How to Start a Prop Firm of Your Own: Detailed Guide

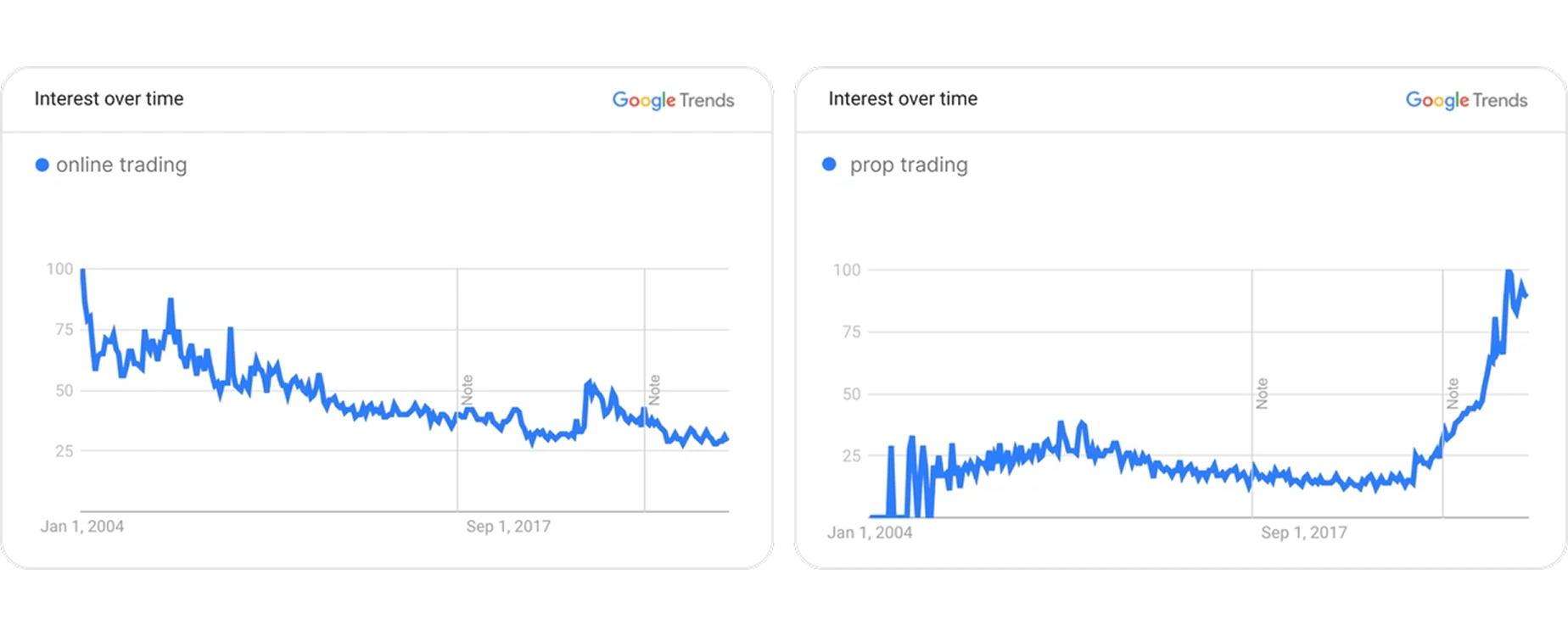

Interest in proprietary trading has exploded. According to Google Trends, global search volume for “prop trading” surged by over 5,000% between 2020 and 2025, reflecting a massive uptick in awareness and demand.

At the same time, the market itself is expanding. From a $5.8 billion valuation in 2024, the prop trading industry is expected to reach $14.5 billion by 2033. For brokerage firms and fintech entrepreneurs, this is a revenue model worth serious consideration.

So, how to start a prop firm successfully?

What is a Prop Firm?

