How to Start White Label CFD Brokerage

Articles

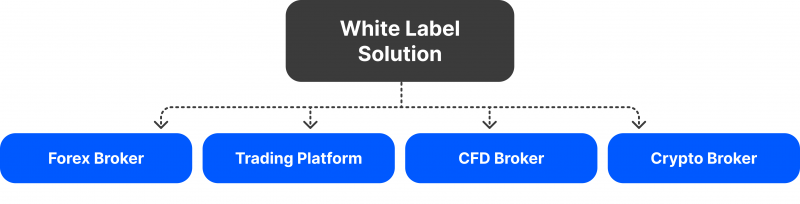

Today, financial markets are in a stage of dynamic development due to the creation of new business models aimed at supporting small and medium-sized businesses operating in Forex, CFD, crypto and other areas of financial trading. One such business model is White Label (WL).

At the same time, one of the popular uses of this model has become the niche of CFD brokerage companies, where there is a steady demand for white label CFD broker products, which represent a completely new format of working with CFD markets.

This article will guide you in the world of White Label solutions and tell you what a White Label CFD brokerage business is. You will also learn about the White Label CFD brokerage business model’s advantages and structure. In the end, you will figure out the necessary steps that will help you become a White Label CFD brokerage house.

Key Takeaways

- White Label CFD brokerage is a complete solution working with the help of the ready-made infrastructure of another company providing it.

- White Label CFD brokers have advantages such as access to deep CFD liquidity, fast market entry, and access to all CFD markets.

- CFD brokerage system based on WL is similar in principle to any other solution (product) working on the same model.

What is White Label CFD Brokerage Business?

White Label CFD brokerage business uses a ready-made set of solutions and systems designed for conducting business on the CFD market.

As a rule, such a complex includes a set of ready-to-use products that together form a brokerage infrastructure with such characteristics as universality, flexibility, and scalability. Another company uses this infrastructure in its own interests to establish and promote its brand. This model includes full support, maintenance, and service from the selling company, which ensures reliability and security, as well as convenient interaction with the final product.

Using the White Label model to create the best broker for CFD gives direct access to the market of the same name instruments, which allows gaining valuable experience in working with them, as well as deep knowledge and understanding of the field.

This, as a result, is the foundation for the implementation of their own new solutions directly or indirectly related to CFDs or similar trading instruments, which are usually recommended for trading in tandem with others. It also gives the opportunity to create new concepts that take into account the use of similar models to White Label for the realisation of other companies.

CFD niche is one of the most promising within the number of WL solution providers to create brokerage firms due to its promising nature.

Selling Points of the White Label CFD Brokerage Business Model

The CFD brokerage business model based on the White Label solution, as well as other models, has its own distinctive advantages, thanks to which many startups and newcomers in the CFD niche have an opportunity to create their own products and take a worthy place in the promising market. Let’s take a closer look at them.

1. Ready CFD Brokerage Infrastructure

Launching a CFD Brokerage business using the WL model, first of all, gives full access to a complete brokerage infrastructure with all the necessary systems, modules, and components for efficient work with CFD markets within the trading process.

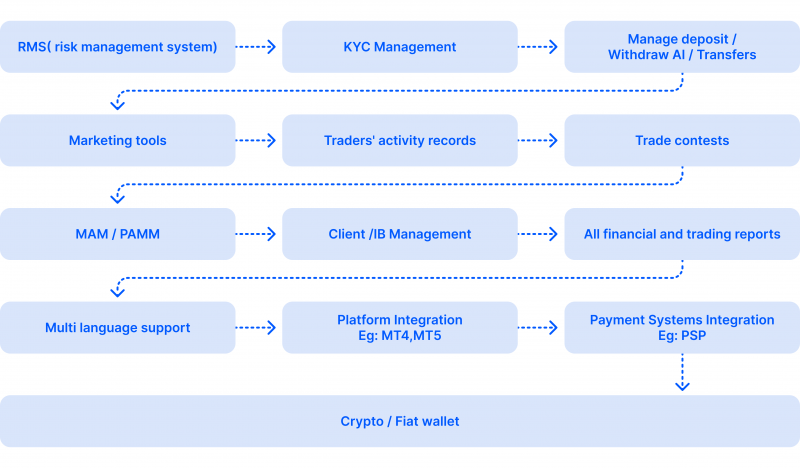

It connects all important elements of the brokerage and serves as the foundation on which all backbone services are based, including payment modules, security modules, verification and identification, analytics, statistics, data accounting and management, risk management, trading platform, trader’s room, order matching engine, CFD liquidity pools and many others.

