How to Choose The Best PAMM Software for Your Brokerage

PAMM accounts have long been a staple of brokerage infrastructure, but today, they’re doing more than just ticking boxes. With demand for passive investing models rising and competition for trader acquisition heating up, a strong PAMM offering is now a strategic differentiator.

Modern brokerages use PAMM software to unlock new revenue streams, build investor trust, and scale faster, without the cost of fund management infrastructure. But not all systems are equal. Performance, flexibility, and usability vary widely depending on the vendor and tech stack.

In this guide, we’ll break down how PAMM works and what to look for in modern software.

How PAMM Works: A Win-Win for Traders, Investors, and Brokers

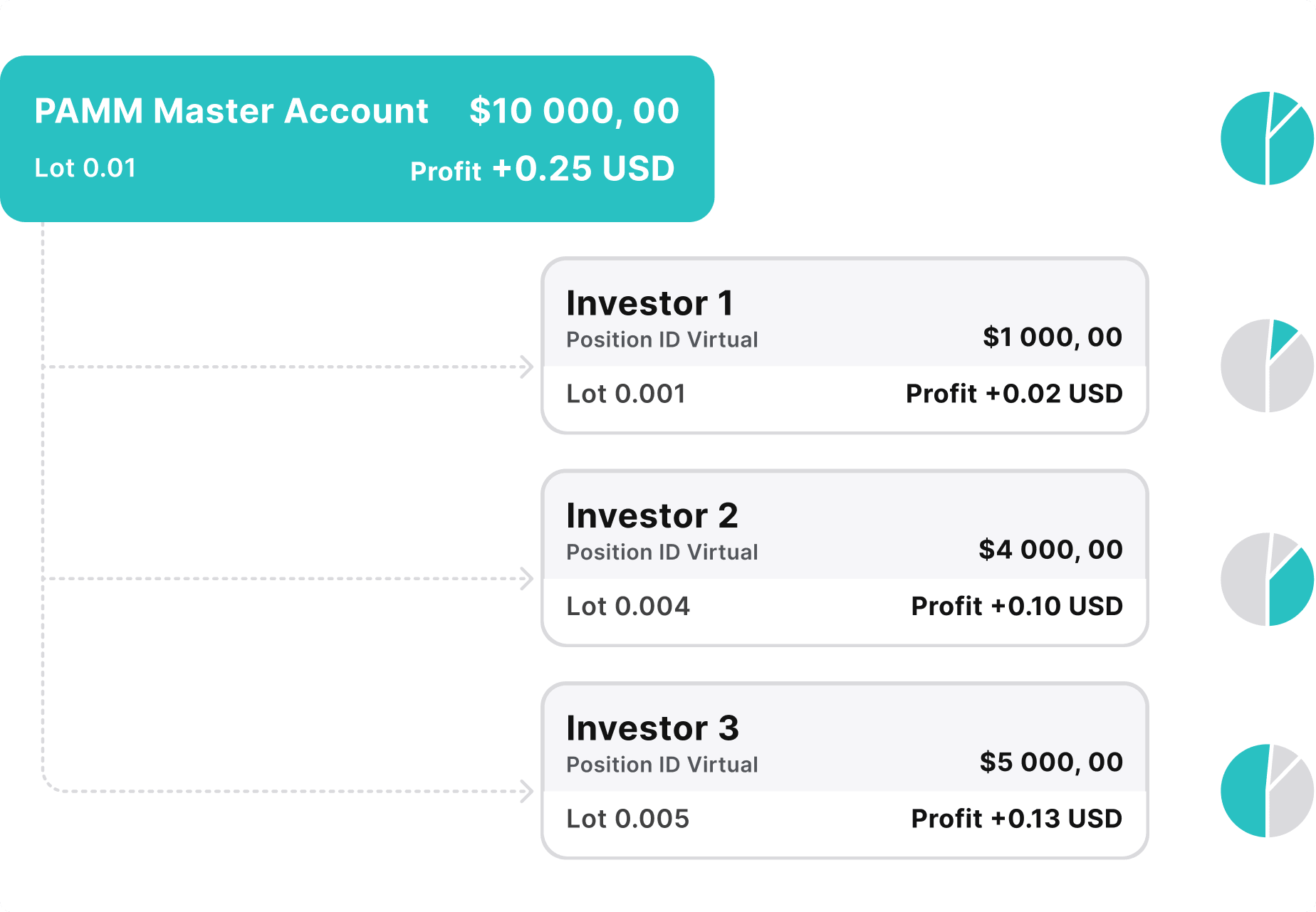

PAMM (Percentage Allocation Management Module) is a portfolio management system that lets traders manage capital on behalf of multiple investors through a single master account. Here’s how the ecosystem works:

- Master Traders (Money Managers) operate a single PAMM account, executing trades as they normally would.

- Investors (Followers) allocate capital to a trader’s strategy. Each investor owns a proportionate share of the PAMM account, and profits/losses are distributed accordingly.

- Brokers act as the infrastructure layer. They host the system, manage custody, handle allocations, and ensure transparent execution and reporting.

Unlike copy trading, where trades are mirrored into separate accounts, PAMM consolidates all funds into a single pool.

Compared to MAM (Multi-Account Manager), PAMM is more hands-off. MAM allows granular control (traders can adjust allocation per client), but it’s more complex to operate and manage. PAMM focuses on automation, transparency, and proportional distribution, making it ideal for retail-focused brokerages.

Ultimately, everyone wins:

- Traders build verified track records and earn performance and management fees.

- Investors access pro-level strategies without trading manually.

- Brokers attract capital inflows, increase trading volume, and offer a stickier, value-added service that improves retention and monetisation.

Want to Offer This Experience to Your Clients?

B2COPY PAMM makes it easy to connect traders and investors through transparent, automated PAMM accounts.