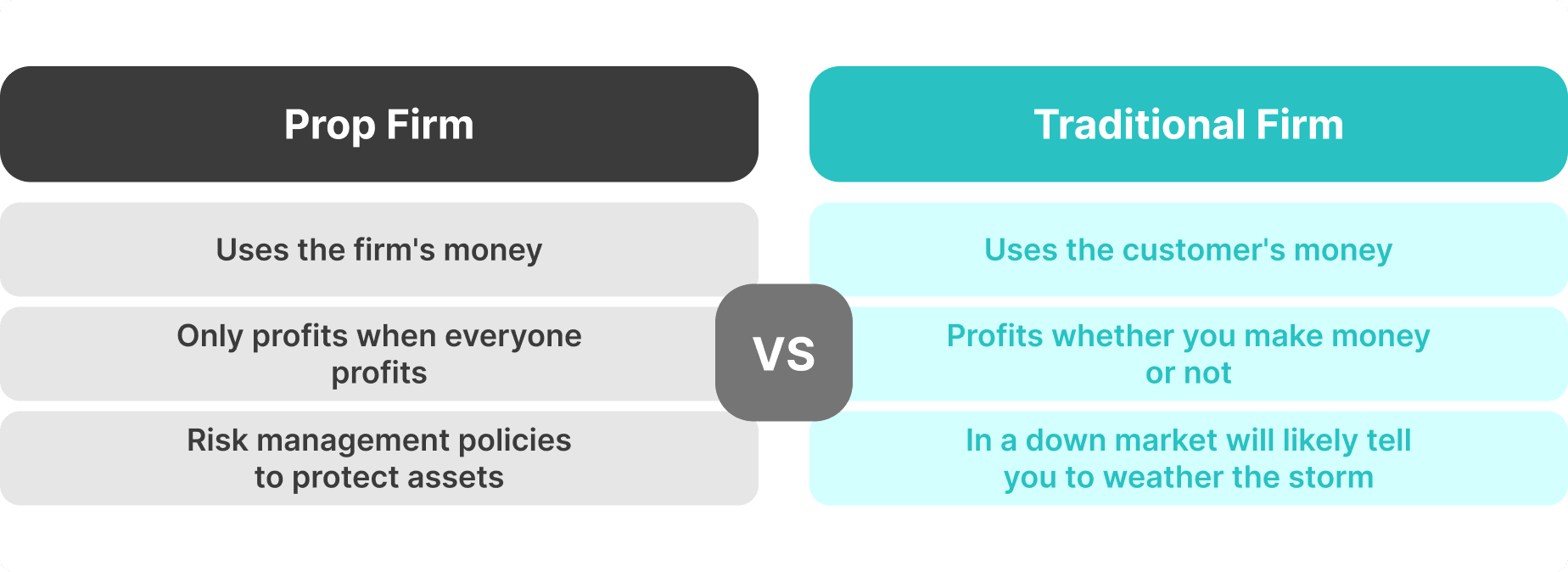

A proprietary trading firm (commonly called a prop firm) is a financial company that allows traders to trade with the firm’s own capital instead of their own.

In return, the trader keeps a percentage of the profits they generate, while the firm covers all losses and operational costs. The model is performance-driven: traders earn by proving they can trade different asset classes profitably under strict risk limits.

Unlike a traditional broker that earns from spreads, commissions, and service fees on client capital, a prop firm generates revenue directly from its traders’ results. It effectively becomes the investor, allocating internal funds to external traders based on performance rather than deposits.

