How Online Forex Brokers Access Liquidity?

Currency investors understand the role of the FX market in the national and international economy as the primary driver of stability and development.

This impact extends to online brokerage, where trade operators and investors benefit from the vast number of participants and massive cash circulating in the currency market.

However, if you are looking to launch an FX brokerage company, you need to deeply understand how liquidity works and who provides liquidity to online Forex brokers. Let’s discuss this in more detail.

Key Takeaways

- Liquidity is high in the Forex market due to the large pool of providers, traders, investors and other operators that populate the market with tradeable assets.

- Financial corporations, investment firms, central banks, and hedge funds are the leading liquidity providers for online FX brokers.

- Regulatory changes, technological advancements and competition levels can primarily affect the liquidity offerings.

Why is Forex Liquidity Important?

Liquidity drives much of investors’ activity and motives, affecting the way prices move and market stability. The FX market is the oldest and largest financial market in the world, with traders from central and investment banks, financial institutions, hedge funds, retail brokers, and seasoned traders executing millions of orders daily.

This increased activity makes Forex highly liquid, where most assets move moderately and the market more stable. As such, in order to successfully launch a brokerage firm in the FX market, it is crucial to source this liquidity and offer the best trading conditions for your users.

High liquidity enables the broker to match pending orders through broad order books and pools to execute quickly and at low costs.

The Role of Forex Liquidity Providers

Liquidity providers connect online Forex brokers to sources and pools with a considerable number of orders and market participants, allowing them to execute orders. In short, they give brokers direct market access to buy and sell foreign currencies.

Financial institutions and non-financial corporations, like investment firms, are the primary sources of liquidity. They actively operate in the market, hold assets in multiple currencies and trade for them and on behalf of their clients.

Much of FX brokers’ performances are defined by the FX liquidity provider (LP), who, in turn, operates through multiple channels and intermediaries to improve order execution and minimise volatility. LPs typically offer the following services.

Providing Bid-Ask Spreads

The difference between the bid and ask prices dictates how efficient a broker is and drives clients to sign up at a specific trading platform. Typically, traders aim to attain the lowest spread range possible, while brokers profit from this price differential as an income source.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

FX LPs supply brokers with tradeable assets, populating more foreign currencies and securities to be executed whenever a trader places a matching order.

This increased supply will dynamically lower the trading price, decreasing the gap between bid and ask prices and offering online FX brokers tight spread ranges. Ultimately, this makes trading more effective, attracting more traders and increasing brokers’ profits.

Executing Market Positions

Forex liquidity providers also act as executing brokers who process transactions and record settlements. LPs use their connections with clearing houses and financial markets to “make trades happen”.

At the same time, these intermediaries ensure orders are executed timely to minimise security risks and slippage. When a market order is pending for a long time, it has a higher potential for data leakage or infiltration, making it a standout target for hackers.

Additionally, price slippage happens when the position is processed at a value different from what is intended. This slight price change occurs because of the delay as the broker searches for a matching order.

Therefore, when liquidity levels are high, trade execution is more accurate because there are many orders pending matching.

Boosting Business Stability

Having a solid source of liquidity improves your business performance, where execution and operations face fewer fluctuations, and prices are less likely to change sharply due to market forces.

This motivates new traders to sign up on your platform and encourages existing ones to remain and increase their investments, which eventually boosts your sales.

On the flip side, if your platform faces liquidity gaps or insufficient volume that causes volatility and slippage, traders’ outflow is more likely to happen, resulting in exponential losses.