What to Look for in Modern PAMM Software

PAMM technology is part of your brokerage’s core value proposition. Thus, your PAMM software must meet high operational standards.

Ease of Use for All Users

The interface must work equally well for both master traders and passive investors. That means intuitive dashboards, fast onboarding, clear investment breakdowns, and real-time P&L tracking. If your traders or investors struggle to use the system, they’ll go elsewhere.

Scalability

Can your PAMM platform handle hundreds of strategies, thousands of investors, and millions in AUM? Look for cloud-native infrastructure, load balancing, and database architecture designed to support scale without performance degradation.

Transparency and Live Performance Stats

Investors demand clarity. Your system should offer detailed dashboards with up-to-date data on trading history, ROI, risk metrics, and current allocations. Visibility builds trust, and trust builds deposits.

Integration with Your Tech Stack

Modern PAMM systems must connect seamlessly with your existing infrastructure. That includes trading platforms like MT4/MT5 and cTrader, payment processors (including crypto gateways), CRMs, and KYC providers. Native integration reduces operational friction and ensures clients get a cohesive, consistent experience from registration to ROI tracking.

Customisation and Branding

Your PAMM platform is an extension of your brand. Choose a system that lets you customise the user interface, tier commission structures by trader level, and set flexible investor fees or profit-sharing models.

Security and Compliance

PAMM systems handle sensitive user data and pooled capital. Look for platforms with role-based access controls, encrypted data handling, audit logs, and real-time monitoring. It's a bonus if the system comes with built-in reporting features for regulators or syncs directly with your compliance workflows.

Multi-Asset Support

A future-ready PAMM platform shouldn’t stop at FX. Look for support across crypto, commodities, indices, and equities. The more asset classes, the broader your reach with both traders and passive investors.

See How B2COPY Handles All of This

Book a live walk-through to explore its PAMM, MAM, and copy trading capabilities in action.

Launching and Managing Your PAMM Offering

To build a sustainable product, you need structure: onboarding, rules, a legal framework, and a strategy to attract both traders and investors.

Start with Legal and Compliance Groundwork

Even if PAMM doesn’t require a standalone license in most jurisdictions, the structure of fund allocation, investor onboarding, and performance fee distribution must align with local regulations. Define your T&Cs, risk disclosures, and capital thresholds early.

Onboard Master Traders the Right Way

Your entire PAMM ecosystem is only as strong as the traders managing capital. Build a structured onboarding flow with verification, trading history review, and risk tiering. Limit access to firm capital until minimum strategy metrics (e.g., Sharpe ratio, drawdown, track record) are met.

Build a Strategy Directory That Converts

Traders need visibility; investors need filters. Create a clean, searchable ranking board showing strategy performance, historical metrics, and trader bios. The easier it is to compare, the faster capital flows.

Define Fee Structures and Limits

From management fees and performance cuts to drawdown protection and loss thresholds, set rules that protect investors but still reward skilled traders. Choose structures that are simple, transparent, and easy to display on the strategy pages.

Market It Like a Real Product

Promote your offering with landing pages, referral programs, content campaigns, and integrations with popular signal communities. PAMM also gives you a new way to segment and target user acquisition campaigns.

Monitor, Improve, Scale

Track flows, churn, and performance by trader segment. Use built-in analytics or CRM integrations to adjust fee models, promote top traders, or flag risky strategies.

The global social trading platform market (which includes copy, mirror, and parallel investment models) was valued at $8.81 billion in 2024, with expectations to grow further into 2030.

B2COPY: Advanced PAMM Technology Built for Brokers

Grow your Business with Copy, PAMM & MAM in One Platform

Flexible Investment Management for Traders & Investors

Supports Multiple Strategies Across Asset Classes

Seamless Integration with Existing Trading Infrastructure

B2BROKER’s B2COPY PAMM solution is engineered for performance, transparency, and operational scale. Whether you're launching a new investment product or upgrading legacy infrastructure, B2COPY gives you everything you need to run a modern, multi-strategy PAMM offering.

Scalable Infrastructure, Built for Growth

At the core of B2COPY is a modular architecture capable of handling thousands of active investors and strategies in parallel. The system is designed for maximum uptime, instant execution, and seamless rollover handling — all backed by a reliable backend hosted on AWS with Kubernetes-powered multi-region redundancy.

Designed for Traders, Investors, and Brokers

For Investors: Clean, responsive dashboards provide real-time performance metrics, profit-sharing visibility, and fast deposit/withdrawal actions. Investors can manage risk with adjustable drawdown limits and follow strategies with just a few clicks.

For Master Traders: Traders can manage multiple strategies from a single interface, set fee plans (performance, volume, subscription, etc.), and maintain privacy via leaderboard visibility settings. B2COPY supports complex logic such as rollover schedules, partial fills, and open-position management during investor actions.

For Brokers: From the back office, brokers control user tiers, fee structures, and permissions, while monitoring system performance, investor inflows, and P&L distribution in real time. Every action is logged and export-ready for compliance or auditing purposes.

Feature Highlights

- Plug-and-play integration with MT4, MT5, and cTrader

- Built-in reporting and automated trader/investor payouts

- Multi-account management for advanced traders

- Full PSP and wallet connectivity

- Advanced UI widgets for strategy leaderboards, performance stats, and client engagement

Scale Your Brokerage with B2COPY

B2COPY gives you more than PAMM infrastructure—it’s your gateway to building a high-performance MAM, PAMM and copy trading offering with less friction, faster time to market, and deeper client engagement.

As part of the B2BROKER ecosystem, it integrates seamlessly with our B2CORE back-office and CRM solution, trading platforms, liquidity, and beyond.

Want to See It in Action?

Book a live walkthrough of the tools you're reading about — tailored to your business model.