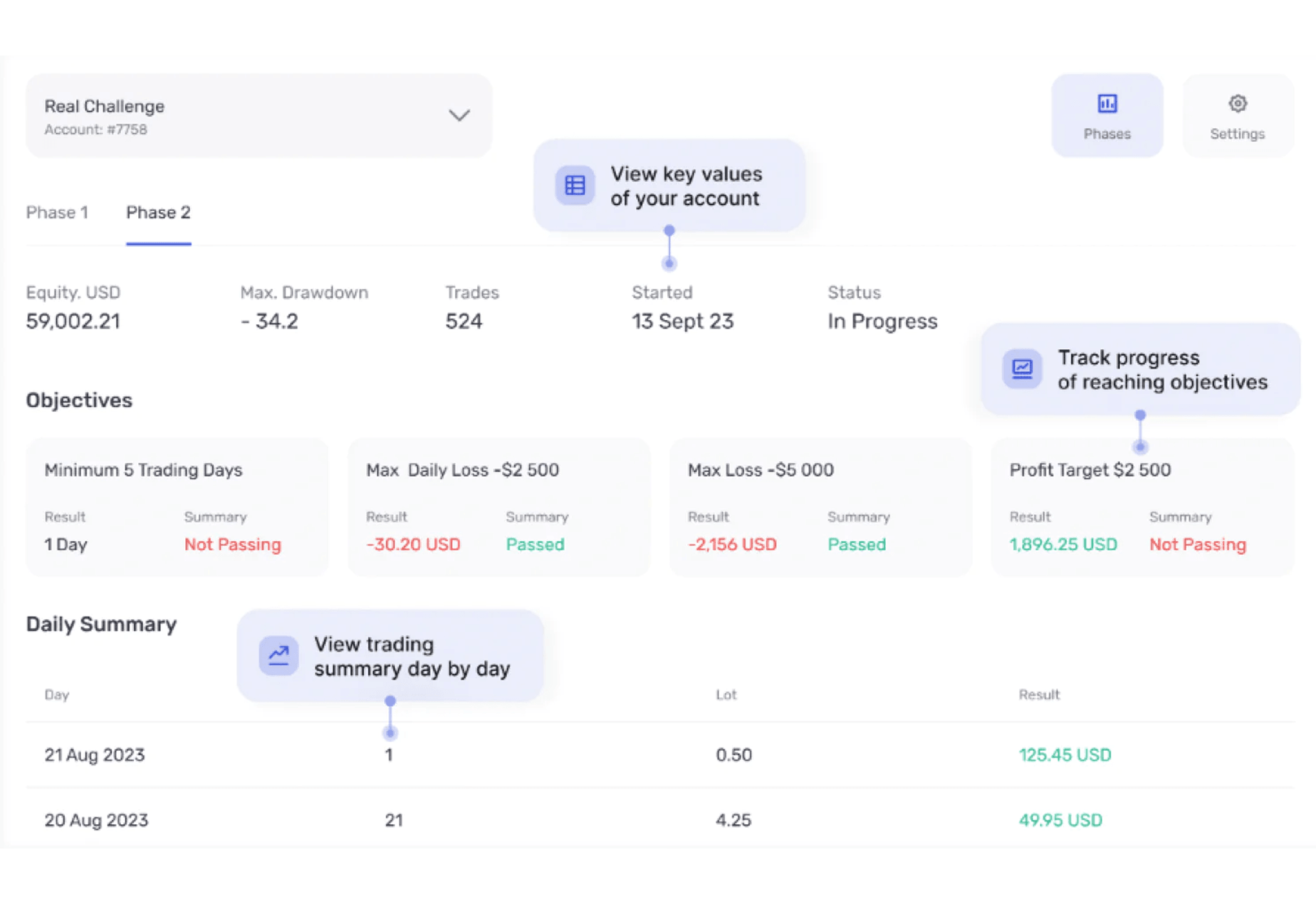

Today’s prop firms operate with modern digital infrastructure. Most follow a challenge-based model, where aspiring traders must pass a structured evaluation (based on drawdown limits, profit targets, and risk discipline) before gaining access to live-funded accounts. This system allows prop firms to filter talent at scale while offering traders a clear path to capital—with no need for personal investment.

Why Start a Prop Firm Today?

The proprietary trading model is a scalable, high-margin business today. It’s a global trend in which brokers, retail traders and institutional investors are increasingly interested. This growth is still in its early stages, and brokers can capitalise on its massive potential.

Income Diversification

Launching a prop trading solution expands your reach to new markets, more clients and more revenue streams. There are different profitability models in proprietary trading.

You can earn from charging entry fees to challenges for new participants and those who want to re-take the challenge. You can receive investment revenues from the trader’s activities as they attempt to reach their objectives. Some goals may include investing in growing markets or doubling a given capital in actual markets.

Once you hire successful traders, you can implement several profit-sharing methods to earn from the traders’ activities. Nevertheless, you can create investing templates from successful trading systems and sell them as copy-trading strategies.

