Liquidity Aggregation Nature and Its Advantage For The Crypto Market

Liquidity, playing the most substantial role in the stable functioning of all types of capital markets, without exception, has a huge impact on the efficiency of electronic trading. To ensure the latter, there is a special process aimed at accumulating liquidity from various sources and its further redistribution among market participants to ensure the ability to conduct large transactions at prices closest to market prices. This process is called liquidity aggregation.

This article will provide comprehensive information on what liquidity aggregation is and what advantages and disadvantages it has. You will also learn about its main features and what methods of liquidity aggregation exist in the market.

Key Takeaways

- Liquidity aggregation is the process of accumulating and systematising organic liquidity from various sources.

- Liquidity aggregation helps to increase the overall level of liquidity for each individual trading instrument and distribute it between buyers and sellers.

- Liquidity aggregation uses the smart order routing system, which is responsible for the automatic routing of orders for the most rapid trading orders’ execution.

What is Liquidity Aggregation?

Liquidity aggregation is the process of combining offers to buy/sell an asset from different sources and forwarding them to executors. This process plays an essential role in creating the necessary conditions for the possibility of crypto trading operations at the most favourable (close to market) price in large trading volumes. As a result, thanks to the process of liquidity aggregation into one large stream from different sources, it is possible to achieve a relative balance between the levels of supply and demand, which in turn helps to avoid unpleasant phenomena in the crypto market, such as slippage and spread, which have a negative impact on the effectiveness of trading.

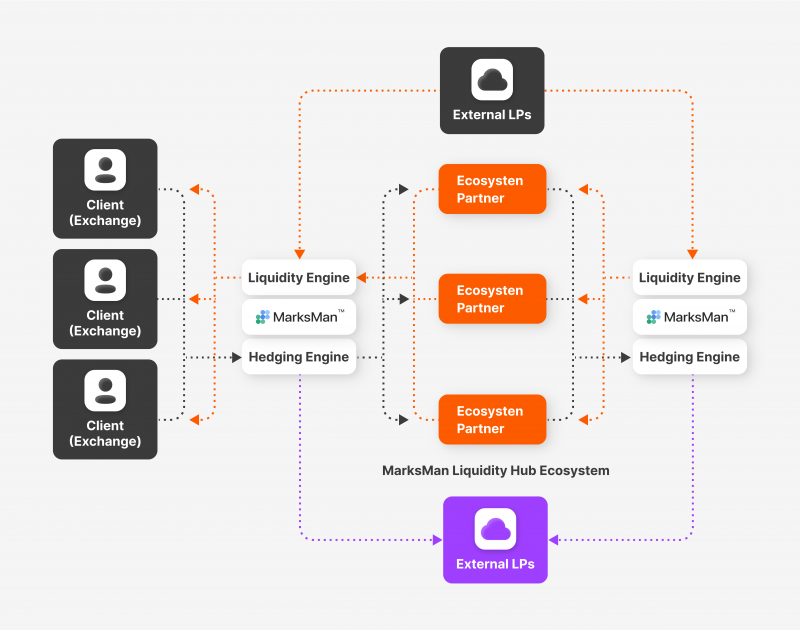

Liquidity aggregation is a closed process. Crypto liquidity aggregators, receiving liquidity from significant exchanges, simultaneously form their liquidity pool with their requests, increasing turnover. In turn, clients connected to aggregators act as both consumers of liquidity and suppliers. Thanks to this, it becomes possible to ensure a perfect balance between the level of demand from buyers and the level of supply from sellers. By establishing a liquidity hub, liquidity aggregators use multiple external sources to provide all trading instruments without exception with liquidity sufficient to maintain a stable price even in force majeure circumstances, in which there is increased volatility in the crypto market. One of the brightest examples of such organisations on the market is B2CONNECT liquidity hub, which offers so-called organic liquidity services.

In cryptocurrency, market liquidity is a crucial element providing a restraining effect of factors contributing to increased price volatility. Therefore, its aggregation is designed primarily to reduce the impact of the activities of particular market participants called “whales”, whose financial capital can significantly influence the behaviour of the price of virtually any asset in any market and manipulate the general trend in the trading. Liquidity aggregation, a process of accumulating cash flows from different sources into one crypto liquidity pool, also provides constant consolidation of the order book, ensuring instant trade execution of both buy and sell transactions, giving an advantage in buying assets at the market price.

Liquidity aggregation is used in all financial markets, mitigating the effects of the highly nutritious nature of trading while avoiding slippage and high spreads.