2. Deep CFD Liquidity Access

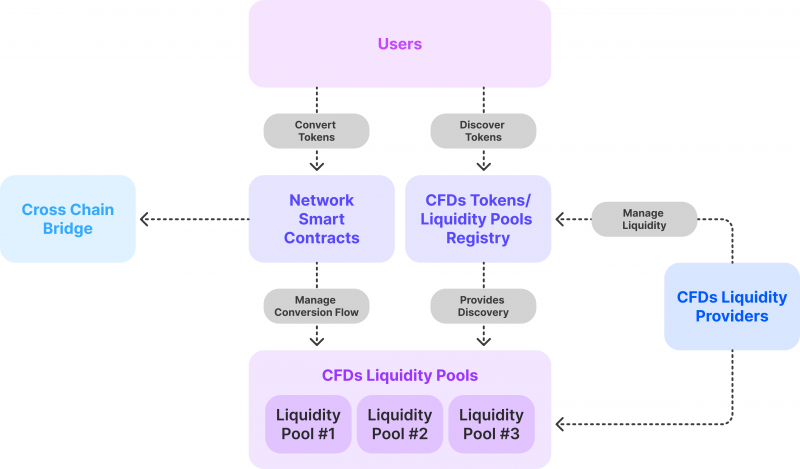

Using the White Label CFD business model to create a brokerage company, one can get instant access to pools of liquidity, which is designed to provide stable trading in CFD instruments of any class, among which crypto assets, commodities, currencies, and equities predominate.

Thanks to the availability of pools of deep (institutional) CFD liquidity from multiple sources, White Label broker is able to provide all the necessary conditions for smooth, uninterrupted and safe trading (investment) activity within the framework of certain trading assets, regardless of market conditions and individual terms of each transaction, both buying and selling.

3. CFD Markets Access

Any CFD broker, regardless of its type, size or operating model, has direct access to CFD markets, i.e. provides its clients with the opportunity to trade with complex contracts on various financial assets, among which, as already mentioned, we can distinguish cryptocurrencies, stocks and Forex currencies.

In this case, there is a possibility of full customisation in terms of choosing the preferred markets that may be of interest to the broker’s clients, depending on the factors that directly or indirectly affect the trading process, including possible restrictions and legal formalities of trading in a particular country.

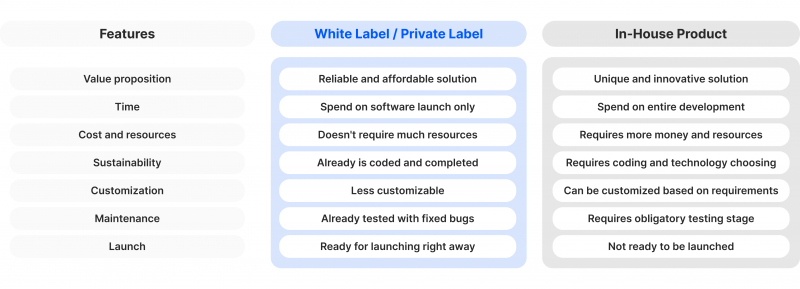

4. Simplicity and Speed of Market Entry

Using the White Label model to create a CFD brokerage business, it’s possible to get a tangible advantage in the speed and ease of entering the market while significantly saving labour, financial and time resources for implementing all stages of launching a brokerage company from scratch.

Also, this model helps to get a clear vision of how this kind of business works in a very short time and evaluate its nuances and pitfalls to be able to confidently compete in the market of similar products with other companies, which also, in turn, allows you to take a profitable place in the niche quickly.

5. Brand Establishment and Development Tools Access

As practice shows, the use of White Label solutions helps in the effective and systematic promotion of the brand of any company due to the availability of the necessary set of tools for generating leads, conversion development, creation of advertising campaigns, as well as for working with referral projects, which also involve cooperation with other companies to meet the interests of both parties in business development.

