How Does MT4 Trade Manager Work?

One of the best decisions you can make as an FX trader is investing in MT4 Trade management software. MT4 Trade Manager is an absolute time saver and a powerful tool that enhances trading performance by offering features like trade automation, risk management, trade tracking, and backtesting, thereby increasing profits and boosting trading experience.

Key Takeaways

- MetaTrader 4 is a popular trading venue developed by MetaQuotes with various tools and resources to execute trades.

- MT4 Trade Manager is a third-party app that enhances trade and money administration.

- MT4 Manager is essential for every trader.

MT4 Management Software for Trades

MetaTrader 4 platform is a popular trading venue that provides traders with various tools and resources to execute trades, analyse markets, and manage their trading activities effectively. It offers automated trading capabilities, including EAs and a Market Watch window for real-time quotes and prices.

MT4 supports one-click trading, allowing traders to execute market orders, limit orders, stop orders, and other order types. MT4 trade management software also offers advanced trade features like trailing stop options, multiple order types, and partial order closing. Additionally, MT4 provides access to extensive historical price data, allowing traders to analyse past market behaviour and develop trading strategies based on historical performance.

Explaining MetaTrader 4 Trade Manager

MT4 Trade Manager is a third-party application that integrates with MetaTrader 4 to enhance trade and money management and help traders handle their trades more effectively, either manual or automated. Known as Expert Advisors (EA), they offer a powerful tool for automating trade-related tasks and executing trades based on pre-set rules; MT4 EA can automate trade entry and exit, monitoring the market for specific conditions that align with a trader’s strategy.

The tool retrieves trade data like open positions, account balances, and pending orders. It also provides features like trade automation, input of trade size, trailing stop, risk administration, trade tracking, and backtesting, enhancing traders’ trading experience.

The Trade Manager program simplifies order planning and management on MetaTrader 4 and 5 platforms, allowing users to control risk and manage opened trades and eliminating the need for constant monitoring.

The strategies for optimal use of the Forex Trade Manager include scaling in and out of profitable trades, dynamic stop-loss adjustments, and news event considerations. These strategies are crucial in managing risk and maximising profits during favourable market conditions. Traders can integrate the Forex Trade Manager with their approach to news events, adjusting trades before, during, or after major economic announcements to mitigate risk.

MT4 trade managers are a popular trading tool, but alternatives are available. MT5 trade manager, designed for use with MetaTrader 5, offers features like order management, risk management, and performance tracking. Some platforms like cTrader and NinjaTrader have built-in trade management tools, allowing traders to manage their trades, manage risk, and track performance directly.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

MT4 Trade Manager Key Features and Benefits

A Trade Manager is an essential trade management tool for every trader. It offers features like order management, risk management, and performance tracking. It also allows traders to set risk levels, open pending trades, adjust stop-loss and take profit levels, close pending trades, adjust buy and sell lines, and more.

Order management allows traders to open and close trades with a single click, while risk management calculates position size and margin requirements. Performance tracking generates reports, helping traders identify strengths and weaknesses and improve their trading strategies.

The built-in calculator assists traders in performing calculations in just a few clicks, allowing them to manage trades, risk management, set stop-loss levels, and take profit. It also allows traders to take profit levels in pips or price, saving time and reducing the time spent on manual calculations.

The MT4 Trade Manager is a user-friendly software that allows traders to accurately open and close trades, save time, and customise risk levels. It can be placed anywhere on the chart, minimised, and moved around.

If not executed by price, it can automatically delete pending trades, preventing losses. The trade manager sends confirmation messages and alerts when sensitive operations are performed. It allows trading strategies to be backtested on historical data, evaluating profitability and risk before deployment in a live trading environment. Some MT4 Trade Managers enable traders to scale into or out of positions as trade progresses and market conditions change.

Using MT Trade Manager offers such benefits as trade analysis tools, such as performance metrics, trade history, and statistics, that help traders assess the effectiveness of their trading strategies and make data-driven decisions. These features help users focus on other tasks, reduce workload, and greatly improve their trading performance, ultimately leading to increased profits.

How to Manage Trades in MT4

To start using any MT4 trade manager tool, download it and install it into MT4, following the instructions (usually with a double click on the installation file). The MT4 terminal allows users to manage open trades, display the terminal, understand trade tab information, close positions, modify stop-loss, and take profits. It also allows access to account history and generates trading reports to monitor progress.