Lowering Operational Costs

Converting leads from interested individuals to clients can be costly. There are different sales funnels, lead generation firms and other intermediaries that will charge you for their services.

Retail brokers employ different marketing campaigns and advertising efforts to capture potential customers, which can be costly. Moreover, inexperienced traders require broad educational materials, support efforts and other investments before they become experienced.

However, attracting skilled traders whose trading is their bread and butter lowers your cost-per-action and enables you to focus on the main platform’s operations and offer your investors the best features.

Easier Money Management

Conventional brokerage firms deal with funds from a massive number of clients, each in different currencies, payment methods, tax systems, and settlement cycles. This financial complexity requires advanced accounting and money management skills.

Brokers must utilise advanced security systems to safeguard deposited user funds and transactions. However, prop trading firms deal with their own funds, leading to simpler money management and more flexible financial practices.

This approach also results in fewer fees payable to payment processors because the broker trades with their funds and enters two-way transactions.

Less Regulatory Complexities

Prop trading is still in its preliminary stages, and financial regulators have yet to create formal jurisdictional regulations and frameworks. As such, proprietary brokerage firms can try innovative approaches to capitalise on these opportunities and make as much money as possible.

It is easier now to start a prop firm of your own because the nature of this niche requires fewer financial requirements for account segregation, investor compensation schemes, and other financial insurance programs.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

How Much Money Do You Need to Start a Prop Firm?