Advantages and Downsides of Liquidity Aggregation

Today, many crypto exchanges use the liquidity aggregation process to expand trading opportunities using advanced technologies based on the principles of stability and effectiveness of all aspects of the trading process. Playing an important role in stabilising market quotes, liquidity aggregation ensures a smooth cycle of buying and selling financial instruments. At the same time, this process has its advantages and disadvantages.

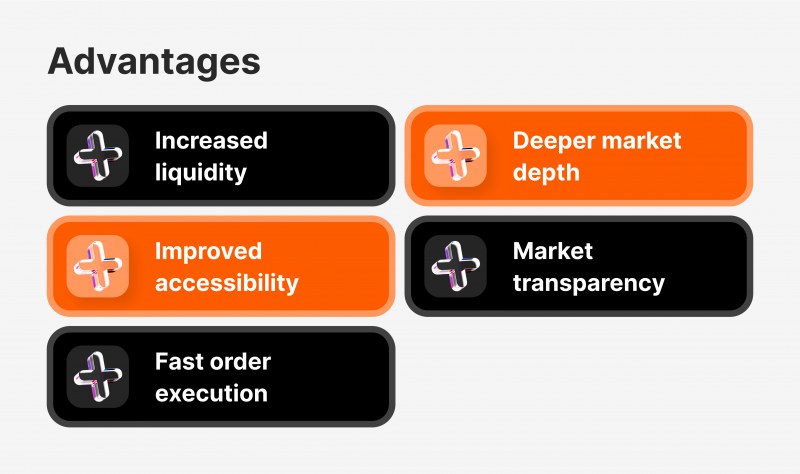

Advantages of Liquidity Aggregation

First, let’s look at some of the main strong sides of liquidity aggregation in the crypto market.

1. Increased Liquidity and Deeper Market Depth

As the cryptocurrency market is the most demanding in terms of liquidity, its aggregation plays an intrinsic role in procuring the stability of the trading process. Thanks to the aggregation of liquidity in the crypto market, it is possible to increase the market’s depth by accumulating a large amount of funds within the trading of a particular crypto asset. This enables traders to trade more efficiently due to better execution of orders, especially with large trading volumes. Moreover, increased liquidity enables market participants to trade equally effectively on both the spot and futures markets without experiencing problems with low market depth and delays in order execution.

2. Improved Accessibility and Market Transparency

The increased transparency provides a clear indication of the extent of market manipulation in situations where large amounts of cash are used by whales to exploit market movements to their advantage by setting the market trends of a particular trading asset. Ultimately, by utilising the resources of multiple liquidity providers, it becomes possible to provide a clear picture of the market and eliminate the problems associated with market manipulation and insufficient liquidity.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

3. Faster Order Execution

As practice shows, market participants often receive a speed several times slower than is provided by the trading conditions. In this case, if they do not have time to make a transaction at the desired price, slippage occurs, and they have to accept the next price in the price stack. And the lower the speed of order execution, the greater this slippage is. In this case, the level of slippage is directly proportional to the level of liquidity, which, in the process of aggregation, increases in direct proportion to the degree of distribution of funds from different sources into different trading instruments.

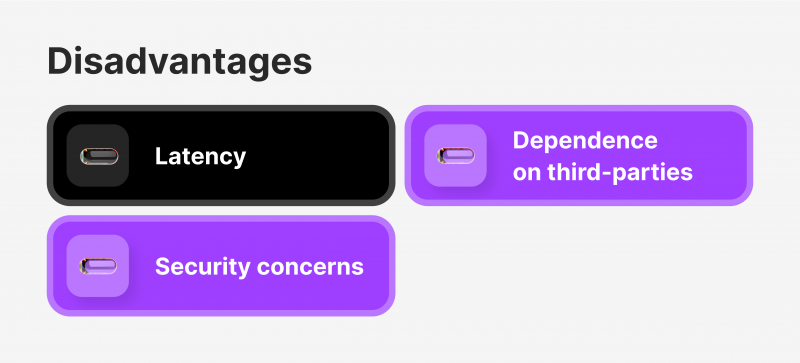

Disadvantages of Liquidity Aggregation

Now, let’s look at the main disadvantages of liquidity aggregation.

1. Latency

Despite modern technologies used in electronic trading, imperfect systems and processes, in particular those used in liquidity aggregation in the cryptocurrency market, give rise to a number of side effects, one of which is latency – the time delay between the receipt of a request and the expected response (result). In the context of liquidity aggregation, latency is expressed as the delay in receiving information from distinct liquidity suppliers about the state of cash flows for distribution, which is reflected in reduced trading efficiency, which does not allow traders to execute large-sized transactions at the same speed.