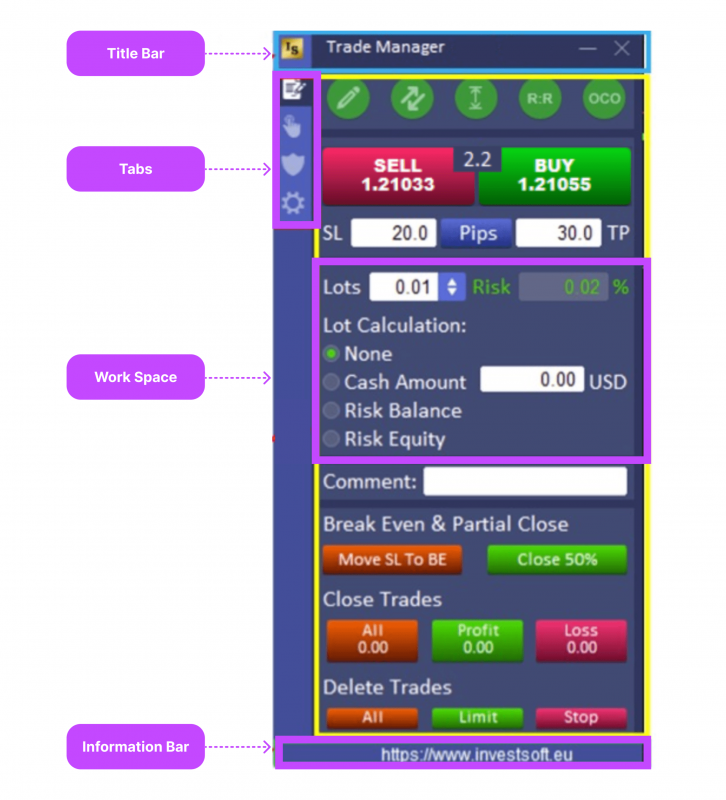

When you run the Trade Manager program, a panel will appear on the chart. It can differ for various providers but mainly consists of four parts:

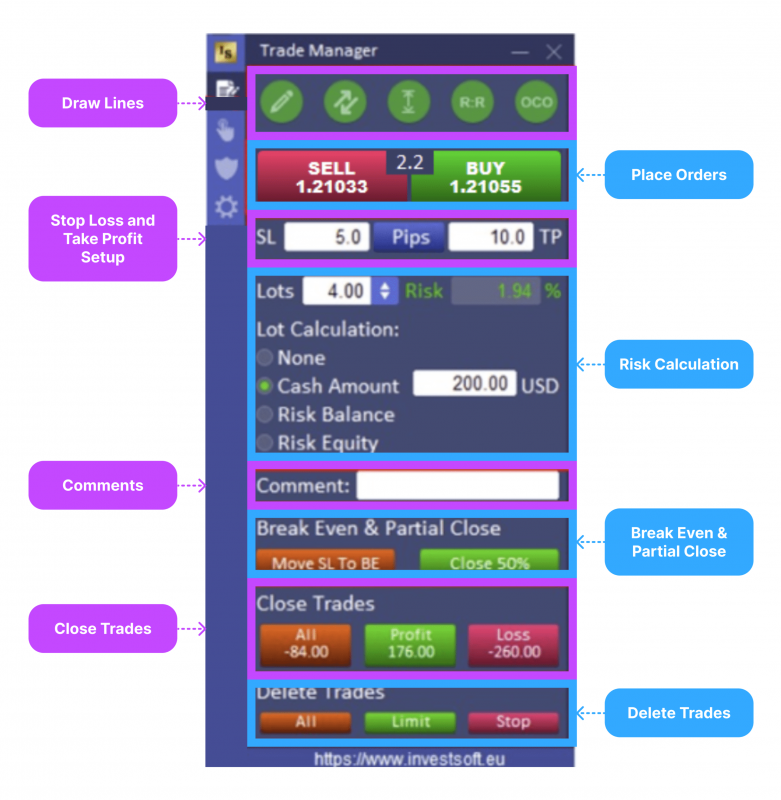

The Trade Manager EA panel features four tabs: Placing orders, Manually managing orders, Break Even and Trailing stop, and Configuration. Users can place market and pending orders using the BUY and SELL buttons on the panel or by drawing horizontal lines on a chart to indicate the level of opening, stop, and target. These tabs allow easy switching between main functions.

The panel features BUY and SELL buttons for placing market orders. Set Stop Loss and Take Profit levels under the BUY/SELL buttons to open a market order. Default, SL and TP are set in pips as the distance from the opening price, but they can also be set as the price. To switch to price levels, click the “Pips” button, then “Price” to display the price. To configure default Stop Loss and Take Profit values, refer to the “Program configuration option” section.