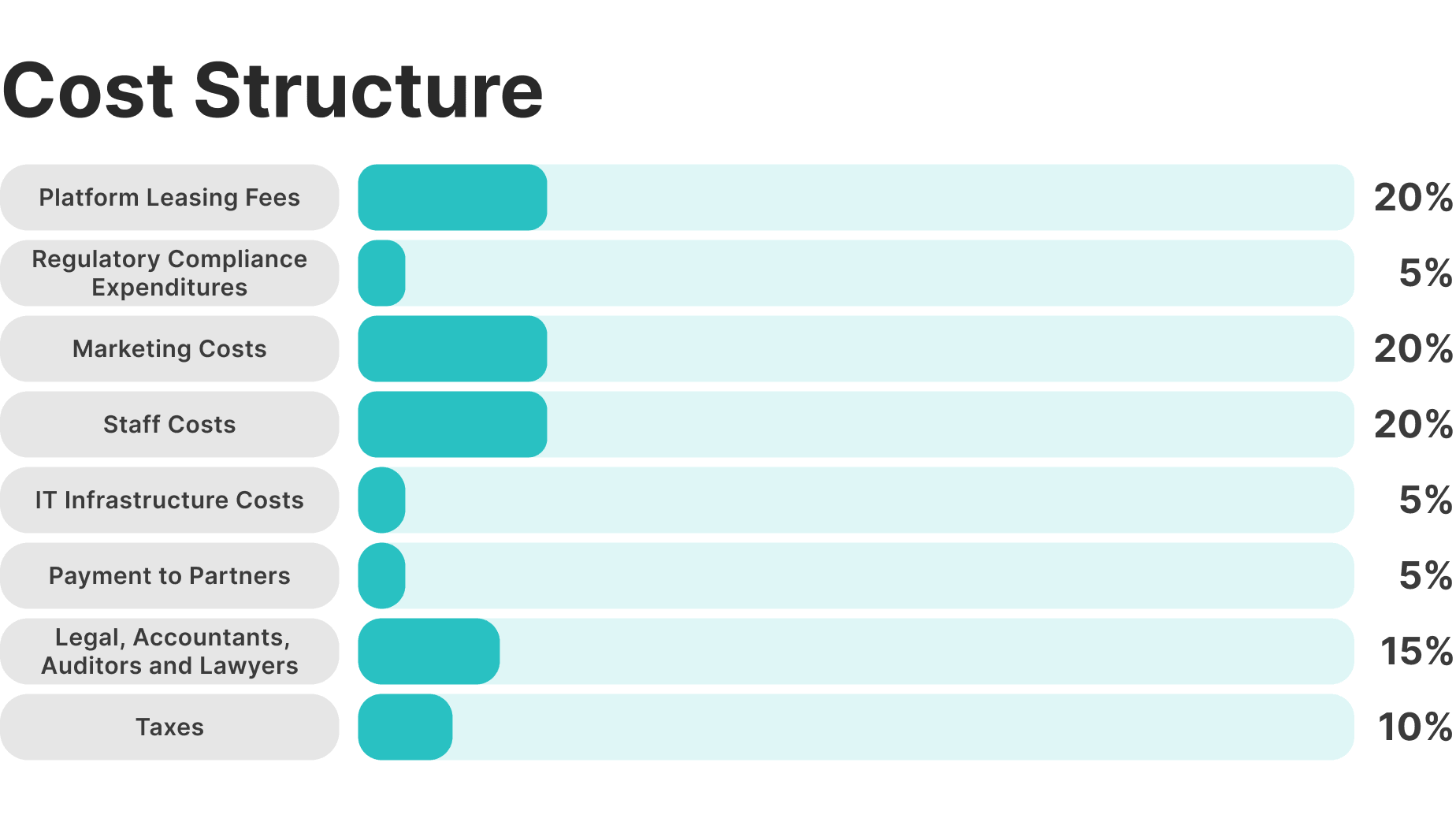

The costs depend on the target market where you are launching your prop trading business and the license requirements for operating legally.

A significant portion of your budget will go to integrating a prop trading solution. This cost depends on the features offered, trading software, challenge monitoring, and client acquisition program. You can estimate a yearly fee between $10,000 to $50,000.

Afterwards, you will pay to obtain the license and apply to become a legal financial service provider. Although prop trading might not have dedicated license requirements, as a brokerage firm, you will need to get a particular financial license that can go up to $10,000.

Moreover, some jurisdictions might require an initial operational capital in your bank account. This is not practically a fee you must pay, but it is a financial requirement that you must consider.

How to Start a Prop Firm: The 6 Core Pillars

Building a successful prop firm from scratch means getting six core elements right from day one. These pillars define how your firm will operate, scale, and stay profitable over time.

