and legal compliance side of things.

These dealers usually garnered a solid reputation and network over the years and can access exclusive information. Therefore, they work as advisers with wealthy investment firms and individuals with high-volume trading activities.

Independent dealers may offer similar products and securities that a discount or full-service broker would offer. However, these experienced traders can offer access to updates that are not known to the public yet, giving their clients a competitive edge in the marketplace.

This type of dealer can be a bit more expensive than discount brokers, but they provide tailor-made services that promise high returns.

Additionally, brokers working with wirehouses and large corporations usually receive a fixed income with a tiny fraction of their sales, around 3-5%. However, brokers who work with this type of dealer can bring substantially higher commissions, ranging between 25% to 50%, simply because they have fewer overheads and fixed costs to pay.

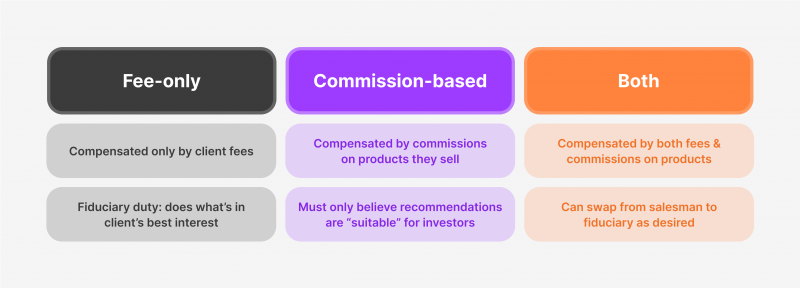

Types of Fees of a Broker-Dealer

Brokerage fees vary widely depending on the type of broker-dealer and the type and size of company they work with and represent. However, there are several pricing policies that most brokers follow.

Full-Service Brokers

Full-service brokerage firms offer a wide range of financial services that exceed a typical broker’s duty of trading and executing orders. Therefore, brokerage fees depend on the package of services they offer you, like account management, financial research, strategy creation and implementation, risk assessment, and others.

Besides any yearly or monthly fee these firms may charge, you can expect a fraction of 1% to 3% commission from the total investment.

Discount Brokers

This type of broker offers a limited service exclusive to executing market orders and some advisory services while offering a set fixed range of tradable instruments. Therefore, this might be a good choice if you are looking for a more budget-friendly brokerage service.

You may expect to pay less while dealing with a discount broker or even as low as $5 per trade while incurring an annual account retainment fee of less than 1%.

Spread

The spread is one of the most common brokerage fees, which is the difference between the asking and the bidding prices. Thus, just like any business, they buy and sell securities at higher prices and reap the differences as profits.

For example, a broker can purchase 50 shares from company ABC for $100 each and resell them in secondary markets for $101 per share and a profit of $1 per share. Note that it is an imaginary example because $1 is a significant amount, and $0.15 is a reasonably sufficient spread per share.