The program configuration options include the Risk Reward Ratio, Acceptable Risk %, Include Commission, Spread Multiplier, Line Drawing Location Settings, Default lines (Stop Loss and Take Profit) distance, and Automatic, Cyclic updating of Stop Loss and Take Profit distances.

The Risk Reward Ratio field allows users to specify a constant RR value that will be maintained by the program when using the RR function. Acceptable risk % shows the risk level for the planned transaction, and the program changes the colour of the text with the risk level when the designated level is exceeded.

The Include Commission field is necessary for brokerage accounts with low or no spreads but charges when opening or closing the trade. The Trade Manager allows users to define a commission for each opened transaction in the configuration field. Setting “Spread Multiplier” = 0 disables the function of including the spread in orders.

Line drawing location settings allow users to define how the entry price line should be set by default when opening a new trade. Options include the point of click, over/below bar, and Bar Distance.

The configuration section allows you to set the default lines (Stop Loss and Take Profit) distance, with options including None, PIPS, and ATR.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

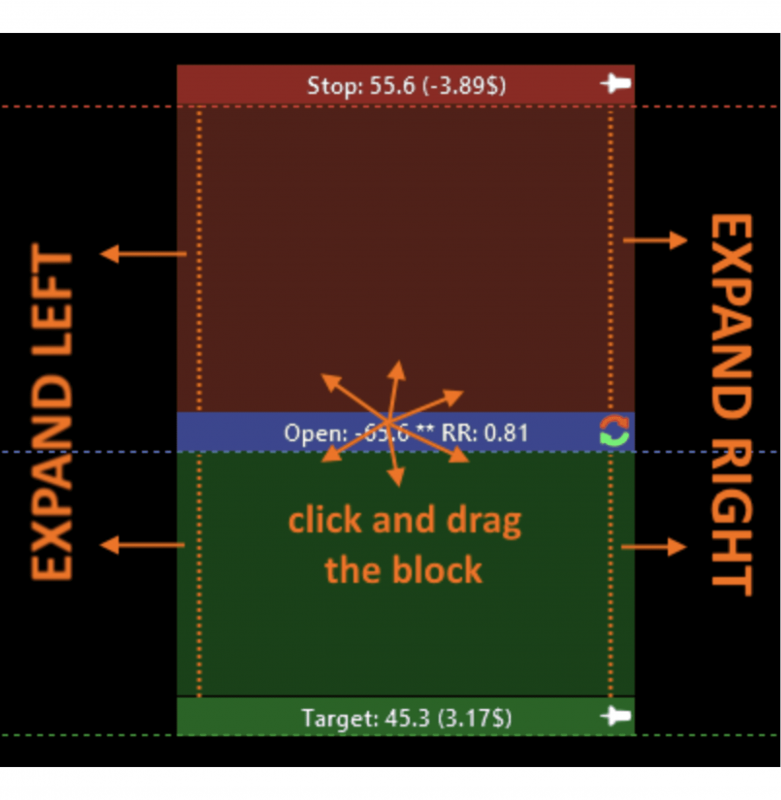

To set the opening price line for a new trade, you can choose the point of click or over/below bar. To position the line above or below the candle, click the pencil icon on the main panel. Then, select a candle and set the open price of the buy pending order at the top of the sell orders open price at the bottom of the candle.

It is important to configure the tool and test it on a demo account. Also, regularly monitor the tool’s performance and adjust it if needed. It is important to choose tools from reputable sources with documentation and user support. A trade manager should align with your specific needs and strategies and be compatible with the current version of your MT4.

The Trade Managers developed by 4xPip and Tradale is a top-notch Expert Advisor and is considered the best MT4 trade manager designed to assist FX and manual traders. It features a user-friendly interface and a time-saving calculator and allows traders to adjust lot size, either using fixed or automatic lot size, based on their risk tolerance. It also has a built-in calculator for calculating prices for placing trades, handles Buy-stop, Sell-stop, Buy-limit, and Sell-limit, and adjusts Stoploss and Takeprofit.

Bottom Line

An MT4 Trade Manager helps traders make informed decisions, manage trades effectively, and potentially secure profits in the constantly evolving FX market. It caters to both novice and experienced traders, enabling them to navigate market complexities and achieve trading success in the ever-present market, no matter what currency pairs they choose or where the price moves.