1. Technology Stack

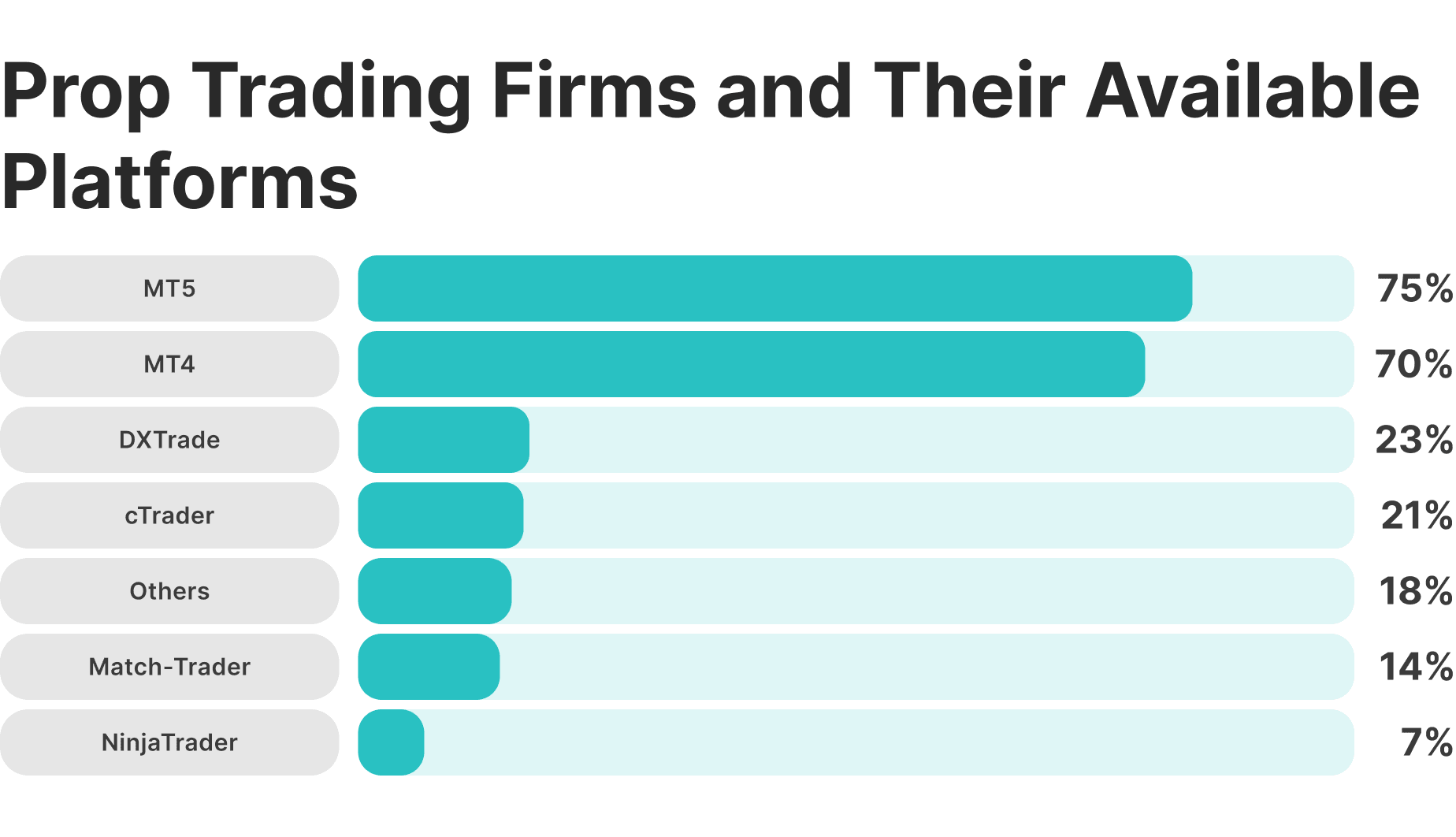

Your platform is your business. You need a flexible, scalable trading system that supports challenge creation, trader onboarding, real-time monitoring, and profit distribution.

Most firms start with a white-label prop solution that includes backend tools, front-end trader dashboards, and built-in automation for challenge rules and payouts. Beyond that, you’ll need integrations for payments (including crypto payments), KYC verification, analytics, and CRM—all stitched together into a clean, reliable infrastructure.

2. Legal Framework

There’s no universal “prop trading license,” but you’ll still need a legal foundation. In most jurisdictions, this means registering a financial services business and applying for a brokerage or investment firm license, depending on how you structure your operations.

You’ll also need a documented AML/KYC policy, data protection measures, and internal compliance workflows. Work with a legal partner who understands your regional requirements. Plan for license lead times.

3. Liquidity and Market Access

Even if traders don’t deposit funds, you still need top-tier execution. That requires a multi-asset liquidity provider with deep market access and low-latency routing. For live-funded traders, your execution quality is part of your brand.

A provider like BROKER gives you access to institutional-grade liquidity across forex, crypto, commodities, and indices, so you can offer professional-level conditions from day one.

Deep, Reliable Liquidity Across 10 Major Asset Classes

FX, Crypto, Commodities, Indices & More from One Single Margin Account

Tight Spreads and Ultra-Low Latency Execution

Seamless API Integration with Your Trading Platform

4. Create Investing Challenges

Your evaluation model is the engine of your business. Design trading challenges that are fair but firm—clear profit targets, drawdown limits, and time constraints. Use automation to track results, flag rule breaks, and trigger payouts or retries.

The best firms balance difficulty and accessibility: they attract skilled traders but keep barriers low enough to drive volume. Your onboarding funnel should feel more like a competitive game than an application form.

5. Risk Management

Once live, your firm becomes an ongoing product. You’ll need performance analytics, CRM flows, and retention mechanics to convert active users into long-term revenue. You’ll also need real-time risk tools to monitor trader behaviour and exposure, especially when scaling capital allocations.

Set rules for maximum daily loss, consistency checks, and platform abuse prevention. A solid growth loop with embedded controls is what separates sustainable prop firms from one-hit launches.