2. Dependence on Third-Parties

Cryptocurrency liquidity aggregation is provided by specialised liquidity suppliers and technology companies that use appropriate technologies to generate and distribute cash flows between markets and trading instruments.

Given this fact, liquidity aggregation technology implies cooperation with a liquidity aggregator, which in turn obliges the company to rely entirely on a third-party platform, trusting the safety of all personal and financial information and the stability of the services provided. In other words, working with liquidity aggregation implies cooperation and dependence on a third party offering such a service.

3. Security Concerns

Security, which is considered one of the most important components of working in any financial market and with any financial products, is a serious problem faced by users of cryptocurrency liquidity aggregators. As a rule, when using trading platforms that enable the use of cryptocurrency liquidity aggregation process, users have to connect their accounts to several exchanges, which, as a consequence, increases the risk of compromising personal information. On the other hand, security systems for simultaneous work on different crypto exchanges already allow for reducing the probability of situations in which any kind of information theft is possible.

Main Features of Liquidity Aggregation

Liquidity aggregation is a unique process aiming to maximise the processing time of trade orders in the rally engine and increase the throughput for trading any type of crypto asset on any market, be it spot or derivatives. With tangible advantages in terms of issues related to the supply of liquidity to markets from distinct suppliers, the aggregation process has several peculiarities, summarised below.

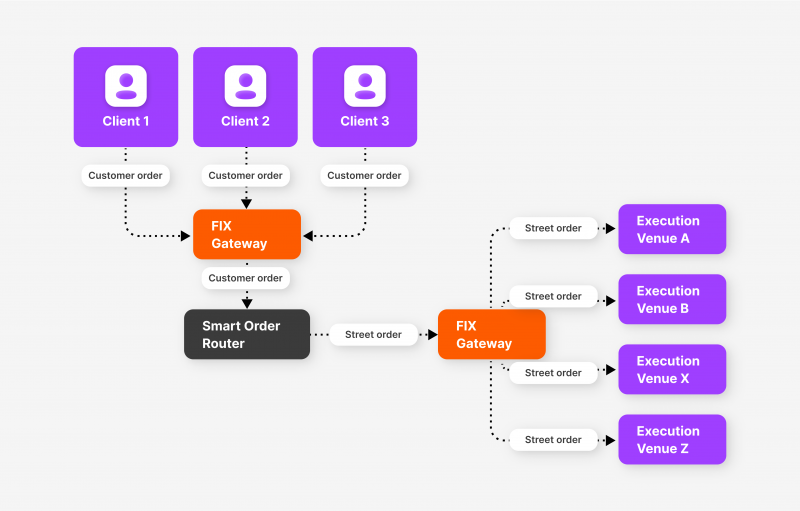

Smart Order Routing (SOR)

The process of liquidity aggregation involves the use of a smart order routing (SOR) system that allows market players to simultaneously access several liquidity pools in order to determine the best direction for routing orders and optimise their execution (adjust the speed and quality of sending orders to the Intermarket for subsequent processing in the matching engine). These systems scan pre-defined financial markets in real time to determine the best offer and quotes for a specific buy or sell order, achieving the best price.

In addition, the smart order router selects the appropriate execution location on a dynamic basis, that is, based on real-time market data streams. Such provisions support the dynamic allocation of orders to the execution location, offering the best conditions at the time the order is entered, including or excluding explicit transaction costs and/or other factors.