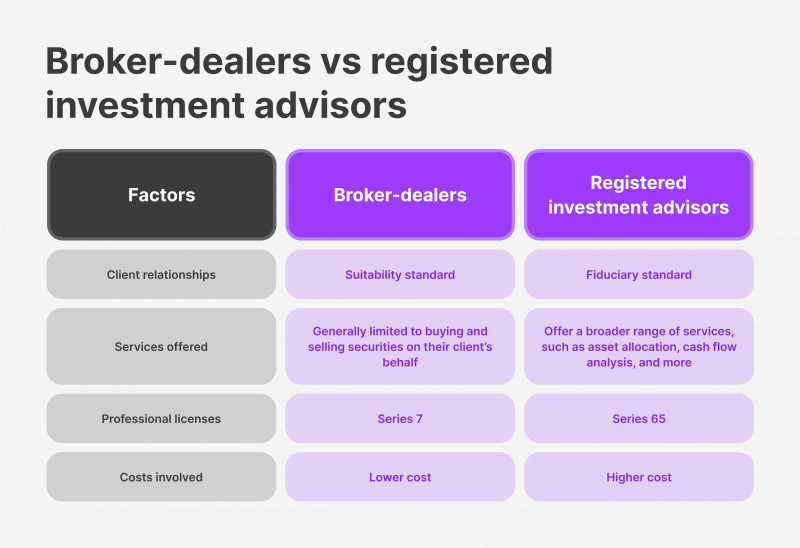

RIA vs Broker-Dealer

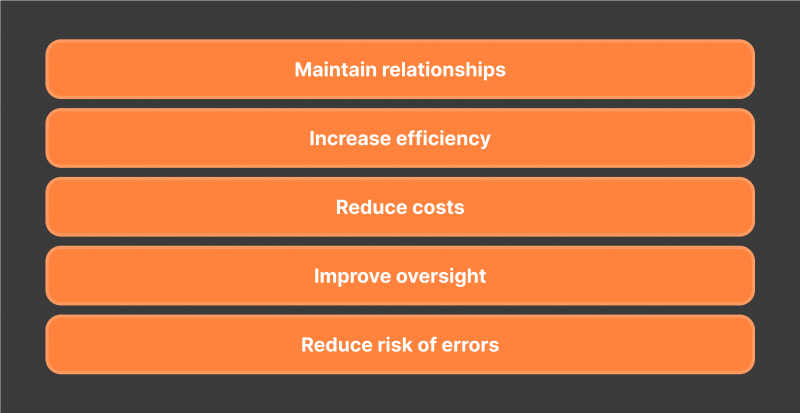

Choosing between a broker-dealer or an independent investment adviser depends on your objective, the size of your organisation, your budget, and the type of services you expect to receive.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Therefore, to make the choice easier for you, we have put brokers-dealers and the RIA market head-to-head to draw a clearer picture.

Broker-Dealers

Broker-dealers who work at a wirehouse firm offer typical brokerage services in two types: either full–service trading assistance or discount brokers. A full-fledged broker will provide consultancy, trade execution, financial planning, strategy building, asset management, and more, depending on your needs.

These brokers harness technological solutions and multi-account management to grow your portfolio.

The other type is the discount broker, who merely works on placing market orders for you and ensures the execution of certain assets at a determined price requested by the client. This type of brokerage is beneficial for those who do not want to pay additional fees or have enough knowledge to plan their trades or outsource them.

RIA

On the other hand, a registered investment adviser works independently from any organisational arrangement and utilises their extensive experience and knowledge in assisting clients. These experts are regulated to work by a series 7 license, which allows them to buy and sell securities from different classes.

However, they lack the technological means to handle securities transactions and have lower overhead and administrative expenses. This type of broker is practical for large hedge funds and financial institutions with trading platforms and solutions looking for financial advisors to provide fully-fledged services.

Registered investment advisors may charge higher fees than a conventional broker-dealer. However, they have a higher potential to bring better return on investment and provide access to exclusive news and updates that the public may not be aware of, giving their clients a competitive advantage.

Conclusion

Broker-dealers are financial market participants and entities who trade for their clients using their or other’s securities (brokers) and trade for their own accounts to benefit their firm (dealers).

These are usually large financial corporations that handle multiple accounts and manage assets of different classes, offering trade opportunities for their customers. Broker-dealers come in two categories: full-service brokerage firms or independent registered brokers.

Both types offer different services tailored to grow their client’s capital and optimise their return on investment. Therefore, you may choose according to your business size, type, and goal.

FAQ

What are the duties of a broker-dealer?

Broker-dealers engage in financial markets to execute market orders, buying and selling securities for their clients as brokers and for their firm’s account as dealers. Therefore, their sole purpose is to grow their clients’ and company’s wealth.

What is the difference between a broker and a broker-dealer?

A broker works as a middleman between investors and markets, managing market orders on their behalf. However, broker-dealers provide brokerage services besides trading for their own account to grow their wealth.

What are examples of broker-dealers?

Significant financial corporations and investment banks like Wells Fargo, Morgan Stanley and Charles Schwab are a few examples of broker-dealer multi-million dollar institutions that trade for their investors and trade for themselves to benefit their accounts.

How do broker-dealers make money?

Broker-dealers make their money from brokerage commissions and fees, like spread, charging a fraction of every trade they execute, annual account management fees, etc. These fees can be determined as fixed fees or a percentage of each transaction.

What are broker-dealers?

Broker-dealers are financial entities or individuals that participate in financial markets by executing trades on behalf of clients (as brokers) and trading for their own accounts to generate profits (as dealers). They play a dual role, offering brokerage services like executing market orders and financial advisory while also engaging in proprietary trading to grow their firm’s assets.