6. Growth Strategy

A proprietary trading platform involves fewer marketing expenses than retail brokers because prop firms target a specific market segment. On the other hand, a multi-asset brokerage firm has a broader target market, leading to more costs in social media campaigns, advertisements, and promotions.

Prop brokers focus their resources on professional investors, using dedicated channels, such as online communities and referral programs, where professional investors are available.

You can include introducing broker and affiliate marketing strategies to motivate other businesses and institutional investors to refer other traders to your platform in exchange for a commission.

Download the free PDF guide covering the key decisions, common mistakes, and real costs of starting a brokerage.

Common Challenges of Building a Prop Trading Firm

Even though prop trading is gaining momentum, launching and running a successful firm comes with unique operational, regulatory, and financial risks. Below, we outline the key challenges and offer ways to mitigate them before they impact your growth.

Regulatory Uncertainty

Prop trading exists in a grey zone in many jurisdictions. While firms don’t always require the same licenses as brokers, compliance expectations are rising—especially as client-facing models blur the line between prop trading and traditional brokerage.

Upfront Investment in Tech and Infrastructure

A functioning prop firm needs challenge logic, trader monitoring, client management, payout flows, and high-performance execution, all built for scale. Many underestimate the true cost of building this from scratch.

Trader Performance and Risk Exposure

Prop firms profit when traders succeed, but poor-performing traders or challenge abuse can drain company funds. Without the right controls, you risk outsized drawdowns or inconsistent P&L exposure.

Monetisation Bottlenecks

Many firms launch with a narrow monetisation plan: one-time challenge fees or profit splits. But growth stalls without diversified income sources. Moreover, traders now have dozens of prop firms to choose from. Without strong branding, trust signals, or a competitive edge, it’s hard to stand out.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

The Turnkey Alternative: How to Start a Prop Firm with cTrader Prop Trading

Launching a prop firm in 2025 is promising—but far from easy. With rising infrastructure costs, regulatory grey zones, and the difficulty of sourcing liquidity, onboarding traders, and maintaining profitability, new operators face a demanding landscape.

Our turnkey cTrader Prop Trading solution delivers immediate answers to these challenges, without months of development or fragmented vendor management.

It’s purpose-built for both startups and established brokers looking to enter the booming prop space with minimal development risk and maximum operational control.

Instead of spending months (and hundreds of thousands) building a custom stack, you can launch a branded, institutional-grade prop trading platform in a matter of weeks, fully equipped to handle challenges, funding logic, risk limits, payouts, and more.

What’s Included in the cTrader Prop WL Package?

Instead of building multiple disconnected systems (challenge engine, CRM, trading platform, payments, analytics), cTrader WL delivers an all-in-one environment.

You get:

- A challenge creation and management module

- Fully integrated trading via cTrader

- KYC, client onboarding, IB tools, and back office via the B2CORE back-office solution

- Payment processing via B2BINPAY

- Liquidity across 10 asset classes

- REST and FIX APIs to connect trading data, user management, and payments with third-party tools or your internal systems.

All components are pre-integrated, tested, and supported—removing 90% of the integration and maintenance burden.

The cTrader prop system goes beyond challenge fees. With flexible profit-sharing models, trade copying for company accounts, and spread/commission customisation, you’re building multiple revenue streams into your firm from day one.

Ready to Build Your Prop Firm?

B2BROKER’s solutions are trusted by hundreds of brokers and institutions worldwide. Book a demo to see the cTrader Prop Trading in action—or get in touch for a tailored proposal.

Frequently Asked Questions About Launching a Prop Firm

- How to start a prop firm business?

Create a business plan to identify your goals, then search for a platform and liquidity provider. Develop your technology infrastructure and add integrations that support your platform. Get over the legal requirements, create trading challenges, market, and launch your prop firm.

- How much does it cost to set up a prop trading firm?

Many factors determine the cost of your prop firm, such as the trading platform, software, legal requirements, and marketing activities. You can allocate a $50,000 to $100,000 investment to launch a prop firm.

- Is there a license for prop firms?

Operating a proprietary trading brokerage does not entail a special prop license. However, as a brokerage firm, you must obtain a broker-dealer license or other permits required by your local authority.