Top FX Liquidity Providers

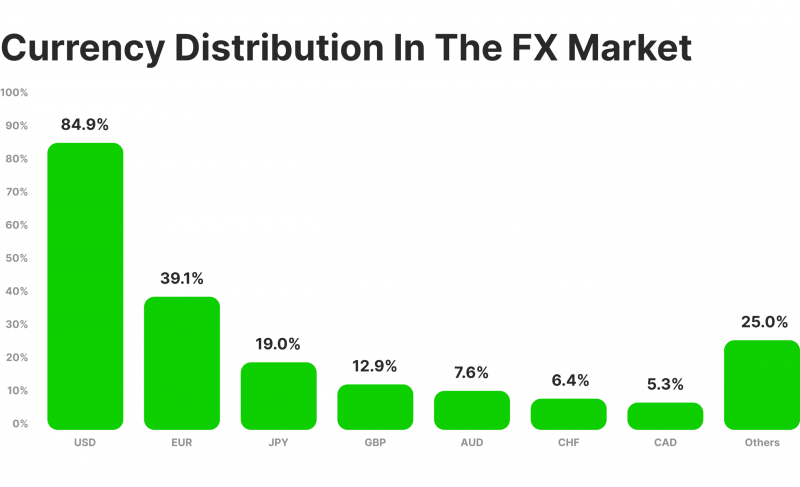

The Forex liquidity provision market spans numerous financial players, such as banks, retail brokers, hedge funds, market makers and Electronic Communication Networks (ECNs), which engage in buying and selling foreign currencies.

This Forex liquidity distribution is attributed to the function of each of the following market participants.

- Banks: Central and investment banks are the largest contributors to Forex liquidity, holding and trading millions of foreign currencies, besides other lending and financing activities.

- Market Makers: Market makers increase liquidity levels by actively buying and selling Forex currencies from investors and other market participants to make assets more available.

- Hedge funds: Financial institutions like hedge funds execute significant trading orders, contributing mainly to Forex liquidity.

- Brokerage firms: Retail brokers share a moderate piece of the liquidity market, but their huge quantity makes them key players.

- ECNs: Electronic communication protocols provide access to deep liquidity pools and order books, making order execution more effortless and efficient, which eventually improves asset liquidity.

Forex Market Liquidity Assets

In order for the Forex liquidity provider to offer market access to trading pools and make tradeable securities more available, they manage three classes of capital that dynamically control market liquidity levels.

- Tier-1: The top-tier capital assets are retained earnings and shareholders’ equity, which define financial health and can be liquidated quickly.

- Tier-2: Tier-2 capital is used as a backing for tier-1 assets, which consist of debts, cash reserves, and other financial instruments.

- Tier-3: The lowest-quality assets included unsecured debts, which banks used to cover trading market gaps and risk. This type of asset was abandoned after the infamous 2008 crisis.

Online Forex brokers can evaluate their Forex liquidity provider quality by inspecting the level of tier-1 and tier-2 assets they hold.

During the 2007–2008 global financial crisis, spreads were 400% wider than before the collapse, while some currencies had 16 pips in their bid-ask differential.

Factors Affecting Online Forex Brokers

Besides the internal structure of LPs, other external factors can affect their work and hinder their liquidity and stability efforts. These include.

Legal Environment

Regulatory changes can highly affect the way FX LPs work. For example, imposing new capital requirements or currency restrictions will require different resource allocation by the provider.

Adapting to new financial frameworks may require restructuring and operational changes impacting liquidity flow and trading volume.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Competition

Market competition is usually a driver of innovation and better service offerings in various industries.

When it comes to financial markets, an increased number of financial institutions and investment firms motivates FX liquidity providers to provide the best trading conditions to brokerage firms, which eventually benefits end-users.

Technology Developments

The use of technology has mainly contributed to liquidity provision. Modern tech and algorithmic capabilities can be harnessed for faster order matching and execution, leading to higher liquidity rates.

Additionally, financial firms can use artificial intelligence to improve risk analysis and asset management, allowing them to optimise liquidity distribution.

Conclusion

Forex is the largest and most liquidity financial market with one of the largest pools of traders and liquidity providers. Spanning numerous central banks, investment corporations, hedge funds and other financial institutions, FX brokers benefit from the wide range of liquidity sources.

Launching a Forex brokerage firm requires you to integrate a network of LPs to access the trading market and offer the best trading conditions to attract more investors and boost your sales.