White Label CFD Brokerage Business Model Structure

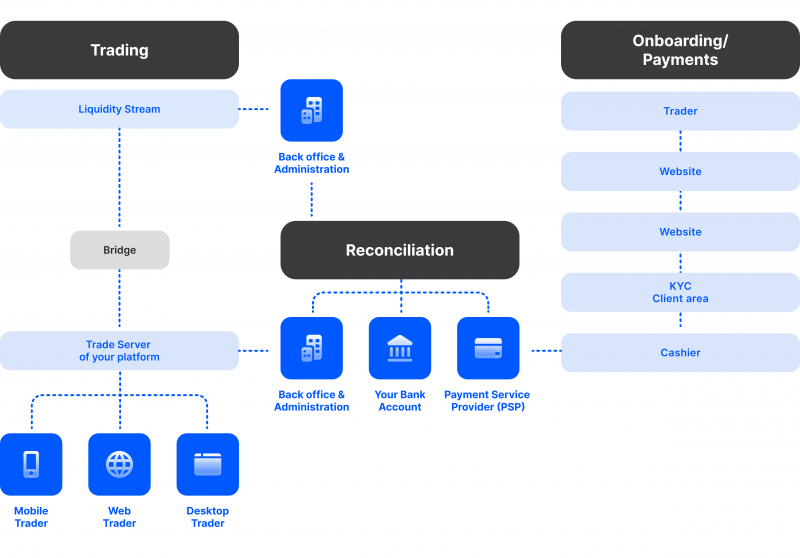

The structure of the White Label CFD brokerage business model is an interconnected system of complex components providing a full and efficient process of trading in investment instruments, as well as the process of user interaction with the broker interface. The infrastructure is quite simple in its composition and includes components that are common to a number of other types of brokers, not only CFDs. These include:

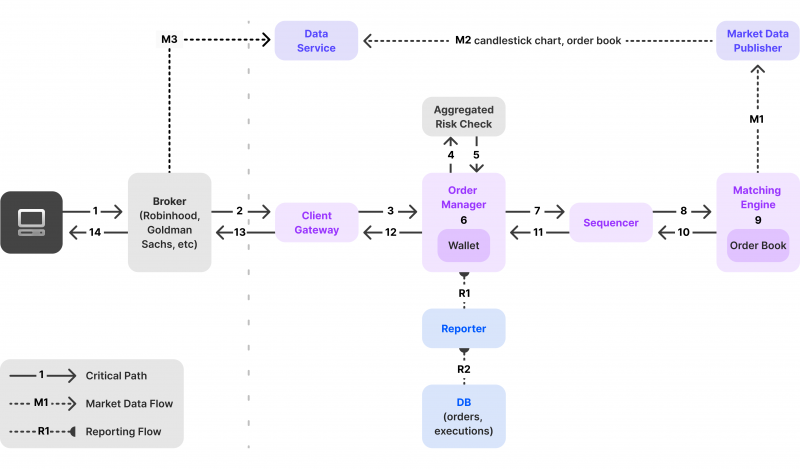

Matching Engine

An order matching engine, or a matching system, is an automated electronic system designed to match buy and sell orders for financial exchanges such as stock exchanges or commodities markets. The order matching system is the foundation upon which all electronic exchanges are built, matching buy and sell orders from various traders based on specific criteria such as price, quantity, and timing.

The system’s efficiency and accuracy are critical to the functioning of the exchange, as they ensure that transactions are executed quickly and at the best possible price. As such, the design and implementation of an order-matching system require careful consideration and expertise.

Latency is the term used to describe the speed at which a matching mechanism can execute trades. A matching engine with low latency can execute trades quickly, whereas a high-latency engine may take several seconds or more to find a counterparty for your trade.

The significance of low latency becomes apparent when you consider that market prices can change quickly. When attempting to buy or sell at a specific price, you’ll want your transaction completed as quickly as possible to avoid missing the opportunity.

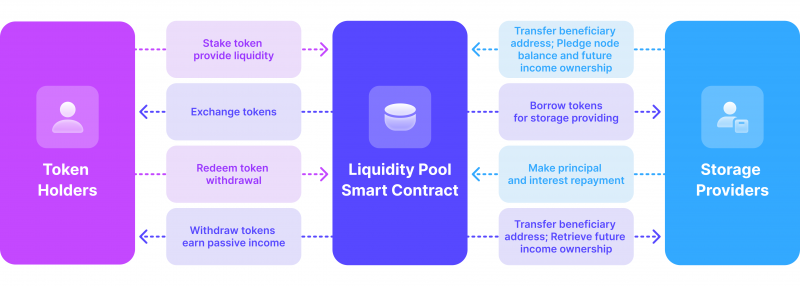

Liquidity Pool

Liquidity pools are a collective mass of coins or tokens aggregated on smart contracts to enable trading, financing, lending and other transactions.