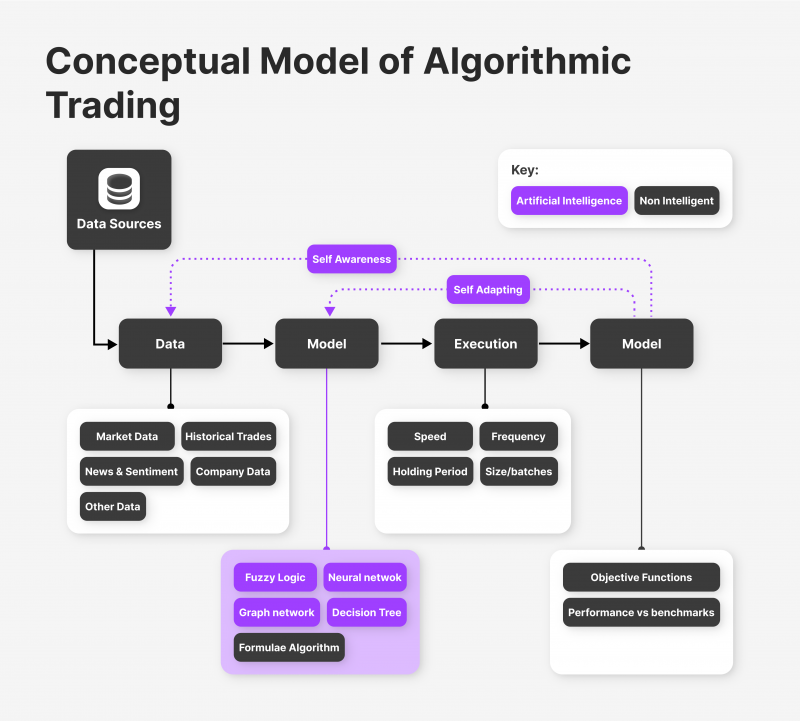

Algorithmic Trading

In most cases, algorithmic trading refers to automated trading based on the use of trading robots (automated algorithms) and special software, time, and others. After that, transactions to buy and sell assets take place without the trader’s participation in automatic mode. At the same time, direct access to the stock exchange is often used to increase the efficiency of algorithmic trading.

In combination with liquidity aggregation, this technology allows for optimised order execution by dynamically selecting the best sources of liquidity from different suppliers. As a result, market participants have the opportunity to take full advantage of this trading method because, with efficient liquidity aggregation, automated order processing systems split large orders into smaller ones and then execute them. This helps to quickly solve important algo-trading tasks, including correlation (pair) trading, technical analysis, arbitrage, etc., without affecting the pricing dynamics of crypto assets on the market.

Order Book Consolidation

When trading on any market, the order book is an organised structure that visually reflects the exact number of trade orders to buy on one side (demand) and sell orders on the other (supply). The formation of visual patterns on the basis of information received by the exchange about the dynamics of prices of certain assets occurs in real time and allows us to see the state of a particular trading instrument.

Through liquidity aggregation, the order book is consolidated, systematising (combining) detailed information on both types of orders from different sources to provide a complete picture of the market. This aspect helps traders get more information about the “economics” of the traded asset by tracking important trading indicators in the order book, such as the amount of the asset being sold or bought at any given time, the exact price at which it is traded, and the total number of limit orders needed to get an idea of market sentiment.

Major Methods to Aggregate Liquidity in the Market

Providing a stable trading process requires a closed and continuous process of liquidity aggregation that ensures the smooth operation of all necessary systems. It is common for brokers and companies receiving liquidity from large liquidity suppliers to create liquidity pools through their application, which increases trade turnover. As a result, clients connected to these companies act as liquidity consumers and suppliers. Several sources of liquidity are responsible for creating liquidity in the crypto market.

Exchangers

Exchangers are major players in any market as they are specialised professional organisations (services) where one financial instrument is exchanged for another, be it cryptocurrency, fiat currency or even precious metals, with possible retention of a certain commission. Exchangers allow quick and easy financial exchange operations due to aggregating a large amount of liquidity in different liquidity pools.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Professional exchange services allow the exchanging many different trading instruments, including fiat and cryptocurrencies, using various payment methods and systems. In particular, they allow for instantaneous exchange operations due to the availability of high-speed payment gateways, providing almost instantaneous execution of various orders. Due to the large volumes of funds passing through them, exchange services have incredibly high liquidity, which can also be aggregated within the work of a single crypto exchange or forex broker.

Retail Investors

Incoming buy/sell orders from common private traders and investors are the primary sources of liquidity in trading any investment asset on any exchange. By putting in market and pending orders, they start the process of creating liquidity, which can be utilised to restock liquidity in assets with low liquidity. High demand (interest) for a particular trading instrument typically results in high liquidity of that instrument, although significant supply from sellers is also required for stable operation. Due to the absence of circumstances in which traders are unable to fulfil their obligations, this method of aggregation removes the phenomenon known as counterparty risk.

Corporate Investors

The phrase “corporate investor” (or capital corporation) is typically used to refer to large, international companies or their associations that gather funds (capital) from smaller players with the intention of making money through investments in capital markets. Their primary distinction is the extent of their investment capital and the volume of their transactions, which far exceed those of virtually all other investors. One of their preferred trading practices is aggregating liquidity into pools, which is used to keep a trading volume of trading instruments. The majority of the time, this class of investors consists of significant international financial conglomerates, such as banks, giving aggregated liquidity for multiple exchanges.

Conclusion

Liquidity aggregation is a great tool in the markets that is not only used to reduce the likelihood of unpredictable market movements due to low volatility but also helps to stabilise the markets, which gives increased comfort when trading crypto assets, allowing trades to be executed quickly, efficiently and with minimal risk, which ultimately helps to maintain an efficient trading process.