These pools aim to ensure that buy and sell orders can be executed at any time and at any price you desire without requiring you to find a direct counterparty. When you wish to purchase a token, searching for a seller is unnecessary — sufficient liquidity in the pool is all that is necessary.

The system employs automated market makers (AMMs) — smart contracts that execute orders to accomplish this. As tokens are exchanged, the AMM adjusts prices based on its algorithm. The algorithm guarantees liquidity in the aggregator, regardless of the transaction’s size.

Trader’s Room

The trader’s room is an indispensable component of a brokerage’s operations. This system empowers clients to personalise their space on the brokerage company’s website while providing critical functionality for its back office, payment systems, and document processing. The trader’s room is a central hub for clients to manage their trading activities, monitor market data, and execute trades securely and reliably. Its integration with the brokerage’s backend systems ensures accurate and timely processing of transactions while safeguarding client data and privacy.

The Trader’s Room is an indispensable system that integrates a comprehensive suite of tools for managing accounts, analysing transaction histories, and facilitating transfers.

It is worth noting that the Trader’s Room is a crucial component of various CRM systems that can streamline the trading process and provide access to advanced analytics for developing effective trading strategies. Its powerful features allow users to efficiently manage their accounts and access real-time data insights that can help inform trading decisions.

Overall, the Trader’s Room is an essential tool for traders seeking to optimise their trading operations and maximise their investment returns.

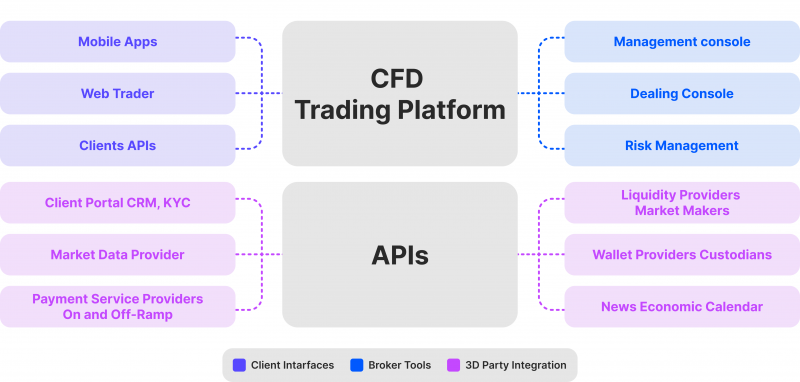

Trading Platform

White Label broker trading software always assumes the presence of a trading system (in this case, the CFD platform) for the possibility of interaction with the interface elements of financial markets. It consists of many interconnected modules and components, each of which fulfils a function, from CFD liquidity processing to order execution, which ultimately ensures the stability of the trading process.

Becoming a White Label CFD Brokerage – Ultimate Guide

White Label CFD broker is a complex and multifaceted product designed for professional activity within the framework of trading CFD assets in all their diversity. However, despite its complexity, the WL model allows you to use a ready-made set of tools in the form of broker infrastructure to launch your project.

Let us consider the main stages of this process and identify important nuances and aspects of its implementation.

1. White Label CFD Brokerage Solution Providers Market Study

When establishing a CFD White Label brokerage and developing its operations, conducting a comprehensive analysis of your competitors and identifying your target audience is imperative. Various parameters must be taken into account, including age, interests, income level, and country of residence.

Consequently, the location of your firm will impact several other aspects of your business, such as how you approach platform promotion and the number of languages your trading platform supports. These considerations are vital to the success of your CFD White Label brokerage, and a thorough assessment of these factors will help you establish a competitive advantage in the market.

2. Legal Formalities Handling

CFDs are assets that have been a subject of controversy in the trading market. For instance, regulatory bodies, such as the US government, have banned CFDs from regulated exchange markets because they do not comply with all the necessary laws and regulations set by the US regulators.

CFDs are permitted in various markets and countries, but some regions have strict limitations on their use. In some places, the absence of regulations could indicate that trading CFDs could pose potential risks for both parties involved.

Therefore, individuals aspiring to become CFD brokers must deeply understand the local laws and regulations to responsibly navigate the CFD market and determine if their particular CFD sector is properly regulated without being overly restrictive, since excessive regulation might restrict the business opportunities for developing a CFD broker business.

3. Trading Platform Selection

The White Label solutions market has experienced significant growth in recent years due to the emergence of numerous White Label providers who offer competitive pricing and avant-garde software. However, there is no one-size-fits-all solution in this market. Aspiring CFD brokers must thoroughly analyse their specific requirements to identify the White Label providers that are best suited for their needs.

When selecting a White Label solution, several factors must be carefully evaluated. The most significant considerations are platform charges, functionality, and customisation flexibility.

Specific White Label solutions are more limiting than others, offering limited options for CFD brokers to alter. On the other hand, other White Label solutions may offer almost infinite customisation possibilities, but their high costs may be unfeasible for brokers with restricted budgets.

Thus, choosing a White Label solution that balances cost-effectiveness with customisation abilities is critical when selecting a White Label solution.

4. Liquidity Provider Connection

Choosing an appropriate CFD provider is essential for various reasons. Firstly, the efficiency and accuracy of the CFD provider’s software play a crucial role in ensuring the precision of the trading and investment outcomes.

The support and expertise provided by the CFD provider can also greatly impact the amount of time and effort required to establish and execute a trading process, enabling traders to take full advantage of market opportunities.

The services provided by the CFD liquidity provider can differ in cost, and selecting a provider that offers a reasonable price for the level of quality and support provided is crucial. Additionally, the security and privacy of the data shared during the simulation process are significant factors that must be taken into account.

5. Payment Processor Connection

CFD brokers are tasked with complex responsibilities, requiring perfectly refined technical procedures. One area of focus in this regard is the management of customer deposits, which necessitates identifying and selecting payment service providers (PSPs) that can fulfil specific location-based criteria and offer the payment options that customers require.

While processing fees may vary, most PSPs do not levy account initiation fees. It is also advisable to engage with multiple providers to ensure that clients can be directed to alternative accounts during an outage. Given the critical nature of this aspect of the business, it is imperative to remain vigilant and continuously evaluate payment providers.

6. Brand Development

In order to create the best CFD broker on the market, a strong marketing campaign and support are required. A set of marketing activities may include a large number of different advertising tools, ranging from classic variants to modern ones, oriented mainly on the distribution and management of information in social networks.

At the same time, WL broker cost may include means of providing marketing support to a new startup if the company selling the WL solution provides access to appropriate resources developed by it or attracted from outside.

7. Website Creation

A company’s website serves as its calling card, so it should be easily accessible, visually appealing, and user-friendly. A well-designed website lets visitors learn more about the company, its products, and its services.

The website must include all the necessary elements to facilitate navigation through the broker’s offerings. While individuals who possess programming and computer science knowledge may be able to create an adequate website without difficulty, it is often advisable to enlist the assistance of experienced professionals. This approach ensures that the website is of the highest quality and meets the company’s needs.

When developing a website, paying close attention to essential factors such as usability, design quality, and operational speed is imperative. These parameters are critical in determining the site’s engagement rate, conversion rate, browsing depth, time on site, and other vital features directly impacting the user experience.

The website’s overall goal is to attract and retain new customers, and developing these parameters is thus of utmost importance to the company. It is essential to ensure that the website is designed to meet these requirements to facilitate a seamless user experience.

Conclusion

White Label CFD brokerage is a promising initiative that can become a cost-effective business model in the world of trading on financial markets. At the same time, using all the advantages of WL solutions, you can get an idea of their work, peculiarities and nuances, which will allow you to carry out your own developments in the field of CFD trading and become a unique opportunity to create a new form of business.

FAQ

What is the essence of White Label CFD Brokerage Business?

This model implies the use of a ready-made brokerage infrastructure, allowing one to carry out full-fledged activities related to trading on CFD markets.

What are the advantages of the White label CFD Brokerage model?

Among the key advantages of launching a CFD broker operating using the WL model are fast market entry, access to a wide variety of CFD instruments and deep pools of CFD liquidity.

What is the cost of WL CFD Broker Business?

Generally, the cost of running your own CFD brokerage on the WL model varies considerably depending on many factors, which requires clarification on a case-by-case basis.